PDD Holdings Inc (NASDAQ: PDD), the multinational commerce group that owns the popular Pinduoduo platform, released its second quarter 2024 earnings report on Aug 26 2024. The report earnings revealed a slight revenue miss but another strong profit beat, while management laid out plans for increased investments in the future. This comprehensive analysis delves into PDD's Q2 2024 performance, its impact on the stock price, and the company's future outlook.

Key Highlights of PDD's Q2 2024 Earnings

PDD Holdings Inc's fiscal quarter results showcased impressive growth across various financial metrics:

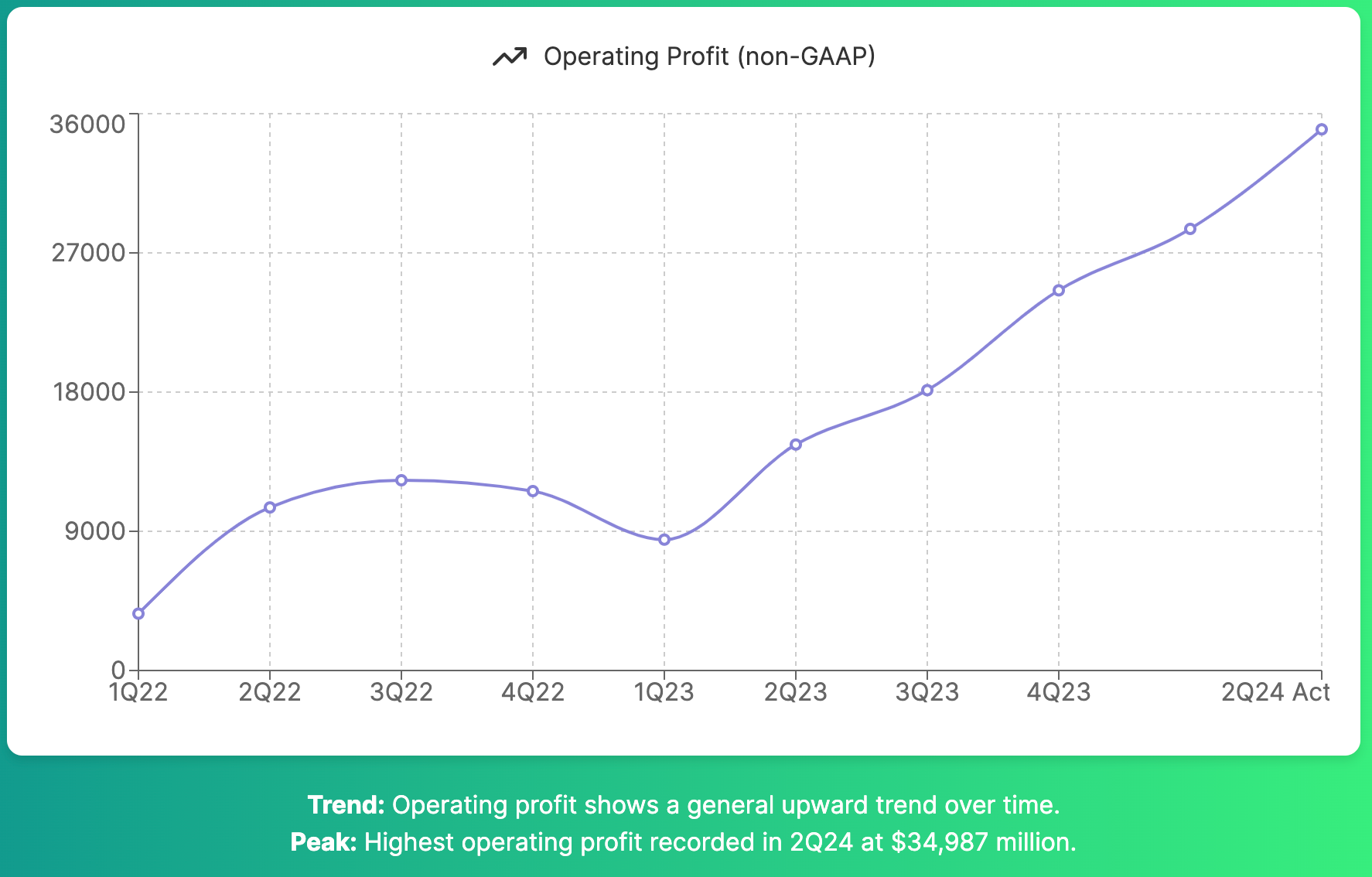

- Revenue: RMB 97.1 billion, up 86% year-over-year but slightly below expected figures

- Adjusted Operating Profit: RMB 35 billion, up 139% year-over-year, beating consensus estimates

- Diluted Earnings Per ADS: RMB 21.61, compared to RMB 9 in Q2 2023

- Non-GAAP Diluted Earnings Per ADS: RMB 23.24, up from RMB 10.47 in Q2 2023

- Concerning Earnings Call: Very opaque and vague earnings call raised me doubts regarding future investments and sustainable margin level

These earnings demonstrate PDD's continued strong performance in the digital economy, despite facing challenges in the global business environment.

"This quarter, we benefited from the improving macro environment and achieved robust financial results. Our total revenue reached RMB 97 billion, which represents a year-on-year increase of 86%." - Lei Chen, Chairman and Co-Chief Executive Officer

Revenue Breakdown and Analysis

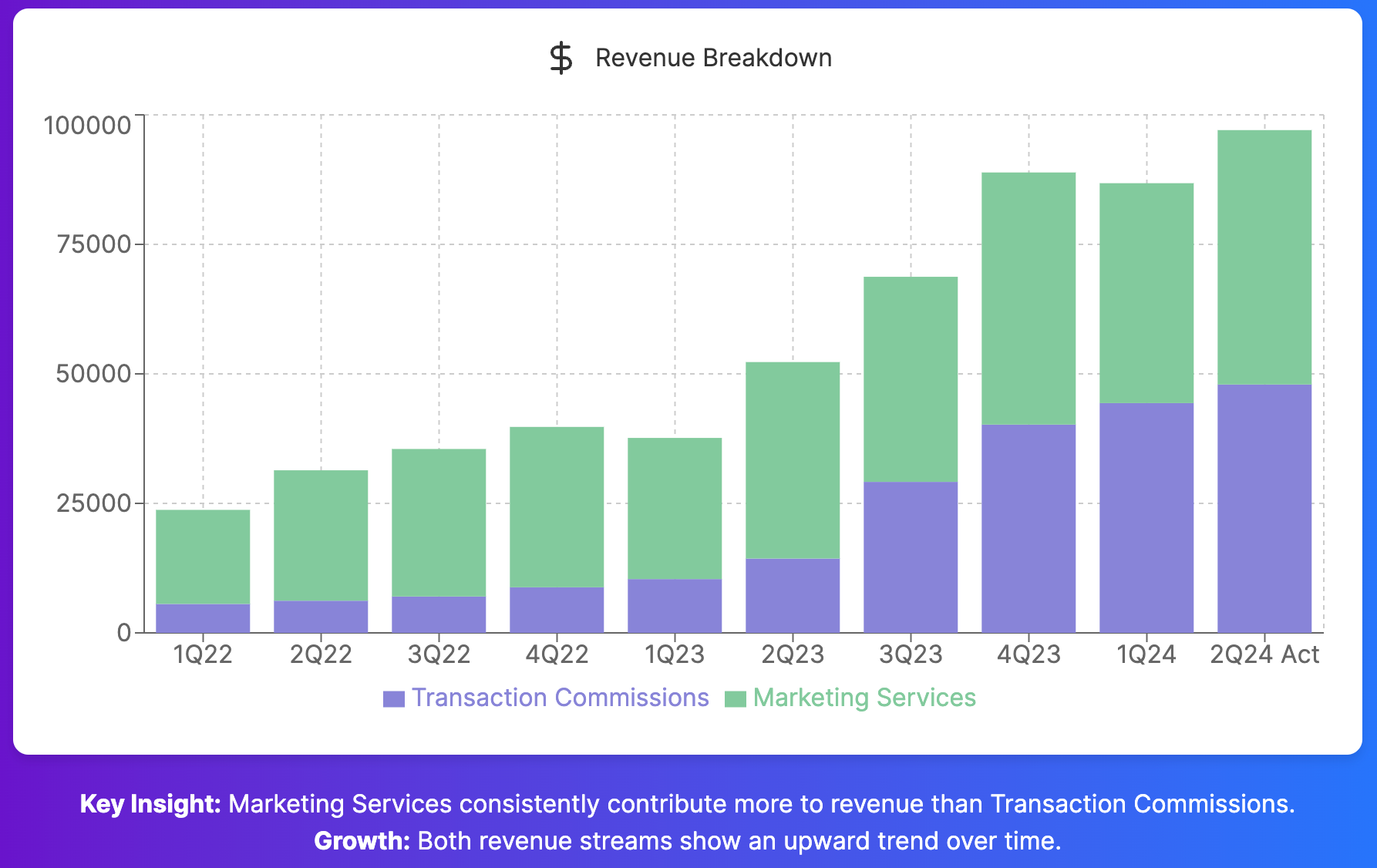

PDD's revenue streams showed significant growth:

- Online Marketing Services: RMB 49.1 billion, up 29% year-over-year

- Transaction Services: RMB 47.9 billion, up 234% year-over-year

The substantial growth in transaction services revenue indicates continued strong performance of PDD's international e-commerce platform, Temu. This expansion has allowed PDD to support small businesses and local communities across various markets.

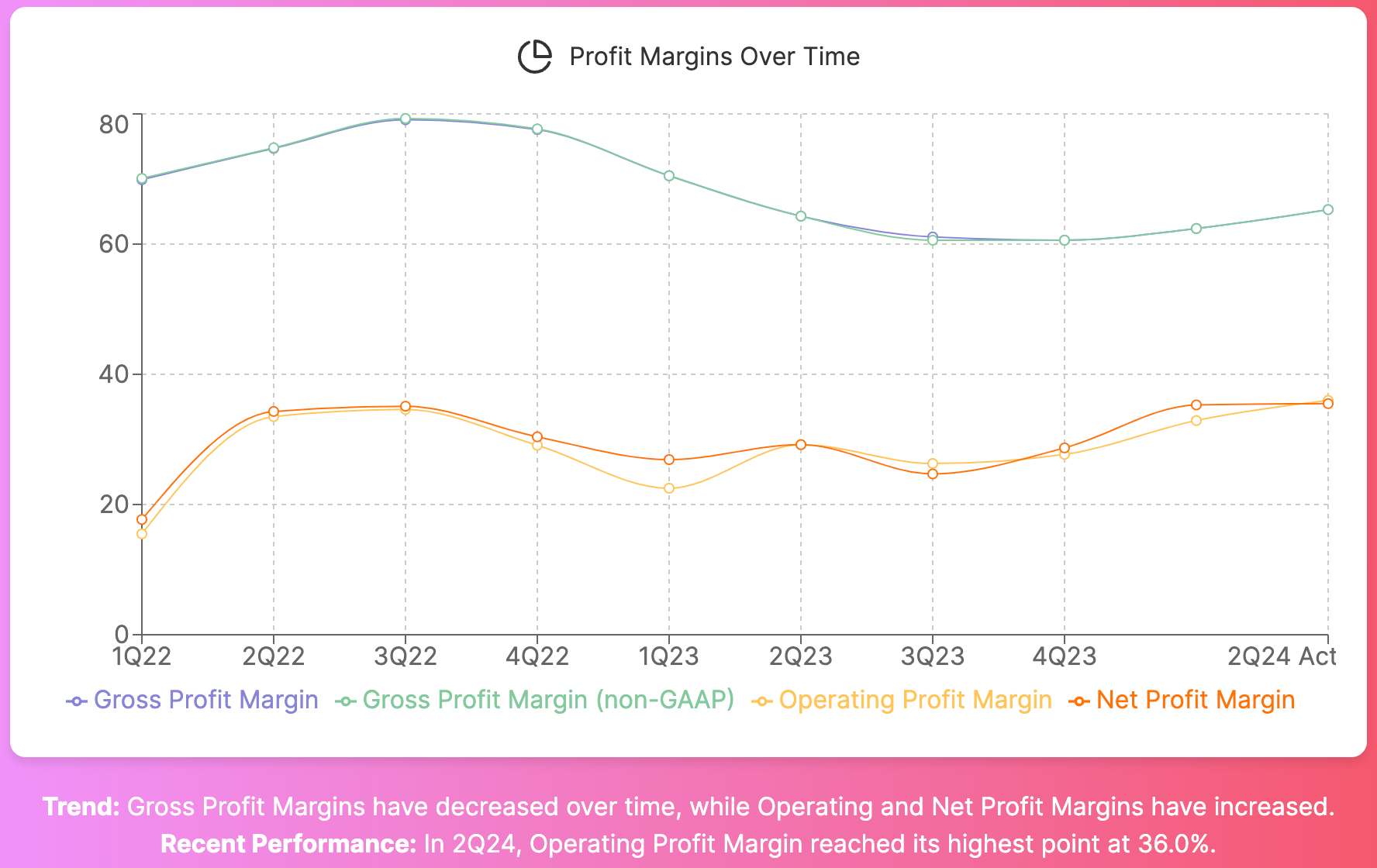

Profitability and Margins

PDD's profitability metrics remained robust:

- Non-GAAP Operating Profit Margin: 36%, compared to 28% in Q2 2023

- Net Income Attributable to Ordinary Shareholders: RMB 32 billion, up from RMB 13.1 billion in Q2 2023

Despite the strong profit performance, management emphasized that future profitability is expected to trend lower due to increased investments and competitive pressures. This outlook has impacted the PDD stock price, leading to some volatility in trading on the NASDAQ.

Future Investments and Strategic Focus

PDD's management outlined several key areas for future investments, demonstrating the company's commitment to strengthening its underlying businesses:

- Merchant Ecosystem: Investing RMB 10 billion in the first year to support high-quality merchants through transaction fee reductions

- Supply Chain Improvements: Focusing on enhancing sourcing and fulfillment capabilities to improve product quality and delivery times

- Agricultural Initiatives: Continuing investments in agricultural research and supporting local growers to bolster the company's portfolio of offerings

- R&D and Operations: New investments to streamline merchant onboarding and product listing processes

These investments aim to solidify PDD's position in the digital economy and create new opportunities for growth.

"On the supply side, we will invest substantial resources to support high-quality merchants who are willing to innovate and improve qualities. And we will offer significant transaction fee reductions to these merchants, with an initial target of CNY 10 billion in the first year." - Lei Chen, Chairman and Co-Chief Executive Officer

Management Commentary on Future Outlook

Chairman and Co-CEO Chen Lei provided insights into PDD's future strategy:

"As we enter a new investment phase, I would like to make it clear to our investors that our earnings will gradually trend down starting in Q3, and there will be fluctuations or rebounds in the short term. In the long run, the decline in profitability is inevitable as we focus on strengthening our network and support for businesses in our ecosystem."

Global Business and Competitive Landscape

Management noted increased uncertainty in the global business environment and intensifying competition. They emphasized a focus on core strengths, supply chain capabilities, and customer service to navigate these challenges. PDD's logistics network and fulfillment capabilities will play a crucial role in maintaining its competitive edge.

"Our global business is facing significant uncertainties from intense competition and evolving external environment. These factors combined will inevitably cause fluctuations to our business. As shown in this quarter's results, high revenue growth is not sustainable and a downward trend in profitability is inevitable." - Lei Chen, Chairman and Co-Chief Executive Officer

Investor Considerations

- Short-term Profitability: Expect fluctuations and potential declines in profitability as investments increase

- Long-term Growth Strategy: Focus on high-quality development and sustainable ecosystem growth

- Competitive Pressures: Monitor PDD's ability to maintain market share in an increasingly competitive e-commerce landscape

- Global Expansion: Watch for updates on Temu's performance and expansion into new markets

- Opaque Management: As most Chinese companies, PDD has a very poor communication with investors and about its plans, which certainly raises a lot of doubts about the company

- Government Hates Winners: As we've seen multiple times in China, when a Company starts to make a lot of money, that usually triggers a series of negative reaction from the government side, implying in increasing Capex and lower margins – that probably would be my base case.

Frequently Asked Questions

Is PDD making money?

Yes, PDD Holdings Inc is making money. The company reported a net income attributable to ordinary shareholders of RMB 32 billion in Q2 2024, showing significant profitability. However, future earnings are expected to trend lower due to increased investments.

"Net income attributable to ordinary shareholders was RMB 32 billion for the quarter compared to RMB 13.1 billion in the same quarter last year." - Jun Liu, VP of Finance

What is the earnings forecast for PDD stock?

While specific earnings forecasts may vary among analysts, PDD's management has indicated that earnings are expected to decline in the coming quarters due to increased investments. Going forward, we expect more fluctuations in profitability as the company focuses on long-term growth strategies.

"Looking ahead, we will invest firmly to support a healthy ecosystem that encourages high-quality merchants. Our profitability may fluctuate in the short term, but we gradually track lower in the long run. This is inevitable as we focus on the long-term, high-quality development of our platforms." - Jun Liu, VP of Finance

Is PDD a good stock to buy?

The decision to buy PDD stock depends on individual investment goals and risk tolerance. While the company has shown strong growth and profitability, future earnings are expected to decline. Honestly, we consider PDD's long-term growth potential, market position, and the competitive landscape before making investment decisions.

Why is PDD stock down?

PDD stock may experience downward pressure due to several factors, including the management's forecast of declining profitability, increased investments, and global economic uncertainties. Additionally, the competitive nature of the e-commerce industry and potential regulatory challenges in various markets may impact investor sentiment.

What does PDD holding stand for?

PDD Holdings Inc is the parent company that owns various businesses, including the popular e-commerce platform Pinduoduo. The company operates in the digital economy, providing online marketing services, transaction services, and other e-commerce-related offerings.

"As a global company in this era, we are committed to drive innovation, adapting to change and taking on greater social responsibilities in the region across the globe." - Lei Chen, Chairman and Co-Chief Executive Officer

Conclusion

PDD Holdings delivered another strong quarter in Q2 2024, with impressive profit growth despite a slight revenue miss. However, shareholders should be prepared for potential profitability declines in the coming quarters as the company increases investments in its merchant ecosystem, supply chain, and global expansion efforts. The management's focus on high-quality development and long-term sustainability could position PDD well for future growth, but it may come at the expense of near-term profits.

Furthermore, China has a terrible trackrecord with cash generating Companies. The government likes screwing with companies doing well. This summed with the opaque communication from management, it's pretty understandable the market reaction after the earnings call.

As PDD continues to evolve its business model and expand its international presence, we are closely monitor the company's ability to navigate competitive pressures, regulatory challenges, and changing market dynamics. While short-term fluctuations in the stock price are likely, PDD's strong position in the digital economy and its focus on supporting small businesses and local communities may provide long-term growth opportunities for patient investors.

"2024 is a critical year on our path towards high-quality development. We will focus on creating healthy and sustainable platform ecosystem and empowering our ecosystem partners with more platform resources and technical support. Together, we will lay a solid foundation towards the high-quality development of our platforms." - Zhao Jiazhen, Co-CEO & Executive Director