My Fintech Fascination Meets Nubank's Potential

As someone who’s been knee-deep in the world of finance for over a decade, I’ve seen my fair share of “revolutionary” companies come and go. But every once in a while, a true game-changer emerges. Enter Nubank, the Latin American fintech powerhouse that’s been turning heads and challenging the status quo since 2013.

I’ll be honest – when I first heard about Nubank, I was skeptical. Another digital bank? But as I dug deeper, I realized this wasn’t just another fintech startup. Nubank offers a digital account that stands out with features like real-time transaction tracking, no fees, and an international credit card with worldwide acceptance and no annual fee, enhancing customer experience significantly.

This digital account, known as NuConta, provides access to various financial products through a mobile application, setting Nubank apart from other digital banks. Additionally, Nubank helps users manage their money effectively by offering tools for monitoring savings, investment options, and easy access to funds, making it a comprehensive solution for financial management. Nubank has the potential to reshape the entire banking landscape in Latin America, and savvy market watchers are taking notice.

In this post, I’ll break down why Nubank has captured my attention and why it might deserve a spot in your portfolio. We’ll dive into the numbers, dissect the business model, and examine the risks. By the end, you’ll have a clear picture of Nubank’s potential and be better equipped to make an informed decision about its place in your investment strategy.

Nubank by the Numbers: A Snapshot of Rapid Growth

Before we dive into the nitty-gritty, let’s take a look at some key figures that paint a picture of Nubank’s impressive trajectory:

- Founded: 2013

- IPO Date: December 9, 2021 (NYSE: NU)

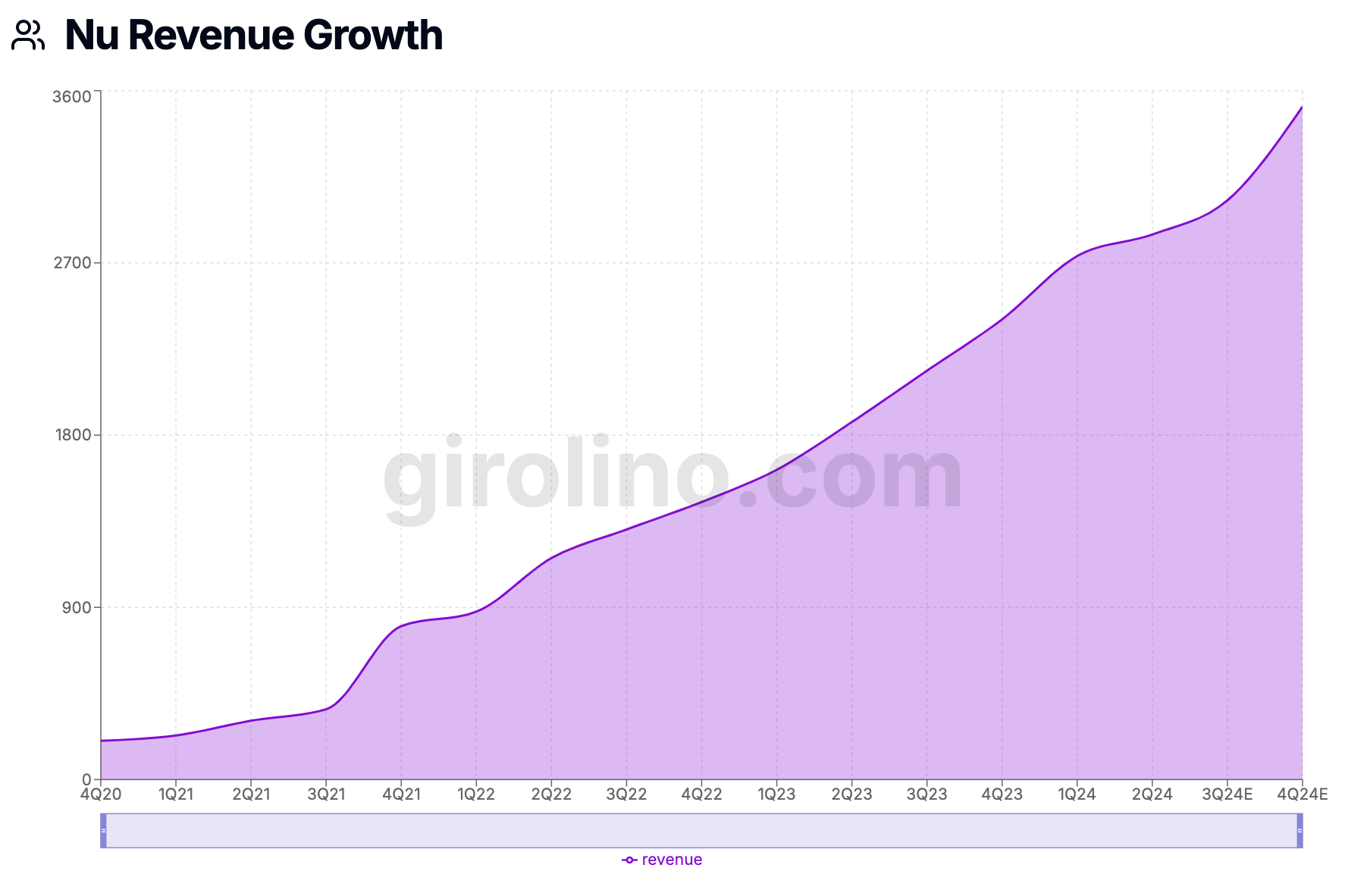

- Revenue (2022): $4.8 billion (Up 182% from 2021)

- Total Payment Volume: $208.1 billion

- Monthly Active Users: 75.1 million

- Customer Base: Over 100 million across Brazil, Mexico, and Colombia

NU Pagamentos SA, also known as Nubank, provides diverse financial services including digital accounts, credit cards, and loans.

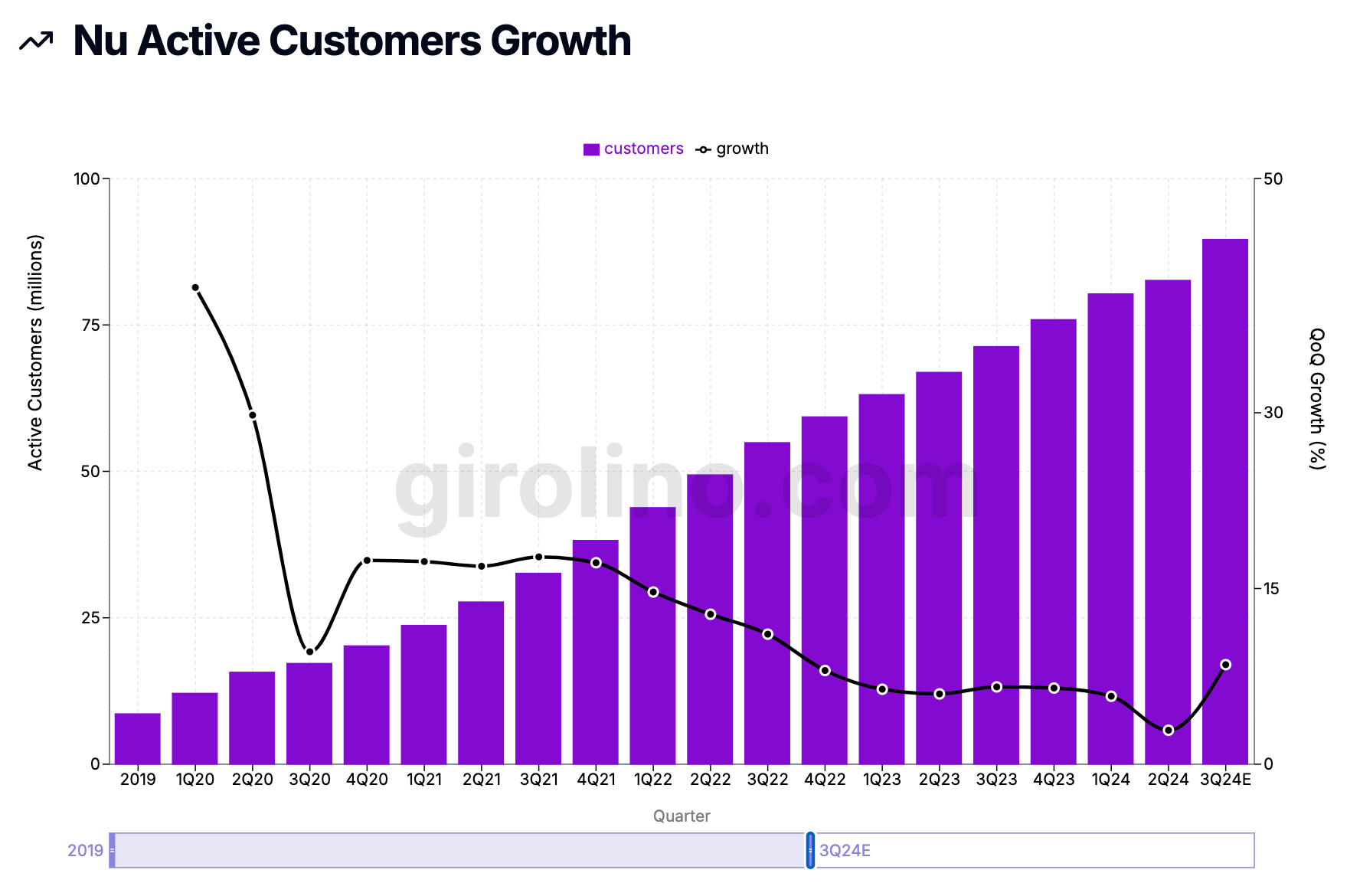

Highest Active Customers: 137 million (Q4 2027E)

Highest QoQ Growth: 40.7% (Q1 2020)

Recent quarters show continued growth with slowing growth rate

These numbers aren’t just impressive – they’re staggering. In less than a decade, Nubank has gone from a scrappy startup to a financial behemoth with a customer base larger than the population of most European countries.

The Secret Sauce: Nubank's Financial Services Business Model Decoded

Nubank’s meteoric rise in the Latin American fintech space isn’t just a stroke of luck. The introduction of debit payments in 2018 significantly enhanced customer convenience by allowing users to manage transactions in real time through the mobile app. It’s the result of a carefully crafted business model that leverages technology, customer-centricity, and financial innovation. Let’s dive deep into the components that make Nubank’s approach so effective.

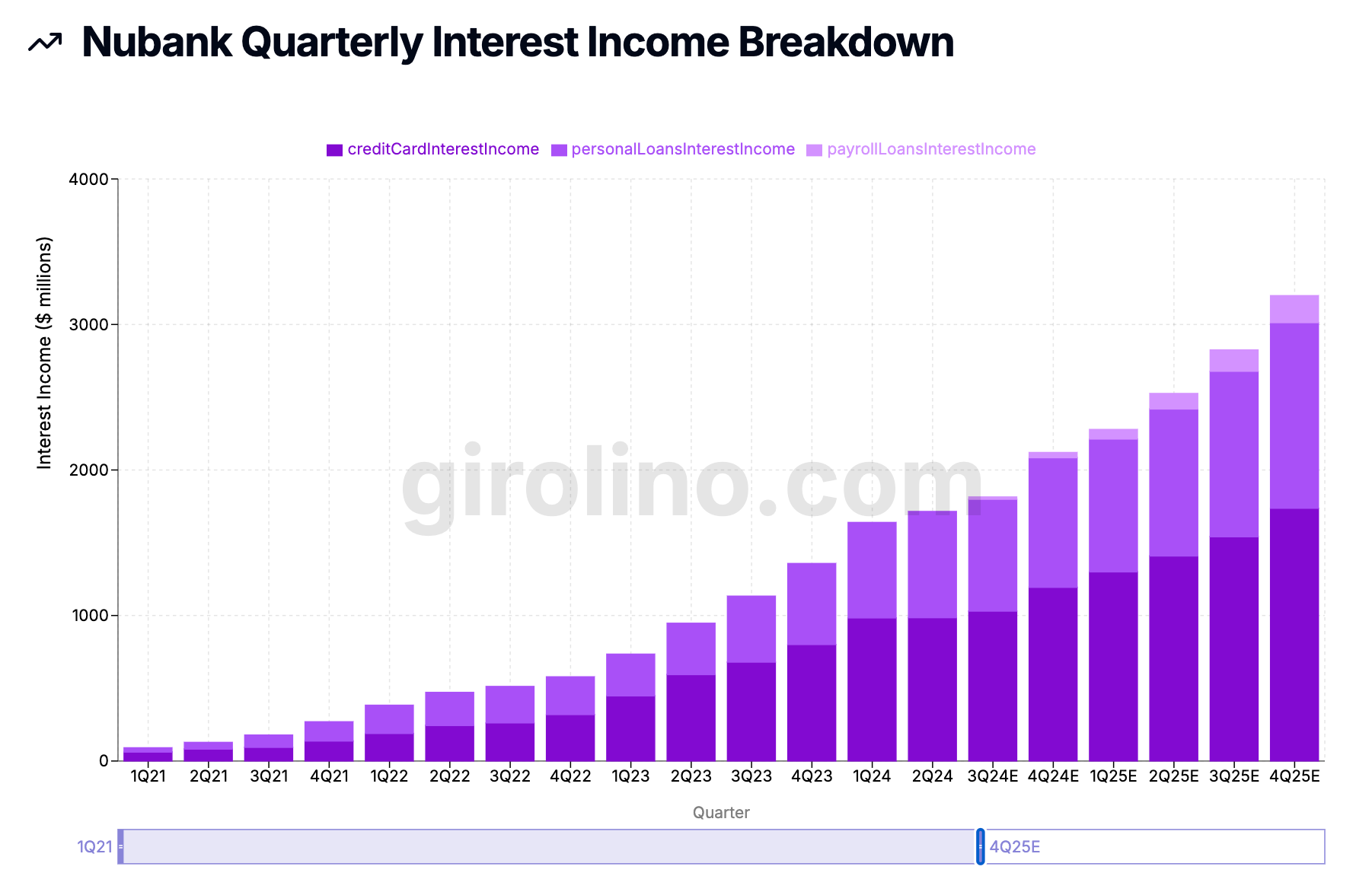

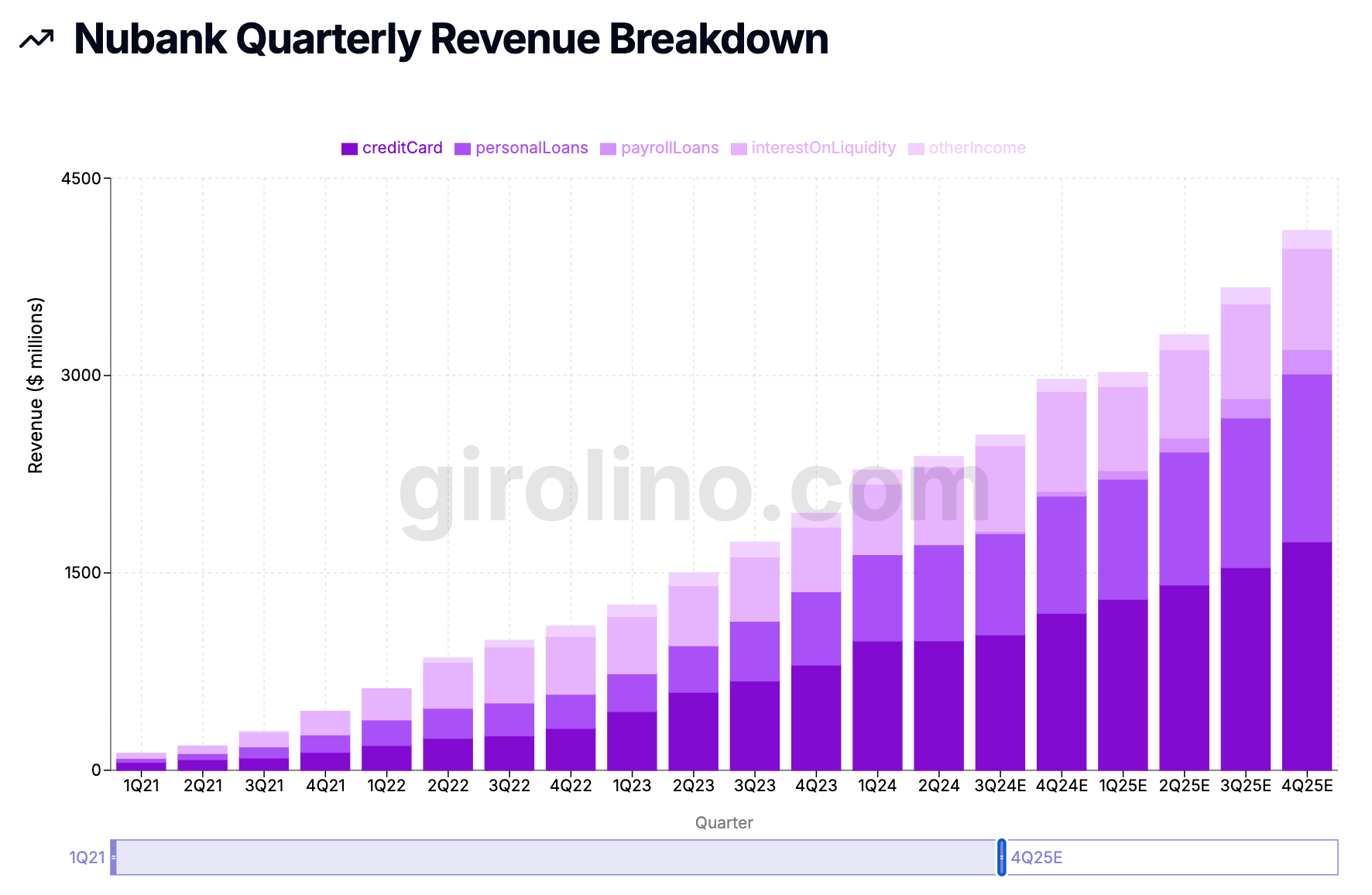

Interest Income: The Primary Revenue Driver

At the heart of Nubank's financial success lies its interest income, which accounts for a significant portion of its revenue. This income stream is derived from three main sources:

- Credit Card Balances: Nubank's flagship product, its no-fee credit card, serves as a gateway to the company's ecosystem. When customers carry balances on their credit cards, Nubank earns interest on these unpaid amounts. The company's ability to offer competitive interest rates while maintaining profitability is a testament to its efficient operations and risk management.

- Personal Loans: As Nubank's customer base has grown, so has its personal loan portfolio. These loans provide a steady stream of interest income while helping customers access funds for various needs. The company's data-driven approach to credit assessment allows it to offer personalized loan terms, balancing risk and reward effectively.

- Payroll Loans: A relatively newer addition to Nubank's product lineup, payroll loans are gaining traction. These loans, which are repaid through automatic deductions from the borrower's salary, offer lower risk for Nubank and potentially better rates for customers. This product demonstrates Nubank's ability to innovate and diversify its income sources within the lending space.

The growth in Nubank's interest income is vividly illustrated in the image above, which shows a steady upward trend in all three categories - credit card interest, personal loans, and payroll loans. This diversification not only boosts revenue but also helps mitigate risks associated with relying too heavily on a single product.

Before you dive into our in-depth analysis, we have a quick request:

If you find this content useful, please consider sharing it!

Why? Your shares help us reach a wider audience, allowing us to continue producing high-quality, comprehensive content like this—completely free, with no paywalls or subscriptions.

Thank you for your support!

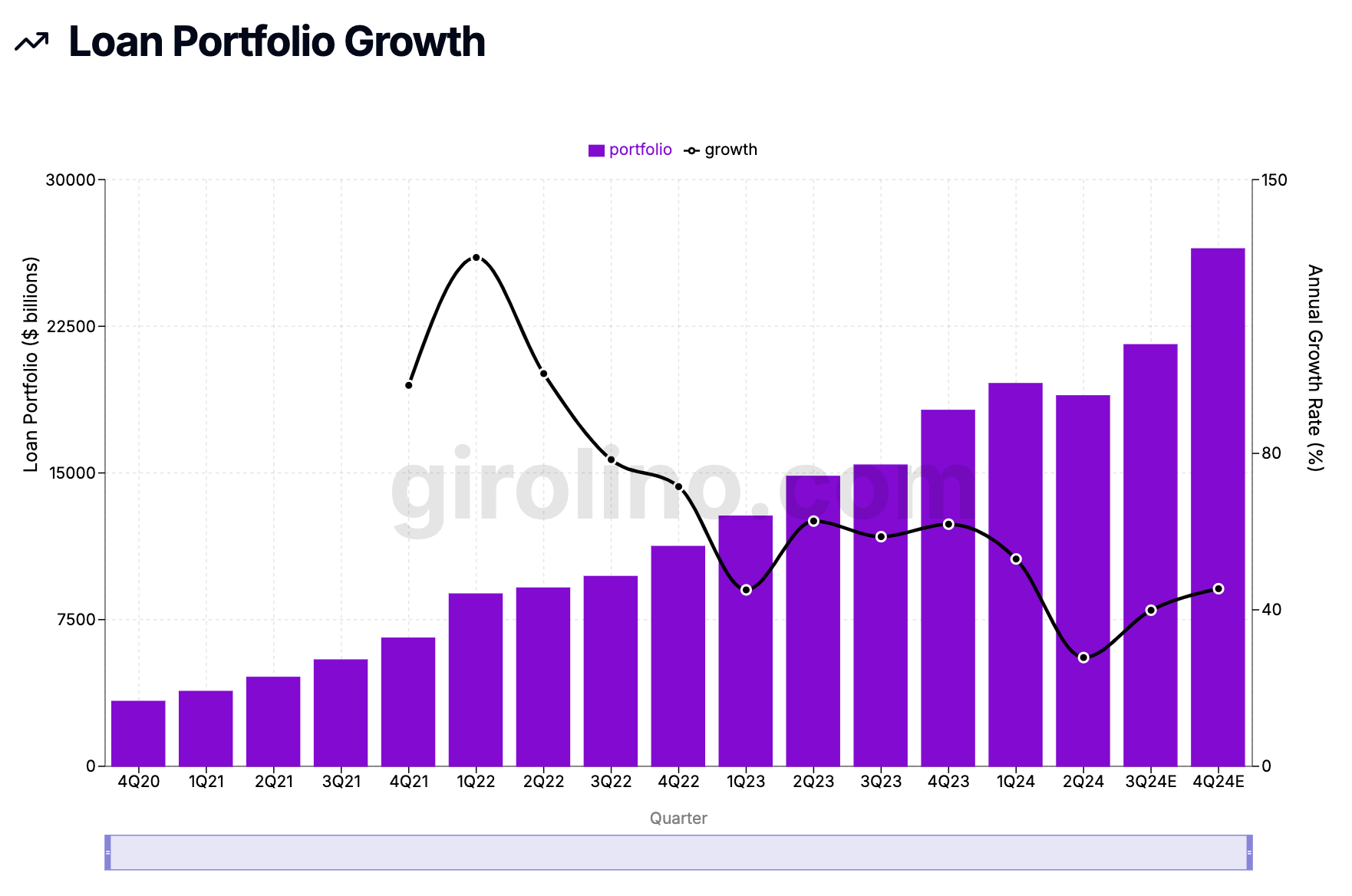

The Loan Portfolio: A Growth Engine

Nubank's loan portfolio has been a key driver of its growth, as evidenced by Image 3. The graph shows a remarkable upward trajectory in the loan portfolio size, growing from around 5 billion in Q4 2020 to projected values exceeding 25 billion by Q4 2024. This exponential growth underscores Nubank's increasing market penetration and customer trust.

Interestingly, the growth rate (represented by the black line) shows some fluctuations. After an initial surge, there's a period of moderation, followed by another uptick. This pattern suggests that Nubank is adept at managing its growth, possibly alternating between phases of aggressive expansion and consolidation to ensure sustainable progress.

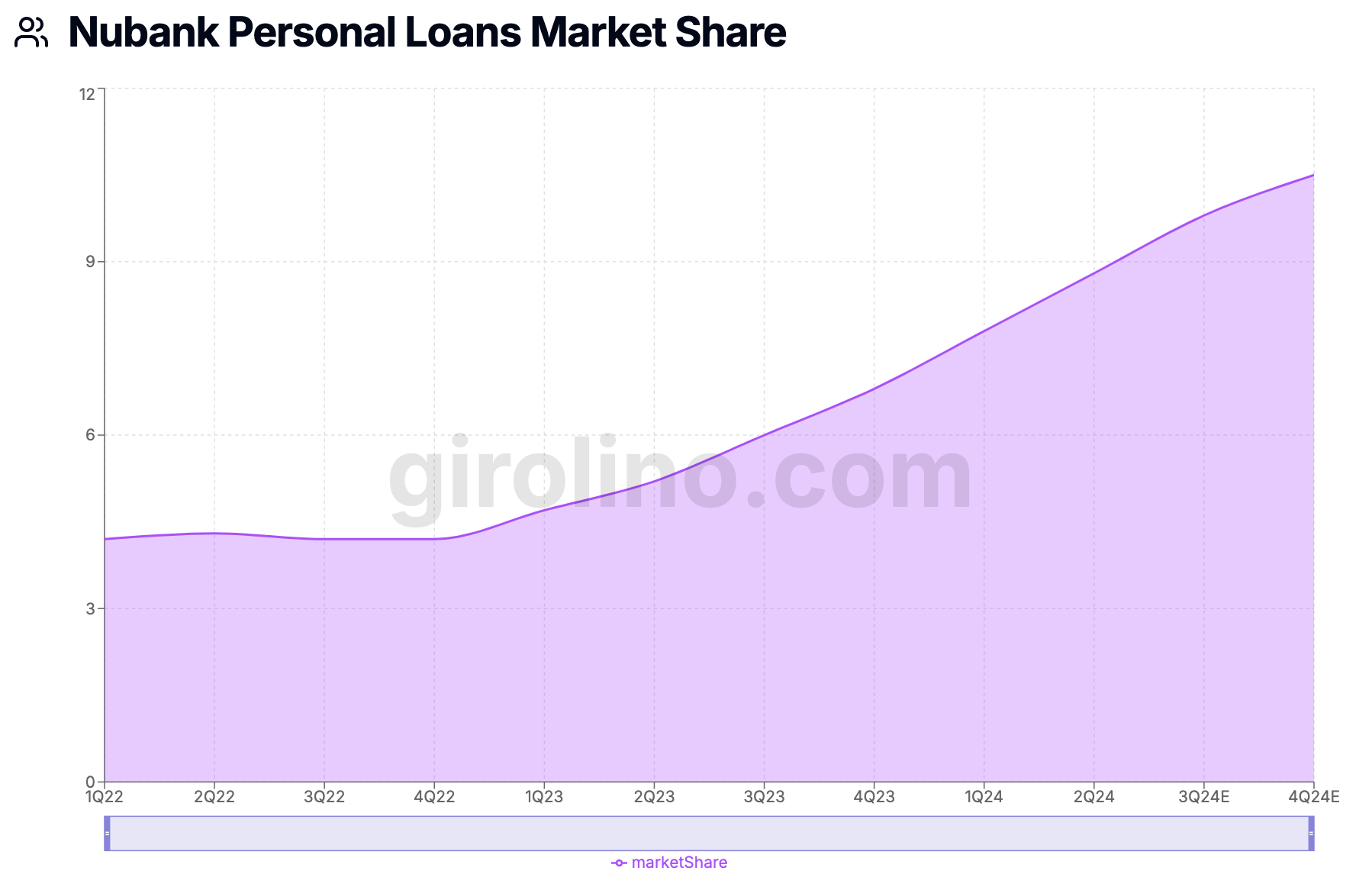

Market Share Expansion in Personal Loans

The chart below provides a compelling visualization of Nubank's growing influence in the personal loans market. Starting from a modest market share of around 4% in Q1 2022, the projection shows a steady climb, potentially reaching over 10% by Q4 2024. This consistent upward trend in market share is a clear indicator of Nubank's increasing competitiveness and customer preference in the personal loans segment.

The gradual but persistent increase in market share suggests that Nubank is not just growing its loan book in absolute terms, but is also outpacing the market average. This could be attributed to several factors:

- Competitive Pricing: Nubank's efficient operations may allow it to offer more attractive interest rates.

- User-Friendly Application Process: The company's digital-first approach likely makes loan applications more accessible and convenient.

- Targeted Marketing: Leveraging its vast customer data, Nubank can offer personalized loan products to the right customers at the right time.

- Trust and Brand Loyalty: As customers become more comfortable with Nubank's other services, they may be more inclined to choose Nubank for their loan needs.

This growing market share in personal loans not only contributes to Nubank's interest income but also deepens its relationship with customers, potentially leading to increased cross-selling opportunities for other financial products.

Interchange Fees from Card Transactions

Interchange fees are charges that merchants pay to card-issuing banks for each transaction processed. For Nubank, as a card issuer, these fees represent a significant and growing source of income. Here's why interchange fees are so important to Nubank's business model:

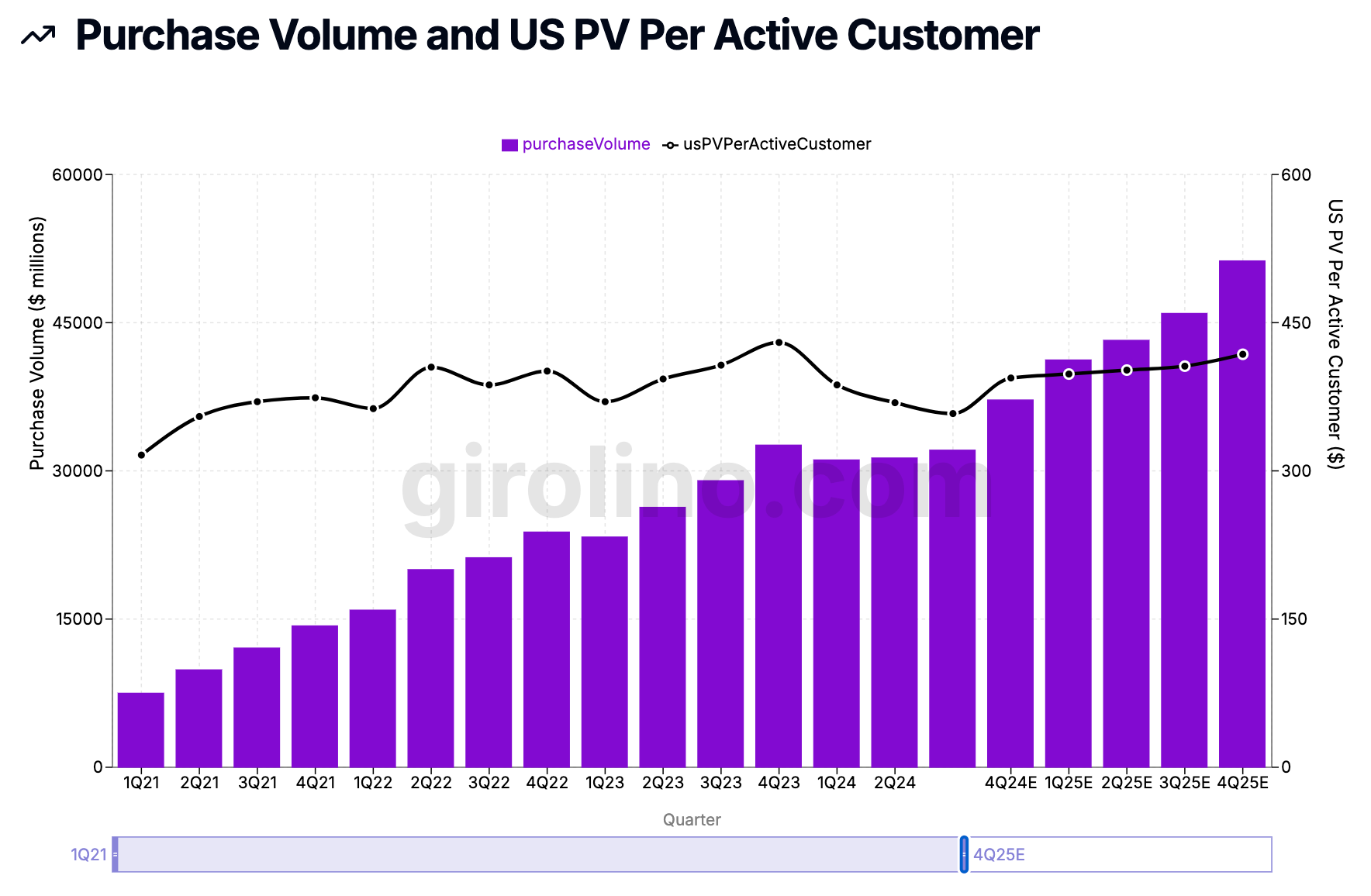

- Volume-Driven Revenue: Nubank's purchase volume has been on a steady upward trajectory. This massive growth in transaction volume directly translates to higher interchange fee revenue.

Purchase volume has grown from $22.5B in 2020 to an estimated $84B in Q4 2027.

The data suggests strong growth in both total purchase volume and per-customer spending over the years.

- Increasing Per-Customer Value: Not only is Nubank adding more customers, but existing customers are also increasing their card usage, further boosting interchange revenue.

- Market Share Growth: Nubank has shown impressive growth in credit card market share. This growing slice of the credit card market ensures a larger pool of transactions from which Nubank can earn interchange fees.

- Scalability: Unlike interest income, which carries inherent risk, interchange fees are relatively low-risk. As Nubank's customer base and transaction volumes grow, the company can increase its fee income without a proportional increase in risk or operational costs.

- Customer Engagement Driver: High card usage, which generates more interchange fees, is also an indicator of customer engagement. Engaged customers are more likely to use other Nubank products, creating cross-selling opportunities.

- Competitive Advantage: Nubank's no-fee credit card model is partly subsidized by interchange fees. This allows the company to offer attractive, fee-free products to customers while still generating revenue, giving Nubank a competitive edge in customer acquisition.

The combination of rapidly growing purchase volumes, increasing per-customer spending, and expanding market share paints a picture of robust growth in Nubank's interchange fee income. This revenue stream not only contributes directly to the bottom line but also supports Nubank's customer-friendly pricing model, fueling further growth and market penetration.

As Nubank continues to innovate and expand its product offerings, we can expect the company to find new ways to leverage its growing transaction volumes and market share to enhance its fee income streams, further solidifying its position in the Latin American fintech landscape.

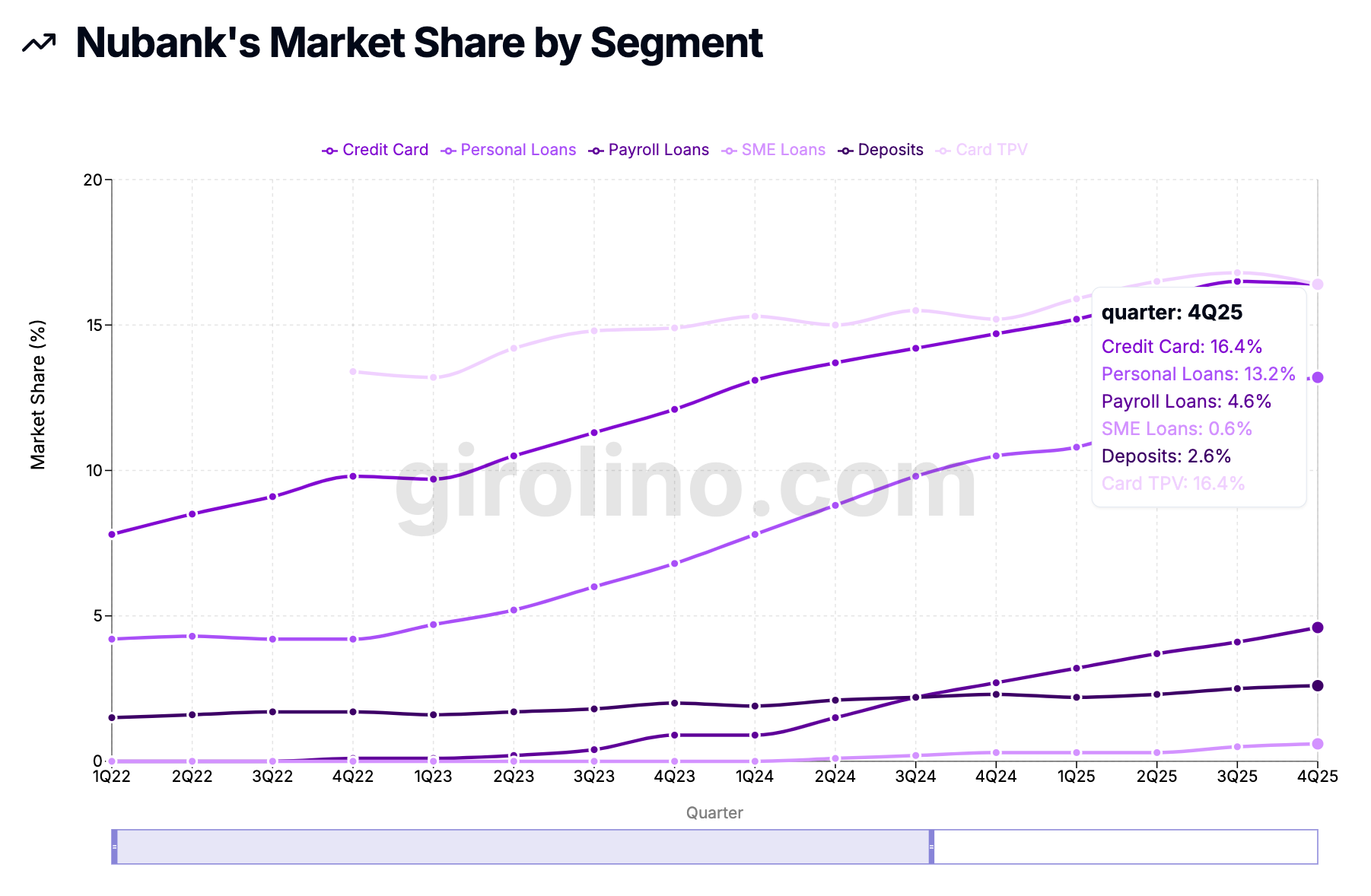

Nubank's Market Share: A Multi-Segment Success Story

Nubank’s rapid growth isn’t just confined to one area of financial services. São Paulo, where Nubank's headquarters are located, plays a significant role in the fintech landscape of Latin America. The company has been steadily increasing its market share across multiple segments, demonstrating its ability to capture a significant portion of the Latin American financial market. Let’s break down Nubank’s market share by segment:

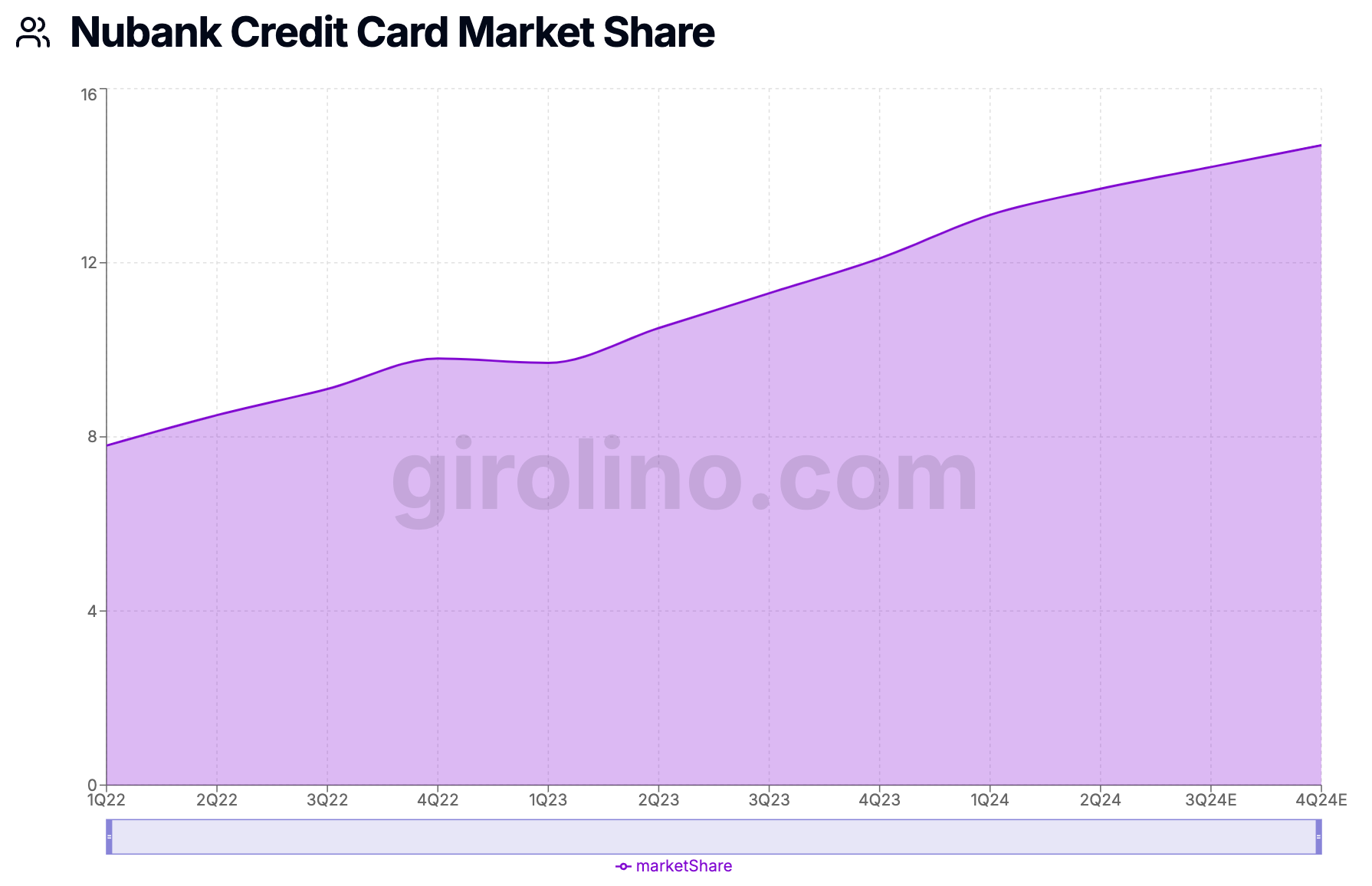

Credit Cards: The Flagship Product

Nubank's credit card offering has been its most successful product in terms of market penetration. By Q4 2025, the company is projected to capture an impressive 16.4% of the credit card market. This substantial market share is a testament to Nubank's innovative, fee-free credit card model that has resonated strongly with consumers.

Personal Loans: A Rising Star

The personal loans segment shows one of the most dramatic growth trajectories. Starting from a modest position, Nubank's market share in personal loans is expected to reach 13.2% by Q4 2025. This rapid growth indicates Nubank's successful expansion beyond its initial credit card offering.

Payroll Loans: Steady Growth

Payroll loans represent a newer product category for Nubank, but one that's showing promising growth. By Q4 2025, Nubank is projected to hold 4.6% of this market, indicating successful penetration into this more traditional banking product.

SME Loans: An Emerging Opportunity

While still a small part of Nubank's portfolio, SME loans show the company's ambition to serve small and medium-sized enterprises. The projected 0.6% market share by Q4 2025 may seem modest, but it represents a foothold in a potentially lucrative market segment.

Deposits: Building Trust

Nubank's 2.6% market share in deposits by Q4 2025 demonstrates that customers are increasingly trusting the digital bank with their savings. This is crucial for Nubank's long-term strategy of becoming a full-service financial institution.

Card TPV: Matching Credit Card Share

Card Total Payment Volume (TPV) closely mirrors Nubank's credit card market share, reaching 16.4% by Q4 2025. This alignment indicates that Nubank's credit card users are not just numerous, but also active and engaged.

The diverse growth across these segments showcases Nubank's successful execution of its multi-product strategy. By capturing significant market share in various financial services, Nubank is positioning itself as a comprehensive alternative to traditional banks, appealing to a wide range of customer needs and preferences.

This multi-segment success not only diversifies Nubank's revenue streams but also deepens its relationships with customers, creating opportunities for cross-selling and increased customer lifetime value. As Nubank continues to expand its product offerings and refine its services, we can expect to see further market share gains across these and potentially new segments in the coming years.

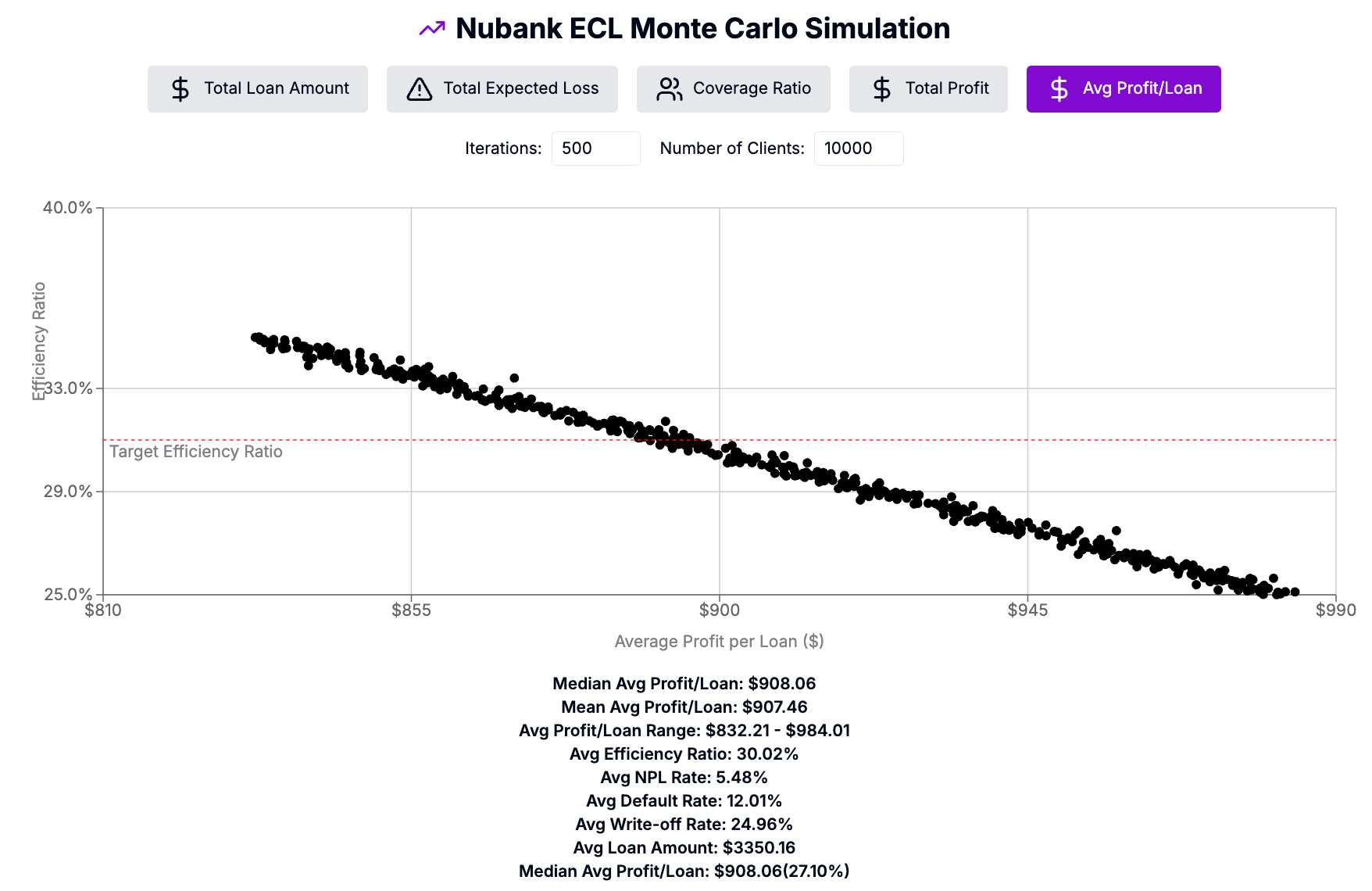

Unveiling Nubank's Profitability Drivers: An ECL Monte Carlo Simulation

In a groundbreaking analysis, we've conducted a Monte Carlo simulation of Nubank's Expected Credit Loss (ECL) model to uncover the key factors driving the company's profitability. This simulation, based on data released by the Brazilian Central Bank (BCB) and focused solely on Nubank's Brazilian operations, provides unprecedented insights into the fintech giant's financial dynamics.

Unparalleled Complexity and Depth

The level of sophistication in this analysis sets a new standard for fintech valuation models:

- Individual Loan Simulation: For each iteration, we simulated a single loan accrual for every client, running a default model for each one. This granular approach captures the nuances of Nubank's loan portfolio in a way that aggregate models simply cannot match.

- Comprehensive Modeling: Our model comprises five distinct modules, totaling between 2,000 to 2,500 lines of code. This complexity allows us to account for a wide array of variables and their intricate interactions.

- Unprecedented Detail: The depth of this analysis far surpasses what you'd typically find in sell-side reports. While some reports might include a simple Excel table simulating a single loan based on a couple of variables, our model provides a holistic view of Nubank's entire loan ecosystem.

- Computational Intensity: The sheer computational power required to run this simulation underscores its complexity and the depth of insights it provides.

- Tailored Risk Models: We implemented different default and writeoff models based on loan terms, loan amounts, and for each Non-Performing Loan (NPL) category (15-day and 90-day). This level of specificity allows for a more accurate representation of Nubank's diverse loan portfolio and risk profile.

- Model Validation: One of the most reassuring aspects of this complex modeling process was the high degree of adherence between our model's outputs and the numbers officially released by Nubank. This alignment validates the accuracy of our approach and lends credibility to the insights derived from the simulation.

The combination of granular loan-level simulation, multiple risk models, and extensive code base creates a comprehensive picture of Nubank's operations that goes far beyond traditional financial analysis. The model's ability to closely match Nubank's official figures not only validates our approach but also provides a solid foundation for exploring various scenarios and potential future outcomes for the company.

This level of detail and accuracy is crucial for understanding the true dynamics of a digital-first financial institution like Nubank, where traditional metrics and analysis methods may fall short. It allows for a nuanced exploration of how different factors - from loan terms to default rates - interact to drive the company's overall performance and profitability.

The Power of Efficiency

The simulation results reveal a critical insight: efficiency is the most crucial factor in Nubank's profitability. This finding underscores a fundamental advantage Nubank holds over traditional banks - its lack of legacy systems and processes. Let's break down the key metrics:

- Efficiency Ratio: The average efficiency ratio stands at an impressive 30.02%. This metric, which measures operating expenses as a percentage of revenue, indicates that Nubank operates with significantly lower costs compared to traditional banks.

- Average Profit per Loan: The simulation shows a median average profit per loan of $908.06, representing a robust 27.10% return. This high profitability is largely attributed to Nubank's efficient operations.

- NPL and Default Rates: The average Non-Performing Loan (NPL) rate of 5.48% and default rate of 12.01% are manageable, especially considering the high profitability per loan.

- Write-off Rate: At 24.96%, the write-off rate might seem high, but it's offset by the high profitability and efficiency of the overall loan portfolio.

The Legacy-Free Advantage

Nubank's ability to achieve such high efficiency ratios is largely due to its status as a digital-native bank. Unlike traditional financial institutions, Nubank doesn't bear the burden of legacy IT systems, extensive branch networks, or outdated processes. This allows the company to:

- Operate with lower overhead costs

- Implement cutting-edge technology without integration hurdles

- Scale operations rapidly without proportional cost increases

- Offer competitive rates while maintaining profitability

Implications for Future Growth

The simulation results suggest that as Nubank continues to grow and potentially enters new markets, its efficiency-driven model will be a significant competitive advantage. The company's ability to maintain high profitability even with relatively high write-off rates indicates a robust risk management strategy coupled with operational excellence.

This unique analysis not only validates Nubank's business model but also provides a quantitative basis for understanding its success in disrupting the traditional banking sector. As Nubank expands its product offerings and enters new markets, maintaining this high level of efficiency will be crucial for continued success and profitability.

Growth Trajectory: Where Nubank Is Headed in Latin America

Nubank’s growth strategy revolves around three key pillars:

- Geographic Expansion:

- Current markets: Brazil, Mexico, Colombia

- Potential future markets: Argentina, Peru, Chile

- Product Diversification:

- Recent launches: Personal loans, investment products, insurance

- On the horizon: SME banking, expanded credit offerings

- Comprehensive offerings: Personal loans and life insurance to help manage a customer's financial life

- Technological Innovation:

- AI and machine learning for risk assessment and personalization

- Open banking initiatives

I’m particularly excited about the SME banking potential. Small and medium enterprises are often underserved by traditional banks, presenting a massive opportunity for Nubank to replicate its success in consumer banking.

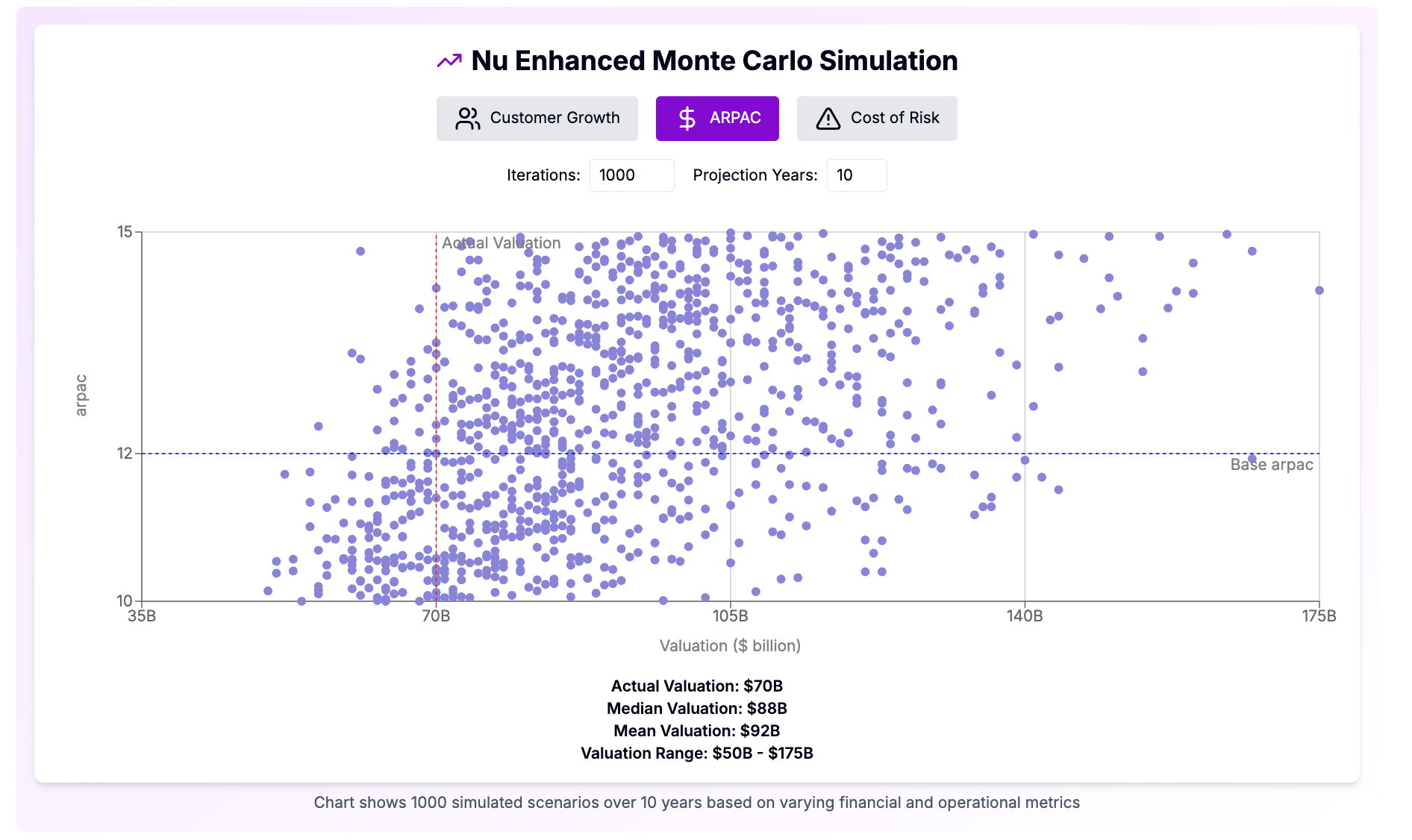

Nubank's Valuation: Unlocking Future Potential

To gain deeper insights into Nubank's potential value, we conducted a comprehensive valuation analysis using a 10-year Free Cash Flow to Equity (FCFE) Discounted Cash Flow (DCF) model. This model was then validated and expanded upon through a Monte Carlo simulation that ran 1000 iterations of 10-year FCFE DCFs, providing a robust range of potential outcomes.

Key Value Drivers

Our model identified several critical factors that drive Nubank's valuation:

- Customer Growth

- Average Revenue Per Active Customer (ARPAC)

- Cost of Risk

- Operating Expenses (as a percentage of revenue)

- Tax Rate

- Discount Rate

- Terminal Growth Rate

These drivers form the foundation of our valuation model and Monte Carlo simulation, allowing us to explore a wide range of potential scenarios for Nubank's future performance.

Simulation Insights

The Monte Carlo simulation reveals fascinating insights into Nubank's potential valuation:

- Current vs. Projected Valuation:

- Actual Valuation: $70 billion

- Median Projected Valuation: $88 billion

- Mean Projected Valuation: $92 billion

- Valuation Range: The simulation suggests a wide valuation range from $50 billion to $175 billion, indicating significant growth potential but also some uncertainty.

- ARPAC Impact: Higher ARPAC generally correlates with higher valuations, as seen in the upward trend of data points in the simulation results. This underscores the importance of Nubank's ability to increase revenue per customer over time.

- Upside Potential: Notably, the scenarios where Nubank's valuation falls below the current $70 billion are limited, suggesting a significant upside potential.

Interpreting the Results

- Growth Expectations: The substantial difference between the current valuation and the upper range of projections ($175 billion) indicates high growth expectations, likely factoring in Nubank's potential for market expansion and product diversification.

- Efficiency is KEY: The operating expenses range highlights the importance of maintaining Nubank's efficient, legacy-free operations.

- Risk Management: The cost of risk range underscores the critical role of effective risk management in realizing the higher end of the valuation spectrum.

- Customer Acquisition and Retention: With customer growth as a key driver, Nubank's ability to continue attracting and retaining customers will be crucial for achieving higher valuations.

- Revenue Diversification: The ARPAC range suggests that Nubank's ability to increase revenue per customer through cross-selling and new product offerings will be a key factor in driving valuation growth.

Future Growth Potential

It's important to note that this valuation model does not include any potential upside from Nubank's operations in Mexico. This suggests that there could be additional growth potential beyond what's captured in the current model, which will be explored in future analysis.

This valuation analysis not only validates Nubank's current market position but also highlights the company's significant growth potential. The limited scenarios where Nubank's valuation falls below its current market cap underscore the robust foundation of the company's business model and its strong position for future growth. As Nubank continues to execute on its strategy, focusing on customer growth, increasing ARPAC, managing risks effectively, and maintaining operational efficiency, it has the potential to realize valuations well above its current market cap, further solidifying its position as a leading global fintech player.

The Bottom Line: Why Nubank Has Earned a Place in My Portfolio

After diving deep into Nubank's business model, financials, and growth prospects, I'm convinced that this is a company with enormous potential. Here's why I've added Nubank to my portfolio and why you might consider doing the same:

- Market Leadership: Nubank is the dominant digital banking player in Latin America, a region ripe for financial disruption.

- Impressive Growth: The company has demonstrated its ability to scale rapidly while improving efficiency.

- Profitability Milestone: Achieving profitability in 2022 validates Nubank's business model and sets the stage for sustainable growth.

- Massive Addressable Market: Latin America's banking sector is underpenetrated, especially in digital services, providing a long runway for growth.

- Technology Advantage: Nubank's proprietary tech stack gives it a significant edge in customer acquisition and risk management.

Of course, this doesn't mean Nubank is without risks. The regulatory environment, credit risk management, and competitive landscape all need to be monitored closely. But for those willing to embrace some volatility in pursuit of potentially outsized returns, Nubank presents a compelling opportunity.

As always, this analysis is based on my personal research and opinion. Before making any investment decisions, it's crucial to do your own due diligence and consider your individual financial goals and risk tolerance.