NVIDIA Corporation (NASDAQ: NVDA) has once again demonstrated its dominance in the AI chipmaking market with its latest earnings report. This comprehensive analysis delves into NVIDIA's Q2 fiscal 2025 performance, highlighting key metrics, growth drivers, and future prospects. Even though that NVIDIA still a small position for my, it's impossible to ignore understanding its position in the industry.

Quarterly Performance: Exceeding Expectations and Net Income

NVIDIA’s fiscal second quarter results have set new benchmarks in the semiconductor industry:

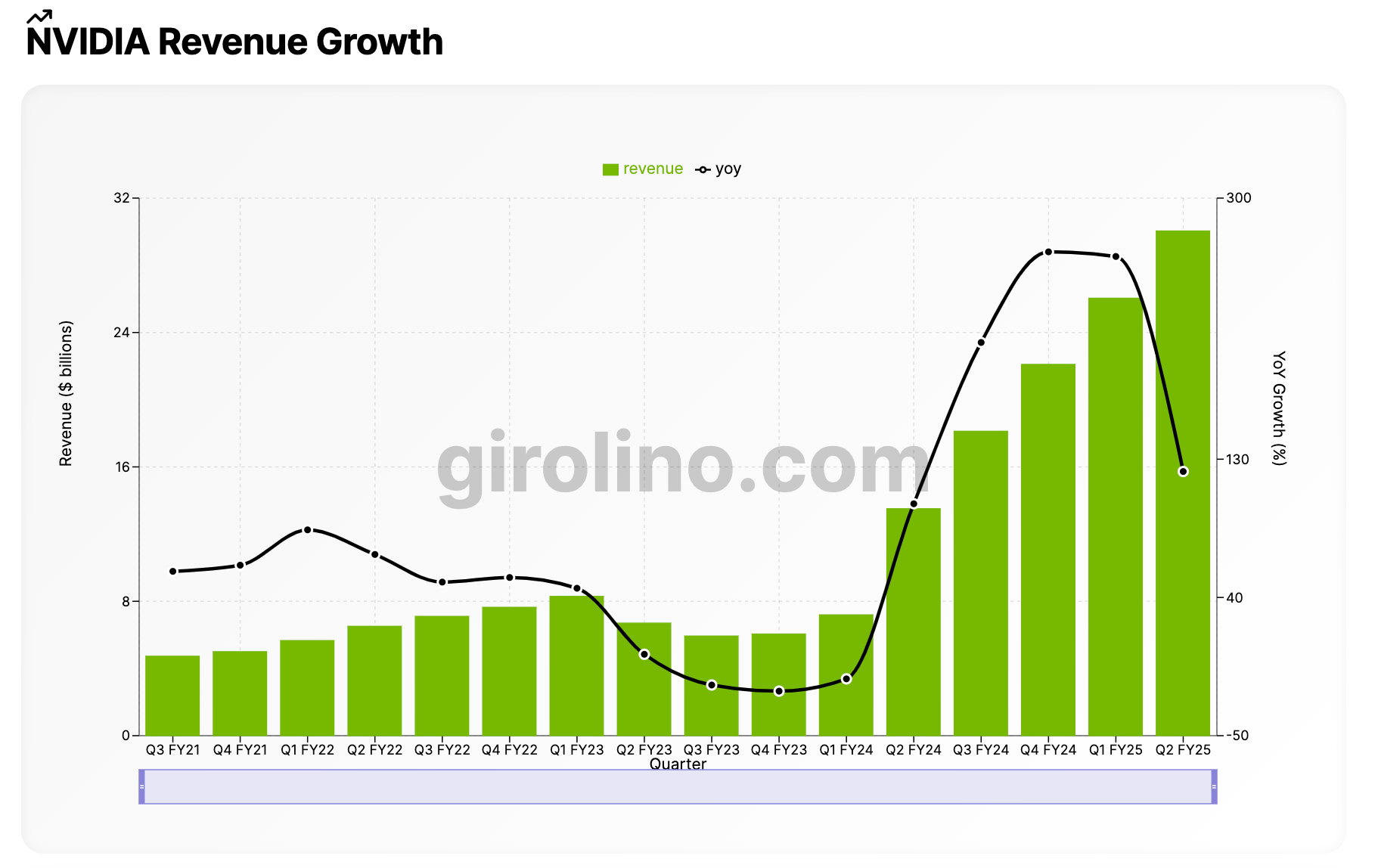

- Record-Breaking Revenue: NVIDIA reported a staggering revenue of $30.04 billion for the quarter ended July 28, 2024. This represents a 122% increase year-over-year and a 15% increase from the previous quarter. Despite strong earnings, Nvidia stock has experienced fluctuations, reflecting market reactions and investor expectations.

- Consistent Growth Trajectory: This marks NVIDIA’s fifth consecutive quarter of triple-digit percentage gains on a year-over-year basis, showcasing the company’s consistent growth in the AI-driven market.

- Profitability Surge: Net income more than doubled to $16.6 billion, or $0.67 per diluted share, reflecting the company’s ability to translate revenue growth into bottom-line results.

Highest Revenue: $30.04 billion (Q2 FY25)

Highest YoY Growth: 265% (Q4 FY24)

Recent quarters show significant revenue acceleration and YoY growth

Jensen Huang, Founder and CEO of NVIDIA, summarized the quarter’s success:

“NVIDIA achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI.” This statement underscores the pivotal role NVIDIA plays in the ongoing digital transformation across industries.

Before you dive into our comprehensive analysis of Nu Holdings' risk management strategies, we have a quick favor to ask:

If you find value in this content, please consider sharing it!

Why? Your shares help us reach more readers, allowing us to keep producing high-quality, in-depth analyses like this one—completely free, with no paywalls or subscriptions.

Earnings Highlights: Data Center Dominance

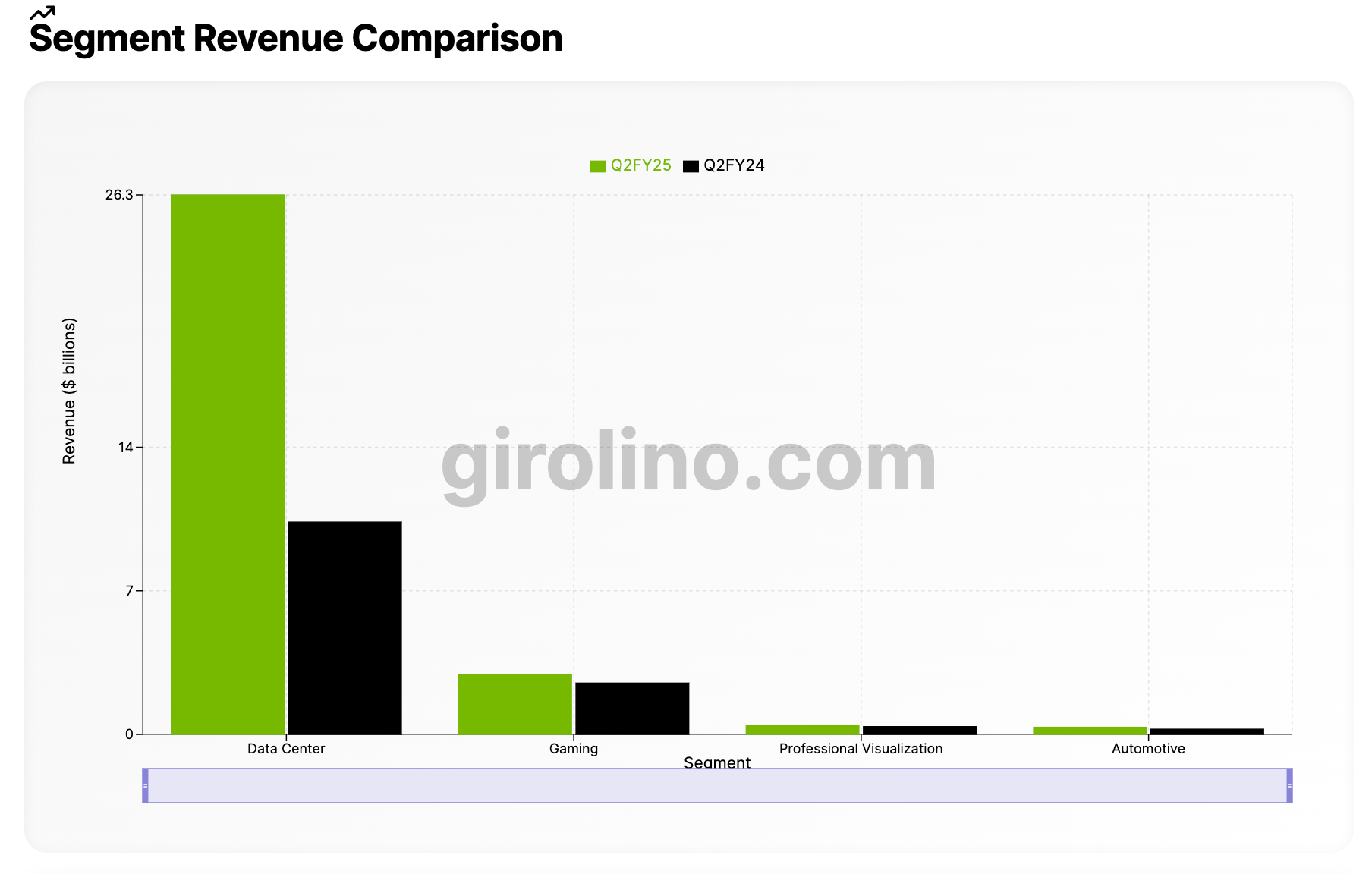

The standout performer in NVIDIA’s portfolio continues to be its Data Center segment:

- Data Center Revenue: A record $26.3 billion, up 16% sequentially and an impressive 154% year-on-year.

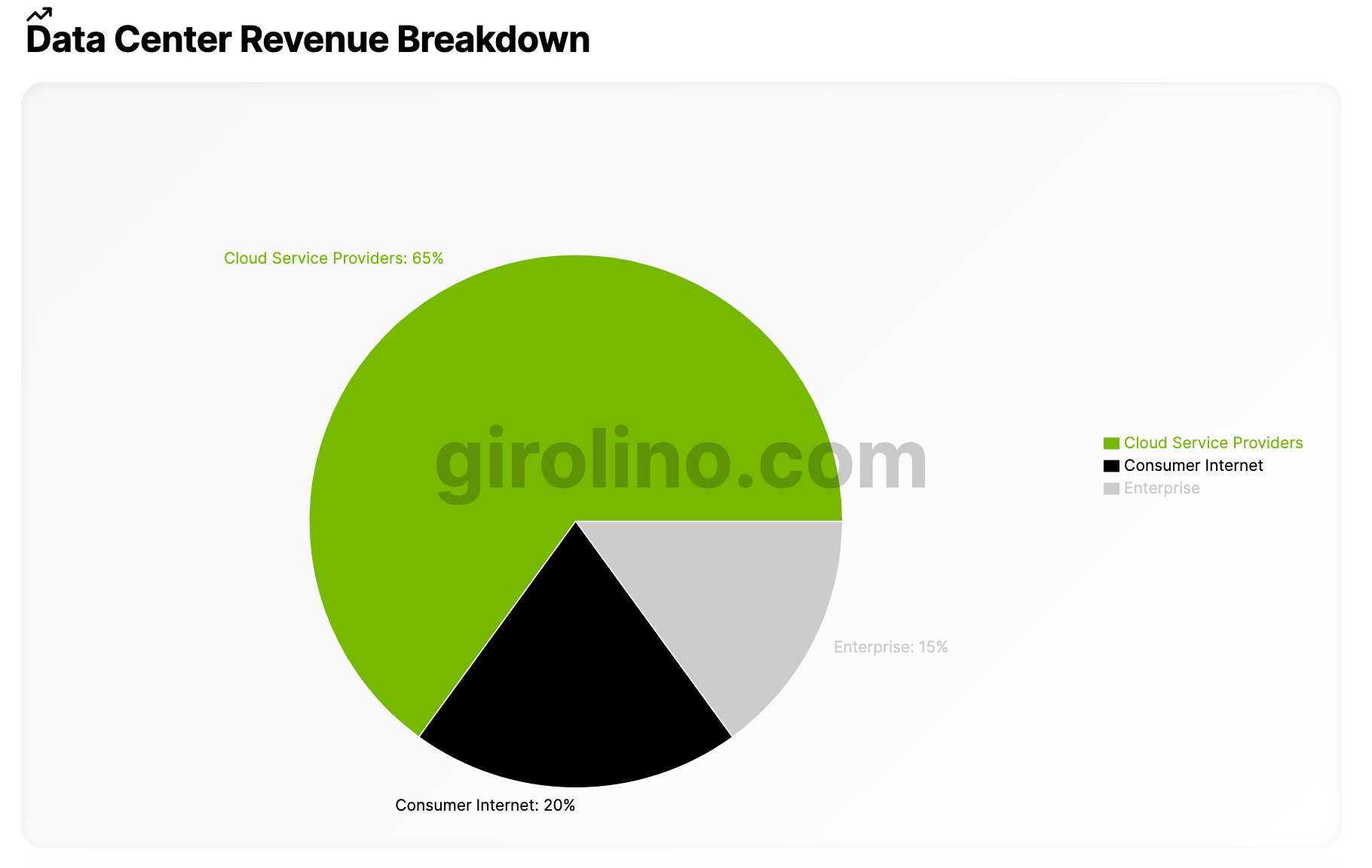

- Cloud Service Provider Contribution: Approximately 45% of Data Center revenue came from cloud service providers, highlighting NVIDIA’s strong position in this crucial market.

- Product Demand: Hopper GPU computing platform demand remains robust, while the next-generation Blackwell architecture is generating significant interest among partners and customers.

- The significant computing infrastructure investment by companies in NVIDIA's AI technology has driven this remarkable growth.

Total Data Center Revenue: $26.3 billion

Largest Segment: Cloud Service Providers (65%)

Enterprise segment shows potential for growth at 15%

Huang emphasized the strength of both current and upcoming product lines:

“Hopper demand remains strong, and the anticipation for Blackwell is incredible. Blackwell samples are shipping to our partners and customers.”

This statement not only confirms the success of NVIDIA’s current offerings but also builds excitement for future products, indicating a strong pipeline that could sustain growth.

Fourth Quarter Analysis: Margins and Expenses

Diving deeper into the financial metrics:

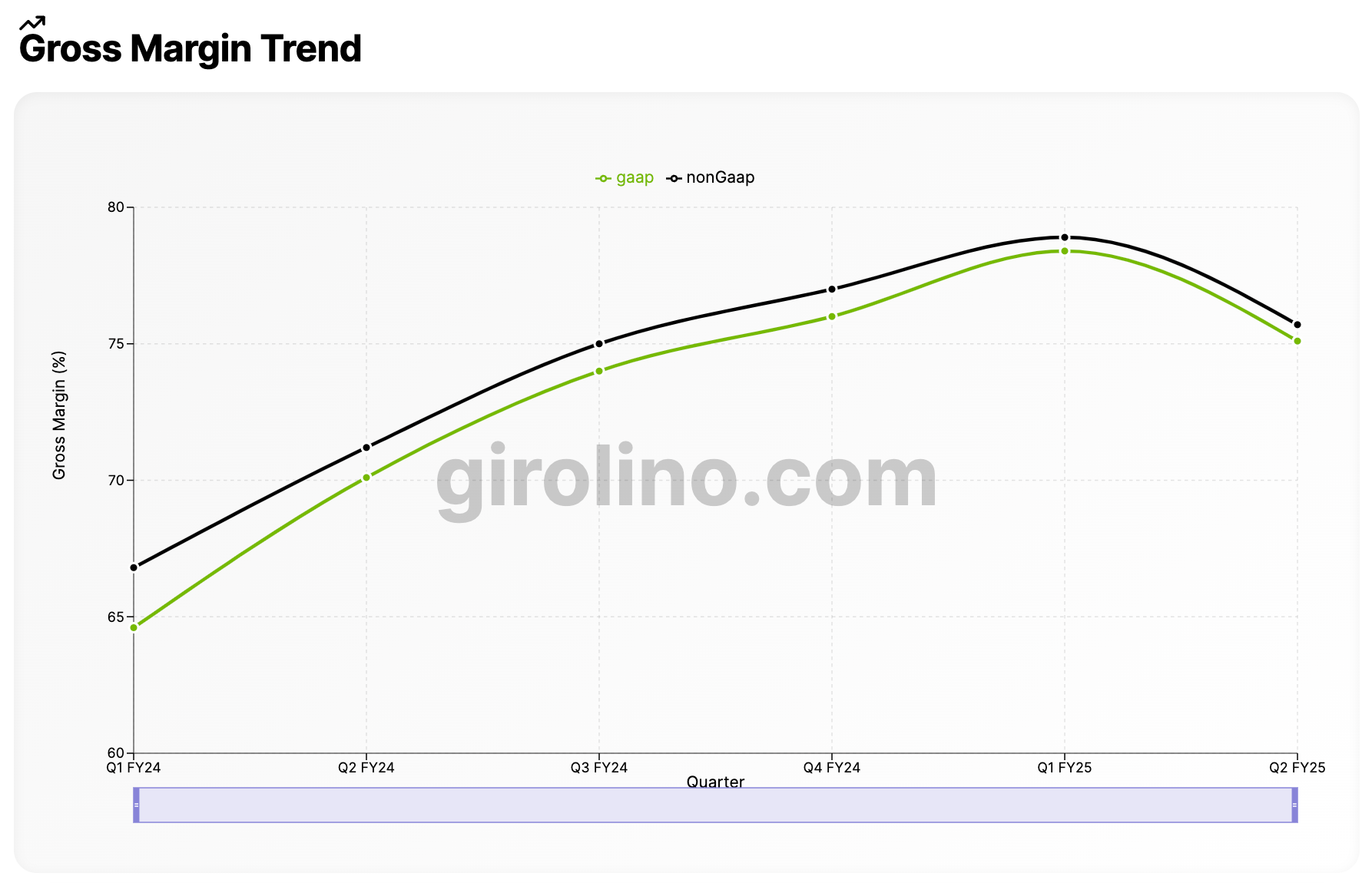

- Gross Margins: GAAP gross margin stood at 75.1%, while non-GAAP gross margin was 75.7%, reflecting the high-value nature of NVIDIA’s products.

- Operating Expenses: Both GAAP and non-GAAP operating expenses increased by 12% sequentially, indicating continued investment in R&D and sales efforts.

- Cash Flow: NVIDIA generated a substantial $14.5 billion in cash flow from operations, showcasing strong liquidity and financial health.

Highest GAAP Gross Margin: 78.4% (Q1 FY25)

Highest Non-GAAP Gross Margin: 78.9% (Q1 FY25)

Consistent upward trend in gross margins over the past quarters

Colette Kress, Executive Vice President and Chief Financial Officer of NVIDIA, provided insights into the company’s financial strategy:

“We executed a change to the Blackwell GPU mask to improve production yields. Blackwell production ramp is scheduled to begin in the Q4 and continue into fiscal year ‘twenty six. In Q4, we expect to ship several $1,000,000,000 in Blackwell revenue.”

The fourth quarter is expected to see a significant ramp-up in Blackwell production, contributing to several billion dollars in revenue.

This statement reveals NVIDIA’s proactive approach to manufacturing optimization and sets clear expectations for the Blackwell architecture’s contribution to future revenues.

AI and Data Center Growth: Fueling the Revolution with Cloud Service Providers

NVIDIA’s growth is intrinsically tied to the AI boom:

- AI Infrastructure Demand: The 154% increase in data center revenue underscores the explosive demand for AI computing infrastructure.

- Chip Utilization: NVIDIA’s GPUs are the backbone of data centers training and operating AI systems, particularly for generative AI applications.

- The enterprise AI wave is driving numerous Fortune 500 companies to adopt NVIDIA's advanced AI solutions, further fueling data center revenue growth.

- Future Production Plans: The company is gearing up to increase production of its Blackwell AI chips, starting in Q4 and continuing through fiscal 2026.

Highest Growth: Data Center (154% YoY)

Largest Segment: Data Center ($26.3 billion in Q2 FY25)

Gaming segment shows steady growth despite market fluctuations

Huang’s vision for AI’s impact is clear:

“Generative AI will revolutionize every industry.”

This bold statement positions NVIDIA not just as a chip manufacturer, but as a key enabler of a broader technological revolution.

Expanding Product Portfolio and Market Reach

NVIDIA's growth strategy extends beyond its core GPU business. Huang elaborated on the company's expanding offerings:

"Spectrum-X Ethernet for AI and NVIDIA AI Enterprise software are two new product categories achieving significant scale, demonstrating that NVIDIA is a full-stack and data center-scale platform."

This diversification into networking and software solutions strengthens NVIDIA's position as a comprehensive AI solutions provider, potentially opening up new revenue streams and market opportunities.

Furthermore, NVIDIA is capitalizing on the growing demand for national AI infrastructure projects. Kress highlighted this emerging opportunity:

"Our Sovereign AI opportunities continue to expand as countries recognize AI expertise and infrastructure at national imperatives for their society and industries. We believe Sovereign AI revenue will reach low double digit billions this year."

This insight reveals a significant new market for NVIDIA, as governments worldwide invest in AI capabilities.

Analyst Insights: Positive Outlook

Wall Street’s reaction to NVIDIA’s performance has been overwhelmingly positive:

- Blackwell Revenue Projections: Analysts anticipate Blackwell-based products to generate several billion dollars in revenue by Q4 fiscal 2025, aligning with management’s guidance. This performance is even more impressive when compared to the same quarter last year, showcasing substantial year-over-year growth.

- Market Dominance: NVIDIA’s leadership in AI chipmaking is expected to persist, with its products being the go-to choice for consumer internet companies and cloud service providers.

Future Outlook: Continued Growth on the Horizon

NVIDIA's guidance for the upcoming quarter remains optimistic:

- Q3 Revenue Forecast: Expected to reach $32.5 billion (±2%), surpassing analyst expectations.

- Gross Margin Projections: GAAP and non-GAAP gross margins for Q3 are anticipated to be 74.4% and 75%, respectively.

Key Takeaways for Investors and Industry Watchers

- Unprecedented Growth: NVIDIA's 122% year-over-year revenue increase is a testament to its central role in the AI revolution.

- Data Center Dominance: The 154% growth in data center revenue highlights NVIDIA's stronghold in AI computing infrastructure.

- Innovation Pipeline: With Hopper's strong demand and Blackwell's anticipated success, NVIDIA's product roadmap looks robust.

- Financial Health: Strong cash flows and high margins indicate a well-managed, profitable operation.

- Market Leadership: NVIDIA's chips remain the preferred choice for major tech companies and cloud providers, solidifying its market position.

- Diversification: The company's expansion into networking, software, and national AI infrastructure projects demonstrates a strategic approach to long-term growth.

Conclusion: NVIDIA's Pivotal Role in the AI Era

NVIDIA's Q2 fiscal 2025 earnings report not only showcases impressive financial metrics but also underscores the company's pivotal role in shaping the future of AI and high-performance computing. As generative AI and other advanced applications continue to proliferate, NVIDIA's hardware and software solutions are poised to remain at the forefront of this technological revolution.

IMO, NVIDIA represents a compelling opportunity to participate in the growth of AI and data center technologies. The company's strong quarterly performance, coupled with optimistic future guidance and strategic expansions into new markets, positions it as a leader in one of the most transformative technological shifts of our time.

As we look ahead, NVIDIA's continued innovation in AI chip design, its expanding ecosystem of software and services, and its strategic partnerships across the tech industry suggest that its growth trajectory may well continue.

The company's ability to not only meet current demand but also anticipate and shape future market needs through products like Blackwell and initiatives in Sovereign AI demonstrates a forward-thinking approach that could sustain its leadership position.

However, as with any investment, it's crucial to consider potential risks such as market competition, regulatory changes, and the cyclical nature of the semiconductor industry. While NVIDIA's current position is strong, the rapidly evolving nature of the AI industry means that continued innovation and strategic execution will be key to maintaining its market leadership.

In conclusion, NVIDIA's Q2 fiscal 2025 earnings paint a picture of a company at the forefront of the AI revolution, well-positioned to capitalize on the growing demand for advanced computing solutions.

As AI continues to transform industries and create new opportunities, NVIDIA's role as a key enabler of this technology positions it as a central player in shaping the digital landscape of the future.

With strong financial performance, a clear vision for the future of AI, and a expanding portfolio of products and services, NVIDIA appears poised to continue its trajectory as a leader in the tech industry.