Thank you for reading Giro's Newsletter. This post is public so feel free to share it.

Recently, Rogério Panca became the president of the Brazilian Association of Credit Card and Financial Services Companies (“Abecs”), the official representative of the electronic means of payment sector in Brazil (~96% market share).

The former president, Mr. Pedro Coutinho, was hired by Safra Bank in an attempt to accelerate Safra Pay’s (Portuguese-only) market share in the acquiring business.

In this first interview (Portuguese-only) as Abecs’ president, Mr. Panca pointed out that the expansion of payment via debit in e-commerce and the development of the use of cards in segments where penetration is still low are a few of his top priorities ahead of the association.

The entity hired a consultancy to identify growth opportunities. In the interview, the executive did not detail all the fronts raised by the consultancy but anticipated some.

Online sales, for example, are a point of attention. “Credit is established in e-commerce, but debit is not yet,” he says.

According to the consultancy company Gmattos, debit cards were accepted in 30.5% of the analyzed online stores, against 37.3% a year earlier.

I didn’t access the consultancy’s report, but these numbers mean nothing to the overall industry picture.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Day after day, commerce platforms such as Vtex, Shopify, Meli, and Locaweb are increasing their penetration by offering one-stop solutions for merchants.

My guess is that a few of them are not offering debit in their checkout, so the problem might not be over acceptance but about the product itself.

For instance, let’s say that I’m moving my Substack to Ghost, and since Stripe is giving me a lot of headaches, I’m moving to the PagSeguro solution using a simple API structure.

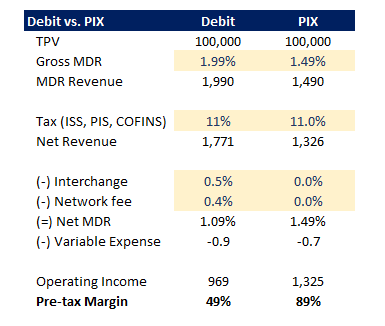

Will Pags try to sell me a debit card or a Pix solution for my recurrence business? To answer this question, let’s crunch a few numbers.

Looking at the image above, it’s clear that the value proposition for PIX transactions is superior to debit. They are cheaper for acquirers, margins are higher, and friction using Pix became inexistent after Pix QR Code.

Therefore, I don’t believe acquirers and payment gateways, such as Pagar.me (owned by Stone), will offer debit as a highlight payment option considering that the product is less profitable.

The problem is the product compensation structure. Network companies and issuer banks will not negotiate easily with acquirers, so they’re making the turnaround.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.