We’ll go briefly on Sea’s earnings and its highlights in this post. Then, we intend to extend to a discussion about the company’s operation in LatAm.

Read our last post explaining Shopee’s business in Brazil and its PnL breakdown if you haven't.

Earnings Highlights

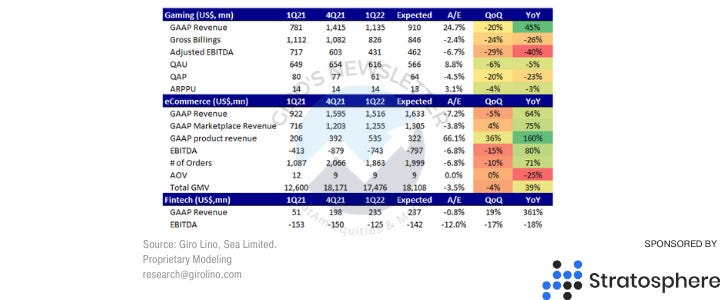

Sea Limited ($SE, “Shopee”, “Shopee Brazil”) reported 1Q22 results, largely in-line on the top line and much better than expectations on cash burn level.

The eCommerce segment delivers GMV growth of 39% YoY, while its cash burn also lowers QoQ. We welcome the message from management that Sea may achieve profitability sooner than expected.

“In particular, Shopee's adjusted EBITDA loss per order before allocation of HQ costs in Southeast Asia and Taiwan improved by more than 70% year-on-year to $0.04. This shows that Shopee is well on track to achieve positive adjusted EBITDA before allocation of costs in the region”.

Also, management reduced its GAAP revenue guidance to US$8.5-9.1bn from US$8.9-9.1bn reflecting the growing uncertainties in macro conditions, which could impact the spending power of consumers.

We believe that the guidance now implies that the GMV growth outlook for 2022 is now +30-40% YoY for the consolidated company, with LatAm growing 100% YoY.

We recently wrote our outlook for eCommerce in LatAm.

Management reaffirmed that they focus on profitability over growth, which is an encouraging message. As a result, we believe Sea could deliver high double digits growth without cash burn, which, in our view, would be great.

The positive highlight was the monetization increase in the eCommerce operation, as the GAAP marketplace revenue as a percentage of total GMV rose to 7.2% during the quarter compared to 5.7% last year.

As expected, gaming faced pressure in 1Q22, with bookings down 24% QoQ. However, the company started to see the monthly user trend showing early signs of stabilization towards the end of 1Q22.

Entering a new market

Breaking down Sea’s business, management always mentioned they optimize the business for unit economics through growing operating leverage across its e-commerce ecosystem with scale.

Sea invests in growing a broad base of buyers and sellers across comprehensive core online marketplace categories and deepening engagement.

This promotes user growth, conversion, retention, and purchase frequency, which allows Sea to efficiently grow order volume and density.

With sufficient and continually improving order volume and density, Sea aims to achieve cost leadership for the ecosystem to profitably serve the broadest base of buyers and sellers and the most extensive range of consumption categories.

However, we highlight that management has been increasingly vocal about growing of financial services:

“This also allows us to efficiently cross-sell more products and service offerings, including digital financial services, especially to the underserved mass market, a market segment that we believe represents the largest opportunity in our global markets.”

This is important because, on May 2nd, Sea Limited was granted a license to operate as a payment institution (“IP”) in Brazil by the Brazilian Central Bank (“BCB”).

Even though a few local companies are spreading rumors that it would take time for Sea to ramp up its financial operations in Brazil, we profoundly disagree.

We are confident that Sea has been thinking about opening its financial arm in Brazil since the inception of its marketplace business.

We found Sea’s certification of incorporation for its payment institution, filed on September 8th, 2020. Also, we’d like to highlight the key people behind the financial operation in Brazil:

- Pine Kyaw, VP for LatAm

- Haowen Zheng, Sea’s Controller

- Teck Yong Lim, Director of Operation, Brazil

Sorry, this one cannot share a public link.The BCB released a release that Mr. Forrest Xiadong Li filed a request for the payment institution as a partner (Nov/21). (Portuguese-only)

Also, we highlight that, recently, Mr. Kyaw had his designation changed from “Brazil” to “LatAm,” indicating that Sea will pursue to grow in different countries, such as Colombia, Mexico, etc.

The timing, of course, is uncertain, but the evidence foreshadowing Sea’s next moves could not be clear. Nevertheless, there are several implications for the company.

The most important is the transaction cost. Today, for not being a payment institution, Sea has to pay a few intermediaries for executing the transactions for not being a payment institution.

Even though it sounds minor, we estimate that company could increase its margins by 20bps on GMV, which would be translated to 100-170bps in gross margin, which is a lot.

However, we are curious about Sea’s wallet. Considering that every retailer has one, we’re wondering how they’ll try to attract customers and make them keep the money there.

The Marketplace

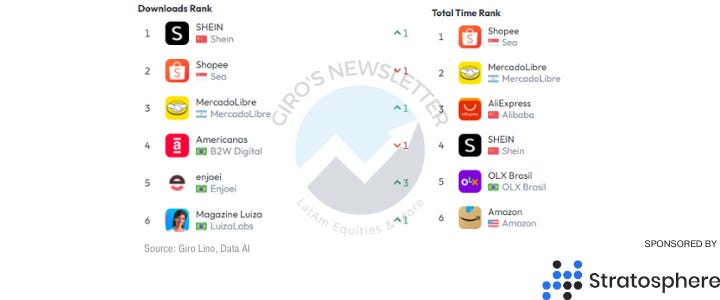

In Brazil, Shopee ranked second by downloads and the first for the total time spending app for the shopping category, according to data.ai.

Shopee Brazil had the highest number of monthly active users in the shopping category in March and April as we further expanded our leading positions.

Shopee is also growing our local sellers, with over 2mn Brazilian sellers currently registered on the Shopee platform.

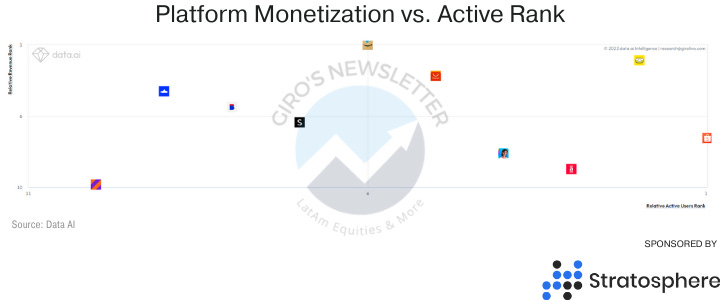

Nevertheless, according to data.ai, Shopee is lagging behind peers in monetization. Moreover, as pointed out in our post about Meli's marketplace, the company is paying a lot of cash for its customers.

A range from SMEs to establish the brand, and we are working across the board to enable them to serve more buyers across more categories, demographics, and consumption locations.

Shopee traction in Brazil underlines a prominent and auspicious opportunity to serve underserved communities of sellers and buyers in that market.

The company successfully played out an outstanding cross-border strategy to expand its penetration. Shopee did so well that also, Alibaba benefited from it.

Clients started to realize they could easily buy goods directly from China and receive it in weeks with very competitive prices.

Also, in many cases, most CB sellers from Shopee sell on Baba, so clients can choose between the cheaper ones. But clearly, Shopee was the most benefited.

However, Sea’s business is primarily local to local, raising a flag. So, expect the company to bring strategic partners to Brazil and to keep deepening the existing commercial agreements.

As largely anticipated in our post about Meli’s marketplace, the Asian shipping company J&T Express (privately owned) recently entered Brazil. J&T Express has worked with Shopee for more than five years in Southeast Asia.

Data from the company’s 200+ current job openings in the country, many of which are in regional locations, indicate that J&T Express could eventually build out a full-service model across all regions of Brazil.

In fact, in February 2022, J&T Express officially announced its expansion into the Mexican market, where its 12 sorting and 26 distribution centers cover all 32 Mexican states.

Also, more recently, our checks show Shopee increasingly working with Brazil third-party logistics operators such as Sequoia, Loggi, Rede Sul, and Total Express (Portuguese-only).

Turning to profitability, we heard an encouraging message from management about the operation in Brazil, with an extra data:

“We also made very healthy progress in Brazil in the first quarter where such loss was $1.52, an improvement of more than 45% year-on-year.”

According to our estimates, Shopee Brazil registered a $1.2bn in GMV in the 1Q22, +189% YoY, and above the 4Q21 GMV, indicating a strong trend in the GMV growth.

We recognize a slight upside risk for our initial expectation presented in the post about Meli, even though we’re not reviewing this number right now.

However, we point to considerable downside risk for the market estimates for GMV in Brazil. In our channel checks, we hear players with GMV above $8bn in 2022, which is ridiculously high and would not match management comments.

Sea has been doing an outstanding job communicating with the market. As a result, information flow has been slow but continuous each quarter.

Nevertheless, a few analysts keep pushing the bar with risorius expectations and punishing Sea in their quarterly update due to “weak reports.”

It's impressive. I'm working alone; I don't have access to any significant industry monitoring company (Euromonitor, etc.), and I still can perform a reasonable industry analysis scavenging for data all day long. At the same time, a few analysts with all resources globally are unable.

Shopee Unit Economics

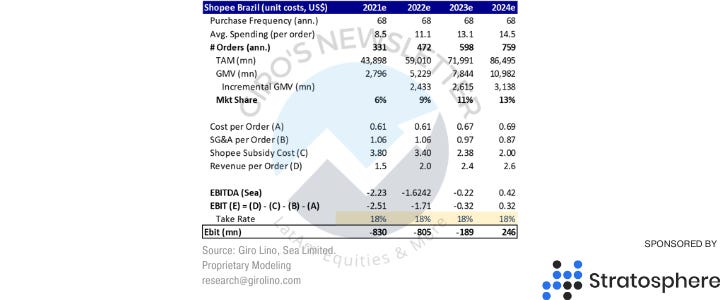

Finally, we’ll present a simple update for Shopee Brazil and its unit economics. Surprisingly, Shopee Brazil has shown a better subsidy cost dilution than expected, significantly reducing the expected cash burn.

Previously, we expected a $1.7bn cash burn for 2022. So, considering the reported cash burn per order, management gave invaluable information for estimating the entire year. Thank you, Sea.

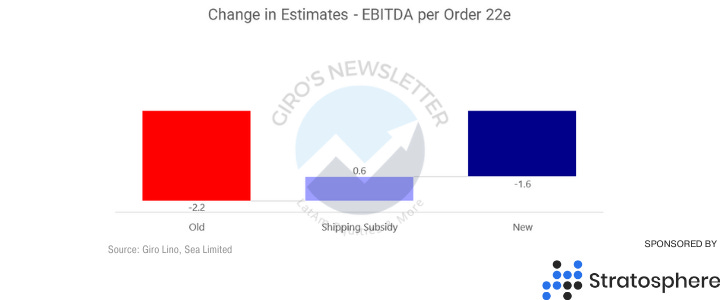

Just as complementary, this is the waterfall for the unit economics. Again, we estimate a 30% improvement in Sea’s PnL due to higher than expected cost dilution.

Remember that we consider transaction costs and all costs related to a traditional marketplace operation. Therefore, we expect sequential upside risk when the Payment Institution is running.

Finally, Giro’s Newsletter is a reader-supported publication, and, therefore, I rely a lot on dear readers. You can support my job by sharing Giro’s. 💙

I work hard to bring the best analysis daily. A simple act, such as sharing the post in seconds, will impact my business more than you could possibly realize. 💙