Nu Holdings Ltd. (NU), the disruptive Brazilian fintech company specializing in digital banking, has been revolutionizing the Latin American financial sector with its innovative approach to banking.

Recent analysis and statements from top executives provide compelling evidence that the company’s provision levels are not just adequate, but potentially excessive in covering its current risk exposure.

This post delves deep into the reasons behind this assessment, offering crucial insights for investors, analysts, and industry observers.

Before you dive into our comprehensive analysis of Nu Holdings' risk management strategies, we have a quick favor to ask:

If you find value in this content, please consider sharing it!

Why? Your shares help us reach more readers, allowing us to keep producing high-quality, in-depth analyses like this one—completely free, with no paywalls or subscriptions.

Nu Holdings Ltd's Sophisticated Credit Risk Management Strategy

At the core of Nu Holdings’ success is its implementation of a highly sophisticated credit risk management strategy. This approach is built on three key pillars:

- Data-driven decision making

- Continuous model improvement

- Proactive risk assessment

Nu Holdings uses data-driven decision making to determine credit risk and customize scoring results, allowing for personalized evaluation of stock performance.

These elements work in concert to enable Nu to maintain robust provision levels while simultaneously expanding its loan portfolio at an impressive rate.

During the Q4 2023 earnings call, Youssef Lahrech, COO and President of Nu Holdings, provided a clear articulation of their strategy:

When we underwrite credit, our objective is not to minimize NPLs. Rather, our objective is to maximize the NPV of that credit brand to maximize the NPV of that customer relationship subject to resilience constraints.

This statement underscores Nu’s sophisticated approach to risk management, prioritizing long-term value creation over short-term metrics.

The Critical Role of IFRS 9 in Nu's Provisioning Approach

Nu Holdings' adherence to IFRS 9 accounting standards sets it apart from many traditional financial institutions. This framework requires the company to book provisions based on expected losses, resulting in a more conservative and forward-looking approach compared to traditional provisioning methods.

Guilherme Lago, CFO of Nu Holdings, elaborated on this approach during the earnings call:

We front-load provisions when we originate loans in accordance with IFRS 9's expected loss methodology.

This proactive stance on provisioning contributes significantly to Nu's robust risk management framework, providing a substantial buffer against potential future losses.

Key Indicators Demonstrating Nu's Strong Provisioning

Non-Performing Loans (NPLs) Trends

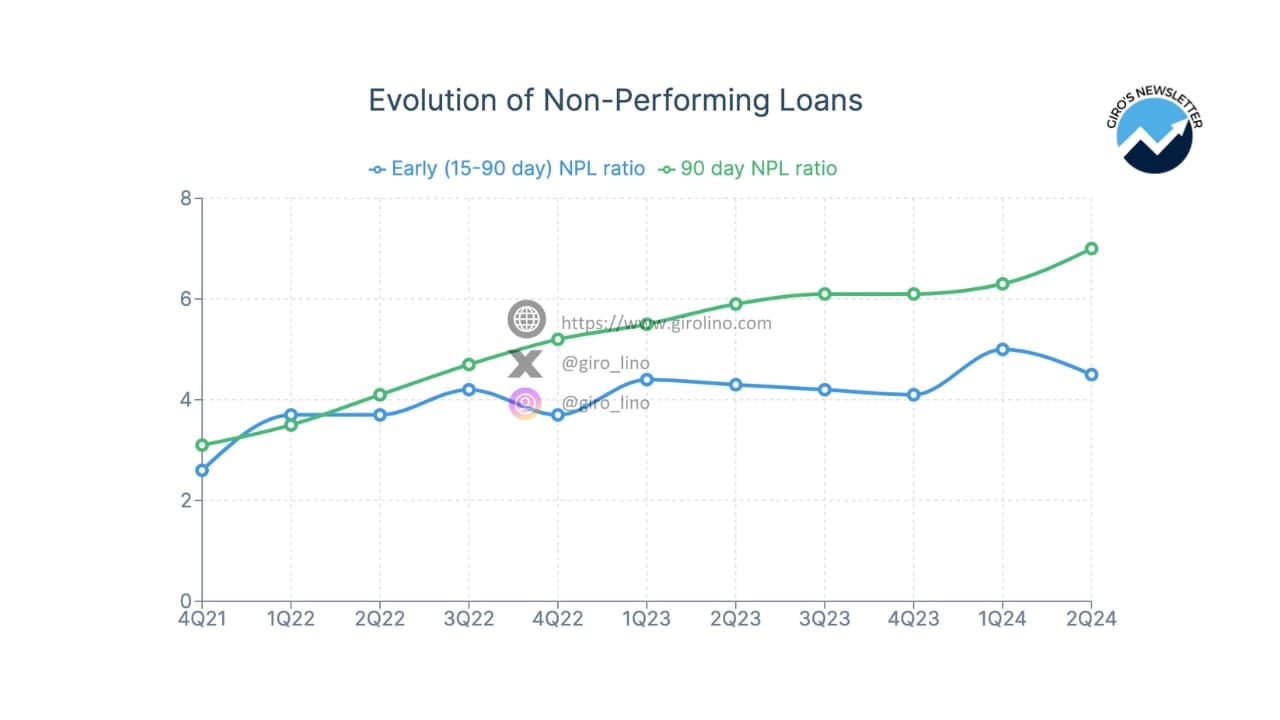

One of the most critical indicators of Nu's provisioning strength is the trend in Non-Performing Loans (NPLs). While 90-day NPLs have shown an upward trajectory, early NPLs (15-90 days) improved by an impressive 50 basis points in the second quarter of 2024. This improvement in early-stage delinquencies is a strong positive signal, indicating that Nu's risk management strategies are effectively addressing emerging credit issues.

Youssef Lahrech provided further context on these trends:

Our leading indicator, NPL 15 to 90, increased to 5% in the first quarter of 2024, broadly in line with expectations. Second, our 90-plus NPL ratio increased slightly to 6.3%, also in line with expectations.

This commentary suggests that Nu's management has a firm grasp on the company's risk profile and that the observed NPL trends are within anticipated ranges.

Cost of Risk Analysis

Another crucial metric in assessing Nu's provisioning adequacy is the cost of risk. Despite a decline in the most recent quarter, this figure remains significantly above write-off levels. This conservative approach to provisioning demonstrates Nu's unwavering commitment to maintaining a strong buffer against potential credit losses, even as it continues to expand its loan portfolio at a rapid pace.

Nu's Expansion Strategy and Its Impact on Provisions

Nu Holdings’ growth strategy extends beyond its home market of Brazil, with significant expansion efforts in Mexico and Colombia. Co-founder David Vélez has played a crucial role in establishing the company and its digital banking services, significantly impacting the fintech landscape in Latin America.

The company has implemented a “know and grow” approach to credit expansion, which involves starting with conservative credit limits for new customers and gradually increasing them as the company gains deeper insights into customer behavior and creditworthiness.

Nubank's international credit card, which features no annuity fees and full management through a mobile app, exemplifies the accessibility and convenience the company offers to its users.

David Velez, Founder, Chairman & CEO of Nu Holdings, outlined their strategy for the Mexican market:

We are preparing to invest significantly in software-related solutions. We think we don't necessarily compete well in the offline world where there are branches required. And we always said that if you need cash, if you need offline distribution, we're not well positioned there to compete. We are well positioned to compete when software becomes a differentiating factor.

This strategy highlights Nu's focus on leveraging technology to drive growth while maintaining strong risk management practices.

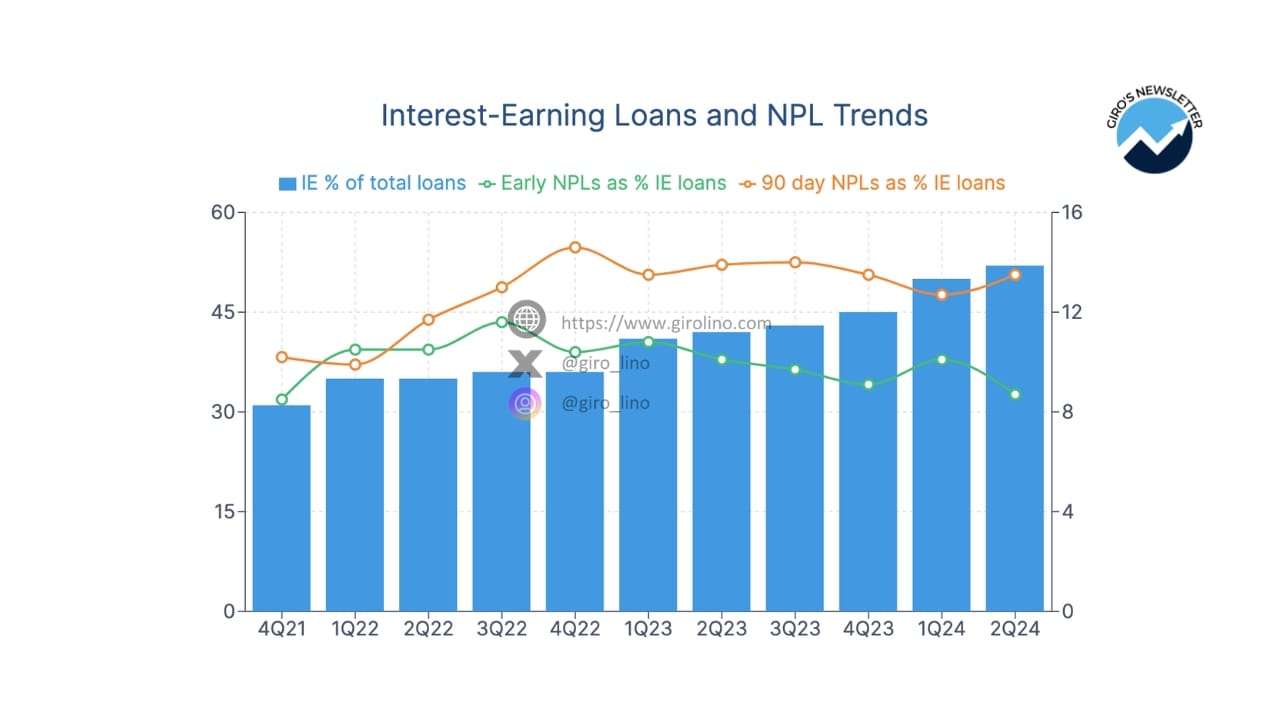

Evolution of Nu's Loan Book Risk Profile

As Nu has expanded its portfolio of interest-earning loans, the overall risk profile of its loan book has increased. However, it's crucial to note that the NPLs of these interest-earning loans have remained well-controlled and have even decreased modestly from peak levels. This trend provides strong evidence that Nu's risk assessment and underwriting practices are effectively managing the increased risk associated with their expanding loan portfolio.

The Strategic Importance of Secured Lending in Nu's Portfolio Diversification

Nu's recent expansion into secured lending products, including payroll loans and FGTS-backed loans, represents a significant strategic move. This diversification is expected to contribute to a more balanced and potentially lower-risk loan portfolio in the future, allowing Nu to tap into new customer segments while potentially improving overall portfolio quality.

Jagpreet Duggal, Chief Product Officer at Nu Holdings, highlighted the success of their secured lending products:

All of the customers to which we are offering these secured loans are current Nubank customers. So we are fishing in the -- in our own fishbowl, not out in the open sea.

This approach of leveraging their existing customer base for secured lending expansion demonstrates Nu's strategic focus on cross-selling and deepening customer relationships.

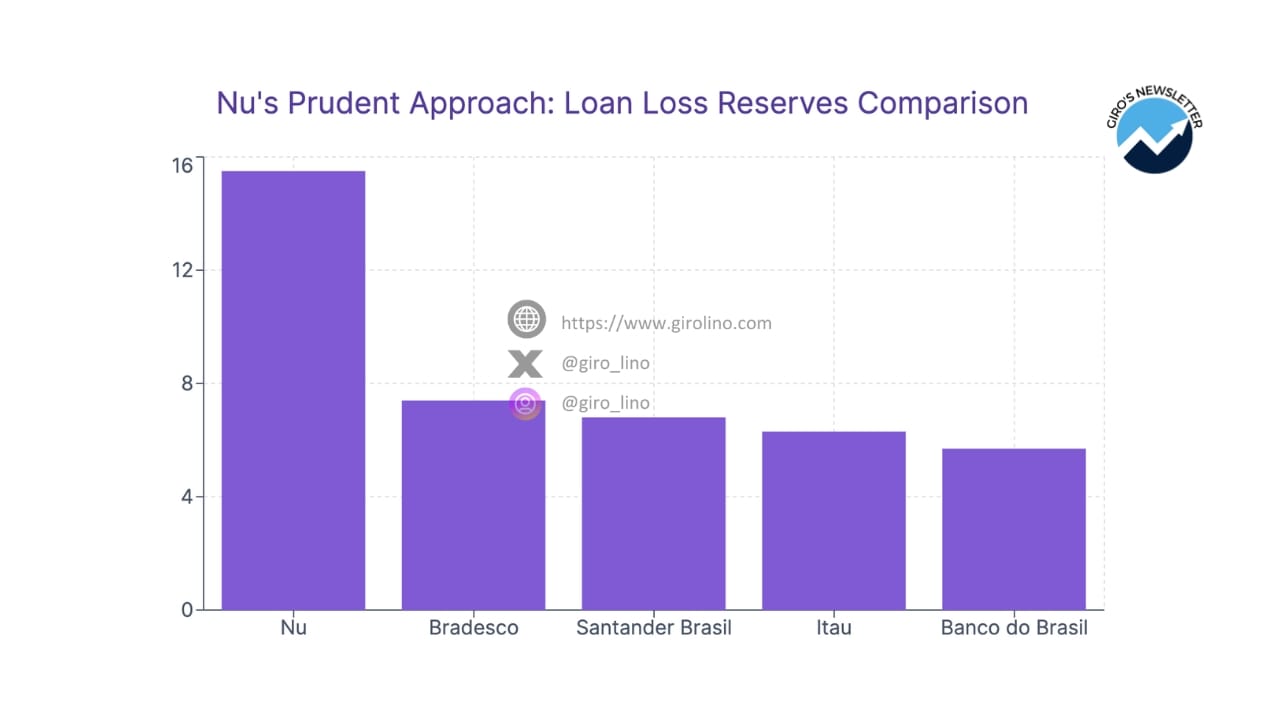

Nu's Provisioning Compared to Traditional Banks: A Comparative Analysis

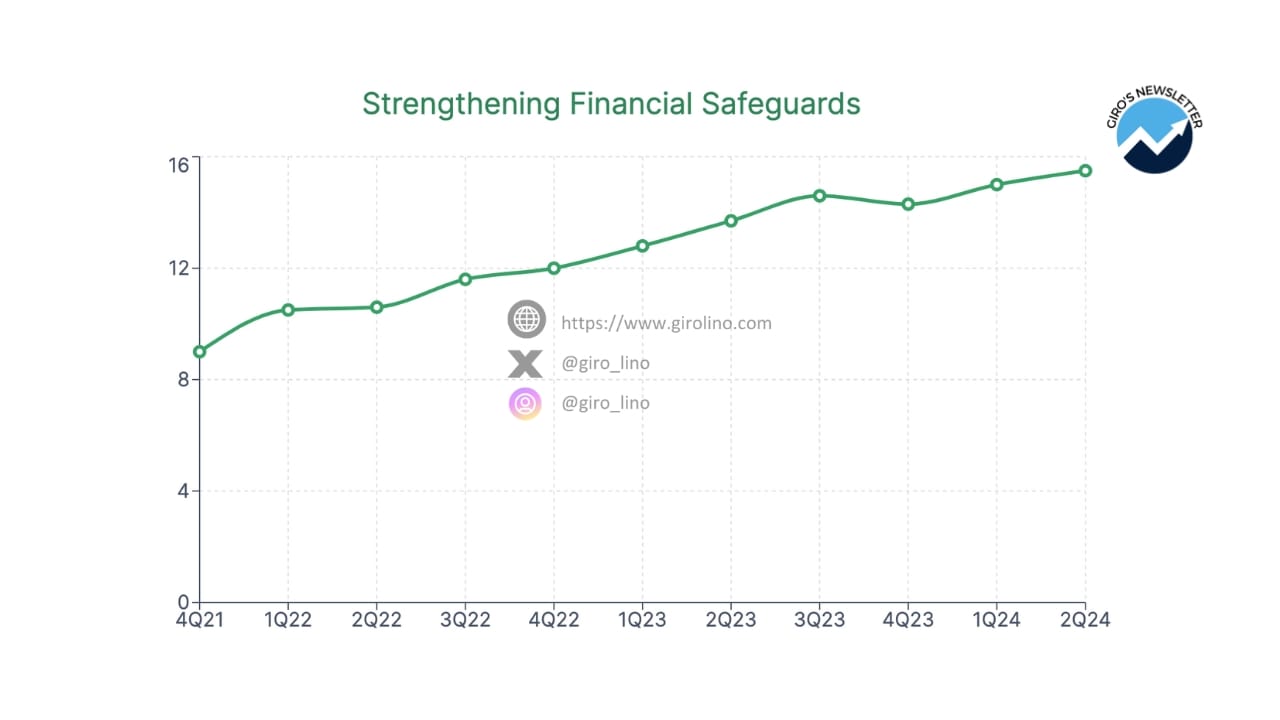

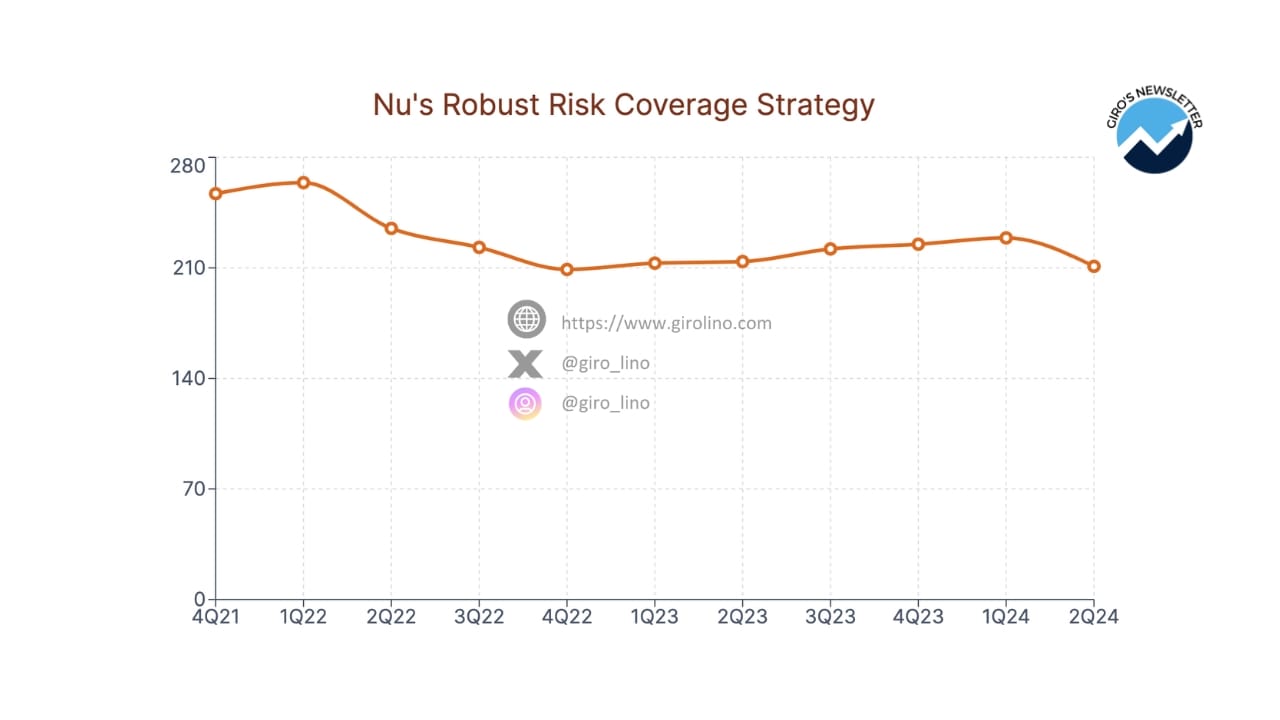

Loan Loss Reserves Trends

Nu's loan loss reserves as a percentage of total loans have shown a consistent upward trend over time. This progression demonstrates the company's increasingly conservative approach to provisioning, reflecting a strong commitment to maintaining robust buffers against potential credit losses.

Among its peers in the Latin American banking sector, Nu maintains the highest level of loan loss reserves on its balance sheet. This approach provides a substantial cushion against potential credit losses and underscores Nu's commitment to prudent risk management.

Guilherme Lago provided further context on Nu's strong capital position:

We have about 2x the minimum capital that are required in these geos. And if above and beyond, you also take into account the $2.4 billion of excess capital that we have at the holding company, we would get to nearly 3x the minimum regulatory capital.

This statement highlights Nu's conservative approach to capital management, which further supports its robust provisioning practices.

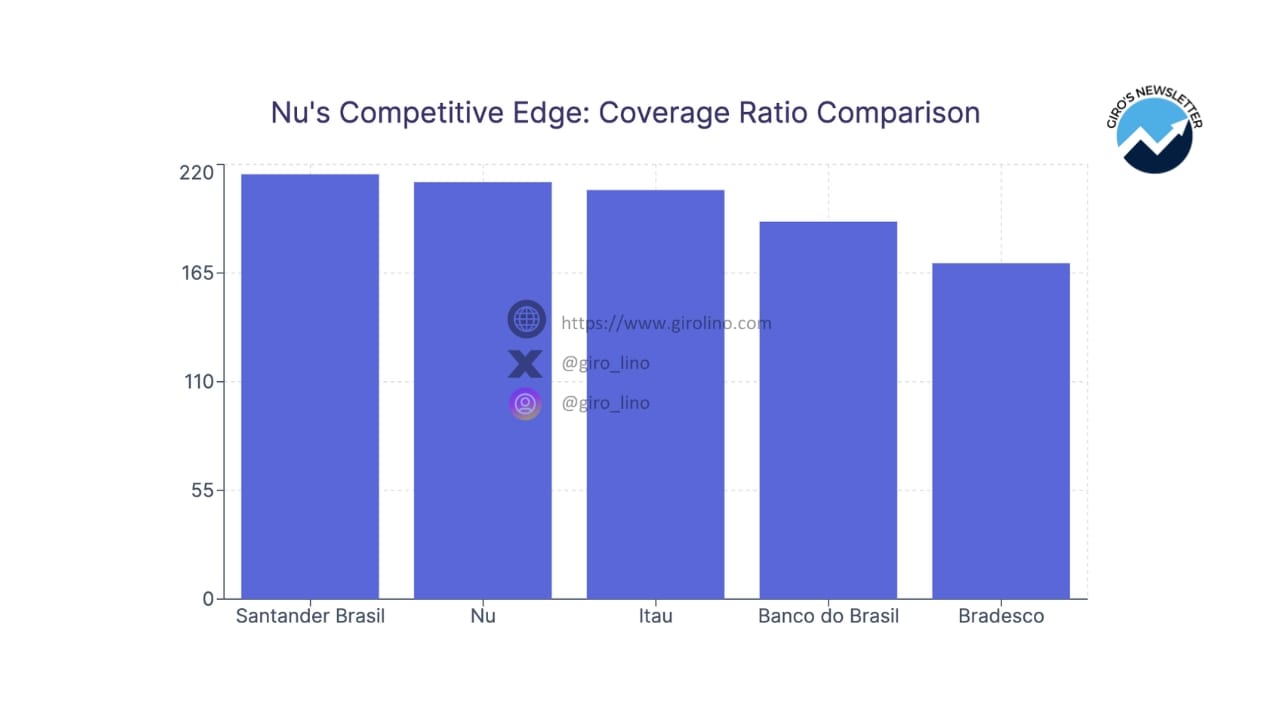

Coverage Ratio Analysis

The coverage ratio, a key metric measuring loan loss reserves as a percentage of NPLs, has trended lower in recent quarters for Nu Holdings. However, it's important to note that it remains at a healthy level, indicating strong provisioning relative to the company's non-performing loan portfolio.

When compared to incumbent banks, Nu's coverage ratio stands out as higher than most, with only Santander Brasil maintaining a higher ratio. This strong coverage position further underscores Nu's robust approach to risk management and provisioning.

Future Outlook: Balancing Aggressive Growth with Prudent Risk Management

As Nu Holdings continues its trajectory of rapid expansion, both in terms of product offerings and geographic reach, several key areas warrant close our attention:

- The evolution of NPL ratios as the company grows its unsecured lending portfolio

- The potential impact of macroeconomic factors on credit performance across Nu's markets

- The company's ability to maintain its impressive risk-adjusted returns while scaling operations

David Velez emphasized the company's focus on long-term value creation:

While we believe we will continue to operate with healthy levels of profitability the opportunities we have ahead of us are so compelling that we believe it is time for planting, not for harvesting.

This statement underscores Nu's commitment to balancing growth with prudent risk management, prioritizing long-term success over short-term gains.

Nu's Technological Edge in Risk Management

A key differentiator for Nu Holdings in its risk management approach is its heavy reliance on advanced technology and data analytics. The company's ability to leverage vast amounts of customer data for credit decisioning and risk assessment sets it apart from traditional banks.

David Velez highlighted the importance of technology in their strategy:

We have over 59 nationalities working at Nubank, and over 50% of our headcount is focused in technology and analytics. This access to world-class technical talent has been a key reason for our historical performance, and will continue to be a great enabler of overperformance over the long run as competition increases.

This focus on technology not only enhances Nu's risk management capabilities but also positions the company to adapt quickly to changing market conditions and customer needs.

The Role of Regulatory Environment in Nu's Risk Strategy

Nu's risk management strategy is also shaped by the evolving regulatory landscape in Latin America. The company has been proactive in engaging with regulators and adapting to new requirements, particularly as it expands into new markets.

During the earnings call, David Velez commented on the regulatory environment in Mexico:

We've asked for a banking license. We apply last year. We've received a couple of back and forth from the regulator, everything else so far is going as expected. And we -- hopefully, that process continues to go well and we can get that bank license over the next month or so.

This proactive approach to regulatory compliance demonstrates Nu's commitment to operating within established frameworks while pushing for innovation in the financial sector.

Nu's Strong Position in Risk Management Underpins Future Growth

Nu Holdings' provision levels appear more than sufficient for its current risk exposure, reflecting the company's unwavering commitment to prudent risk management practices. The combination of conservative provisioning, data-driven risk assessment methodologies, and a strategic focus on portfolio diversification positions Nu exceptionally well for sustainable growth in the highly competitive Latin American fintech landscape.

Analyzing Nu Holdings stock, the company's strong provisioning practices and sophisticated risk management approach provide a compelling case for long-term value creation. As Nu continues to disrupt traditional banking across Latin America, its robust risk management framework is likely to prove a key differentiator and source of sustainable competitive advantage in the years to come.

The company's ability to balance aggressive growth with prudent risk management, leveraging cutting-edge technology and data analytics, sets it apart in the fintech sector. As Nu Holdings continues to expand its footprint and product offerings, its strong foundation in risk management will be crucial in navigating the challenges and opportunities that lie ahead in the rapidly evolving Latin American financial services landscape.