In a week that reads like a tech thriller, Silicon Valley giants are tumbling from their AI-powered pedestals while a familiar gadfly stings the Indian markets once again. Buckle up, folks – this ride is anything but smooth.

🚨 Hindenburg's Encore: SEBI in the Crosshairs Just when you thought it was safe to invest in emerging markets, Hindenburg Research is back with a sequel that's shaking the foundations of Indian finance. Their latest blockbuster alleges that the chair of India's Securities and Exchange Board (SEBI) and her spouse have cozy investments in Adani-linked offshore funds. Who watches the watchmen, indeed?

💼 Hindenburg's Profit Puzzle: The $4 Million Question In a twist that would make even the most seasoned Wall Street trader scratch their head, Hindenburg's previous Adani short netted them a mere $4 million – pocket change compared to the $153 billion market value they erased. Either Hindenburg is playing 4D chess, or someone needs a new calculator.

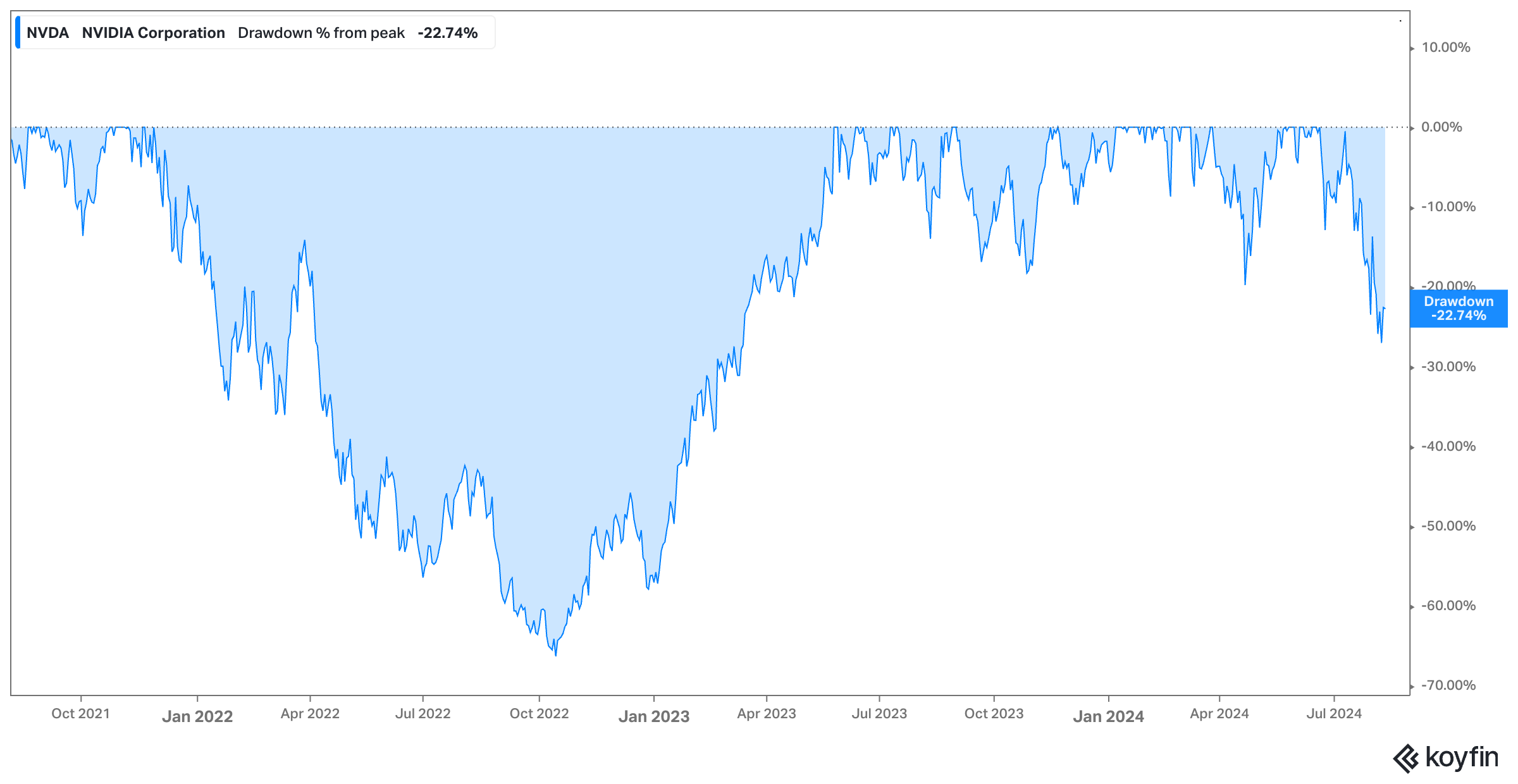

🚨 Nvidia Nosedives, Dragging Tech Sector Down Nvidia, the AI chip darling, is seeing a 22.8% drawdown, becoming the heaviest weight on the S&P 500. This sharp decline has sent shockwaves through the tech sector, raising concerns that AI-related stocks may be overvalued.

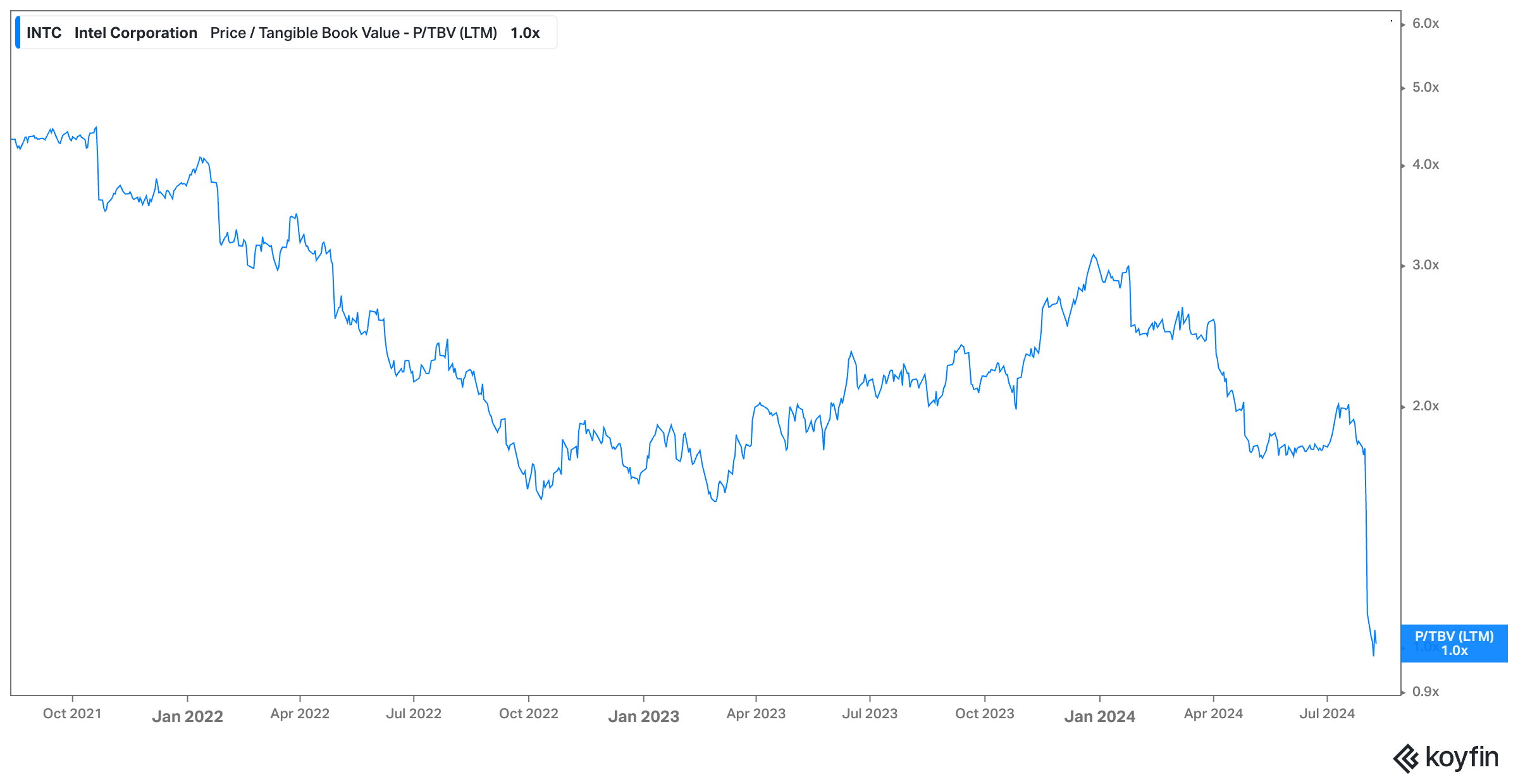

💻 Intel: Chip Giant at a Crossroads Following a disappointing second-quarter earnings report, Intel is poised to eliminate thousands of jobs. Meanwhile, INTC trades at 1x price to tangible assets, suggesting investors are now acquiring the company for its liquidation value. This precarious position raises questions about Intel's future in an increasingly competitive chip market.

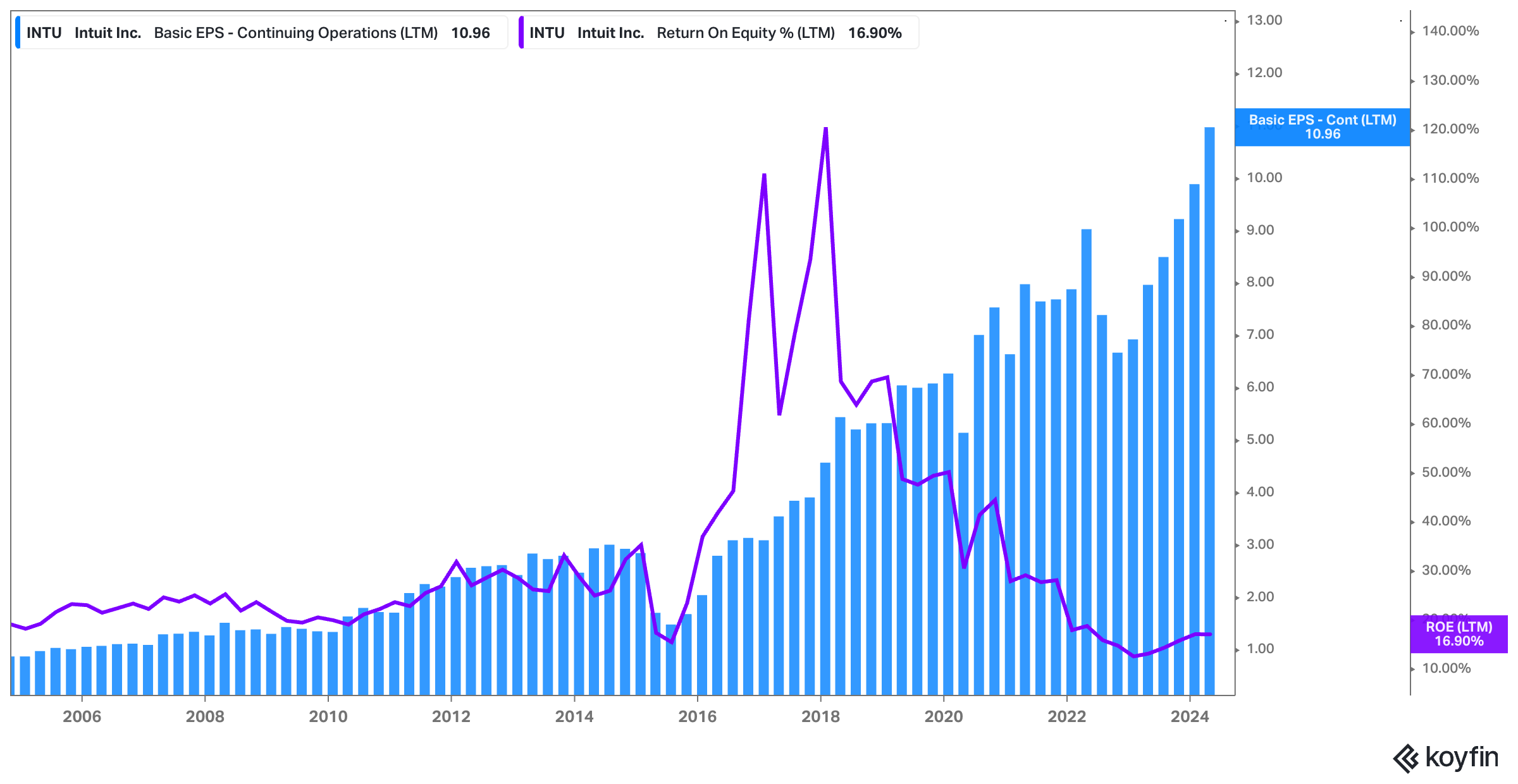

🧮 Intuit's Paradox: Layoffs Amid Record Profits Intuit presents a fascinating case study in corporate strategy. Despite announcing 1,800 layoffs, the company's financial performance is robust. Q2 FY2024 saw revenue jump 12% year-over-year to $6,737 million, with net profits increasing by 14.5% to $2,389 million. With a net profit margin of 35.46% and an ROE of 17%, Intuit's restructuring amid strong financials underscores the proactive measures tech companies are taking to stay competitive.

📱 Google's Strategic Shuffle: Layoffs Amid Innovation Push Google's recent move to lay off hundreds while emphasizing "key strategic areas" reflects the broader challenges facing tech giants in a rapidly evolving landscape. CEO Sundar Pichai's assertion that they're "reallocating resources" rather than simply cutting costs hints at the complex balancing act between maintaining profitability and investing in future growth drivers.

💼 The Human Element: Tech Workers Navigate Uncertainty As layoffs ripple through Silicon Valley, tech workers face a shifting job market. The emphasis on AI and machine learning skills highlights the importance of continuous learning and adaptation in the tech industry. This period of transition may lead to a redistribution of talent across the sector, potentially fueling innovation in unexpected areas.

📊 Economic Headwinds: Recession Fears Loom With 40% of business leaders contemplating layoffs, the specter of a recession looms large. This cautious outlook among executives could become a self-fulfilling prophecy if it leads to widespread cost-cutting measures. The tech sector's health often serves as a bellwether for the broader economy, making these developments particularly significant.

🔮 The AI Imperative: Adapt or Fade As the tech industry undergoes this significant transformation, one thing is clear: AI is not just a buzzword, but a fundamental shift in how technology companies operate and compete globally. Firms that successfully integrate AI into their core operations are likely to emerge as the leaders of tomorrow.

🗣️ Expert Insight: "We're witnessing a pivotal moment in the tech industry. The convergence of AI advancements, market corrections, and regulatory scrutiny is reshaping the landscape. Companies that can navigate these choppy waters – balancing innovation with fiscal responsibility – will define the next era of technology," observes Dr. Eliana Vega, Director of Emerging Tech Studies at the Global Innovation Institute.

In this period of flux, the tech industry's resilience and adaptability are being put to the test. As market dynamics shift and new technologies emerge, the coming months will be crucial in determining which companies and strategies will thrive in this new paradigm, with implications reaching far beyond Silicon Valley to global markets and economies.