StoneCo Ltd. (NASDAQ: STNE), a leading Brazilian financial technology solutions provider, has released its eagerly anticipated second quarter 2024 earnings report, showcasing impressive growth across key metrics and solidifying its position as a dominant player in the Latin American fintech landscape.

Financial Highlights: Surpassing Expectations

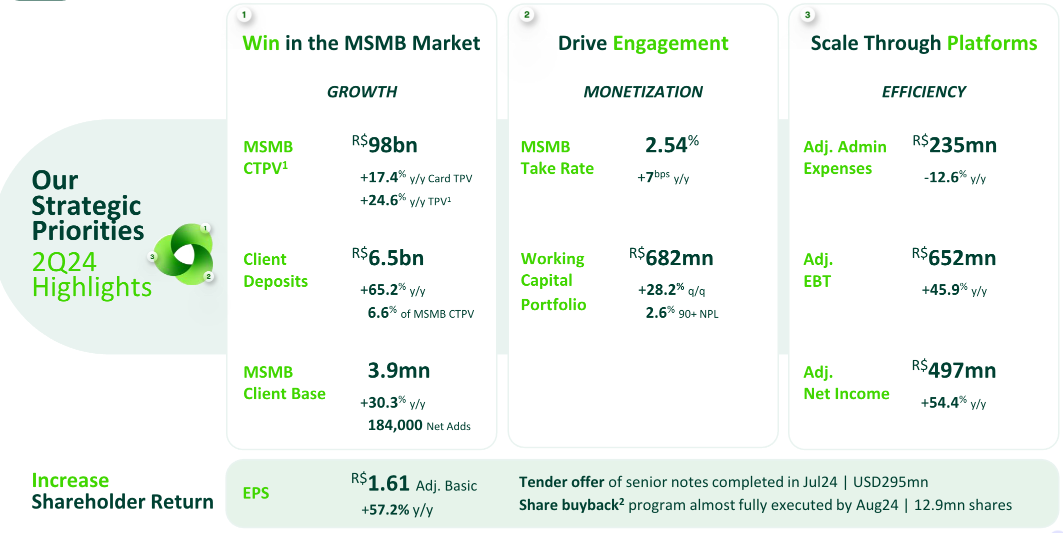

StoneCo's Q2 2024 financial results demonstrate significant year-over-year improvements, exceeding both internal projections and market expectations. Here's a breakdown of the key financial highlights:

- Total Revenue and Income: R$3,205.9 million, up 8.5% YoY

- Adjusted Net Income: R$497 million, a substantial increase of 54.4% YoY

- Adjusted Basic EPS: R$1.61, up 57.2% YoY

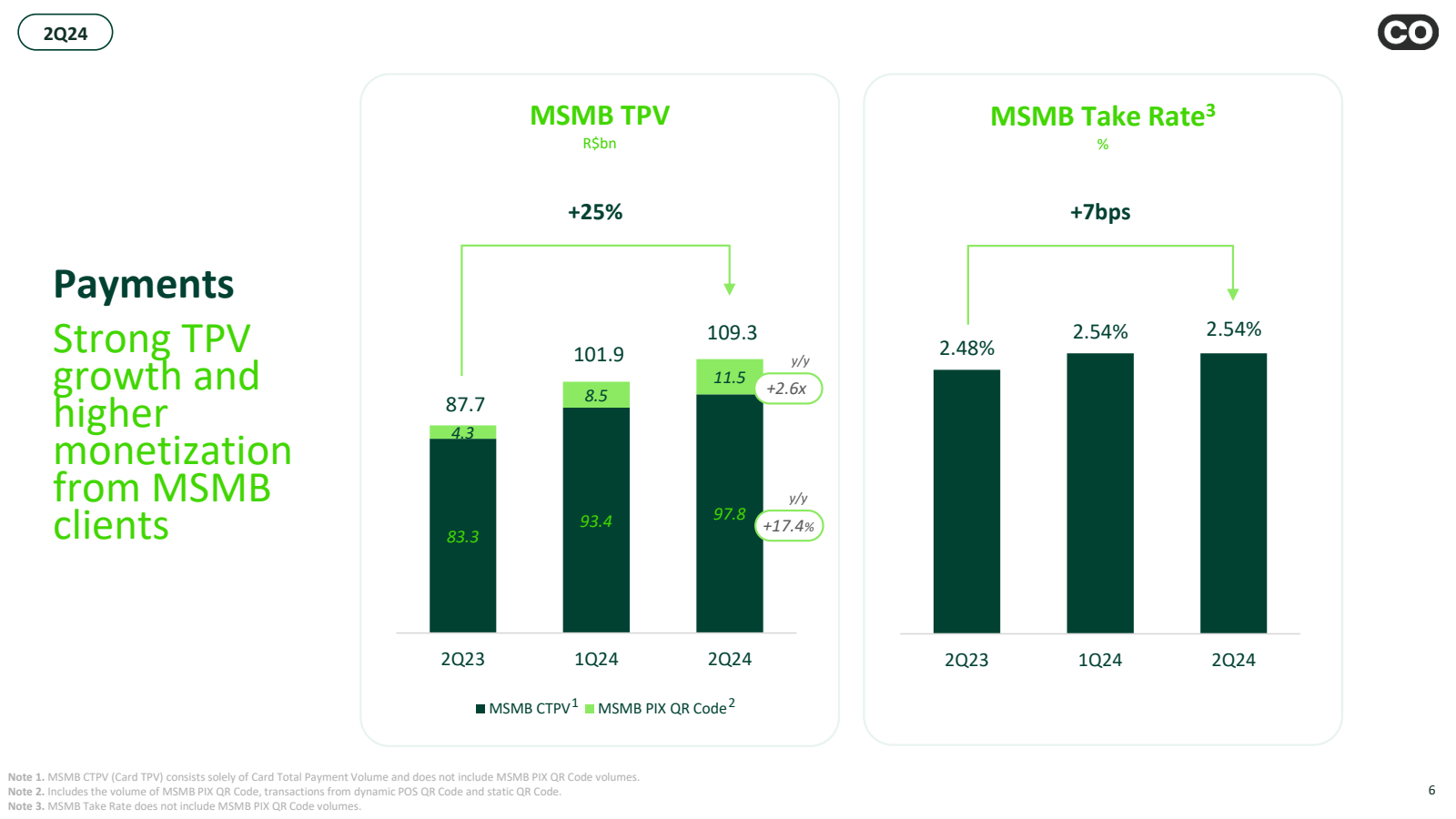

- Total Payment Volume (TPV): R$126.1 billion, growing 21.6% YoY

- MSMB Card TPV: R$97.8 billion, an impressive 45.9% YoY increase

- Active Client Base: 3.9 million, up 29.5% YoY

These results underscore StoneCo's ability to drive growth and improve profitability, even in the face of macroeconomic challenges and regulatory changes.

Management Commentary: Steering Toward Sustainable Growth

In the earnings call, StoneCo's management team, led by CEO Pedro Zinner, provided valuable insights into the company's performance and strategic direction. Here are some key takeaways from their commentary:

"After reviewing our second quarter results and our performance at midyear, I am pleased with our progress across our strategic priorities and believe we are on schedule to meet our 2024 goals," stated Pedro Zinner, CEO of StoneCo.

Zinner highlighted the company's success in the MSMB (Micro, Small, and Medium-sized Businesses) market, noting the 30% year-over-year growth in the client base and the 25% increase in TPV. He also emphasized the expansion of the company's banking and credit offerings:

"In banking, we are making similar progress. Our client base grew 62% year over year and client deposits increased 65% as our team continues to cross-sell effectively. We now have 2.7 million active banking clients and BRL 6.5 billion in deposits, which are approaching our 2024 targets."

The management team also addressed the company's credit portfolio growth and risk management strategies:

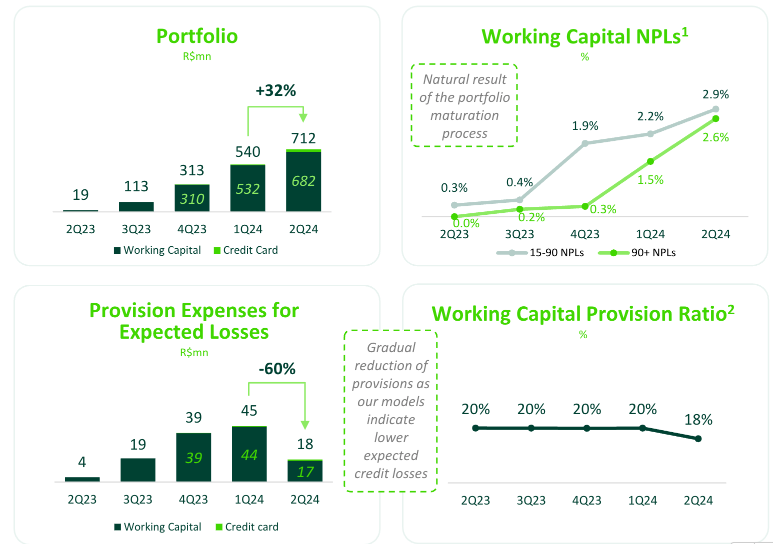

"Our total credit portfolio increased 32% quarter over quarter to reach BRL 712 million. Within that, our working capital portfolio grew over 28%, reaching BRL 682 million this quarter, with strong quality as shown with our NPL over 90 days still at 2.6%, very much in line with our expectations."

Segment Performance: Driving Growth Across the Board

StoneCo's Q2 2024 results demonstrate significant growth across various business segments, reflecting the company's successful diversification strategy and ability to capture market opportunities.

Financial Services: Powering the Core Business

The Financial Services segment, which includes payment processing, banking, and credit solutions, continued to be the primary growth driver for StoneCo:

- MSMB Card TPV: Reached R$97.8 billion, up 45.9% YoY

- Take Rate: Increased to 2.54%, up 7 basis points YoY

- Financial Services Revenue: R$2.8 billion, up 11% YoY

- Adjusted EBT: R$608 million, a significant 53% YoY increase

Banking: Rapid Expansion and Increased Adoption

StoneCo's banking services demonstrated impressive growth, indicating successful cross-selling efforts and increased client trust:

- Active Banking Clients: 2.7 million, up 61.7% YoY

- Client Deposits: R$6.5 billion, representing 6.6% of MSMB CTPV

- Banking ARPAC: R$25.7 per month, slightly down due to lower average CDI

Credit: Portfolio Growth with Improved Risk Management

The credit segment showed encouraging results, with portfolio expansion and improved risk metrics:

- Working Capital Portfolio: R$682 million, up 28.2% QoQ

- NPL over 90 days: 2.6%, indicating strong portfolio quality

- Provision Ratio: Decreased to 18% from 20% in previous quarters

Strategic Initiatives and Future Outlook

StoneCo's management highlighted several strategic initiatives that contributed to the strong Q2 2024 performance and are expected to drive future growth:

- Expansion in the MSMB Market: Continued focus on acquiring and retaining small and medium-sized business clients.

- Enhanced Cross-Selling: Leveraging the integrated platform to offer multiple financial products to existing clients.

- Software Integration: Improving the quality mix of software business towards more recurring revenues.

- Credit Portfolio Management: Gradual expansion of credit offerings while maintaining strong risk management practices.

- Operational Efficiency: Ongoing efforts to streamline administrative expenses and improve margins.

[Suggestion: Insert an image from the conference call presentation showing the strategic initiatives here, with an appropriate caption.]

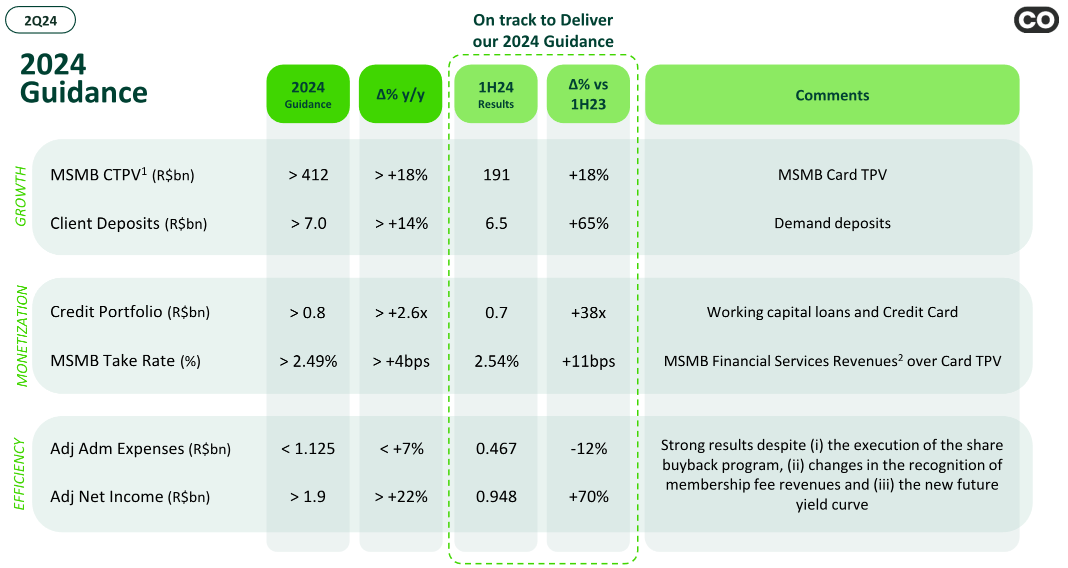

Management Guidance: Confidence in Meeting 2024 Targets

Despite facing challenges such as changes in membership fee revenue recognition and a complex macroeconomic environment, StoneCo's management expressed confidence in meeting the company's 2024 guidance:

"We remain committed to our business plan and the targets established during our Investor Day. In light of this commitment and considering short-term market fluctuations, we allocated capital to repurchase an additional 9.67 million shares, totally BRL 724 million, bringing us closer to completing the BRL 1 billion share repurchase program announced in November 2023," stated Pedro Zinner.

The company reaffirmed its 2024 guidance, which includes:

- MSMB Card TPV growth > 18% YoY

- Banking deposits > R$7.0 billion

- Credit portfolio > R$0.8 billion

- Adjusted Net Income > R$1.9 billion

Management noted that the company is on track or exceeding most of these targets based on the strong performance in the first half of 2024.

Positioning for Long-Term Success

StoneCo's Q2 2024 results demonstrate the company's ability to drive growth, improve profitability, and expand its market presence in the dynamic Brazilian fintech landscape. By focusing on its core MSMB market, enhancing its banking and credit offerings, and maintaining operational efficiency, StoneCo has positioned itself for continued success.

As the company progresses towards its 2024 targets and beyond, investors and industry observers will be watching closely to see if StoneCo can maintain its impressive growth trajectory and solidify its position as a leader in Latin American financial technology solutions.