In recent months, Nvidia has been making headlines not just for its groundbreaking AI chips, but also for the unprecedented level of insider stock sales. As someone who's been closely following the semiconductor industry for years, I've seen my fair share of insider transactions, but the scale and timing of Nvidia's recent sales have caught my attention. Let's dive deep into what's happening, what it might mean, and how it fits into the broader picture of Nvidia's position in the rapidly evolving AI landscape.

The Scale of Insider Sales: Breaking Records

The numbers are staggering. In the third quarter of 2024 alone, Nvidia insiders offloaded a whopping $1.3 billion in shares. To put this into perspective, this is part of a larger trend where Nvidia executives and directors have sold over $1.8 billion worth of shares in 2024 - the highest annual total since at least 2020, even after adjusting for stock splits.

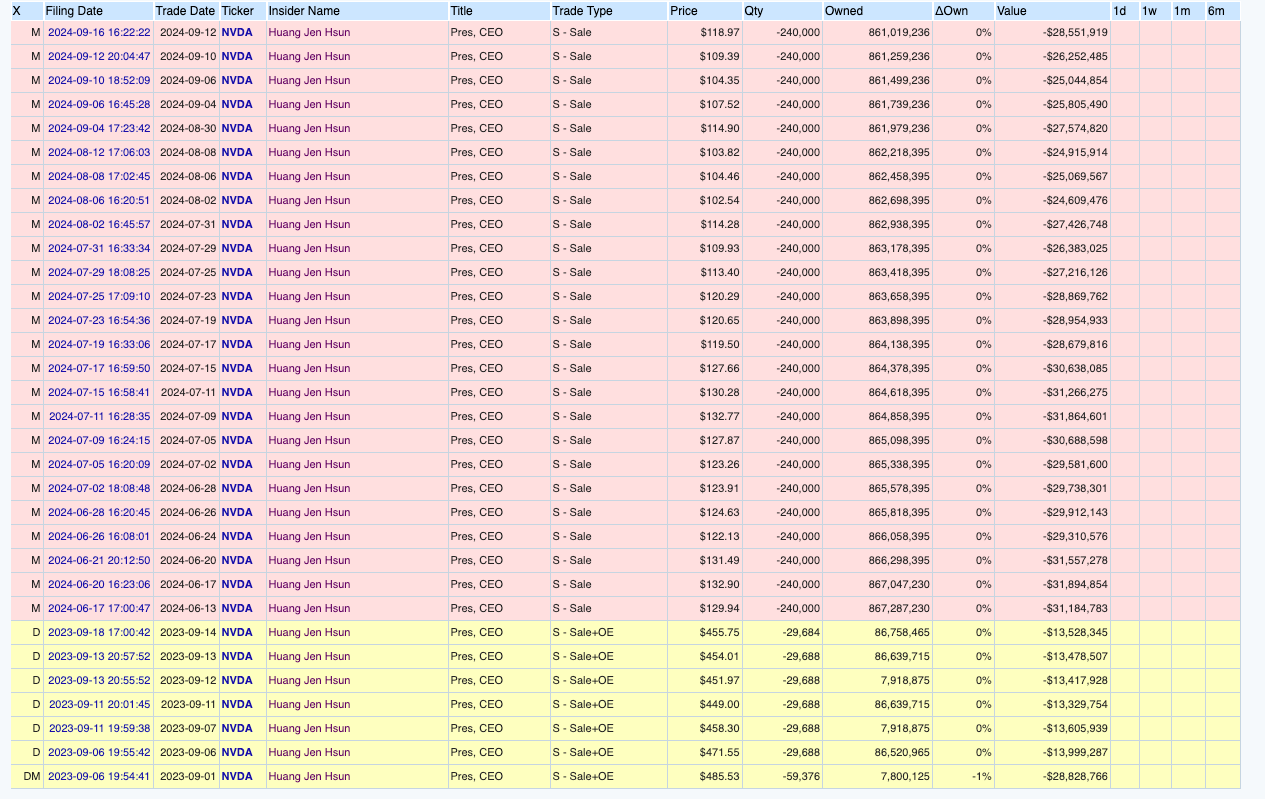

To illustrate the magnitude of these sales, let's take a closer look at CEO Jensen Huang's recent stock transactions:

This table provides a detailed view of Jensen Huang's stock sales over the past year. Several key observations emerge:

- Consistency of Sales: Huang has been selling 240,000 shares consistently in each transaction, indicating a structured selling plan.

- Frequency of Sales: The sales occur roughly every two days, suggesting a pre-arranged 10b5-1 trading plan designed for regular, systematic divestment.

- Price Fluctuations: The sale prices range from a low of $102.54 to a high of $132.90 per share, reflecting the stock's volatility and overall upward trend during this period.

- Total Value: The cumulative value of these sales is substantial, totaling hundreds of millions of dollars.

- Retained Ownership: Despite these large sales, Huang still owned over 861 million shares as of the most recent transaction, underscoring his significant ongoing stake in the company.

- Historical Context: The table also shows some sales from September 2023, where the stock price was much higher (around $450 per share). This was before a stock split, which explains the price difference.

These detailed transaction records provide concrete evidence of the scale of insider selling at Nvidia, particularly by its CEO. However, it's crucial to interpret this data in the broader context of Nvidia's performance, stock price appreciation, and Huang's overall ownership stake.

Context is King: Nvidia's Meteoric Rise

To understand the significance of these sales, we need to look at the bigger picture of Nvidia's recent performance. The company's stock has surged over 137% year-to-date as of December 3, 2024, making it the second-best performer in the S&P 500. This remarkable growth has been fueled by the increasing demand for AI-related processing power, catapulting Nvidia to briefly surpass both Apple and Microsoft as the world's most valuable company.

Jensen Huang, Nvidia's CEO, has been vocal about the company's position in the AI revolution. In a recent earnings call, he stated:

"AI is at an inflection point, setting up for broad adoption reaching into every industry. We are fully prepared. Our new AI factories are coming online. We are helping our customers mine intelligence from the wealth of proprietary data in their AI factories."

This optimistic outlook has been a key driver of Nvidia's stock price, and it's important to consider these insider sales in the context of this unprecedented growth.

Decoding the Motives: Why Are Insiders Selling?

When we see insider sales of this magnitude, it's natural to question the motivations behind them. However, it's crucial to avoid jumping to conclusions. There are several factors at play:

- Capitalizing on High Valuation: With Nvidia's stock price at record highs, insiders may be taking the opportunity to realize substantial gains and diversify their personal portfolios.

- Pre-arranged Trading Plans: Many of these sales, including those of CEO Jensen Huang, were executed through 10b5-1 trading plans. These pre-arranged plans allow insiders to sell shares on a predetermined schedule, helping to mitigate concerns about insider trading based on non-public information.

- Tax Considerations: The timing and scale of these sales could be influenced by tax planning strategies. Executives may be selling shares to cover tax obligations associated with stock-based compensation or to take advantage of current tax rates.

- Market Cycle Awareness: The semiconductor industry is known for its cyclical nature. Seasoned executives with deep industry knowledge might be anticipating shifts in the chip market cycle and adjusting their personal holdings accordingly.

- Broader Industry Trend: It's worth noting that the high level of insider selling isn't unique to Nvidia. Across the semiconductor sector, insiders sold $1.35 billion in shares during the third quarter of 2024 alone, suggesting a broader industry-wide phenomenon.

Technological Advancements and Product Roadmap

Despite the insider sales, Nvidia continues to push the boundaries of AI and GPU technology. The company's recent product launches and roadmap paint a picture of ongoing innovation and market leadership.

The introduction of the H100 AI chip has been a game-changer. As Huang noted in a recent press release:

"The H100 GPU has demonstrated extraordinary acceleration improvements for a wide range of AI applications. It's being deployed by cloud service providers and enterprises worldwide for large language models and generative AI, as well as high performance computing."

This focus on AI-specific hardware has positioned Nvidia at the forefront of the AI revolution. The company's roadmap includes:

- Further development of the Hopper architecture

- Expansion of the CUDA ecosystem

- Advancements in data center GPU technology

- Continued innovation in gaming GPUs

However, it's important to note that Nvidia isn't without competition. Companies like AMD and Intel are ramping up their efforts in the AI chip space, and new entrants like Graphcore and Cerebras are pushing innovative AI-specific architectures.

Financial Performance: Riding the AI Wave

Nvidia's financial performance has been nothing short of exceptional. In the most recent quarter, the company reported:

- Revenue of $13.51 billion, up 101% from a year ago

- GAAP earnings per diluted share of $2.48, up 854% from a year ago

- Data Center revenue of $10.32 billion, up 171% from a year ago

These numbers reflect the surging demand for AI chips and Nvidia's dominant position in the market. CFO Colette Kress commented on the results:

"Our Data Center growth was driven by the accelerating demand for our products to support the ongoing AI market transition. We are seeing growing broad industry acceptance of AI across sectors, including consumer internet, cloud service providers, and enterprises across vertical industries."

While these results are impressive, it's crucial to consider whether this level of growth is sustainable in the long term. The AI boom has created unprecedented demand, but there are questions about how long this surge will last and whether it might lead to overcapacity in the future.

Market Positioning and Competitive Landscape

Nvidia's current market position is strong, but the landscape is evolving rapidly. The company's strengths include:

- First-mover advantage in AI-specific GPUs

- A robust ecosystem of software and developer tools (CUDA)

- Strong partnerships with cloud service providers and AI research institutions

However, challenges are on the horizon:

- Increasing competition from traditional rivals like AMD and Intel

- New entrants in the AI chip space with specialized architectures

- Potential for market saturation as more players enter the AI chip market

Nvidia's ability to maintain its market leadership will depend on continued innovation and strategic partnerships. The company's recent collaboration with VMware, as highlighted by Jensen Huang, is an example of this strategy:

"Our collaboration with VMware will help enterprises accelerate AI deployment by bringing our AI computing platform to VMware's large installed base of customers running workloads on VMware vSphere."

Critical Evaluation: Balancing Optimism and Caution

While Nvidia's recent performance has been exceptional, it's important to maintain a balanced perspective. The insider sales, while not necessarily a red flag, do raise questions about long-term confidence in the company's current valuation.

Positives:

- Dominant market position in AI chips

- Strong financial performance and growth

- Continued innovation in GPU technology

- Robust ecosystem and partnerships

Challenges:

- Potential market saturation in AI chips

- Increasing competition from established players and new entrants

- Questions about the sustainability of current growth rates

- Regulatory risks in the AI space

Final Thoughts

Nvidia's position at the forefront of the AI revolution is undeniable. The company has successfully capitalized on the surge in demand for AI processing power, delivering extraordinary financial results and technological advancements. However, the record insider sales suggest that even those closest to the company are taking a measured approach to their personal holdings.

As we look to the future, Nvidia's continued success will depend on its ability to innovate, adapt to changing market conditions, and fend off increasing competition. The company's strong ecosystem, first-mover advantage, and ongoing R&D efforts provide a solid foundation, but the rapid evolution of the AI landscape means that nothing can be taken for granted.

For those watching Nvidia, it's crucial to balance the company's undeniable strengths with a realistic assessment of the challenges ahead. The insider sales, while noteworthy, should be viewed in the context of Nvidia's overall performance and future prospects. As the AI revolution continues to unfold, Nvidia remains a key player to watch, but like any investment in a rapidly evolving sector, it requires careful consideration and ongoing scrutiny.