I've been keeping an eye on Oracle Corporation and I must say, they're really killing it in the tech stock game. Their recent record-breaking performance in the first quarter of fiscal 2024 is a real game-changer, especially with their focus on cloud computing and AI. It's amazing to see how they've shifted from being just a regular database company to a major player in the cloud industry. I'm excited to take a deeper look at what's driving their success and what it means for their future.

The Numbers Behind Oracle's Success

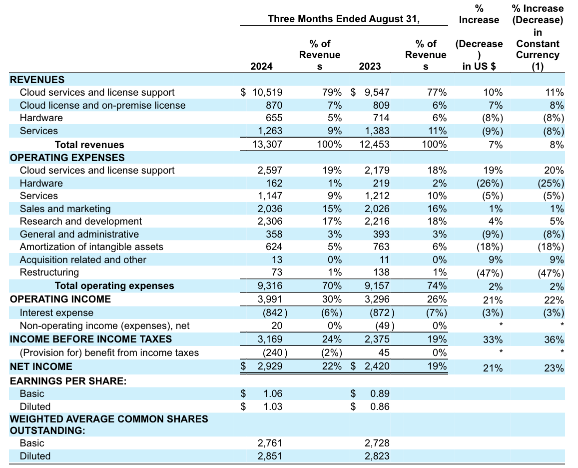

Let's start by examining the financial results that have propelled Oracle to new heights. The company's fiscal 2024 first-quarter report revealed some impressive figures:

- Earnings Per Share: Oracle reported earnings of $1.39 per share, surpassing analysts' expectations of $1.32.

- Total Revenue: The company's revenue reached $13.31 billion, marking an 8% increase from the previous year and exceeding forecasts of $13.23 billion.

- Cloud Services Growth: Cloud services and license support revenue rose 10% year-over-year to $10.52 billion, outpacing Wall Street's consensus estimate of $10.47 billion.

- Cloud Infrastructure Surge: Perhaps most notably, cloud infrastructure revenue skyrocketed by 45% to $2.2 billion, accelerating from the 42% growth rate seen in the previous quarter.

These numbers paint a picture of a company firing on all cylinders, particularly in its cloud and AI initiatives. But what's truly caught my attention is the staggering growth in Oracle's remaining performance obligations (RPO).

"We now have $99 billion in total remaining performance obligations, or RPO, up 53% in constant currency, with $31 billion expected to be recognized as revenue over the next four quarters." - Safra Catz, CEO of Oracle

This record-breaking RPO figure is a clear indicator of Oracle's future revenue potential and the strong demand for its services. It's a metric that speaks volumes about the company's ability to secure long-term contracts and build a sustainable growth trajectory.

The Cloud and AI Revolution at Oracle

At the heart of Oracle's resurgence is its strategic pivot towards cloud computing and artificial intelligence. This shift hasn't happened overnight; it's been years in the making, and we're now seeing the fruits of that labor.

Cloud Services: The New Growth Engine

Oracle's cloud services have become the cornerstone of its business model. The 21% growth in cloud services revenue, reaching $5.6 billion in Q1 2024, is a testament to the company's successful transition from on-premises solutions to cloud-based offerings.

What's particularly impressive is the growth in Oracle's cloud infrastructure segment. The 45% year-over-year increase indicates that Oracle is not just participating in the cloud market—it's actively gaining market share in a highly competitive field dominated by giants like Amazon Web Services (AWS) and Microsoft Azure.

"We're seeing significant increases in our cloud infrastructure consumption revenue growth rate as we expand our global data center capacity and improve our technology." - Larry Ellison, Chairman and CTO of Oracle

This statement from Larry Ellison highlights Oracle's commitment to expanding its cloud infrastructure. The company's plans to build a massive data center powered by modular nuclear reactors underscore the scale of its ambitions in this space.

AI Integration: A Game-Changer

Oracle's approach to AI goes beyond mere buzzwords. The company has been strategically embedding AI capabilities into its cloud service products, making its software an increasingly attractive option for companies looking to streamline operations and gain competitive advantages.

The collaboration with NVIDIA, allowing Oracle to offer generative AI solutions that run on NVIDIA's powerful graphics processors, is a prime example of how Oracle is positioning itself at the forefront of the AI revolution.

"Our partnership with NVIDIA and our rapid introduction of new AI cloud infrastructure and services has attracted many of the world's most important AI companies to OCI." - Larry Ellison

This partnership not only enhances Oracle's AI capabilities but also allows it to offer these services at competitive prices, potentially twice as fast and at half the cost of its competitors, according to company claims.

Strategic Partnerships: Oracle's Multi-Cloud Approach

One of the most intriguing aspects of Oracle's recent success has been its approach to partnerships. Rather than viewing other cloud providers solely as competitors, Oracle has embraced a multi-cloud strategy that's proving to be a significant differentiator.

The AWS Collaboration

The recently announced partnership with Amazon Web Services (AWS) is a game-changer. This collaboration will expand Oracle's database services on AWS, making it easier for customers to connect their data across different vendors.

"We're thrilled to work with AWS to provide customers with more options to run their most important workloads." - Safra Catz, CEO of Oracle

This partnership is particularly significant given AWS's dominant position in the cloud market. It demonstrates Oracle's pragmatic approach to growth, prioritizing customer needs over traditional competitive boundaries.

Expanding the Ecosystem

Oracle's partnership strategy extends beyond AWS. The company has also forged alliances with Google Cloud and Microsoft Azure, creating a truly multi-cloud environment for its services. This approach offers several advantages:

- Increased Flexibility: Customers can choose the cloud environment that best suits their needs while still leveraging Oracle's services.

- Broader Market Access: By partnering with major cloud providers, Oracle expands its potential customer base significantly.

- Enhanced Competitiveness: The multi-cloud approach positions Oracle as a flexible and customer-centric provider in a market often criticized for vendor lock-in.

These partnerships are already bearing fruit, contributing to Oracle's impressive growth in remaining performance obligations, which surged 44% to $98 billion.

Oracle's Strengthened Market Position

As we analyze Oracle's recent performance and strategic moves, it's clear that the company has significantly strengthened its market position in both cloud computing and artificial intelligence sectors.

A Pivotal Shift in Business Model

For the first time in Oracle's history, cloud revenue surpassed revenue from licensing and support services operations in the February-ended quarter. This milestone marks a crucial turning point in Oracle's business model, signaling that its transition from a seller of legacy database systems to a formidable AI cloud services provider is nearly complete.

"We're now in the middle of a generational shift to AI technology. Oracle's unique advantage in AI is the combination of our complete suite of cloud applications and our high-performance infrastructure." - Larry Ellison

This shift is not just about revenue numbers; it represents a fundamental change in how Oracle positions itself in the market and how it delivers value to its customers.

Capitalizing on the AI-Driven Cloud Market

While Oracle's current market share in cloud services stands at around 2%, the company is well-positioned for growth. The advent of AI has dramatically accelerated growth opportunities for all cloud providers, with the AI cloud market estimated to grow at a compound annual growth rate of 39.6% from 2023 to 2030.

Oracle's timing couldn't be better. As a relative newcomer to the cloud market, the company isn't burdened by legacy infrastructure and can build its offerings from the ground up with AI in mind. This agility, combined with strong customer interest in its diverse offerings, allows Oracle to capitalize on the AI-driven growth wave more effectively than some of its more established competitors.

A Growing Order Backlog

One of the most telling indicators of Oracle's strengthened market position is its impressive backlog of orders. With remaining performance obligations increasing to $80 billion, and $34 billion expected to be booked as revenues within the next 12 months, Oracle has built a solid foundation for sustained growth.

"Our strategy of aggressively expanding our cloud infrastructure to capture the demand for AI-related cloud services is working." - Safra Catz, CEO of Oracle

This substantial contract backlog not only demonstrates the high demand for Oracle's services but also indicates the sustainability of its AI cloud growth strategy. It provides a level of predictability to Oracle's future revenues, which is particularly valuable in the often volatile tech sector.

Challenges and Future Outlook

While Oracle's recent performance has been impressive, it's important to consider the challenges and potential headwinds the company may face:

Intense Competition

The cloud and AI markets are fiercely competitive, with established players like AWS, Microsoft Azure, and Google Cloud holding significant market share. Oracle will need to continue innovating and differentiating its offerings to gain ground.

Economic Uncertainties

The broader economic environment, including potential recessions and fluctuating IT spending, could impact Oracle's growth trajectory. However, the company's diverse portfolio and strong contract backlog provide some insulation against economic volatility.

Execution Risks

As Oracle continues to expand its cloud infrastructure and AI capabilities, successful execution of these large-scale projects will be crucial. Any significant delays or technical issues could impact the company's competitive position.

Despite these challenges, the outlook for Oracle appears positive. Analysts have responded favorably to the company's strengthened market position, with at least 10 brokerages raising their target price for Oracle's stock since the release of its Q1 2024 results.

Oracle's Renaissance in the AI Era

Oracle's journey from a traditional database company to a cloud and AI powerhouse is a testament to the company's ability to adapt and innovate in a rapidly changing technological landscape. The recent all-time high in its stock price reflects not just its current financial performance, but also the market's confidence in Oracle's future prospects.

Key takeaways from Oracle's recent performance include:

- Cloud-First Strategy Pays Off: The shift to cloud services has transformed Oracle's business model and growth trajectory.

- AI Integration as a Differentiator: By embedding AI into its core offerings, Oracle has positioned itself at the forefront of the next wave of technological innovation.

- Strategic Partnerships: Oracle's multi-cloud approach and collaborations with industry leaders have expanded its market reach and capabilities.

- Strong Financial Foundation: With impressive revenue growth and a substantial order backlog, Oracle has built a solid base for future expansion.

As we look to the future, Oracle's success in the cloud and AI sectors will likely hinge on its ability to continue innovating, executing its growth strategies effectively, and maintaining its newfound agility in a rapidly evolving market.

For those of us watching the tech industry, Oracle's resurgence serves as a powerful reminder of the transformative potential of cloud computing and AI. It also highlights the importance of adaptability and strategic vision in maintaining relevance in the fast-paced world of technology.

As Oracle continues to push the boundaries of what's possible in cloud and AI, it will be fascinating to see how this tech giant shapes the future of enterprise computing and contributes to the broader AI revolution. One thing is certain: Oracle's journey is far from over, and its recent all-time high may just be the beginning of a new chapter in the company's storied history.