Target Corporation (NYSE: TGT) has once again proven its resilience in the ever-changing retail landscape, delivering a strong performance in the second quarter of 2024. This comprehensive analysis delves into Target's Q2 results, exploring key factors driving growth, challenges faced, and implications for the broader retail sector.

Financial Highlights and Growth Drivers

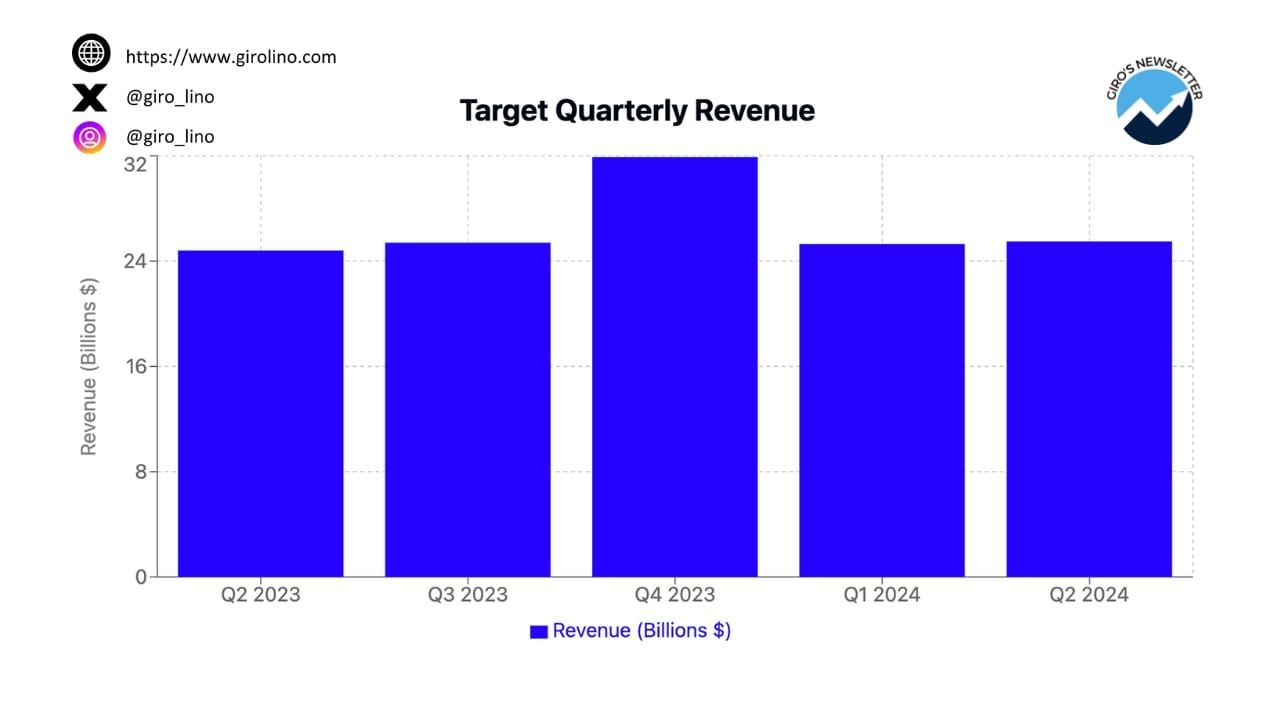

Target's second quarter results exceeded analyst expectations, showcasing the company's ability to navigate a challenging retail environment. Total revenue reached $25.5 billion, up 2.7% year-over-year, with comparable sales growth of 2.0% driven entirely by increased traffic. Earnings per share (EPS) jumped to $2.57, representing a 42.8% increase from the previous year.

Brian Cornell, Chairman of the Board & CEO, expressed his satisfaction with the results:

"On the top line, we met our goal of returning to growth, but moved well beyond that baseline expectation. More specifically, our Q2 comparable sales grew 2% at the very top end of our guidance range. And on the bottom line for the quarter, our EPS of $2.57 was well above the high end of our guidance, representing growth of more than 42% over last year."

Operational Efficiency and Margin Improvement

The company's focus on operational excellence yielded significant benefits in Q2. The gross margin rate improved to 28.9%, up from 27.0% in the previous year, while SG&A expenses were well-managed, with the SG&A rate increasing only slightly to 21.2%. These improvements reflect Target's ongoing efforts to optimize its operations, control costs, and enhance profitability.

Michael Fiddelke, Executive VP, COO & CFO, provided insights into the margin improvements:

"Our second quarter gross margin rate of 28.9% was about 190 basis points higher than a year ago. About 90 basis points of this improvement was driven by our merchandising strategies, which included the ongoing benefit of our efficiency work. We also saw about 40 basis points of benefit from category sales mix, which was largely offset by cost pressures from digital fulfillment and supply chain."

Digital Growth and Omnichannel Strategy

Target's digital initiatives played a crucial role in its Q2 success, with digital comparable sales growing by 8.7%. Same-day services, including Drive Up, Order Pickup, and Shipt, saw double-digit growth, with Drive Up service alone generating over $2 billion in sales during Q2. The company's "stores-as-hubs" strategy continues to be a key differentiator, enabling efficient fulfillment of digital orders while reducing costs and improving delivery speed.

Cornell highlighted the success of their digital initiatives:

"We saw high single-digit growth in our digital comps in Q2 and even faster growth in same-day services, led by Drive Up and Target Circle 360, both of which grew in the low teens. Same-day services now account for more than 2/3 of our digital sales, with the biggest contribution from Drive Up, which generated sales of more than $2 billion in Q2 and more than $4 billion so far this year."

Category Performance and Consumer Trends

Target's Q2 results revealed varying performance across different product categories, demonstrating the company's ability to adapt to changing consumer preferences and capitalize on emerging trends.

Discretionary Sales Rebound

After several challenging quarters, Target saw a notable improvement in discretionary categories, particularly in apparel. The apparel category achieved over 3% comparable sales growth, a significant improvement from previous quarters. This resurgence in discretionary spending suggests a potential shift in consumer behavior and confidence.

Richard Gomez, Executive VP & Chief Commercial Officer, elaborated on the apparel performance:

"Apparel delivered a 3 comp. Some real bright spots was All in Motion performance brand, where the team did a fantastic job on fabrication, colors, fit. $25 leggings was a fan favorite and really demonstrated the power of fashion combined with affordability."

Strength in Essentials and Beauty

Food & Beverage and Essentials categories saw traffic growth as consumers continued to focus on value and everyday necessities. The Beauty category remained a standout performer, with 9% comparable sales growth, further solidifying Target's market position in this competitive segment.

Gomez shared insights on the beauty category's success:

"Beauty continues to gain meaningful market share with comp growth in the high single digits in Q2, driven by a balanced combination of new offerings, celebrity brands and seasonal relevance. This has been a summer of Sun Care with guests looking for familiar, affordable options like up & up Sunscreen as well as newer trending brands such as Vacation."

Strategic Initiatives and Future Outlook

Looking ahead, Target has outlined several key focus areas to maintain its growth trajectory and competitive edge in the retail market.

Store Remodels and Expansion

Target plans to continue investing in store remodels and new store openings, enhancing the shopping experience for customers and supporting its omnichannel strategy. This physical expansion underscores the company's confidence in the enduring relevance of brick-and-mortar retail when integrated with digital capabilities.

Cornell emphasized the importance of this strategy:

"We're committed to continued disciplined capital deployment. Following more than a year of hard work to strengthen our balance sheet, we were pleased to get back to share repurchases in the second quarter, and we expect to have continued capacity within our middle A ratings in Q3 and beyond."

Private Label and Partnerships

The expansion of Target's owned brand portfolio and strategic partnerships remains a priority. These initiatives not only drive margin improvement but also help differentiate Target's offering in a crowded marketplace, fostering customer loyalty and attracting new shoppers.

Gomez highlighted the success of their private label strategy:

"Across categories, our own brands grew faster than the total enterprise, showcasing the relevance, quality and value we provide to consumers. In fact, because of our industry-leading design and sourcing capabilities, we are better positioned to remove unnecessary steps in the process, which allows us to reduce costs and increase speed to market."

Implications for the Retail Industry

Target's Q2 performance offers valuable insights for the broader retail sector, highlighting several key trends and success factors in today's competitive environment.

Cornell summarized the company's unique position in the retail landscape:

"The reason Target is so unique and why we've developed such a special bond with consumers is because we offer something different than everyone else in the marketplace. We offer great prices, convenience, compelling promotions and a great shopping experience. Our nearly 2,000 stores are accessible to the vast majority of the U.S. population, and we have a comprehensive suite of fast and convenient digital fulfillment options for destination in discretionary categories, like Apparel, Home and Hardlines; in frequency categories, like Essentials and Food & Beverage; and in Beauty, which perfectly straddles both."

Target's strong Q2 2024 performance demonstrates the company's ability to navigate a challenging retail environment while delivering value to customers and shareholders alike. By focusing on key growth drivers, operational efficiency, and customer engagement, Target has positioned itself for continued success in the evolving retail landscape. As the industry continues to face disruption and change, Target's strategies and execution provide valuable lessons for retailers seeking to thrive in the digital age.