Hi.

This week, I approached Nu Holdings Ltd. (“Nu”) from a qualitative perspective, telling the reader company’s history, the services, any possible conflict of interest, and many more.

The greatest challenge was identifying Nu’s most valuable intangible asset. Nu has a very short time as a listed company, so I could avoid the old “our people are the most precious asset we have” cliche.

For me, corporate culture has to be proven through a ten-year operational track record. Otherwise, short-term noises could be mistaken by superior execution.

I’m not saying that NU doesn’t have superior execution, but the available evidence to support the hypothesis is weak. This is why it was so challenging.

Hope you enjoy the reading. Please, share it with friends. It helps a lot.

The outline

- Neobanks insurgency

- Access to mobile

- Inefficient industry

- Brief History

- From credit card to international expansion

- Mexico case study and implications

- Market Overview

- TAM, SAM,…

- Credit is key

- Opportunities

- Incumbents should lag

- Poor customer service

- Tailwinds

- Shift from savings

- Favorable regulatory

- Mobile-first Company

- Mobile hits 50% of transactions

- All about frequency

- Management Compensation

- Misalignment?

- Final Words

Neobanks insurgency

In recent years, technological developments in the financial and banking sectors have allowed more and more people to access their bank accounts and finalize banking operations from their devices and apps.

These developments make physical bank branches almost obsolete, at least for essential banking services and products.

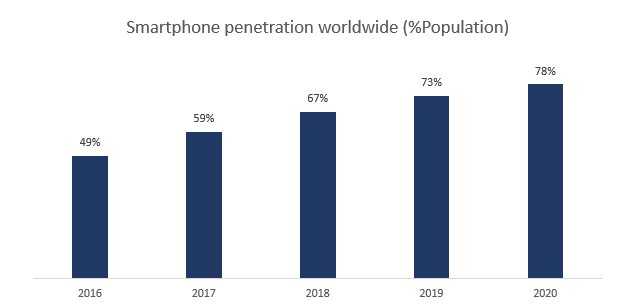

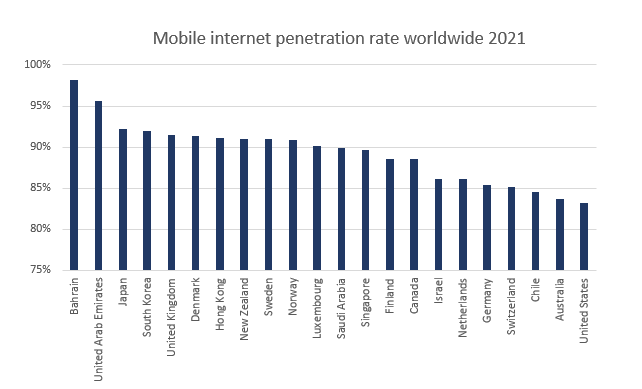

The mobile internet and smartphone growing penetration led to a new player in the financial sector: the digital challenger bank or neobank.

Neobanks, are app-based financial services providers with no physical location for their customers. All of their banking services are conducted completely online via desktop or mobile app.

Thanks to lower costs for running their operations, these new players in the banking industry can focus on customer experience, ease of use, and more personalized services, while offering lower fees compared to traditional banks and even free basic accounts.

Many neobanks have been launched worldwide since 2010, meaning people have become more and more aware of these innovative fintech businesses.

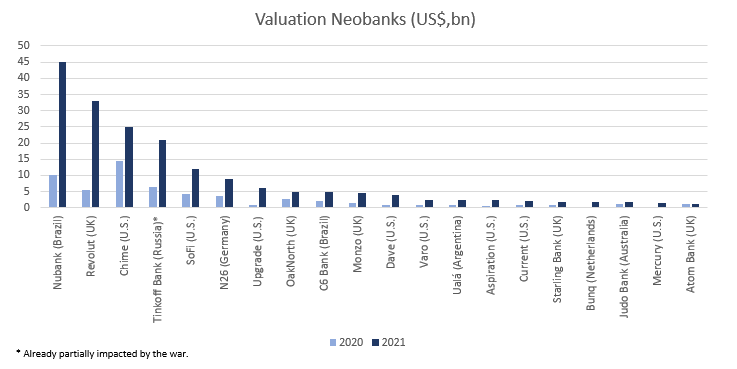

After 2020, the Digital Account Opening (“DAO”) became indispensable for every financial institution, and not only a feature. Despite their young age, some of these companies are already worth billions.

Neobanks struggle to turn a profit in their early years given the costs for scaling their operations. From their launch up until 2020, for instance, Revolut, N26, and Nubank all reported a net loss at the end of the year, and to expand further, they turn to funding rounds.

The investors — who are aware of the appeal and potential of this innovative business model — are willing to provide capital and funding to challenger banks in exchange for high returns in the future.

However, investors should be aware that investing in a neobank is much more than buying a trading multiple and expect a close in the relative valuation gap to peers.

Neobanks have to be profitable and generate cash flow to equity holders. It’s useless to acquire customers operating in losses year after year.

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Brief History

Nu was founded in 2013 with a small group of engineers and designers. In 2014, they launched their first product, the Nu Credit Card, a purple Mastercard-branded credit card in Brazil.

They were a pioneer in offering credit cards that did not have any annual fees and designing an end-to-end mobile-first experience to set a new standard for the best-in-class customer experience that is entirely digital.

With this innovation, Nu provided access to a broader spectrum of customers—from more affluent card users to those starting out.

The strategy was to start with a single product to ensure a great user experience, delight their customers, and gain enough insights about the market and customers to refine and improve data models.

By starting with credit cards, Nu tackled one of the most challenging (and more considerable potential) areas of financial services early in evolution. This has helped them:

- Earn the trust of a large pool of customers by empowering them with differentiated credit solutions that they may have otherwise found to be low quality, expensive, or inaccessible from other providers;

- Build a large and growing pool of proprietary data on customers’ financial and transactional behavior;

- Create a favorable and highly defensible business position in the market Nu seeks to expand.

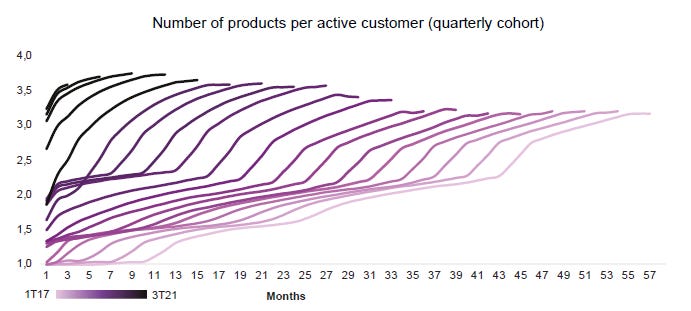

Historically, they have typically started customer relationships with the credit card or NuAccount products, then grown the relationships significantly over time.

As Nu learns more about their customers, they can responsibly raise credit limits and introduce new personal lending and insurance products. As a result, they have generally seen customers spend more and save more over time as they use Nu as their primary bank account to a greater degree.

Their proprietary data shows that customers and Nu grow together by utilizing more products and interacting with social network-level engagement on the app.

Consequently, this results in more data for the company to analyze and ultimately use to better serve customers at a lower cost.

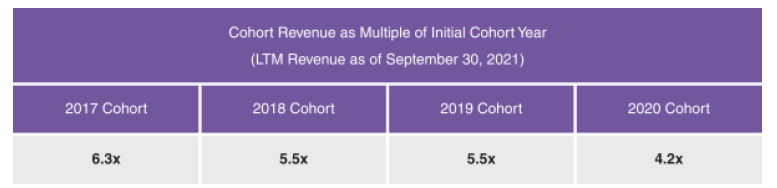

The table shows the growth in total revenue generated by a customer cohort compared to the revenue generated in that cohort’s initial year.

Each cohort represents customers who first joined Nu in a given year, and revenue is indexed to the total revenue generated in that year from the cohort.

Also, the table shows that every cohort exhibits a net expansion in revenue from their initial year, with older cohorts expanding the most over multiple years. This measures the growth in annual cohorts over time, net of any churn.

This expansion for each cohort revenue was achieved by offering beyond credit cards. From 2017 to 2018, Nu reached over 6 million customers and launched its Nu 2.0 Business Plan.

In 2017, Nu launched an all-digital payment account solution, NuConta, which offered customers the ability to make deposits, peer-to-peer transfers, and free payments, as well as withdraw money at a partner ATM network for a nominal fee.

They also created a superior savings product by offering a fair return on your customers’ balances, at a rate equivalent to 100% of the Brazilian interbank deposit rate (“CDI”).

Itaú and Bradesco offer 30-70% of CDI. Also, the client has to proactively look at how to activate the service since they don’t disclose it to their clients.

These were revolutionary features when compared to current account products offered by incumbent banks, where customers had to pay a variety of maintenance fees and transaction fees and received a fraction of the income Nu offers.

In 2018, the Nu prepaid card was launched and made available for any customer with a NuConta, through a simple request through the Nu app.

The launch of NuConta in 2017 and the prepaid card in 2018 were essential evolutions in a suite of products. In addition, they had a notable impact on Nu’s key business metrics, as they allowed them to accelerate the growth of customers.

Recently, Nu started serving a broader population, including low-income customers who would not have started with a consumer credit product.

As a result, customers who join us by purchasing just one NuConta account generally generate lower initial revenue than customers who start with multiple products, such as a credit card and a NuConta account.

However, these unique NuConta customers are highly engaged and strategic. First, Nu often becomes their primary bank account service provider, capturing more of your overall financial life over time, including offering cards, savings, insurance, and investment solutions.

Second, as Nu captures more data on these customers from NuConta alone, they progressively feed and optimize segmentation and credit-granting models.

This leads to the offer of consumer credit, insurance, or third-party products, increasing their value significantly by serving them with a low-cost structure.

Since the beginning of operations, they have had over 100 million candidate requests for the products Nu offers. Not all requests become customers immediately because Nu apply disciplined grant procedures.

As Nu increased the product offering and stayed connected with these would-be customers through the launch of targeted products, they subsequently represented an essential source of growth for Nu’s customer base.

Also, Nu monitors their profiles to see if they meet the subscription criteria for products they have previously applied for. The large pool of candidates consequently further enhances the ability to expand the client base.

From 2019 to 2021, Nu reached over 48 million customers and launched its Nu 3.0 Business Plan, envisioning growth and deepening customer relationships.

The year 2019, in turn, was marked by the launch of a new personal loan product for people with more significant credit needs, allowing customers to sign up, perform simulations, check balances and pay in advance in a flexible, easy, and transparently through the mobile app.

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

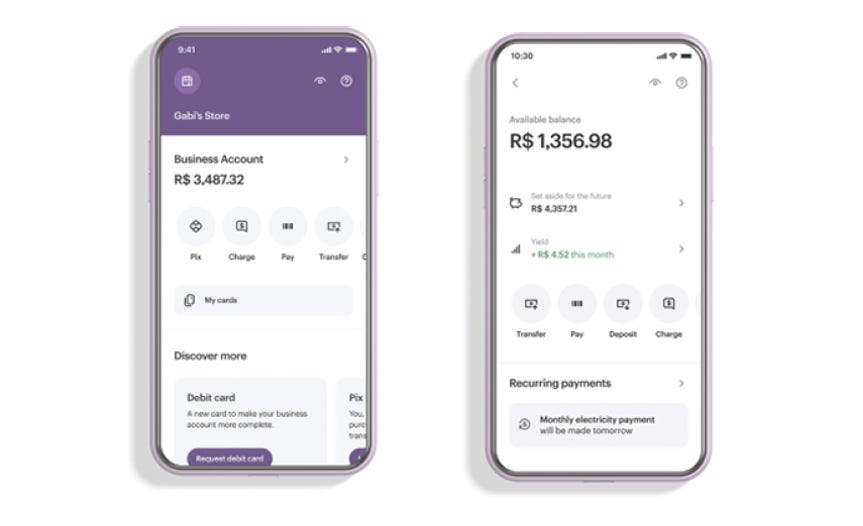

Also, in that year, they launched NuConta PJ, a business account to help meet the needs of almost 11 million micro-enterprises led by entrepreneurs operating in Brazil, according to the Brazilian Micro and Small Business Support Service (“SEBRAE”) by the end of 2020.

As of Sep/2021, Nu had 1.1 million SMEs as customers, representing an increase of approximately 188% from the 0.4 million existing as of Sep/2020.

In 2019 and 2020, Nu expanded internationally, seeking new markets in Mexico and Colombia after verifying that the needs and opportunities identified in these markets were similar to those in Brazil, launching the leading credit card product in both countries.

The first results of the international expansion are proof of the geographic portability of the unique approach. In the future, Nu may also seek to selectively expand the business by expanding into new international markets, where they could provide services to millions of consumers while disruptively innovating legacy models of traditional financial institutions.

Case Study: Expansion to Mexico – In less than two years from the launch of the operations in Mexico in early 2020, we can observe:

Customer Acquisition and Experience - The customer base overgrows to 0.8 million customers. Approximately 70% of whom acquired through unpaid word-of-mouth referrals, and an NPS of 94, well above traditional banks in Mexico.

Consumer Credit Granting (Underwriting) – Nu entered the third generation of their proprietary machine-learning models for Credit Underwriting, significantly increasing the ability to accept new customers.

The First-Payment Default ratio would drop by 64% if approval rates were constantly held since adopting the first model in the country compared against credit bureaus.

First-Payment Default: the percentage of customers that did not pay their first scheduled payment within 10 days of it falling due to the total customers acquired in the period.

On an annual basis, Nu’s First-Payment Default ratio was reduced from 8.4% in the 3Q20 to 5.4% in the 3Q21.

Also, as highlighted in the chart below, compared to Nu’s initial credit engine in Mexico, the three most current versions of the model would reduce the delinquency rates by 33%, 53%, and 64%, respectively.

In just under two years since the launch of their operations in Mexico, Nu became the largest credit card issuer in that country, in terms of the number of cards issued during July and August 2021, based on data from other countries issuers of the Central Bank of Mexico.

Also, Nu expanded into insurance by launching NuVida, a life insurance product integrated and distributed through the mobile app in partnership with Chubb, which offers basic coverage starting at less than US$2.00 per month for benefits up to approximately US$30,000.

Nu also expanded in investment brokerage (brokerage and asset management), announcing the acquisition of Easynvest, the largest direct-to-consumer retail independent investment platform in Brazil, with 2.9 million customers as of Sep/2021.

Finally, in 2021, Nu completed the acquisition of Easynvest and promoted the relaunch of Easynvest under the NuInvest brand, with advanced features and subject to ongoing review.

Still, in 2021, Nu launched several products/services, such as:

- Ultravioleta, the premium metallic credit card for more affluent customers;

- A new online remittance service, in partnership with the “Remessa Online” platform, which joined the market as an integrated strategic partner;

- A series of “Buy Now, Pay Later” solutions that allow customers to (a) pay for their purchases prepaid over time using their personal credit limits in up to twelve installments, and (b) pay their bank slips also in up to twelve installments. In both cases, with the flexibility to anticipate future installments at a discount.

Market Overview

Latin America is a large and dynamic region, with a total population of 652 million people and a GDP of US$4.5 trillion in 2020, according to the World Bank.

Nu currently operates in Brazil, Mexico, and Colombia, representing 60% and 61% of the region’s population and GDP, respectively.

Over time, Nu intends to expand its presence to other markets in Latin America, as individual and SME customers have long faced a banking system with substantial challenges that create market inefficiencies and opportunities for disruption.

The Serviceable Addressable Market, or “SAM,” which stands for Accessible Addressable Market, includes the lines of business Nu currently works within Brazil, including:

• Retail credit (including payroll-deductible personal credit, SME credit, auto finance loans, unsecured personal credit, credit card revolving, credit card financing, among others), defined as net interest income net of financing costs and credit charges);

• Payments, defined as interchange fees for credit and prepaid cards;

• Investments, defined as fees from securities brokers, private pension, savings accounts, and investment funds;

• Insurance brokerage, defined as distribution fees for life and P&C insurance products.

According to the Oliver Wyman Report, retail financial services revenue potential totaled $99 billion in 2020 and is projected to grow at a CAGR of 5% to $126 billion by 2025.

Nu’s US$1,6 billion in revenue in 2021 represented around 1% of this SAM, demonstrating the enormous opportunity that lies ahead.

Near-Term SAM, or “NTSAM,” in addition to Brazil, also considers Mexico and Colombia, countries Nu has recently entered. According to the Oliver Wyman Report, retail financial services NTSAM totaled $129 billion in 2020 and is projected to grow at a CAGR of 7% to $177 billion by 2025.

According to the Oliver Wyman Report, retail credit to individuals and SMEs accounted for ~75% of the revenue pool for retail financial services in 2020, and a CAGR of 6% is projected from 2020 to 2025.

This is the segment in which Nu has substantial competitive advantages due to superior lending capacity, lower customer acquisition costs, and extensive financing.

The fee portion of this revenue pool, comprised of cards, investments, insurance brokerage, and marketplace, is estimated to account for 25% and is projected to have a CAGR of 11% from 2020 to 2025.

Though there is no mention of valuation in this post, credit is key for Nu’s sustainability in the future. There is no angle where the company could achieve profitability without making money in credit.

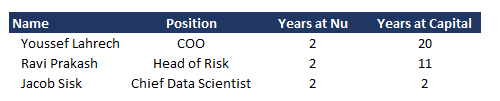

From its early days, Nu has hired former employees of US credit card lender Capital One into risk management roles.

Capital One has consistently been good at finding the mispriced risk in the card market. Similar to Nu, Capital One offers more loans to longtail customers than peers, but with lower line sizes.

It then takes a slow and deliberate approach to raising limits, using payment history to identify good payers and grow with the customer. Below high profile examples of Nu’s Capital One hires.

Opportunities

Individual customers and SMEs in Latin America have long faced a banking system with substantial challenges that create attractive opportunities for disruptors, including:

Highly Concentrated Banking Sector with Lack of Competition – The banking sector in Latin America is highly concentrated, dominated by a small number of incumbent financial institutions in each country.

According to the respective Central Banks, as of Dec/2020, the five largest banks in Brazil, Mexico, and Colombia controlled between 70% and 85% of all global loans, deposits, and banking income in their respective markets, a share that is significantly higher than that of most developed markets.

Due to its highly concentrated nature, the Latin American banking sector has long suffered from a lack of competition and little incentives to improve the product.

This has resulted in less innovation, a more limited selection of products and services, and higher fees than in the more open and competitive markets of the US and Europe.

While this concentration has allowed the large incumbent banks to maintain their status quo, it also created a fertile environment for new entrants who can use advanced technology, data, and quality customer service to level the playing field.

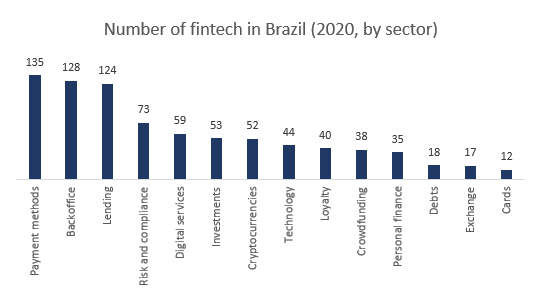

For instance, it is possible to identify the most significant revenue pools under siege by looking at the number of fintechs by sector, as the image above shows.

High Cost of Service – Incumbent banks in Brazil, Mexico, and Colombia have extensive branch-based, high-cost distribution networks supported by large workforces and traditional systems.

For example, each of the five incumbent banks in Brazil has between 12,000 and 15,000 branches and around 80,000 employees each. This traditional infrastructure has translated into a higher cost to serve, encouraging such banks to sell high-margin products, excluding a large segment of the population from the financial system.

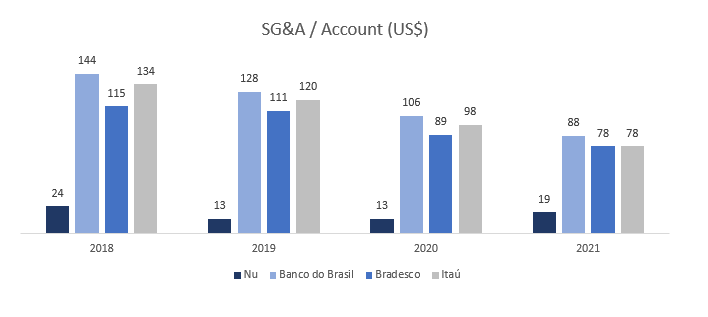

Based on their publicly available financial statements, Nu’s cost of service and general and administrative expenses per customer in Brazil are approximately 85% lower than incumbent banks.

In 2021, Nu’s SG&A/Accounts increased due to new investments in marketing in Mexico. Though it will create a short-term pressure on the income statement, the ramp-up of Nu’s operations in Brazil should compensate for it.

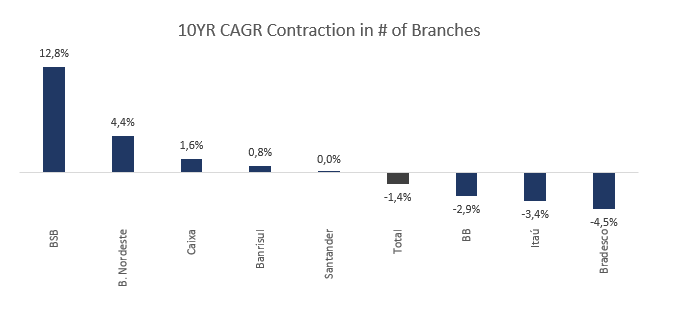

Also, neobanks should enjoy significant tailwinds against their competitors, as branches are a legacy cost to incumbents that will persist on their balance sheets.

Though they are closing branches consistently, the union representing banking employees brings political pressure in how private banks close branches.

For instance, Banco do Brasil has 18 clients per branch, while Itaú has 32. Though Itaú’s figure isn’t good, for being a State-Owned-Company (“SOE”), Banco do Brasil suffers more significant political interference and has the most lethargic branches’ closures.

The old explanation incumbents had was that high-value products weren’t consumed in the digital world, so branches worked as point-of-sales for them. Nevertheless, as we’ll see later on, this isn’t true.

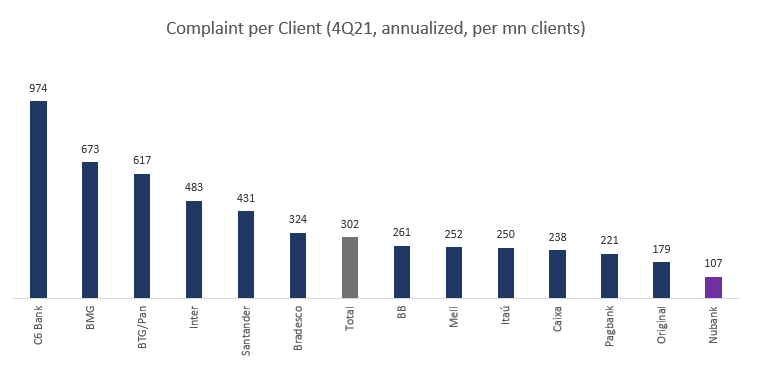

Poor Customer Service and Lack of Trust – Nu believes that incumbent financial service providers in Latin America have historically provided poor customer service given the lack of market competition and alternative choices.

Unlike incumbent banks, Nu’s obsession with customer satisfaction aimed at delighting customers has allowed us to reach and scale to NPS levels above 80 in the countries in which Nu operates, which exceeds those of incumbent banks and those of all the other prominent local fintech companies.

Nu was also recognized for fewer complaints and superior customer service for incumbents and disruptors, lowering its cost of service and greater product penetration.

The high concentration of the banking sector, the historical lack of competition, and the high cost to serve that characterize the financial services sector in Latin America led to a pattern of behavior that resulted in dissatisfied customers.

Market Significantly Underpenetrated – The Latin American banking sector remains significantly underpenetrated. Among the main reasons for these low levels of financial inclusion are the prohibitively high costs for financial services.

According to a study by the Inter-American Development Bank, or the “IDB,” one of the most cited reasons for not having a bank account is that opening and maintaining accounts is too expensive.

According to the World Bank, in Brazil, 30.0% of the 169 million people aged over 15 did not have a bank account in 2017. For the same study, in Colombia and Mexico, the unbanked population was 55.1% and 64.6% of the 40 million and 96 million people.

Together, these three countries represent 134 million unbanked adults, according to the World Bank. In addition, the volume of credit extended by financial institutions to households in Latin American economies was between 5% and 30% of GDP in 2019, according to IMF data, compared to between 55% and 80% in the developed economies of the United States. United States, Western Europe, and Japan.

Mexico, in particular, seems to offer a considerable opportunity for Nu. In Mexico, BBVA is king and is the primary bank for roughly half of the population with a bank account.

Nevertheless, Nu has been consistently among the top 10 most downloaded finance apps in Mexico’s Google Play Store. It will be interesting to see how this evolves in the coming years.

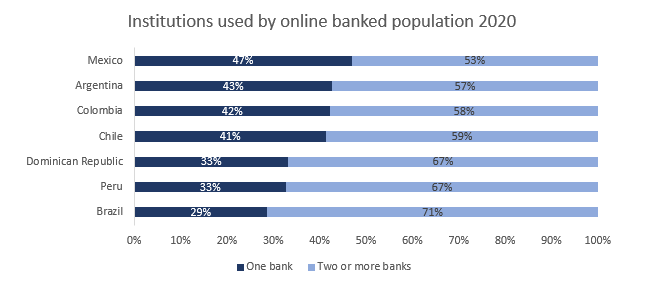

Also, an expressive share of the Mexican population has only one bank account, versus 29% in Brazil, creating an opportunity for Nu to dig in.

Finally, credit card penetration in Brazil, Colombia, and Mexico stood at 27.0%, 13.9%, and 9.5% of the population aged 15 and over, respectively, compared to 65.6% in the US and 65.4% in the UK, according to 2017 World Bank data.

Tailwinds

There is a fertile environment for disruption of new entrants who can use advanced technology, data, and customer service to level the playing field.

Fintech companies like Nu have the potential to completely change this landscape in Latin America, offering low-cost, high-quality financial services to large portions of the region’s adult population.

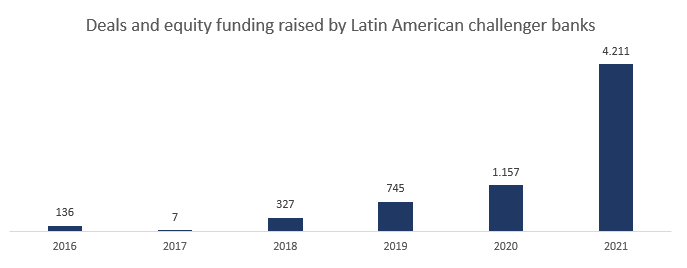

The significant challenges and trends in Latin American markets have already driven more demand for digital banking platforms to meet day-to-day banking needs.

The share of total retail credit attributable to digital banks and fintechs in Brazil more than doubled between December 2017 and December 2020.

As of July 2021, there have been over 27 million banking app downloads in the country, of which nearly 66% were attributable to digital banks and fintechs, compared to approximately 25% for incumbent banks.

This mix has consistently increased the share of digital banks and fintechs, which has doubled over the last three years.

Several factors are contributing to this trend:

Technological Innovation and Growing Payment Volumes – Technological innovation, including instant payment solutions such as PIX in Brazil and CoDi in Mexico, will translate into sustainable growth in electronic payment volumes.

Latin America is estimated to reach an 80% smartphone adoption rate by 2025, according to Statista, further facilitating technology inclusion.

In addition, it is estimated that purchase volumes on credit and prepaid cards in Brazil will grow significantly in the coming years.

A shift from Savings to Higher Yield Investments – Improving levels of financial literacy, expanding middle class, and lower interest rates are moving Brazilian retail investors away from savings products promoted by incumbents to higher-yielding investments, such as stocks.

The share of retail investment assets under the management of banks (AuM) has decreased in the last two years. Superior customer experiences and low-cost, open-platform distribution models employed by independent brokers serving directly to the consumer will continue to migrate assets from incumbent banks.

Favorable Regulatory Environment – Regulators in Latin America promote various initiatives to foster financial technology disruption to increase competition and financial inclusion.

For example, in 2020, the Central Bank of Brazil implemented its plan to enable open banking by launching PIX, an instant payment tool. In Mexico, the Financial Technology Law of 2018 laid the foundations for the development of FinTech companies, and in 2019, CoDi, a commission-free P2P transaction platform, was launched by Banxico.

Nu believes these regulatory changes will increase efficiency, competition, and innovation in the Latin American financial services market and increase access to financial services.

Mobile-first Company

Nu probably is the neobank with greater exposure to these tailwinds for being mobile-first and carrying the first-mover advantage.

A mobile-first strategy is a method in app development in which designing a site for mobile devices takes priority over internet banking, branches, and ATMs.

This tactic was first developed years ago to solve a significant user pain-point. Users wanted to complete the same tasks on their smartphones on internet banking, branches, and ATMs.

For years, the incumbents rejected the concept of having all the information on the phone. Instead, primarily for their own convenience, year over the years, the solutions offered actually complicated customers’ day-to-day activities.

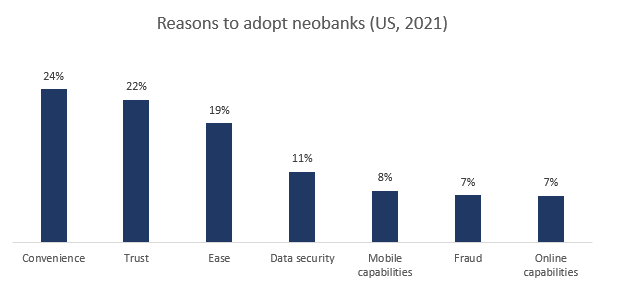

Not surprisingly, the newcomers are taking over incumbents’ clients, offering convenience, capabilities, trust, and practical solutions in the mobile. This approach relieves this pain by creating a mobile version first without sacrificing content or functionality.

To accomplish this, a web designer will build the site for a mobile platform and then improve it for internet banking use. This is the opposite of an internet banking-first strategy where a website is made, stripping off the non-compatible elements to create a mobile site.

Curiosity: Nu’s website is just like the app, but the experience using internet banking is awful(!). Nevertheless, as they offer all solutions in Mobile, most people actually have never accessed their webpage. On the other hand, Itaú’s internet banking is excellent, but the app sucks.

The power of mobile-first design allows businesses to interact with their consumers in more efficient and meaningful ways.

Suppose a better user experience doesn’t convince you to consider a mobile-first approach. In that case, there is this statistic: 57% of people say they won’t recommend a business that has a poorly designed mobile app.

Clients will not trade down convenience, especially after discovering that Mobile works even better than internet banking.

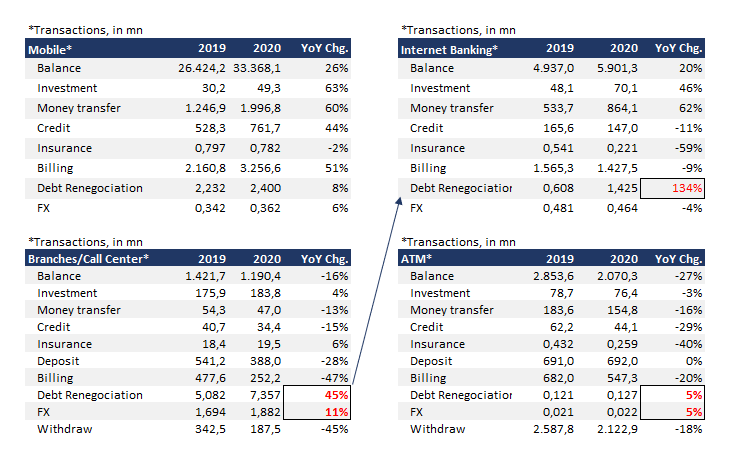

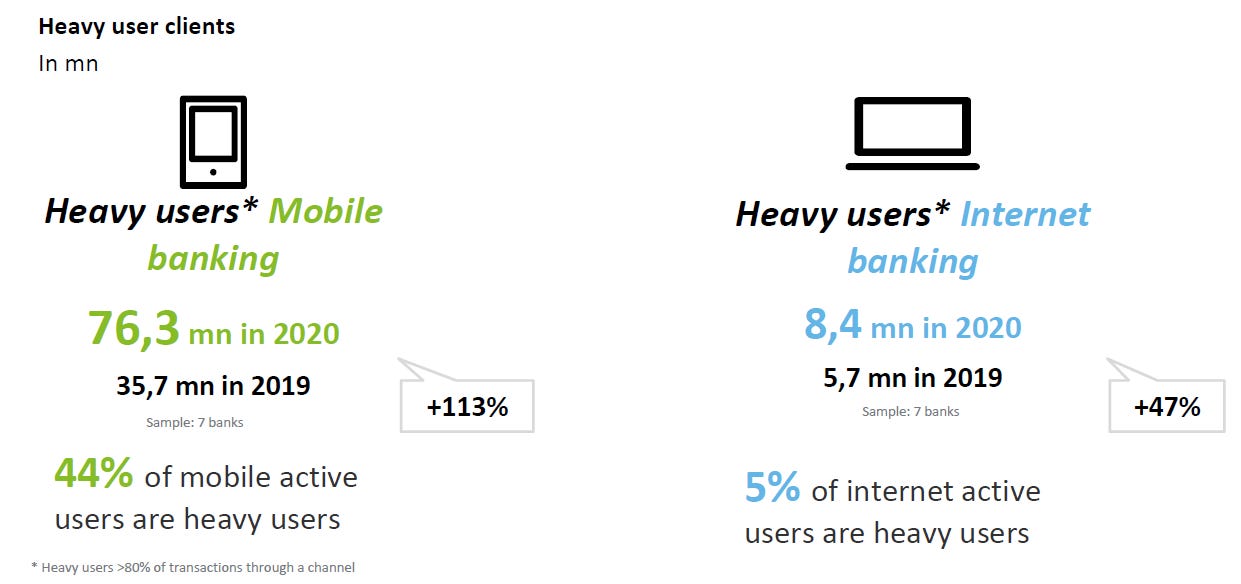

As shown above, based on growth, the available evidence shows that Mobile is the superior model is comparing it to different categories.

Mobile grew its number of transactions at a 30% CAGR (16’-20”), internet banking remained flat, and branches shank.

In 2020, for the first time, Mobile represented more than 50% of all transactions in Brazil. Also, as the image above shows, ATMs and branches are losing their relevance fast.

The first evidence indicates that customers are moving to digital platforms, such as debt renegotiation and FX transactions, even for complex operations.

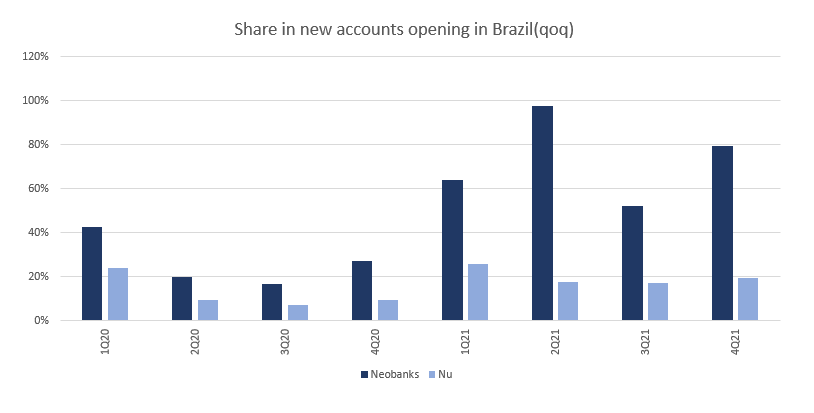

Second, in 2021, Neobanks’ new accounts had gained momentum and represented ~60% of all new accounts opened in Brazil. Nu accounted for 20% of all new accounts in financial institutions in Brazil.

One of the greatest advantages of a mobile-first company is the DAO, where neobanks stand out. The share in new accounts opening in Brazil shows that neobanks are enjoying that trend better than incumbents, as the image above shows.

Third, mobile active accounts jumped almost 40% between 2019 and 2020, a meaning full acceleration that confirms that customers are migrating to mobile devices as their primary channel.

Finally, customers are looking for an excellent DAO, experience using the app, and a one-stop-shop for day-to-day use.

Nevertheless, for companies (banks and neobanks), customers are much more profitable since they access the app much more times, consuming more products.

Management compensation

Probably management’s long-term alignment is one of the most undervalued elements by most analysts and investors, in general.

However, one of the best ways of verifying your thought about the company’s focus is looking where compensations are coming from.

A heuristic that has been working fine to me is that a company whose management doesn’t have skin in the game is doomed to a failure somewhere in the future.

In 2018 and 2019, Nu’s board members did not receive any compensation due to: i) either because they are representatives of investors, or ii) because they exercise executive functions in companies controlled by Nu and, therefore, receive their compensation from companies controlled by Nu.

Starting in 2020, the company started engaging paid independent board members who receive compensation made up of a mix of cash and share-based compensation.

There is no specific ratio between cash and equity. Still, all paid directors received compensation that was primarily weighted towards equity compensation as a means of creating greater alignment to long-term goals and the interests of shareholders.

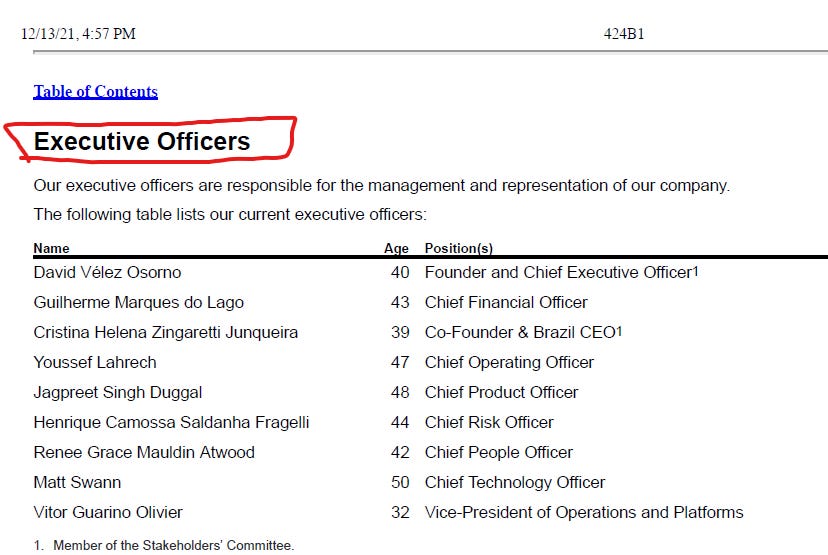

Although Nu discloses nine executive officers in its final prospect, the 2020 total compensation is only for one executive officer, discussed before the stock offer.

Nevertheless, it’s essential to recognize that Nu improved its 2021 disclosure for executive directors and Board Members, giving more details about compensation structure.

Comparing 2021 total compensation to previous years, there is an enormous difference that is not justified not only by Nu growth in those years.

The total compensation jumped from US$11 million to US$42 million from 2019 to 2021, a 100% CAGR, while revenue grew “only” a 54% CAGR.

An implication would be that Nu is overpaying executives after going public. I don’t believe in this thesis. Before explaining why the IR team did a terrific job writing the prospectus. It’s been a while since the last time I read such an organized document.

Now, the “overpay” in 2021 is because of the 2020 Contingent Share Award (“CSA20”) that granted the holding controlled by Mr. Vélez awards after reaching specific targets.

- Upon the closing of primary issuance, secondary sale, or liquidation event in which the aggregate value of the consideration to be paid is at least US$100 million, and at least one participant is neither Nu nor an affiliate of Rua California Ltd. (Mr. Vélez holding);

- Award Applicable Transaction: involving a pre-money valuation of us of equal to or greater than US$20 billion but less than US$30 billion.

- 2020 Award First Milestone: ordinary shares equal to 0.5% of the total number of shares calculated immediately after closing such Award Applicable Transaction and the issuance of such shares to Rua California Ltd.

- Upon the closing of an Award Applicable Transaction involving a pre-money valuation equal to or greater than US$30 billion, or the “2020 Award Second Milestone.”

- 2020 Award Second Milestone: ordinary shares such that the total number of ordinary shares issued according to clauses (i) and (ii) would equal 1% of the total number of shares calculated immediately after the closing of such Award Applicable Transaction and the issuance of such shares to Rua California Ltd.

The 2020 Award First Milestone was achieved upon the closing of Series G preferred financing round, and the 2020 Award Second Milestone was completed upon the conclusion of Series G-1 preferred financing round.

Accordingly, Nu issued 45,6 million Class A ordinary shares in 2021 (after giving effect to the Share Split) due to the achievement of the 2020 Award First Milestone and the 2020 Award Second Milestone under the 2020 Contingent Share Awards.

Also, the Board of Directors approved the 2021 Contingent Share Awards (“CSA21”) serve to align Mr. Vélez’s interests creating a visible and robust link between Mr. Vélez’s incentives and Nu’s long-term performance and impact.

The CSA21 accounts for nearly 100% of Mr. Vélez’s total compensation in performance-based, long-term equity incentive awards.

According to my estimates, the CSA21 could generate an impact from US$400 million to US$1,8 billion throughout the next ten years to Nu’s shareholders, considering that management achieved both Milestones.

Although it seems too much for retaining key employees (Mr. Vélez and a few executive officers), they’d have to generate US$120 billion in a capital gain to minority shareholders to claim for the prize. With that in mind, the CSA21 award would represent ~1% of the value generated, which seems reasonable.

Finally, I could not fail to mention the Omnibus Incentive Plan (“Omnibus”), which establishes the general rules and conditions for stock options plan (“SOP”) and restricted stocks unit (“RSU”).

The purpose is to increase the capacity to attract and retain employees, consultants, and management. In different words, to align long-term interest.

Nu’s or any of Nu affiliates’ employees, officers, non-employee directors, or consultants are eligible to receive awards under the Omnibus.

Nevertheless, I’d have to go for a channel checking over Omnibus. Usually, SOP related to affiliate companies present an intrinsic conflict of interest given that an “affiliate” could be treated as a controlled company and nothing else.

So, admittedly, I don’t know how effective Omnibus is.

The options expire after a maximum of ten years from the grant date, though each option will become exercisable as the board of directors determines.

Considering that Omnibus can’t exceed 5% of the outstanding ordinary shares and that options expire in ten years, it’s possible to reasonably estimate dilution over the years.

Final words

The most challenging aspects about investing in high-growth companies printing losses are i) identifying (if any) the intangible asset that a specific company has and ii) how to estimate its value.

In this first part, I focused on identifying the intangible assets that Nu holds that allow them to print such high growth and improvement in service/product at the same time are.

When Nu started in 2013, there wasn’t really fintech. There was no concept of digital banks. Mr. Vélez saw that banks underestimated their customers and mistreated them, and though he could offer something different.

So, Mr. Vélez looked for inspiration in Capital One. The banking system in the US in the ’90s was underdeveloped and commoditized.

Customers were paying 20% APR on their credit card, regardless of their credit score. So, Capital One added a lot of data, marketing, and analytics to segment the market and build a differentiated product.

Then, Mr. Vélez turned to Russia, where he found Tinkoff. While Capital One was sending envelopes to people’s houses, Tinkoff leveraged its internet operation for communication and customer acquisition.

In my opinion, for being the first entrant and mobile-first — different from both inspirations—Mr. Vélez and his team built an incredible product for its customers and achieved scale incredibly fast with decent operational figures.

In the next post, we’ll go over Nu’s financials and finally evaluate its assets.