In a surprising turn of events, news broke just hours ago about the dissolution of the SoftBank Intel partnership. This development has sent shockwaves through the AI chip market, prompting investors and analysts to reassess the competitive landscape. The partnership's end marks a significant shift in the strategies of major players in the semiconductor industry.

Market Data Reveals Shifting Dynamics

Recent market data paints a compelling picture of the AI chip market's evolution. With the AI revolution in full swing, companies are vying for dominance in this lucrative sector. Let's delve into the latest trends and analyze their implications for key players and investors.

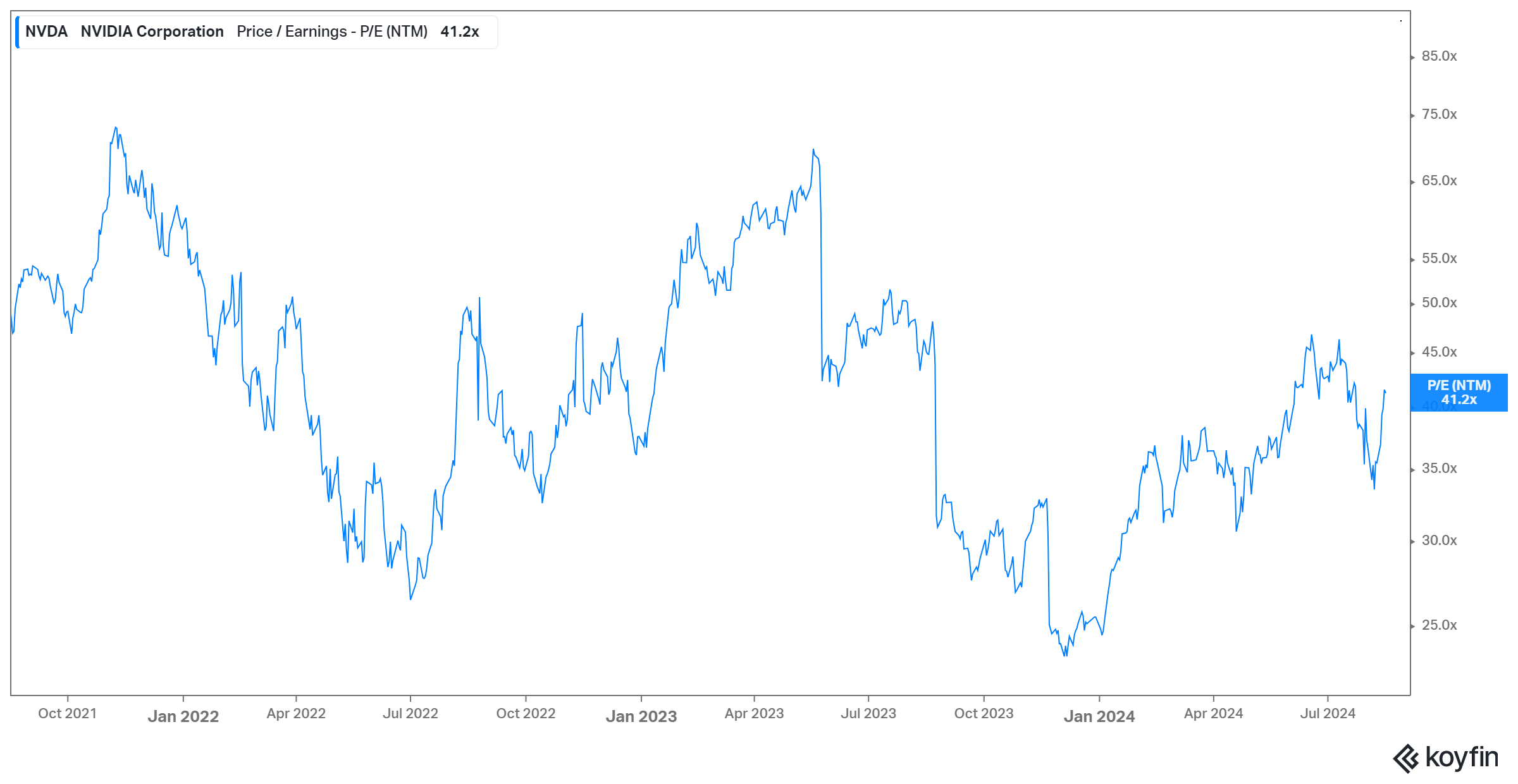

NVIDIA Corporation: The Undisputed Leader

NVIDIA Corporation has emerged as the undisputed leader in the AI chip market. With a staggering market cap of $3,019.33B and a P/E ratio of 41.5x, NVIDIA's stock has been on a tear. The company's focus on GPU technology for AI applications has paid off handsomely, making it a darling of both Wall Street and Silicon Valley.

NVIDIA's Dominance in AI and Gaming

NVIDIA's success isn't limited to AI chips. The company continues to dominate the gaming GPU market, further solidifying its position. This dual strength in AI and gaming has contributed to NVIDIA's impressive revenue growth and market performance.

NVIDIA Corporation continues to assert its leadership in multiple tech sectors, particularly in AI and gaming. The company's GPU technology, unparalleled in its optimization for AI and machine learning tasks, has become the de facto standard in many AI applications.

NVIDIA's CUDA ecosystem provides a robust platform for AI development, further entrenching their position. In the gaming market, their GeForce GPUs remain the gold standard for high-performance graphics. NVIDIA's influence extends deeply into data centers, where their GPUs drive acceleration for a wide array of computational tasks.

The company's innovations in ray tracing and DLSS (Deep Learning Super Sampling) technologies have set new benchmarks for realistic and efficient gaming experiences, maintaining their edge in this competitive market.

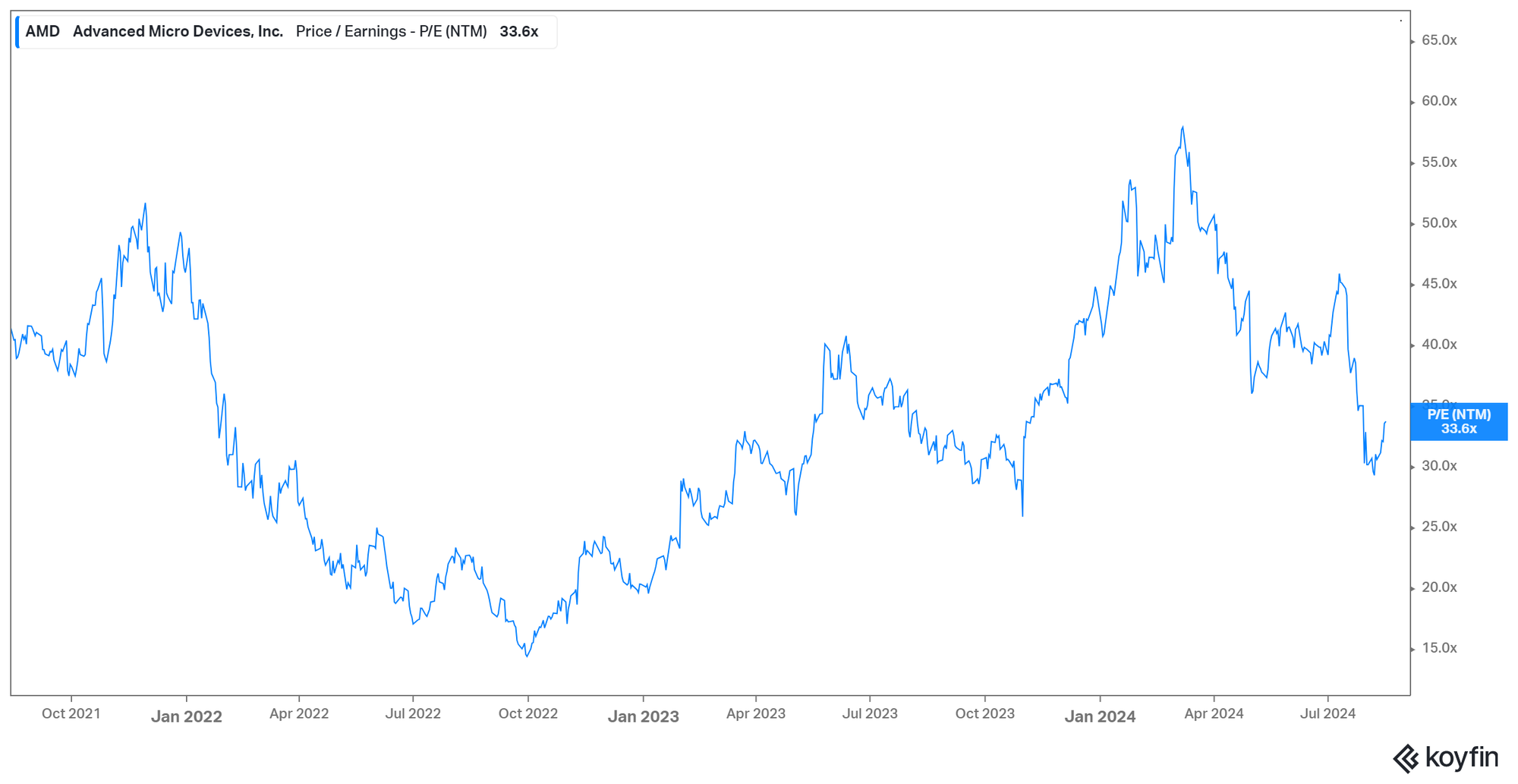

Advanced Micro Devices Inc: The Rising Challenger

Advanced Micro Devices Inc (AMD) has been making significant strides in the AI chip market. With a market cap of $238.50B and a P/E ratio of 33.5x, AMD presents an interesting investment opportunity for those looking to capitalize on the AI boom.

AMD's Competitive Edge

AMD's competitive edge lies in its ability to offer high-performance chips at competitive prices. The company's recent innovations in both CPU and GPU technologies have allowed it to gain market share from its rivals.

Advanced Micro Devices (AMD) has experienced a remarkable resurgence in recent years, carving out a strong position in the tech landscape. The company's success stems from its robust performance in both CPU and GPU markets, offering products that compete effectively with those of Intel and NVIDIA.

AMD's competitive pricing strategy has allowed it to gain market share while still delivering high-performance solutions. The company has also secured significant wins in the gaming console market, providing chips for both PlayStation and Xbox platforms.

In the lucrative data center market, AMD's presence is growing, challenging Intel's long-standing dominance. At the heart of AMD's revival are innovations in chip design, particularly their Zen architecture, which has received acclaim for its performance and efficiency.

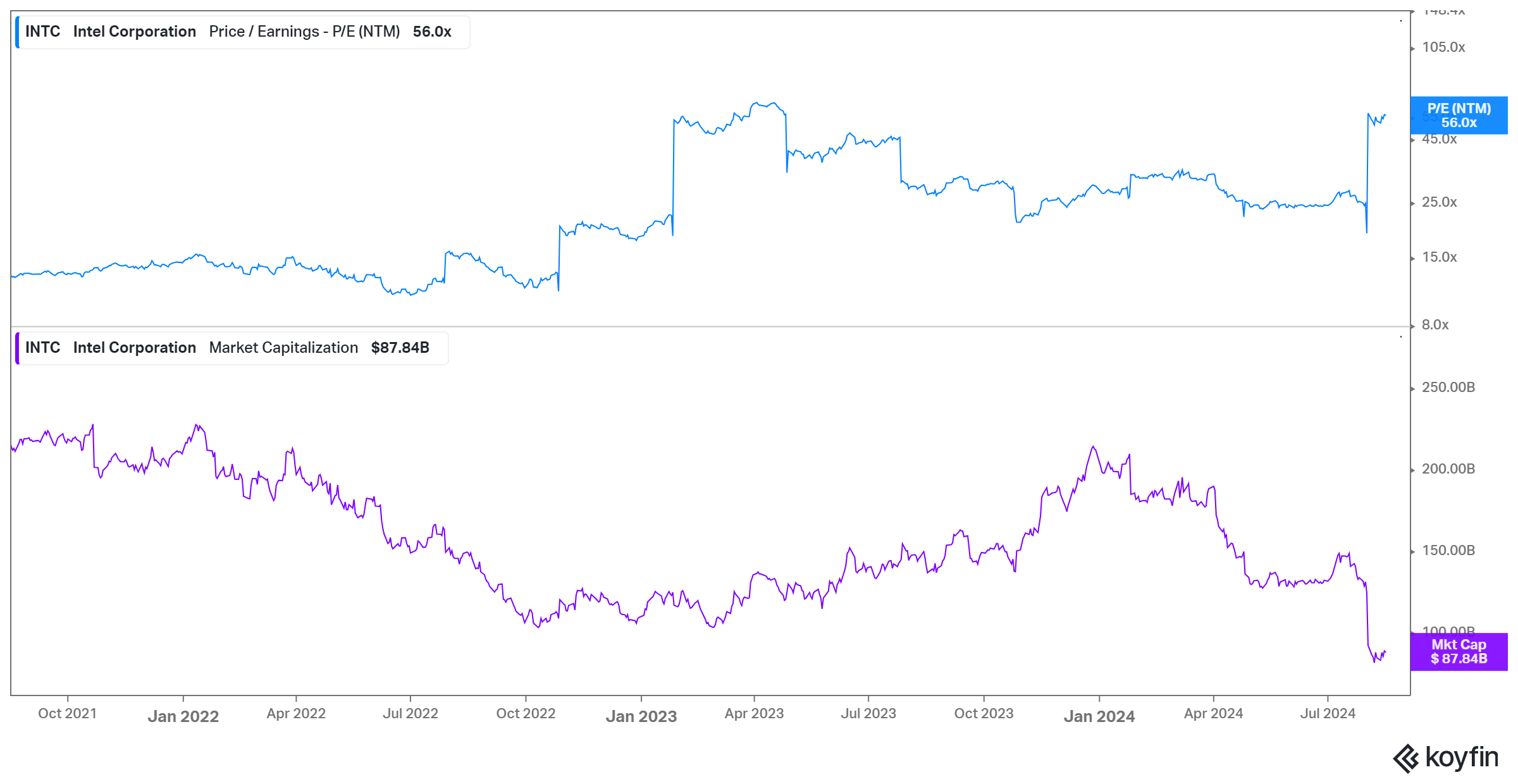

Intel Corporation: Struggling to Keep Pace

Once the dominant force in the semiconductor world, Intel Corporation has been struggling to keep pace with its rivals in the AI chip race. With a market cap of $88.47B and a P/E ratio of 56.4x, Intel's stock has underperformed compared to its peers.

Intel's AI Strategy

Despite setbacks, Intel is not giving up on the AI chip market. The company has been investing heavily in AI technologies and has made several strategic acquisitions to bolster its position. However, Intel faces an uphill battle to regain its former glory in the semiconductor industry.

In response to shifting market dynamics, Intel has recalibrated its focus towards artificial intelligence. The tech giant is developing specialized AI chips, including the Gaudi and Habana lines, aimed at competing in the burgeoning AI hardware market.

Simultaneously, Intel is integrating AI capabilities into its existing CPU product lines, enhancing their versatility. The company is making significant strides in edge AI computing solutions, recognizing the growing importance of processing data closer to its source.

To strengthen its AI ecosystem, Intel is forging partnerships with AI software companies, creating optimized solutions that leverage their hardware. A substantial portion of their AI strategy revolves around data centers and cloud computing environments, areas where AI workloads are increasingly critical.

Taiwan Semiconductor Manufacturing: The Silent Giant

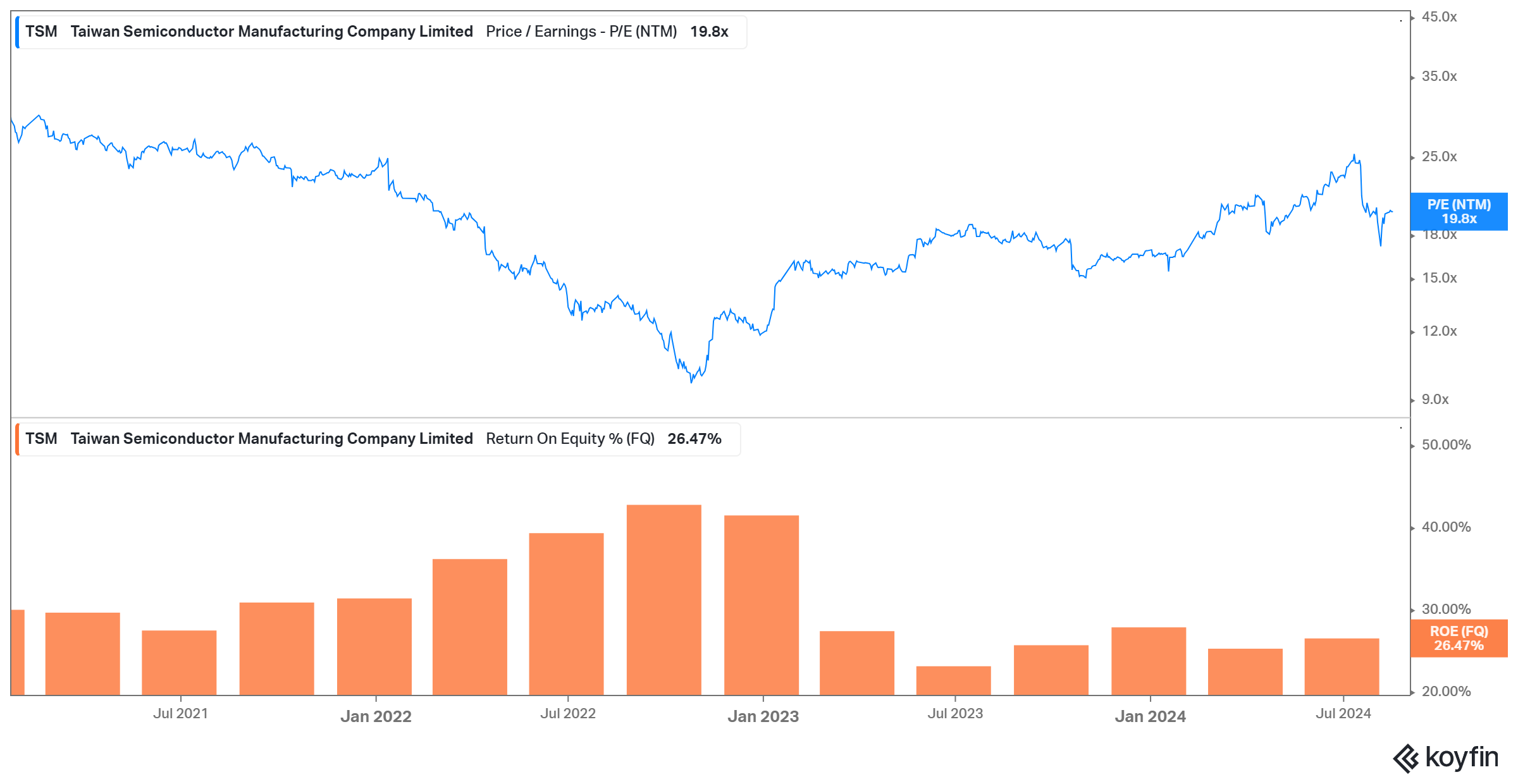

Taiwan Semiconductor Manufacturing Company (TSMC) plays a crucial role in the AI chip market as the world's largest contract chipmaker. Many of the leading AI chip designers, including NVIDIA and AMD, rely on TSMC's advanced manufacturing capabilities. With a market cap of $750B and a P/E ratio of 19x, TSMS's stock has been delivering consistent returns with a high profitability (20% ROE).

TSMC's Competitive Advantage

TSMC's competitive advantage lies in its cutting-edge manufacturing processes and its ability to produce high-performance chips at scale. This has made it an indispensable partner for many AI chip companies.

Taiwan Semiconductor Manufacturing Company (TSMC) stands at the forefront of the semiconductor industry, wielding a formidable competitive edge. The company's prowess in developing advanced process nodes allows for the creation of smaller, more efficient chip designs, keeping them ahead of competitors. TSMC's diverse customer base spans various industries, ensuring a stable demand for their services.

Their production facilities boast high capacity and impressive yield rates, translating to efficient and reliable output. Substantial investments in research and development fuel continuous innovation in chip manufacturing techniques. Moreover, TSMC's geopolitical importance, given Taiwan's strategic position in global tech supply chains, adds another layer to their competitive advantage.

The AI Chip Market: Size and Growth Projections

The AI chip market has been experiencing explosive growth, driven by increasing demand for AI-powered applications across various industries. Market research firms project that the global AI chip market will reach hundreds of billions of dollars by 2025, with a compound annual growth rate (CAGR) exceeding 30%.

Who is Buying AI Chips?

The demand for AI chips comes from a diverse range of customers:

- Cloud service providers (e.g., Amazon, Google, Microsoft) for their data centers

- Autonomous vehicle manufacturers

- Smartphone makers integrating AI capabilities

- Research institutions and universities

- Financial services firms for high-frequency trading and risk analysis

- Healthcare organizations for medical imaging and diagnostics

The Role of AI Chips in Edge Computing

Edge computing is emerging as a critical frontier in the AI revolution. AI chips designed for edge devices enable local processing of data, reducing latency and improving privacy. Companies like Intel are developing specialized AI chips for edge applications, recognizing the growing importance of this market segment.

Investing in AI Chip Stocks: Key Considerations

For investors looking to capitalize on the AI chip boom, several factors should be considered:

- Market leadership and technological innovation

- Financial performance and growth prospects

- Competitive landscape and market share trends

- Partnerships and ecosystem development

- Valuation metrics and potential risks

The Future of AI Chip Technology

As the AI chip market continues to evolve, several trends are shaping its future:

- Increasing specialization of AI chips for specific applications

- Growing focus on energy efficiency and sustainability

- Integration of AI capabilities into a wider range of devices

- Emergence of new materials and architectures for chip design

- Potential disruption from quantum computing and neuromorphic chips

Navigating the AI Chip Revolution

The AI chip market presents both tremendous opportunities and significant challenges for investors and companies alike. As the industry continues to evolve at a rapid pace, staying informed about the latest developments and market trends is crucial for making informed investment decisions.

Whether you're considering investing in established leaders like NVIDIA, rising challengers like AMD, or foundational players like TSMC, it's essential to conduct thorough research and consider your risk tolerance. The AI chip revolution is still in its early stages, and the landscape is likely to see further disruption and innovation in the years to come.

FAQs

Why did SoftBank's partnership with Intel fail?

SoftBank's partnership with Intel collapsed due to Intel's inability to meet SoftBank's stringent requirements for production volume and speed in AI chip manufacturing.

How does this development affect Nvidia's market position?

The failure of the SoftBank-Intel partnership inadvertently strengthens Nvidia's dominant position in the AI chip market by eliminating a potential competitor in the short term.

What opportunities does this create for AMD?

AMD may have an opportunity to strengthen its position as Nvidia's primary competitor in the AI chip space, potentially gaining market share and exploring new partnerships.

How might SoftBank's pivot to TSMC impact the AI chip market?

SoftBank's discussions with TSMC could lead to the development of new, competitive AI chips, potentially increasing competition in the market and driving innovation.

What should investors watch for in the AI chip market going forward?

Investors should monitor market share trends, R&D spending, strategic partnerships, and the development of specialized AI chips for different applications and industries.