When I first heard the news about the Department of Justice (DOJ) launching an antitrust investigation into Nvidia, I couldn't help but feel a mix of concern and curiosity. As someone who's been following the tech industry for years, I've watched Nvidia's meteoric rise in the AI chip market with both admiration and a bit of wariness. Now, it seems, the other shoe has dropped.

On September 3, 2024, Bloomberg reported that the DOJ had escalated its antitrust probe into Nvidia, issuing subpoenas to the chipmaker and other companies in the AI computing market. This news sent shockwaves through the tech industry and financial markets alike. As I delved deeper into the situation, I realized that this investigation could have far-reaching implications not just for Nvidia, but for the entire AI industry and those of us who closely follow it.

In this post, I'll break down what we know about the DOJ investigation, examine its potential impact on Nvidia and the broader AI chip market, and share my thoughts on what this might mean for the future of AI computing. Let's dive in.

The DOJ Investigation: What We Know So Far

The Allegations Against Nvidia

The DOJ's antitrust investigation into Nvidia centers around several key allegations that, if proven true, could significantly impact the company's business practices and market position. As I've looked into these allegations, I've found them to be both complex and potentially far-reaching. Here's what we know:

- Supplier Switching Barriers: One of the main concerns is that Nvidia might be making it difficult for customers to switch to alternative chip suppliers. This could potentially lock customers into Nvidia's ecosystem, limiting competition in the market. I've seen similar practices in other tech sectors, and it's always a red flag for regulators.

- Exclusive Use Penalties: There are allegations that Nvidia penalizes customers who don't exclusively use its AI chips. This practice, if true, could be seen as anti-competitive by discouraging the use of products from Nvidia's competitors. It reminds me of some of the antitrust cases we've seen in the past against other tech giants.

- Bundling and Tying: Nvidia has been expanding its product range beyond just chips, now offering software, servers, networking equipment, and services. The DOJ is concerned that the company may be leveraging its dominant position in AI chips to promote these complementary products, potentially stifling competition in these adjacent markets. This is a classic antitrust concern that we've seen in other industries.

- Preferential Treatment: There are claims that Nvidia offers preferential treatment in supply and pricing to clients who exclusively use its technology or purchase complete Nvidia-designed systems. This could create an unfair advantage for Nvidia and disadvantage competitors. I've seen how such practices can distort markets, and it's no surprise that regulators are taking a closer look.

- Acquisition Concerns: The DOJ is also scrutinizing Nvidia's acquisition of RunAI, which was announced in April 2024. Regulators are examining whether this deal could further cement Nvidia's market dominance and limit customer choice in AI computing management software. As someone who's watched many tech acquisitions over the years, I know how consolidation can sometimes lead to reduced competition.

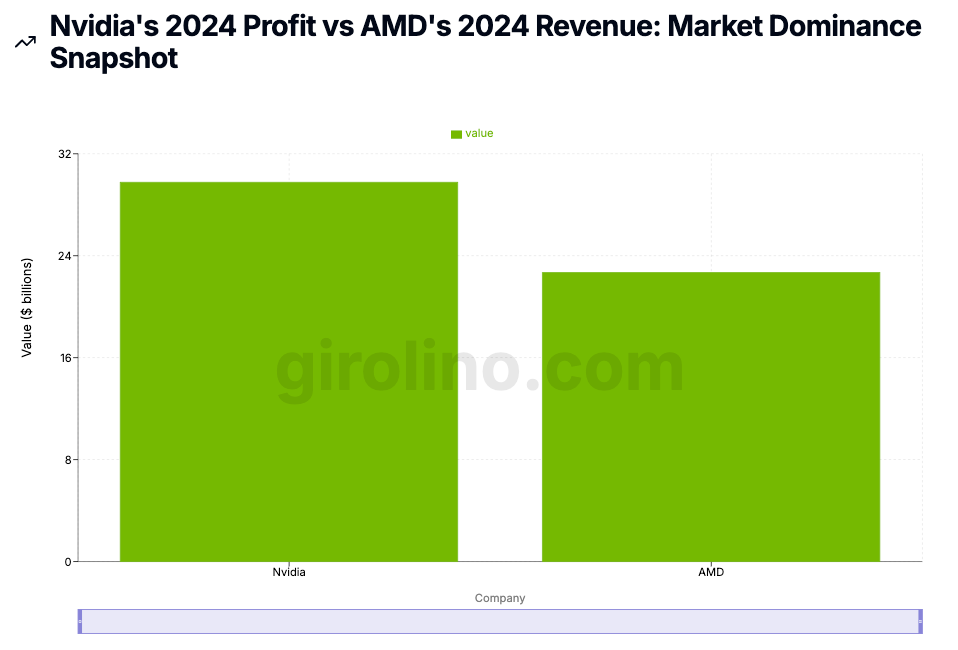

Nvidia's profit alone ($29.76B) exceeds AMD's entire revenue ($22.68B)

This comparison highlights Nvidia's dominant market position

The AI boom has significantly boosted Nvidia's profitability

Market Concentration and Supply Chain Dominance

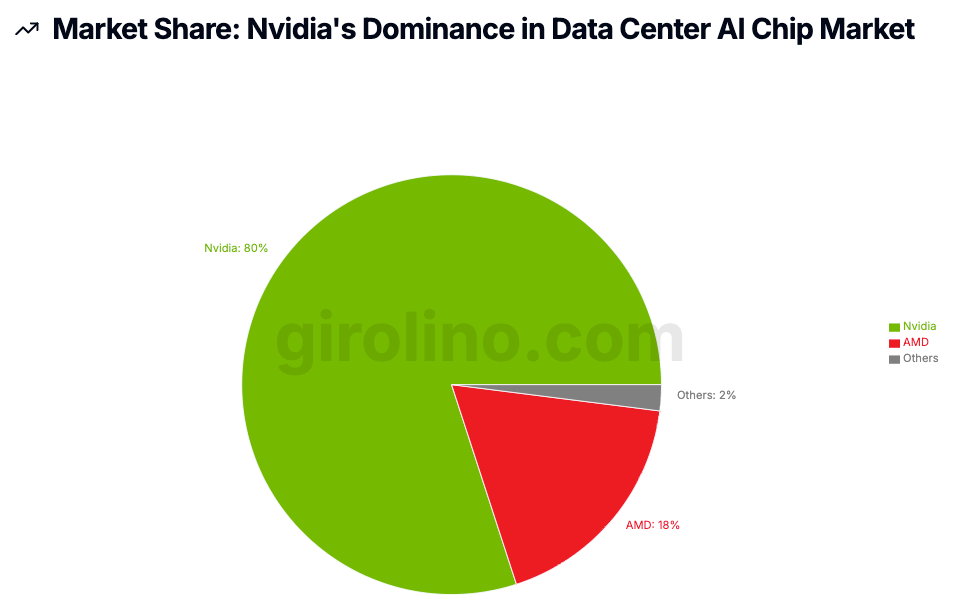

One of the most striking aspects of this investigation is the sheer scale of Nvidia's market dominance. The company currently controls over 80% of the data center AI chip market. That's an astounding figure, and it's easy to see why it's raised eyebrows at the DOJ.

What's more, major tech companies like Microsoft and Meta reportedly allocate more than 40% of their hardware budgets to Nvidia's products. This level of reliance on a single supplier has understandably raised concerns about Nvidia's influence over the AI supply chain.

As I reflect on this, I'm reminded of other instances in tech history where a single company's dominance has led to regulatory scrutiny. The sheer concentration of market power in Nvidia's hands is bound to attract attention, especially given the critical importance of AI technology in shaping our digital future.

The Financial Impact: A $279 Billion Wake-Up Call

The Market's Immediate Reaction

When news of the DOJ's subpoenas broke on September 3, 2024, the market's reaction was swift and severe. Nvidia's stock plummeted by 9.5% in a single day, erasing a staggering $279 billion in market capitalization. To put that into perspective, this single-day loss exceeded the entire market value of AstraZeneca, the UK's largest listed company.

As someone who's weathered many market storms, I've seen my fair share of dramatic sell-offs. But the scale of this one was truly eye-opening. It underscores just how much value the market places on Nvidia's dominant position in the AI chip sector, and how seriously it views any potential threat to that position.

Before you dive into our in-depth analysis, we have a quick request:

If you find this content useful, please consider sharing it!

Why? Your shares help us reach a wider audience, allowing us to continue producing high-quality, comprehensive content like this—completely free, with no paywalls or subscriptions.

Thank you for your support!

Early Signs of Growth in New Flows

The Bigger Picture: Nvidia's Meteoric Rise

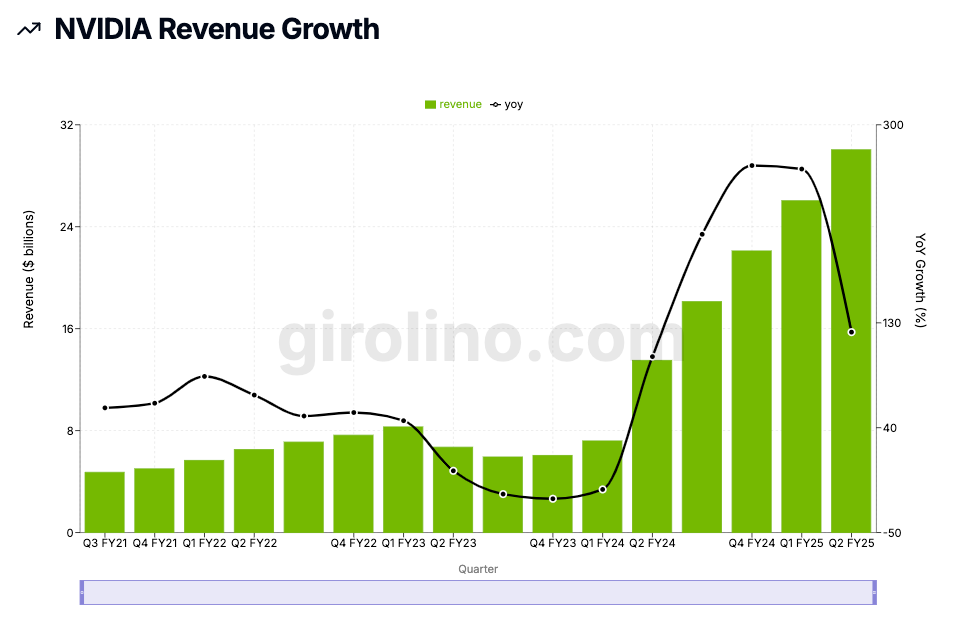

However, it's crucial to put this sell-off in context. Even after this substantial decline, Nvidia's shares were still up more than 124% year-to-date. This remarkable statistic highlights the company's extraordinary growth trajectory in 2024.

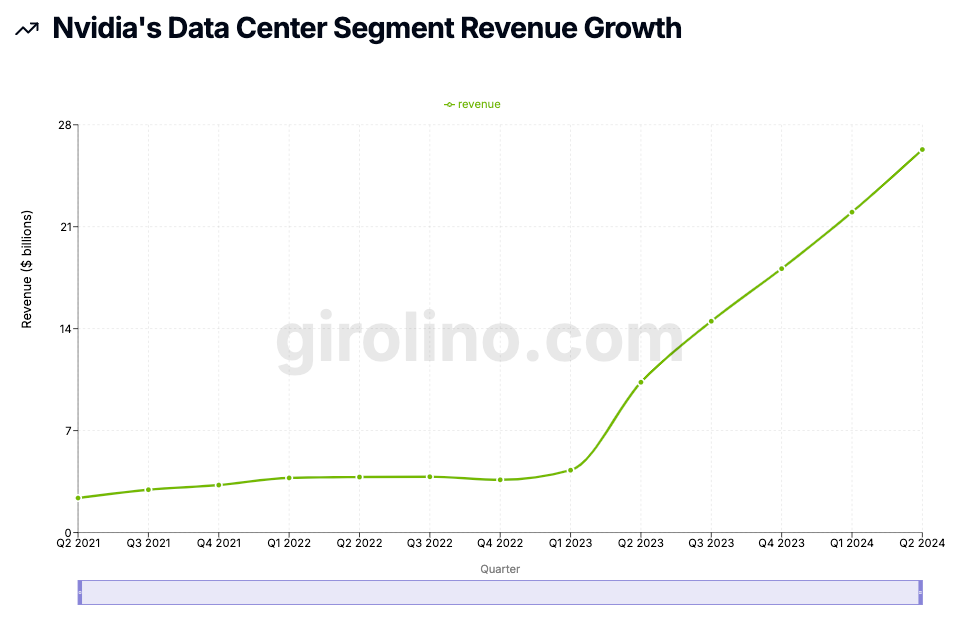

Looking at the numbers, it's easy to see why Nvidia has been such a darling of the markets. Financial analysts project that the company will generate $120.8 billion in revenue for the fiscal year 2024, a dramatic increase from $16 billion in 2020. That's the kind of growth that turns heads and creates fortunes.

What's particularly striking is that Nvidia is expected to earn more profit this year than the total revenue of its closest competitor, Advanced Micro Devices Inc. It's a testament to the company's dominant position in the AI chip market and the immense demand for its products.

The AI Boom: Nvidia's Golden Goose

The primary driver of Nvidia's explosive growth has been its dominance in the AI chip sector, particularly its Graphics Processing Units (GPUs). These chips have become essential for training large language models, the backbone of many of the AI applications we're seeing emerge today.

As I've watched this AI boom unfold, I've been struck by how central Nvidia's technology has become to the entire ecosystem. Major tech companies like Microsoft, Alphabet, and Meta have become heavily reliant on Nvidia's chips, reportedly allocating more than 40% of their hardware budgets to the company's products.

This reliance underscores Nvidia's critical role in the AI ecosystem. It's not just a chip company anymore; it's become the foundation upon which much of the AI revolution is being built. And that's precisely why this DOJ investigation has such far-reaching implications.

Nvidia's Response: Standing Its Ground

Denials and Assertions

In response to the DOJ's investigation, Nvidia has come out swinging, firmly denying any wrongdoing and asserting its commitment to fair competition. The company maintains that its success in the AI chip market is due to superior product quality and value rather than anti-competitive practices.

In an official statement, Nvidia emphasized that it "wins on merit" and that customers are free to choose whatever solution works best for them. The company further stated that it "scrupulously" adheres to all laws.

As someone who's seen many companies face regulatory scrutiny, I have to say that Nvidia's response is pretty standard. They're sticking to their guns, asserting that their market dominance is a result of technological superiority rather than unfair business tactics.

Disputing the Details

Interestingly, Nvidia has disputed some of the reported details of the investigation. While Bloomberg reported that the DOJ had sent subpoenas to Nvidia, the company claimed it had not received any subpoena. A Nvidia representative stated, "We have inquired with the U.S. Department of Justice and have not been subpoenaed. Nonetheless, we are happy to answer any questions regulators may have about our business".

This discrepancy in information is intriguing. In my experience, when there's smoke, there's often fire. But it's also possible that there's been some miscommunication or that the investigation is still in its early stages. Either way, it's clear that Nvidia is prepared to defend itself vigorously.

Nvidia's Defense Strategy

From what I can see, Nvidia's defense against the antitrust allegations centers on several key points:

- Product Value: The company argues that its products offer superior value to customers, which is the primary reason for its market success.

- Customer Choice: Nvidia maintains that customers have the freedom to choose alternatives and are not locked into using its products exclusively.

- Compliance: The company asserts its strict adherence to all applicable laws and regulations.

- Innovation: Nvidia implies that its market position is a result of continuous innovation and investment in AI technology, rather than anti-competitive behavior.

This defense strategy is pretty sound, in my opinion. By focusing on the quality of its products and its commitment to innovation, Nvidia is attempting to frame its market dominance as a result of fair competition rather than anti-competitive practices.

The Broader Context: Tech Under Scrutiny

A Trend of Increasing Regulation

Nvidia's situation doesn't exist in a vacuum. As I've watched the tech industry evolve over the years, I've noticed a clear trend towards increased regulatory scrutiny, particularly when it comes to market dominance and competition.

Similar investigations have been launched into other industry giants like Microsoft, OpenAI, Amazon, and Google. This indicates a broader trend of regulatory concern over market concentration in the technology industry.

From my perspective, this increased scrutiny is a natural response to the growing power and influence of tech companies. As these companies have become more integral to our economy and society, regulators have become more concerned about ensuring fair competition and preventing monopolistic practices.

The AI Factor

What makes Nvidia's case particularly interesting is its central role in the AI boom. AI is not just another technology; it's increasingly seen as a transformative force that could reshape entire industries and societies.

Given the potential impact of AI, it's not surprising that regulators are paying close attention to the companies that control the underlying technology. Nvidia's dominance in AI chips puts it squarely in the spotlight.

As I see it, this investigation is as much about shaping the future of AI as it is about Nvidia's current business practices. The outcome could have significant implications for how AI technology develops and who controls it.

Potential Outcomes and Implications

A Long Road Ahead

Based on my experience following similar cases, I expect the DOJ's investigation into Nvidia to be a lengthy process, potentially spanning months or even years before reaching a conclusion. This extended timeline is typical for complex antitrust cases in the technology sector.

Despite the ongoing probe, experts suggest that the immediate impact on Nvidia's business operations may be limited. The company is likely to continue its operations and growth trajectory even as the investigation proceeds.

Possible Consequences

If the DOJ's investigation finds evidence of antitrust violations, Nvidia could face several potential consequences:

- Legal Challenges and Fines: Nvidia might be required to pay substantial fines if found in violation of antitrust laws. However, given the company's strong financial position, some analysts believe these fines would be manageable. As Patrick Moorhead, president and principal analyst at Moor Insights & Strategy, suggests, any potential fines resulting from the probe would likely be "pocket change" given Nvidia's financial strength.

- Operational Changes: Nvidia may be forced to alter its business practices, potentially including changes to its pricing strategies, customer agreements, or product bundling approaches. This could potentially impact the company's profitability and market position.

- Opening Up Proprietary Technology: In a worst-case scenario, Nvidia could be compelled to open up its CUDA software platform to competitors. This would be similar to how Apple had to open up its App Store and Microsoft its Internet Explorer API in previous antitrust cases. Such a move could erode Nvidia's competitive advantage.

- International Scrutiny: The U.S. investigation could potentially trigger similar probes in other jurisdictions such as the European Union, Korea, Japan, and Taiwan. This would increase regulatory pressure on the company and potentially impact its global operations.

- Market Share Impact: If found to be engaging in anti-competitive practices, Nvidia might face restrictions that could affect its market dominance and ability to expand market share in the AI chip sector.

Industry-Wide Implications

The outcome of this investigation could have significant implications not just for Nvidia, but for the broader AI industry and related technologies. Here are a few potential scenarios I'm keeping an eye on:

- Increased Competition: If the investigation leads to changes in Nvidia's business practices or the opening up of its proprietary technology, we could see increased competition in the AI chip market. This could potentially lead to more innovation and lower prices for AI hardware.

- Shifts in AI Development: Any significant changes to Nvidia's market position could impact the development of AI technologies. If access to high-performance AI chips becomes more democratized, we might see a broader range of companies contributing to AI advancement.

- Supply Chain Diversification: Major tech companies that currently rely heavily on Nvidia's products might be prompted to diversify their supply chains. This could create opportunities for other chip manufacturers and potentially change the dynamics of the AI hardware market.

- Regulatory Precedent: The outcome of this investigation could set important precedents for how antitrust laws are applied to emerging technologies like AI. This could have far-reaching implications for other tech companies and future innovations.

My Thoughts on the Future

As I reflect on this situation, I'm reminded of how quickly things can change in the tech industry. Just a few years ago, Nvidia was primarily known for its gaming GPUs. Now, it's at the center of the AI revolution and facing a major antitrust investigation.

While the immediate market reaction to the news of the DOJ probe was severe, I believe it's important to take a long-term view. Nvidia's fundamental strengths - its technological expertise, its dominant market position, and the growing demand for AI chips - remain intact.

That said, this investigation adds an element of uncertainty to Nvidia's future prospects. The potential outcomes range from minor fines and operational adjustments to more significant changes that could alter the company's business model and market position.

As the investigation unfolds, I'll be closely monitoring its progress and potential outcomes. While Nvidia's dominant market position and strong financial performance provide a buffer against short-term impacts, the long-term implications of the antitrust probe remain a significant factor in assessing the company's future growth prospects and market valuation.

In the broader context, I see this investigation as part of a larger trend towards increased scrutiny of tech giants and their market power. As AI continues to grow in importance, we're likely to see more regulatory attention focused on the companies that control key AI technologies.

For those of us watching the AI and tech sectors, this investigation serves as a reminder of the complex interplay between innovation, market dynamics, and regulation. It's a fascinating situation that encapsulates many of the key issues facing the tech industry today.

As we move forward, I believe the key questions to watch will be:

- How will the investigation impact Nvidia's ability to innovate and maintain its technological lead?

- Will we see increased competition in the AI chip market as a result of this scrutiny?

- How will major tech companies that rely on Nvidia's chips respond to this uncertainty?

- What precedents might this investigation set for the regulation of AI and other emerging technologies?

The answers to these questions could shape not just Nvidia's future, but the future of AI technology as a whole. It's a situation I'll be following closely, and I encourage you to do the same. After all, in the fast-moving world of tech and AI, today's headlines often become tomorrow's market realities.