In the fast-paced world of autonomous driving technology, Tesla has long been considered a frontrunner. However, recent announcements have revealed a slight delay in the company's ambitious plans to bring its Full Self-Driving (FSD) technology to two crucial markets: China and Europe. I find this development both intriguing and potentially impactful for the company's future. Let's unwrap why and the potential impacts on Tesla.

The Road to Global FSD Deployment

Tesla's journey towards making fully autonomous vehicles a reality has been marked by both groundbreaking innovations and occasional setbacks. The recent announcement of a delayed rollout for FSD in China and Europe is the latest chapter in this ongoing saga.

A Slight Detour in the Timeline

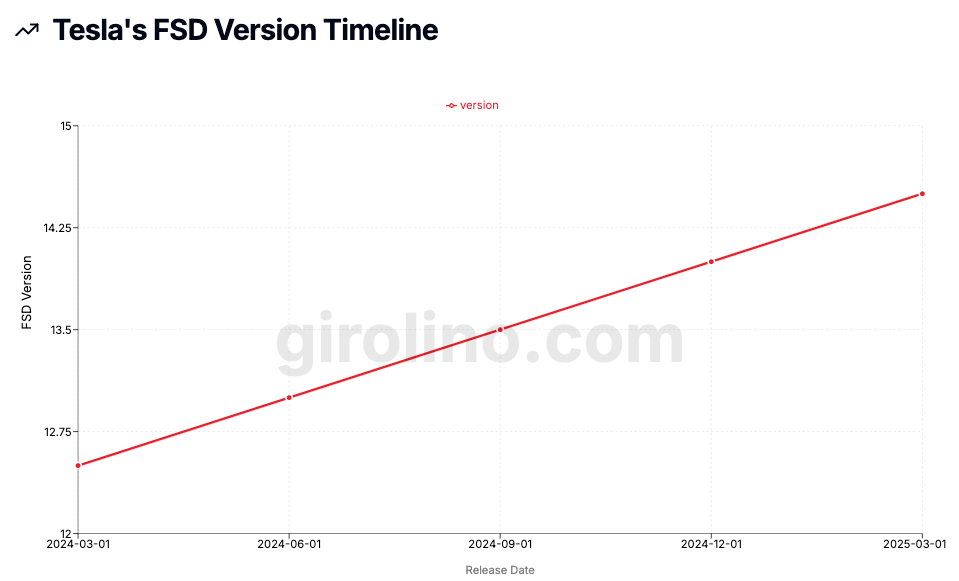

Initially, there was optimism about obtaining regulatory approval for FSD in these markets by the end of 2024. However, Tesla has now pushed this timeline to the first quarter of 2025. While this might seem like a minor delay, in the rapidly evolving world of autonomous driving technology, even a few months can make a significant difference.

As someone who's been watching this space for years, I can tell you that these delays are not uncommon. The complexity of autonomous driving systems, combined with the varying regulatory landscapes across different countries, often leads to shifting timelines. What's crucial is how companies like Tesla navigate these challenges and maintain their competitive edge.

Before you dive into our in-depth analysis, we have a quick request:

If you find this content useful, please consider sharing it!

Why? Your shares help us reach a wider audience, allowing us to continue producing high-quality, comprehensive content like this—completely free, with no paywalls or subscriptions.

Thank you for your support!

The FSD Rollout Roadmap

To fully appreciate the significance of this delay, it's essential to understand Tesla's comprehensive roadmap for FSD deployment. Let me break it down for you:

September 2024: Version 12.5.2

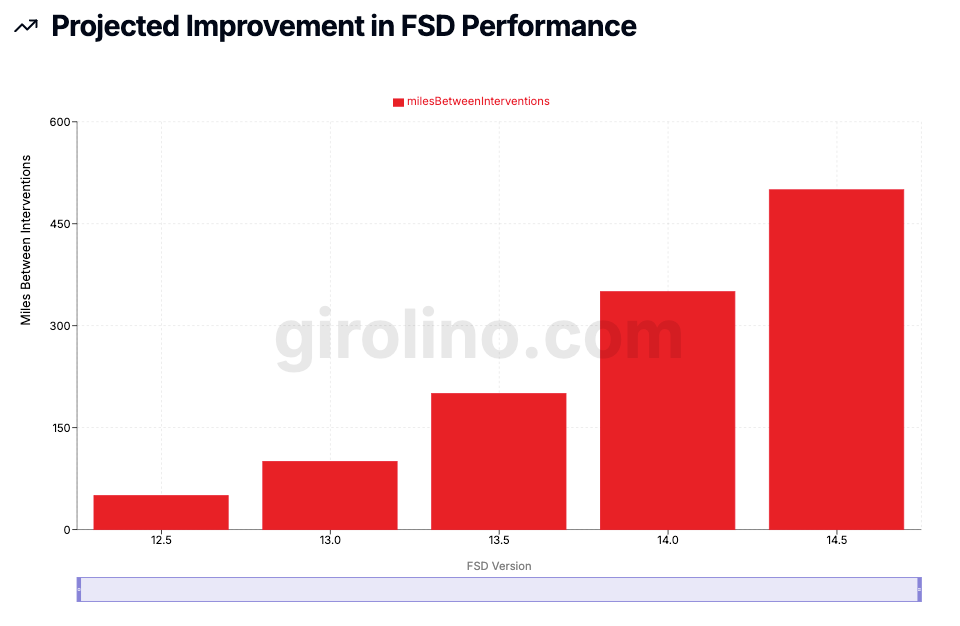

This update is set to be a game-changer. Tesla aims to triple the miles driven between necessary interventions. For those of us who've been following autonomous driving developments, this is a massive leap forward. It means the system will be significantly more reliable and require less human intervention.

Additionally, this version will introduce unified models for both AI3 and AI4 hardware. As someone who's had experience with different iterations of Tesla's Autopilot system, I can tell you that this unification is crucial for ensuring a consistent user experience across different Tesla models.

Some exciting features to look forward to include:

- "Actually Smart Summon": An improvement on the existing Summon feature, likely making the car more adept at navigating parking lots autonomously.

- "Cybertruck Autopark": A specialized parking assist for Tesla's upcoming Cybertruck.

- Eye-tracking technology that works with sunglasses: A small but significant improvement for those of us who frequently drive in sunny conditions.

October 2024: Version 13

Version 13 is where things get really interesting. Tesla is aiming to improve autonomous driving performance by approximately six times the miles between necessary interventions. That's not just an incremental improvement; it's a quantum leap.

This version will also introduce new capabilities such as Unpark, Park, and Reverse in FSD mode. Having experienced the current limitations of FSD in parking scenarios, I can tell you that these additions will significantly enhance the system's utility in real-world situations.

Q1 2025: Global Expansion

This is where the recent announcement comes into play. Tesla plans to introduce FSD technology in Europe and China, subject to regulatory approval. The slight delay from the end of 2024 to Q1 2025 might seem minor, but it's crucial to understand the implications.

Regulatory and Technical Hurdles

The road to global FSD deployment is far from smooth. Tesla faces significant challenges, both regulatory and technical, in its quest to bring this technology to China and Europe.

Navigating the Chinese Regulatory Landscape

China's regulatory environment is notoriously complex, especially when it comes to new technologies. I've seen many Western companies struggle to gain a foothold in this market, and autonomous driving technology presents its own unique set of challenges.

Tesla has been actively seeking approval for FSD in China. In fact, CEO Elon Musk made an unannounced visit to China in late April 2024 to discuss the matter with authorities. Despite these high-level efforts, progress has been slower than initially anticipated.

One interesting tidbit: Tesla had originally planned to start a small internal test of FSD in China in September 2024. However, this test has been postponed. As someone who's seen the importance of these internal tests in refining autonomous systems, I can tell you that this postponement likely played a role in the overall delay of the FSD rollout in China.

The Unique Challenge of Electric Scooters in China

Here's something that might not immediately come to mind when thinking about autonomous driving in China: electric scooters. According to Xpeng's head of autonomous driving, Li Liyun, there are more than 300 million electric scooters in China, many of which share motorized lanes with cars.

This presents a unique challenge for Tesla's FSD system. The technology needs to be adapted to safely interact with these non-motorized vehicles, a task that's not as prevalent in other markets. As someone who's experienced the organized chaos of Chinese traffic firsthand, I can attest to the complexity this adds to the autonomous driving equation.

European Regulatory Hurdles

Europe presents a different set of challenges. The European Union has strict regulations regarding autonomous driving technologies, and Tesla will need to demonstrate that FSD meets these standards before it can be approved for use on European roads.

In my experience following automotive regulations in Europe, I've seen that the EU tends to be more cautious when it comes to new technologies, especially those that have safety implications. Tesla will likely need to provide extensive data and testing results to European regulators to prove the safety and reliability of its FSD system.

The Technical Race

While regulatory approval is crucial, Tesla is also in a race to continually improve its FSD capabilities. The roadmap I mentioned earlier, with versions 12.5.2 and 13, shows the company's commitment to pushing the boundaries of what's possible with autonomous driving.

These advancements are not just about staying ahead of the competition. They're crucial for gaining regulatory approval and ensuring the system's safety and reliability in diverse driving conditions. As someone who's followed Tesla's software updates over the years, I can tell you that each iteration brings noticeable improvements. However, the jump from tripling to sextupling the miles between interventions is ambitious, to say the least.

Market Implications

The planned rollout of Tesla's Full Self-Driving technology in China and Europe, even with the slight delay, has significant implications for both Tesla and the broader autonomous vehicle industry.

Impact on Tesla's Competitive Position

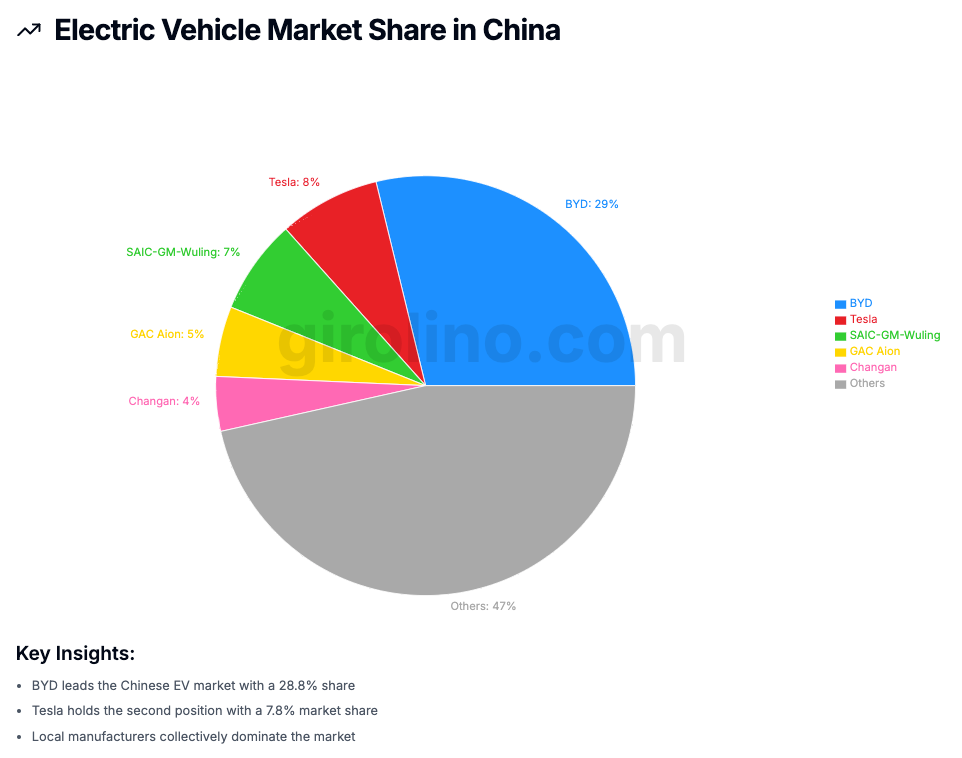

In China, the introduction of FSD could be a game-changer for Tesla. The Chinese electric vehicle market is incredibly competitive, with domestic manufacturers making rapid advancements in autonomous driving technology. Tesla's FSD could be a key differentiator in this market.

However, the delay in FSD deployment may give local competitors more time to catch up technologically. Companies like NIO, Xpeng, and Baidu's Apollo are all making significant strides in autonomous driving. As someone who's been watching this space, I can tell you that the race is incredibly tight, and even a few months can make a difference.

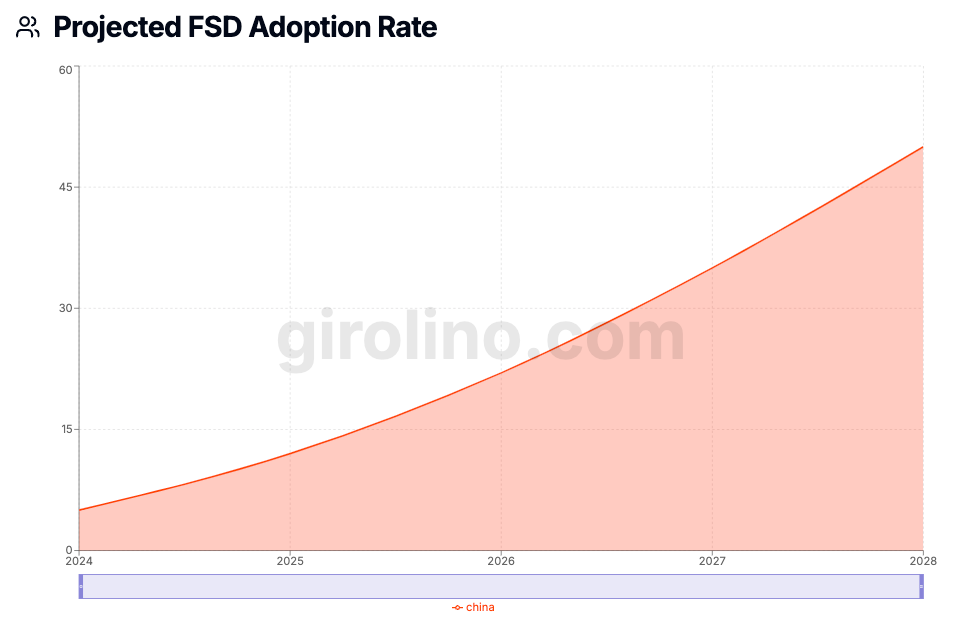

Pricing Strategy and Revenue Implications

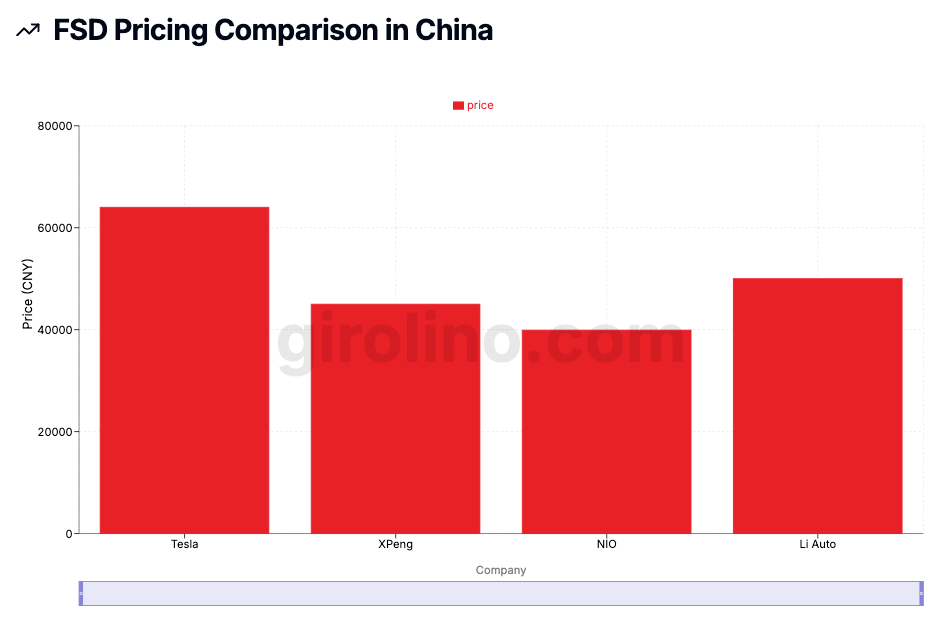

Tesla's pricing strategy for FSD in China is already in place, with the feature offered for a one-time fee of RMB 64,000 (approximately $9,020). This pricing model could have a significant impact on Tesla's revenue streams in China.

If widely adopted, FSD could boost Tesla's profitability in the Chinese market. The high-margin nature of software sales like FSD is particularly attractive from a business perspective. However, the success of this strategy will depend on how Chinese consumers perceive the value of FSD compared to similar offerings from local manufacturers.

European Market Dynamics

In Europe, the introduction of FSD could strengthen Tesla's position in a market that has been increasingly receptive to electric vehicles. Europe has seen a rapid adoption of EVs in recent years, and advanced autonomous features could be a strong selling point for Tesla.

However, Europe also presents unique challenges. The continent has a diverse range of driving conditions, from the autobahns of Germany to the narrow streets of ancient cities. Tesla's FSD will need to demonstrate its capability to handle this variety of scenarios to gain both regulatory approval and consumer trust.

Supply Chain and Production Implications

The global expansion of FSD also has implications for Tesla's supply chain and production capabilities. As demand for FSD-equipped vehicles potentially increases in these new markets, Tesla may need to ramp up production of necessary hardware components, particularly the AI3 and AI4 computers that will support the unified FSD models.

This could potentially lead to increased capital expenditures in the short term, but also open up opportunities for economies of scale in the long run. As someone who's followed Tesla's production ramp-ups in the past, I can tell you that this is an area where the company has shown both impressive capabilities and occasional struggles.

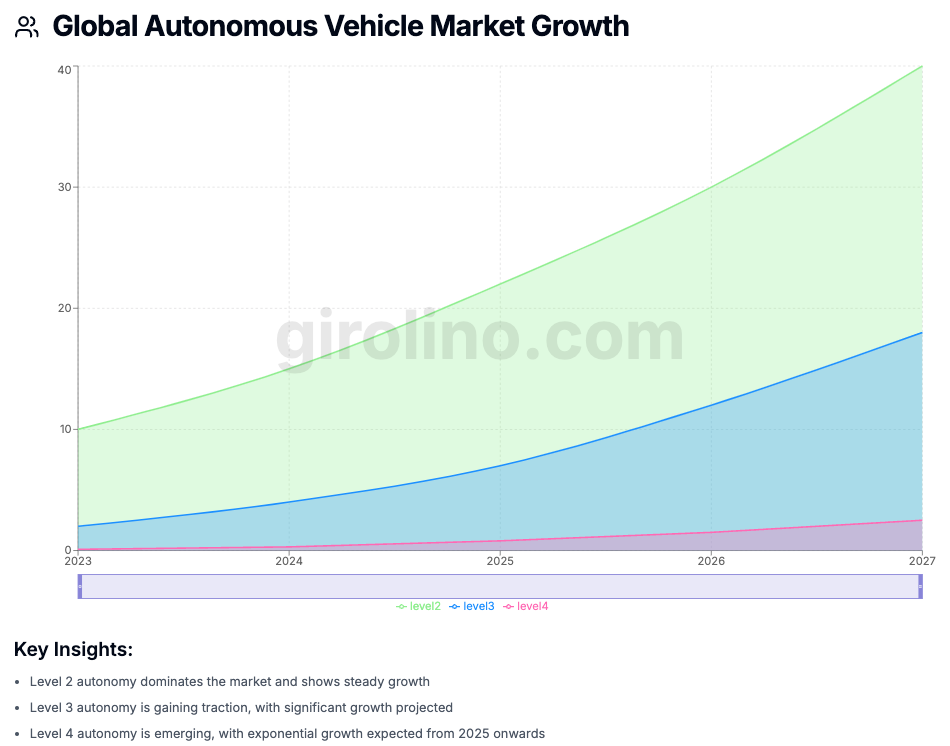

Industry-Wide Impact

Tesla's FSD rollout in China and Europe could accelerate the development and adoption of autonomous driving technologies globally. Competitors may feel pressure to expedite their own autonomous driving programs to keep pace with Tesla's advancements.

This could lead to a faster overall evolution of autonomous driving technology, potentially bringing forward the day when fully autonomous vehicles are a common sight on roads worldwide. As exciting as this prospect is, it's important to remember that safety and reliability must remain the top priorities as this technology develops.

Investment Perspective

From a financial standpoint, Tesla's planned rollout of Full Self-Driving technology in China and Europe presents a complex picture with both opportunities and risks.

Potential Revenue Boost

The expansion of FSD into these key markets could significantly boost Tesla's revenue streams. The high-margin nature of software sales like FSD could substantially increase Tesla's per-vehicle profit margins, particularly in the world's largest automotive market, China.

Consider this: if even a fraction of Tesla's Chinese customers opt for the RMB 64,000 FSD package, it could translate into a significant revenue boost. This kind of high-margin software sale is particularly attractive from a business perspective, as it has the potential to improve overall profitability without necessarily increasing production costs.

Regulatory Risks and Potential Delays

However, it's crucial to consider the potential risks and challenges. The delayed rollout from the end of 2024 to Q1 2025 suggests that regulatory hurdles may be more significant than initially anticipated. Any further delays or regulatory setbacks could have a negative impact on Tesla's market position and potentially its stock price.

In my years of following the automotive industry, I've seen how regulatory challenges can create significant headwinds for companies, especially when it comes to cutting-edge technologies like autonomous driving. The ability to navigate these regulatory landscapes effectively will be crucial for Tesla's success in these markets.

Competitive Landscape

The competitive landscape in both China and Europe is another crucial factor to consider. In China, local EV manufacturers are rapidly advancing their autonomous driving technologies. Companies like NIO, Xpeng, and Baidu's Apollo are all making significant strides in this area.

Tesla's ability to maintain a technological edge will be critical for its market share and pricing power. If Tesla can demonstrate clear superiority in its FSD technology, it could justify premium pricing and potentially increase its market share. However, if competitors catch up or even surpass Tesla's capabilities, it could put pressure on both sales and margins.

In Europe, while the competition in autonomous driving may not be as fierce as in China, Tesla still faces challenges from established automakers who are investing heavily in this technology. Companies like Volkswagen, BMW, and Mercedes-Benz are all working on their own autonomous driving systems.

Production and Supply Chain Considerations

The rollout of FSD in new markets may require increased production of specialized hardware components, such as the AI3 and AI4 computers. This could lead to increased capital expenditures in the short term.

However, it's important to consider the potential long-term benefits. If Tesla can successfully scale up production of these components, it could lead to economies of scale, potentially reducing costs over time. Additionally, having a robust supply chain for these critical components could give Tesla a competitive advantage as autonomous driving technology becomes more widespread.

Brand and Market Position Implications

The success of FSD in these markets could have broader implications for Tesla's brand and market position. If well-received, it could cement Tesla's reputation as a leader in autonomous driving technology, potentially driving demand for its vehicles across all markets.

However, it's crucial to consider the potential risks as well. Any safety concerns or technical issues could have significant reputational and financial consequences. As we've seen with other automakers, issues with advanced driver assistance systems can lead to regulatory scrutiny and erosion of consumer trust.

Future Revenue Streams

Looking beyond the immediate future, the global expansion of FSD could open up new revenue streams for Tesla beyond vehicle sales. The company has plans to unveil a dedicated robotaxi product in the U.S. on October 10, 2024. Success in this venture could pave the way for similar services in China and Europe, potentially transforming Tesla from a car manufacturer to a broader mobility services provider.

This shift could have significant implications for Tesla's business model and potential future earnings. The robotaxi market represents a massive opportunity, with some analysts projecting it to be worth hundreds of billions of dollars globally by 2030.

Balancing Excitement with Caution

As someone who's followed Tesla for years, I can tell you that the company has a history of making bold promises and, more often than not, delivering on them — albeit sometimes later than initially projected. The FSD rollout in China and Europe represents another ambitious goal, and its success could be a key driver of Tesla's future growth and market valuation.

However, it's important to balance this excitement with a realistic assessment of the challenges and risks involved. The regulatory hurdles, intense competition, and technical challenges are significant. Moreover, while Full Self-Driving is an impressive technology, it's crucial to remember that it doesn't currently enable complete vehicle autonomy. Drivers are still required to remain attentive and ready to take control when necessary.

In conclusion, Tesla's planned FSD rollout in China and Europe represents a significant opportunity, but one that comes with substantial challenges. The slight delay announced recently is a reminder of the complexities involved in bringing autonomous driving technology to market, especially on a global scale. As we move closer to the Q1 2025 target, I'll be watching closely for updates on regulatory approval, technological advancements, and market reception. The success or failure of this initiative could have far-reaching implications not just for Tesla, but for the entire autonomous driving industry.