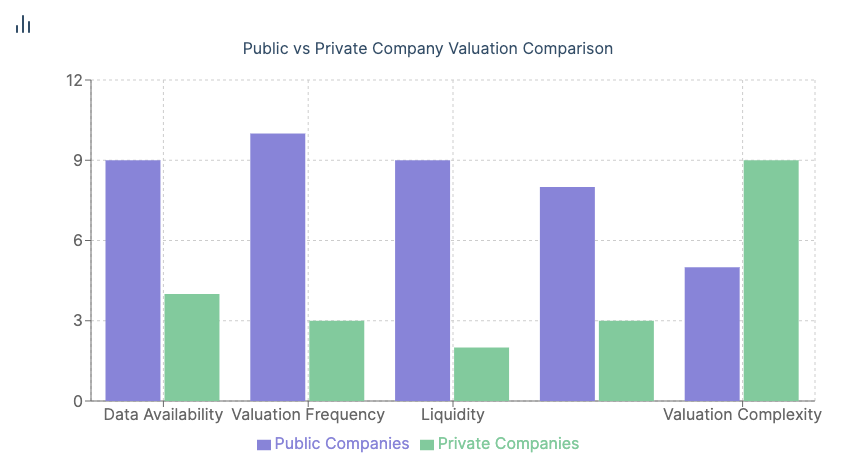

Private company valuation is a complex and nuanced process that plays a crucial role in the world of finance and investment. Unlike public companies, which have their market value determined daily through stock exchanges, private companies require specialized methods to ascertain their worth. This comprehensive guide will delve into the intricacies of how private companies are valued, exploring various valuation methods, key factors influencing valuations, and the challenges unique to valuing private firms.

Understanding Private Company Valuation

Private company valuation is the process of determining the economic value of a privately held company. This process is essential for various purposes, including:

- Mergers and acquisitions

- Raising capital from investors

- Employee stock ownership plans

- Tax reporting and compliance

- Strategic planning and decision-making

Unlike publicly traded companies, private companies do not have a readily available market price. This lack of public market data makes the valuation process more challenging and often requires a combination of quantitative and qualitative analysis.

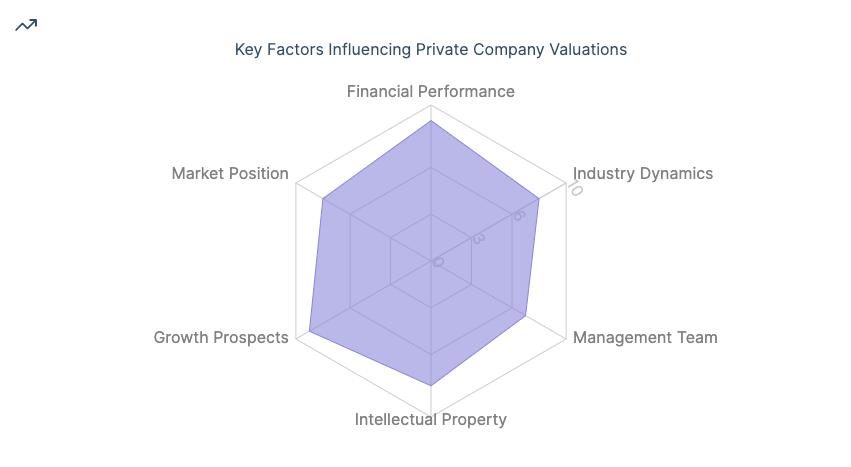

Key Factors Influencing Private Company Valuations

Several factors play a crucial role in determining the value of a private company:

Financial Performance

A company's historical and projected financial performance is a fundamental aspect of its valuation. Key metrics include:

- Revenue growth

- Profitability margins

- Cash flow generation

- Return on invested capital

Investors and analysts closely scrutinize these financial metrics to assess the company's financial health and growth potential.

Industry Dynamics and Market Position

The industry in which a private company operates and its competitive position within that industry significantly impact its valuation. Factors to consider include:

- Market size and growth potential

- Competitive landscape

- Barriers to entry

- Regulatory environment

A private company with a strong market position in a growing industry is likely to command a higher valuation than a similar company in a declining or highly competitive market.

Management Team and Corporate Governance

The quality and experience of a company's management team can greatly influence its valuation. Investors often place a premium on companies with:

- Experienced and successful leadership

- Strong corporate governance practices

- Clear succession plans

A capable management team can be a significant value driver, particularly for private companies where the founders or key executives play critical roles.

Intellectual Property and Intangible Assets

For many private companies, especially those in technology or innovation-driven industries, intellectual property and other intangible assets can be major value drivers. These may include:

- Patents and trademarks

- Proprietary technology or processes

- Brand recognition and customer relationships

Valuing these intangible assets often requires specialized expertise and can significantly impact the overall company valuation.

Growth Prospects and Scalability

A private company's potential for future growth and its ability to scale operations efficiently are crucial factors in its valuation. Investors assess:

- Market expansion opportunities

- Product or service development pipeline

- Operational efficiency and scalability

Companies with strong growth prospects and scalable business models often command higher valuations, even if their current financial performance may not fully reflect this potential.

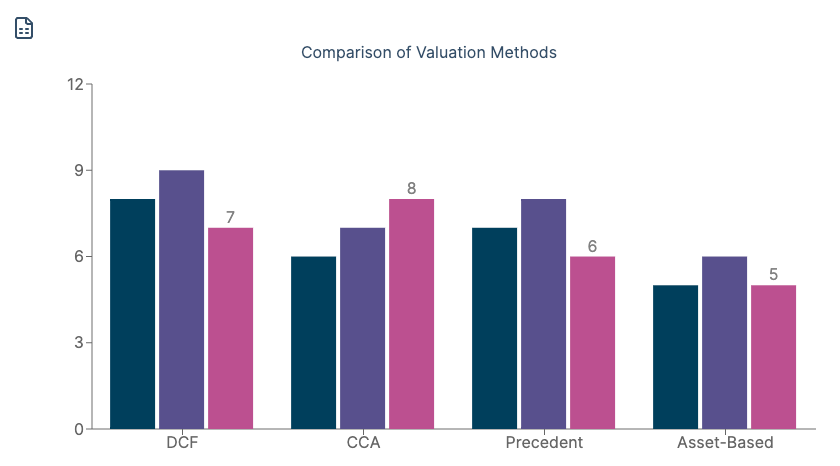

Private Company Valuation Methods

Several valuation methods are commonly used to value private companies. Each method has its strengths and limitations, and often a combination of approaches is used to arrive at a comprehensive valuation.

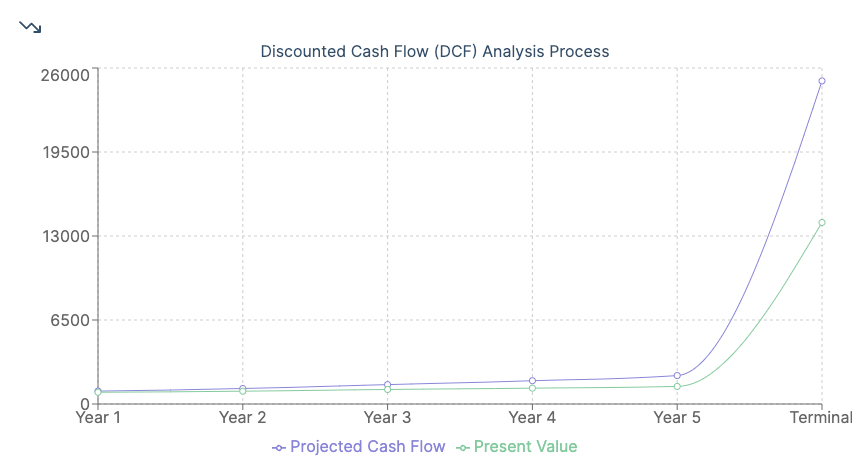

1. Discounted Cash Flow (DCF) Analysis

Discounted cash flow analysis is a fundamental valuation method used for both public and private companies. This method estimates the present value of a company's future cash flows.

Key steps in DCF analysis:

- Project the company's future cash flows

- Determine an appropriate discount rate (often using the weighted average cost of capital)

- Calculate the present value of projected cash flows

- Estimate the terminal value

- Sum the present values to arrive at the enterprise value

DCF analysis is particularly useful for private companies with predictable cash flows and growth trajectories. However, it relies heavily on assumptions about future performance, which can be challenging to estimate accurately for some private firms.

2. Comparable Company Analysis (CCA)

Comparable company analysis, also known as public company comparables or "comps," involves comparing the target private company to similar publicly traded companies.

Process of CCA:

- Identify a set of comparable public companies in the same industry

- Calculate relevant valuation multiples for these public companies (e.g., EV/EBITDA, P/E ratio)

- Apply these multiples to the target private company's financial metrics

- Adjust for differences between the public and private companies

This method provides a market-based perspective on valuation but requires careful selection of truly comparable companies and adjustments for differences in size, growth rates, and capital structures.

3. Precedent Transactions Analysis

This method analyzes recent mergers and acquisitions in the same industry to derive valuation multiples.

Steps in precedent transactions analysis:

- Identify relevant recent transactions involving similar companies

- Calculate transaction multiples (e.g., EV/Revenue, EV/EBITDA)

- Apply these multiples to the target private company's financials

- Adjust for specific transaction circumstances and market conditions

Precedent transactions can provide valuable insights into how the market values similar companies, but care must be taken to account for unique transaction dynamics and changing market conditions.

4. Asset-Based Valuation

For asset-heavy industries or companies in distress, an asset-based approach may be appropriate. This method values a company based on the fair market value of its net assets.

Asset-based valuation process:

- Identify and value all tangible and intangible assets

- Subtract the fair value of liabilities

- Adjust for factors like liquidation costs if applicable

This method can be useful for companies with significant tangible assets but may undervalue companies with substantial intangible assets or growth potential.

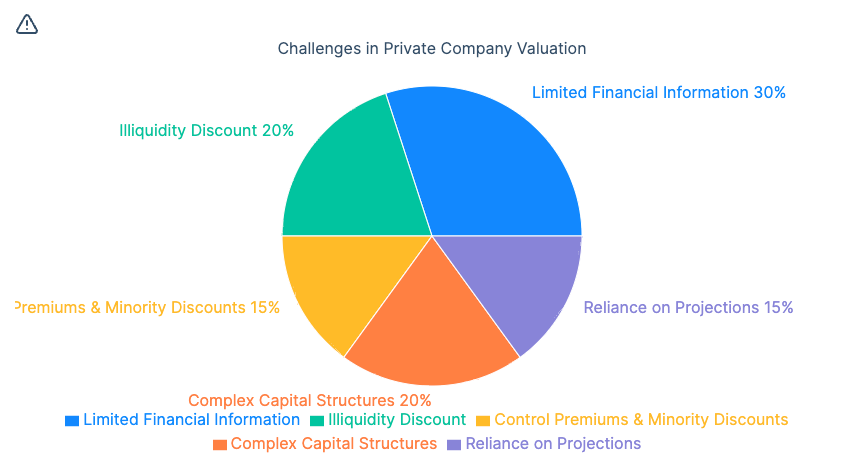

Challenges in Private Company Valuation

Valuing private companies presents several unique challenges compared to valuing public companies:

Limited Financial Information

Unlike public companies, private firms are not required to disclose detailed financial information. This lack of transparency can make it difficult to obtain accurate and comprehensive financial data for valuation purposes.

Illiquidity Discount

Shares of private companies are not easily tradable, which often necessitates applying an illiquidity discount to the valuation. Determining the appropriate discount can be subjective and vary based on factors such as company size, industry, and potential exit opportunities.

Control Premiums and Minority Discounts

The value of a private company can vary depending on the size of the ownership stake being valued. Majority stakes often command a control premium, while minority interests may be subject to a discount due to lack of control.

Complex Capital Structures

Private companies often have complex capital structures with multiple classes of shares, convertible securities, or complex debt arrangements. These structures can complicate the valuation process and require careful analysis of the rights and preferences of different security classes.

Reliance on Projections

Valuation methods like DCF analysis rely heavily on financial projections. For private companies, especially early-stage or high-growth firms, creating accurate long-term projections can be challenging and introduces significant uncertainty into the valuation process.

Best Practices in Private Company Valuation

To navigate the complexities of private company valuation, consider the following best practices:

- Use multiple valuation methods: Employing various valuation approaches can provide a more comprehensive view of a company's value and help identify potential discrepancies.

- Conduct thorough due diligence: Given the limited public information available, comprehensive due diligence is crucial to understand the company's operations, financials, and market position.

- Consider qualitative factors: While quantitative analysis is important, don't overlook qualitative factors such as management quality, competitive advantages, and industry trends.

- Adjust for company-specific factors: Tailor your valuation approach to the specific characteristics of the company, including its stage of development, industry, and growth prospects.

- Be transparent about assumptions: Clearly document and communicate all assumptions used in the valuation process, allowing for easier review and adjustment if needed.

- Perform sensitivity analysis: Test how changes in key assumptions affect the valuation to understand the range of potential values and identify critical value drivers.

- Seek expert opinions when necessary: For complex valuations or niche industries, consider consulting with industry experts or specialized valuation professionals.

Frequently Asked Questions

What determines the value of a private company?

The value of a private company is determined by a combination of factors, including:

- Financial performance (revenue, profitability, cash flow)

- Growth prospects and market opportunities

- Industry dynamics and competitive position

- Quality of management team

- Intellectual property and intangible assets

- Capital structure and financial health

- Market conditions and investor sentiment

Valuation methods such as discounted cash flow analysis, comparable company analysis, and precedent transactions analysis are used to quantify these factors and arrive at a valuation range.

How would you value a privately owned company?

Valuing a privately owned company typically involves the following steps:

- Gather comprehensive financial and operational information about the company

- Analyze the company's historical performance and future prospects

- Understand the industry dynamics and the company's competitive position

- Apply multiple valuation methods, such as:

- Discounted Cash Flow (DCF) analysis

- Comparable Company Analysis (CCA)

- Precedent Transactions Analysis

- Asset-Based Valuation (if applicable)

- Adjust for company-specific factors, such as illiquidity or control premiums

- Synthesize the results from different methods to arrive at a valuation range

- Perform sensitivity analysis to understand the impact of key assumptions

It's important to note that valuing a private company often requires more subjective judgment and thorough analysis compared to valuing public companies due to limited information availability.

How much is a $10 million revenue company worth?

The value of a company with $10 million in revenue can vary significantly based on various factors. However, we can provide a general framework for estimating its value:

- Industry multiples: Different industries have different typical valuation multiples. For example:

- Software companies might be valued at 5-10x revenue

- Manufacturing companies might be valued at 1-2x revenue

- Profitability: A company with higher profit margins will generally be worth more than a company with lower margins, even at the same revenue level.

- Growth rate: Fast-growing companies command higher multiples than slow-growing ones.

- Market position and competitive advantages: Companies with strong market positions or unique intellectual property may be valued higher.

- Financial health: Companies with strong balance sheets and cash flows are typically valued higher than those with high debt or cash flow issues.

As a very rough estimate, a private company with $10 million in revenue might be valued anywhere from $10 million to $100 million or more, depending on the factors above. However, a proper valuation would require much more detailed analysis and information about the specific company and its industry.

How are companies valued in private equity?

Private equity firms use a combination of valuation methods to assess potential investments and monitor the value of their portfolio companies. The process typically involves:

- Comprehensive due diligence: PE firms conduct extensive financial, operational, and market analysis to understand the target company's performance and potential.

- Multiple valuation methods: Common approaches include:

- Discounted Cash Flow (DCF) analysis

- Comparable Company Analysis (CCA)

- Precedent Transactions Analysis

- Leveraged Buyout (LBO) modeling

- Focus on value creation: PE firms often model various scenarios to identify opportunities for operational improvements, strategic repositioning, or add-on acquisitions that could enhance the company's value.

- Exit potential: Valuation in PE often considers the potential future exit value of the company, typically through a sale or IPO.

- Debt capacity: PE firms assess how much debt the company can support, as leverage is often used to enhance returns.

- Industry expertise: Many PE firms specialize in specific industries, allowing them to apply deep sector knowledge to their valuations.

- Regular revaluations: Portfolio companies are typically revalued quarterly, considering both company-specific performance and broader market conditions.

- Consideration of control: PE firms often acquire controlling stakes, so their valuations may include a control premium.

Private equity valuations tend to be more forward-looking and focused on potential value creation compared to traditional corporate finance valuations. They also often incorporate more detailed operational analysis and industry-specific insights.

Conclusion

Valuing private companies is a complex process that requires a combination of analytical rigor, industry knowledge, and sound judgment. While various valuation methods provide frameworks for estimating a company's worth, it's crucial to remember that valuation is as much an art as it is a science, especially when dealing with private firms.

As the business landscape continues to evolve, with new industries emerging and traditional sectors transforming, the practice of private company valuation must also adapt. Staying informed about market trends, industry dynamics, and evolving valuation techniques is essential for anyone involved in private company valuations.

Whether you're an investor, entrepreneur, or financial professional, understanding the nuances of private company valuation is crucial in today's complex business environment. By applying the methods and principles outlined in this guide, you'll be better equipped to navigate the challenges and opportunities presented by private company valuations.