Tech giants duke it out while global markets ride a rollercoaster. Buckle up for today's business bonanza!

Breaking: NVIDIA Crushes Earnings, Stock Soars

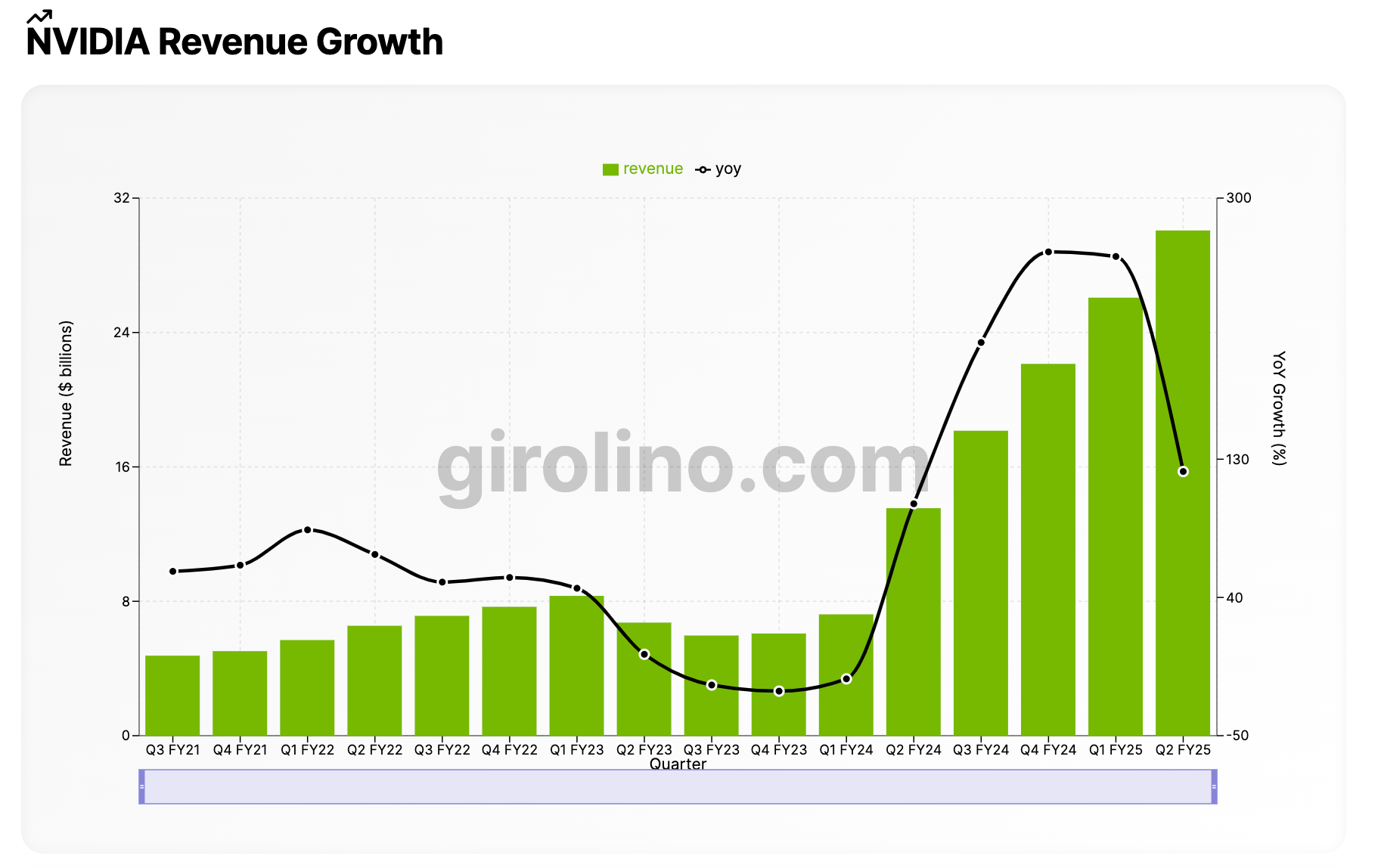

Chipmaker NVIDIA smashed Wall Street expectations, reporting Q2 revenue of $30.04 billion - a jaw-dropping 122% year-over-year increase. The AI boom continues to fuel NVIDIA's rocket-like ascent, with data center revenue skyrocketing 154% to $26.3 billion.

NVIDIA's success story is all about its dominance in AI chips. The company's GPUs, originally designed for gaming, have become the go-to hardware for training and running AI models. This pivot has paid off handsomely, with NVIDIA now controlling over 80% of the AI chip market.

Despite its stellar performance, NVIDIA isn't resting on its laurels. The company is gearing up to launch its next-generation Blackwell architecture, which promises even more powerful AI processing capabilities. CFO Colette Kress hinted at the potential, stating, "In Q4, we expect to ship several $1,000,000,000 in Blackwell revenue."

CEO Jensen Huang declared:

"NVIDIA achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI."

Starbucks Spills the Beans on China Woes

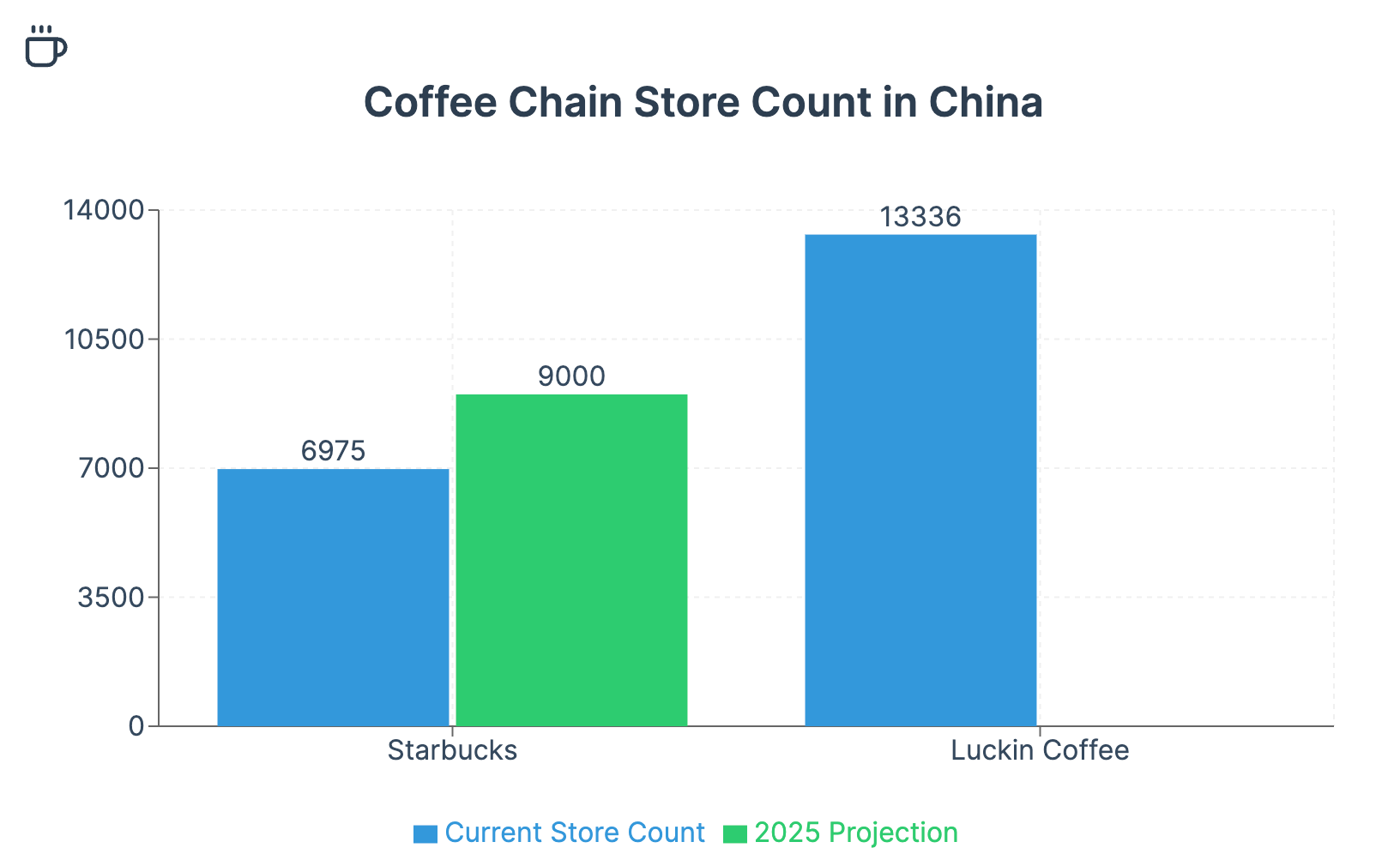

The coffee giant's grande plans for China have hit a bitter brew. Despite aiming for 9,000 stores by 2025, Starbucks faces an uphill battle against local rival Luckin Coffee, which has already surpassed Starbucks' store count.

The recent firing of CEO Laxman Narasimhan suggests all is not well in the Middle Kingdom. Starbucks China co-CEO Belinda Wong's stance may prove problematic:

"We're not interested in entering the price war."

Cost-conscious Chinese consumers may seek their caffeine fix elsewhere.

PDD Holdings: Profit Party Today, Investment Hangover Tomorrow?

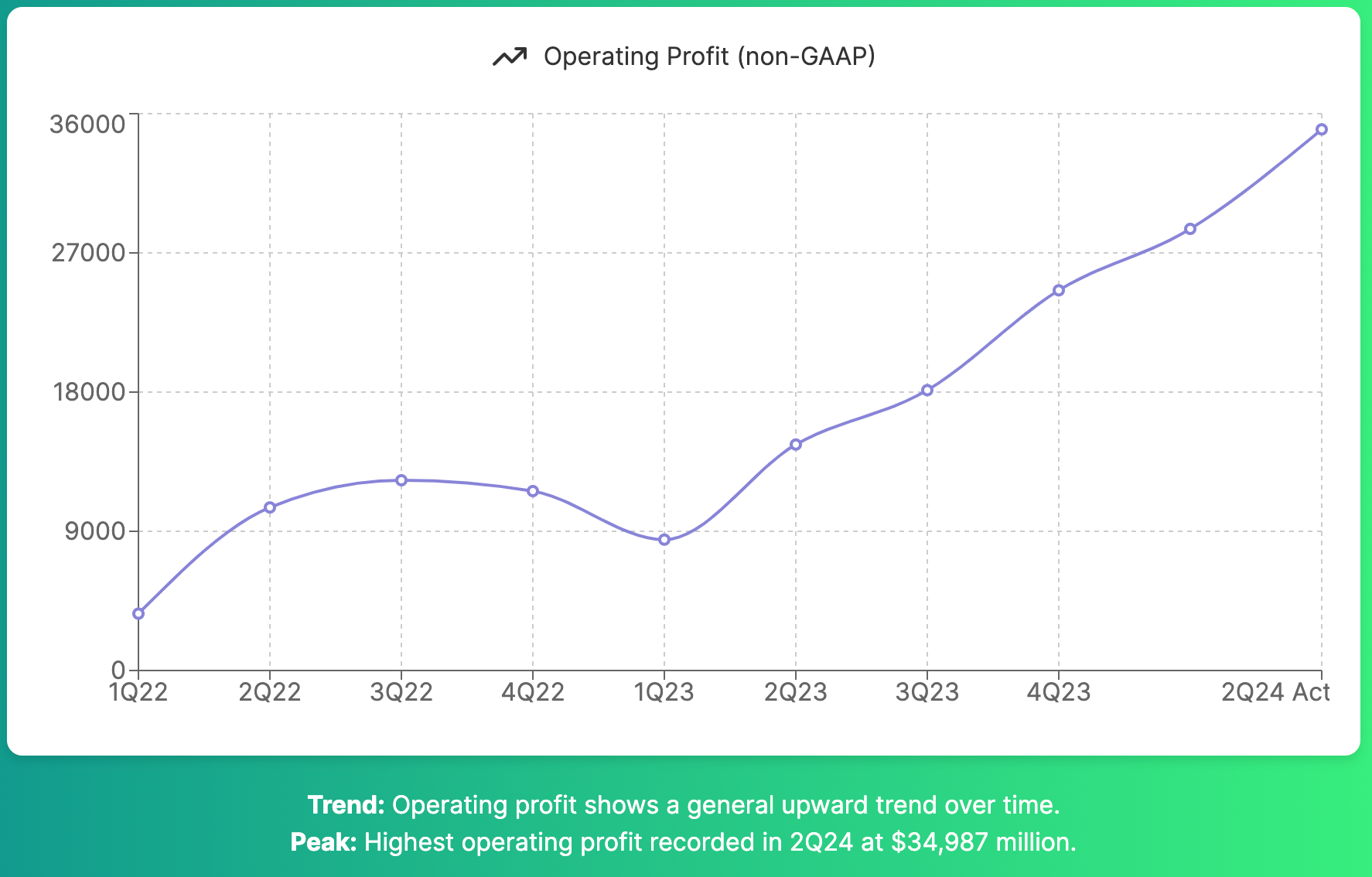

Chinese e-commerce powerhouse PDD Holdings (formerly Pinduoduo) delivered a mixed bag in Q2. While revenue surged 86% year-over-year to RMB 97.1 billion, slightly missing expectations, profits soared.

However, management warned of future profitability declines as the company enters a new investment phase. Chairman Lei Chen stated:

"As we enter a new investment phase, I would like to make it clear to our investors that our earnings will gradually trend down starting in Q3."

The stock took a hit on the news, with investors wary of the opaque communication and potential government scrutiny that often follows Chinese tech success.

Meta's Reality Check: Vision Pro Competitor Canceled

Mark Zuckerberg's metaverse dreams hit a speed bump as Meta reportedly axed its high-end mixed reality headset project, codenamed "La Jolla." The move marks a strategic shift away from competing directly with Apple's Vision Pro in the premium segment. Instead, Meta will focus on more affordable options, targeting devices priced around $500. This pivot could accelerate mainstream AR/VR adoption but leaves the high-end market to Apple - for now.

Human Impact: Tech Layoffs Continue, But New Opportunities Emerge

The tech sector's reshuffling continues, with companies like Meta and Amazon announcing fresh rounds of layoffs. However, it's not all doom and gloom. The AI boom is creating new job categories, with roles like "prompt engineer" and "AI ethicist" gaining traction. Workers with adaptable skills and a willingness to embrace new technologies are finding themselves in high demand.

Quick Take: Embrace the AI Revolution (Responsibly)

As NVIDIA's stellar earnings demonstrate, AI is reshaping industries at breakneck speed. For professionals and investors alike, now's the time to educate yourself on AI's potential impacts and ethical considerations. Don't just ride the wave - help shape its direction.

Quote of the Day

"The pace of AI advancement is not just an evolution; it's a revolution. Those who adapt quickly will thrive, those who don't may find themselves left behind." - Jensen Huang, NVIDIA CEO