Understanding the Net Debt-to-EBITDA Ratio: A Key Metric for Investors

In the complex world of financial analysis, understanding a company's ability to manage its debt is crucial for investors and analysts alike. One powerful tool in this assessment is the Net Debt-to-EBITDA ratio. This comprehensive guide will delve into the intricacies of this important financial metric, helping you grasp its significance in evaluating a company's financial health.

What Is the Net Debt-to-EBITDA Ratio?

The Net Debt-to-EBITDA ratio is a financial metric that measures a company's ability to pay off its debts by comparing its net debt to its earnings before interest, taxes, depreciation, and amortization (EBITDA). This ratio provides valuable insights into a company's financial leverage and its capacity to service its debt obligations.

Unlike the standard Debt-to-EBITDA ratio, the Net Debt-to-EBITDA ratio takes into account a company's cash and cash equivalents, offering a more refined picture of its true debt burden. This distinction is particularly important for companies with significant cash reserves, as it provides a more accurate representation of their financial position.

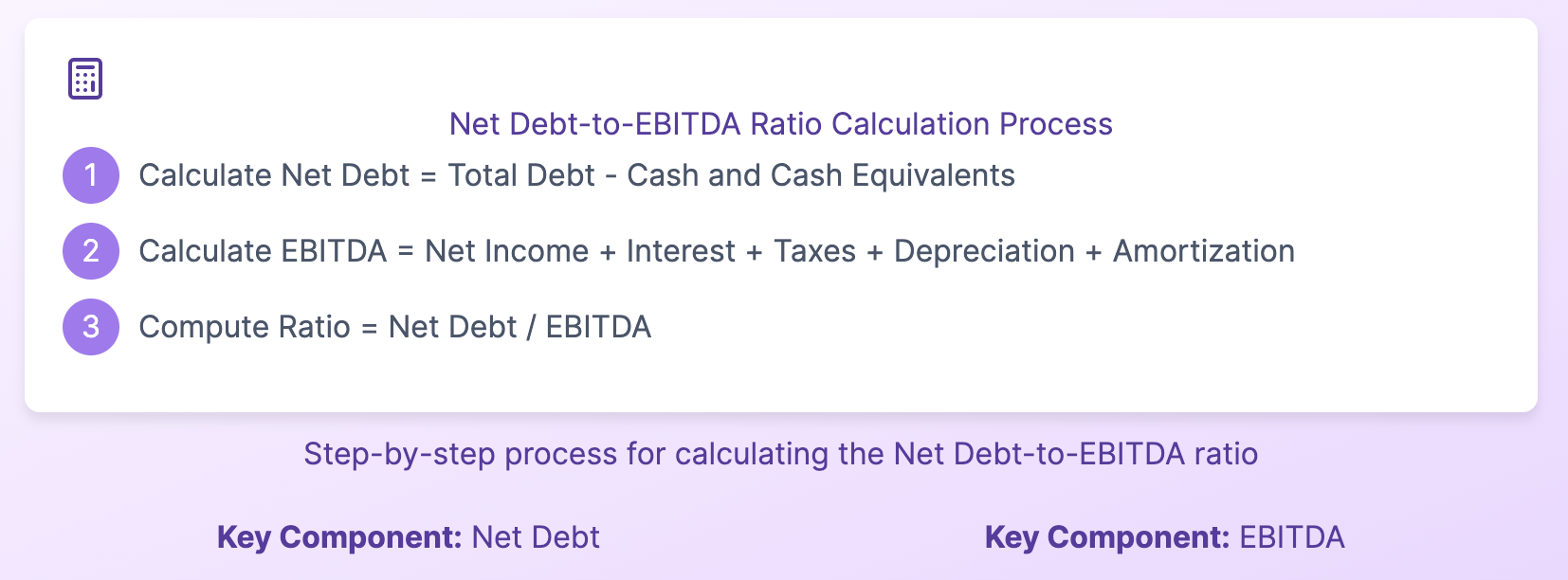

Calculating the Net Debt-to-EBITDA Ratio: A Step-by-Step Guide

To fully understand the Net Debt-to-EBITDA ratio, it's essential to break down its components and learn how to calculate it accurately. Let's explore this process step by step.

Step 1: Determine Net Debt

Net Debt = Total Debt - Cash and Cash Equivalents

To calculate net debt, you'll need to:

- Find the company's total debt on its balance sheet (including both short-term and long-term debt)

- Locate the cash and cash equivalents, also on the balance sheet

- Subtract the cash and cash equivalents from the total debt

Step 2: Calculate EBITDA

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

To calculate EBITDA:

- Start with the company's net income from the income statement

- Add back interest expenses

- Add back taxes

- Add back depreciation and amortization expenses

Step 3: Compute the Net Debt-to-EBITDA Ratio

Net Debt-to-EBITDA Ratio = Net Debt / EBITDA

Once you have both the net debt and EBITDA figures, simply divide net debt by EBITDA to obtain the ratio.

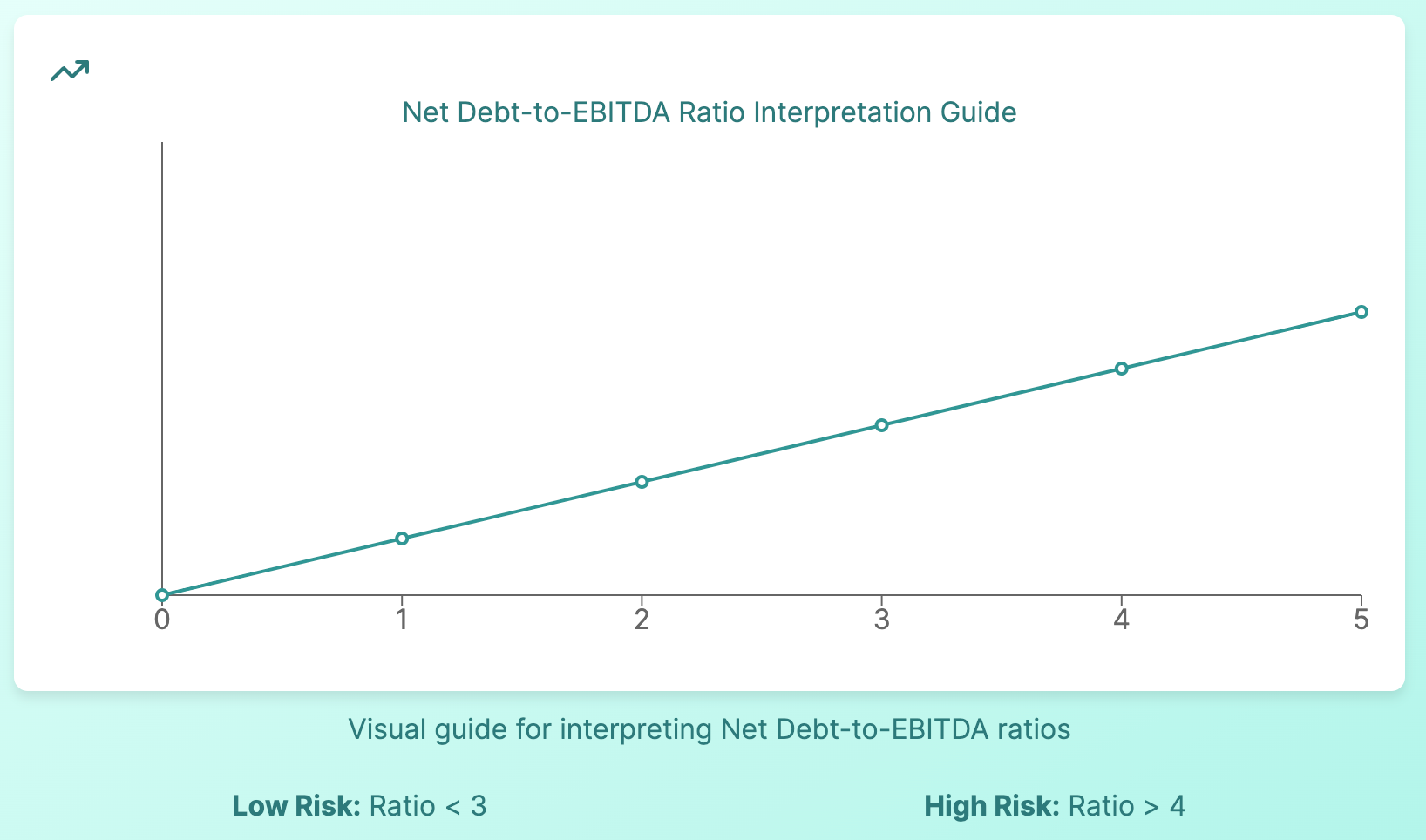

Interpreting the Net Debt-to-EBITDA Ratio: What Do the Numbers Mean?

Understanding how to interpret the Net Debt-to-EBITDA ratio is crucial for making informed investment decisions. Let's explore what different ratio values might indicate about a company's financial health.

Low Net Debt-to-EBITDA Ratio

A low Net Debt-to-EBITDA ratio, typically below 3, generally indicates:

- Strong financial health

- Lower financial risk

- Greater capacity to take on additional debt for growth or acquisitions

- Potentially better positioned to weather economic downturns

High Net Debt-to-EBITDA Ratio

A high Net Debt-to-EBITDA ratio, usually above 4 or 5, may suggest:

- Higher financial risk

- Potential difficulty in servicing debt obligations

- Limited flexibility to take on additional debt

- Increased vulnerability during economic challenges

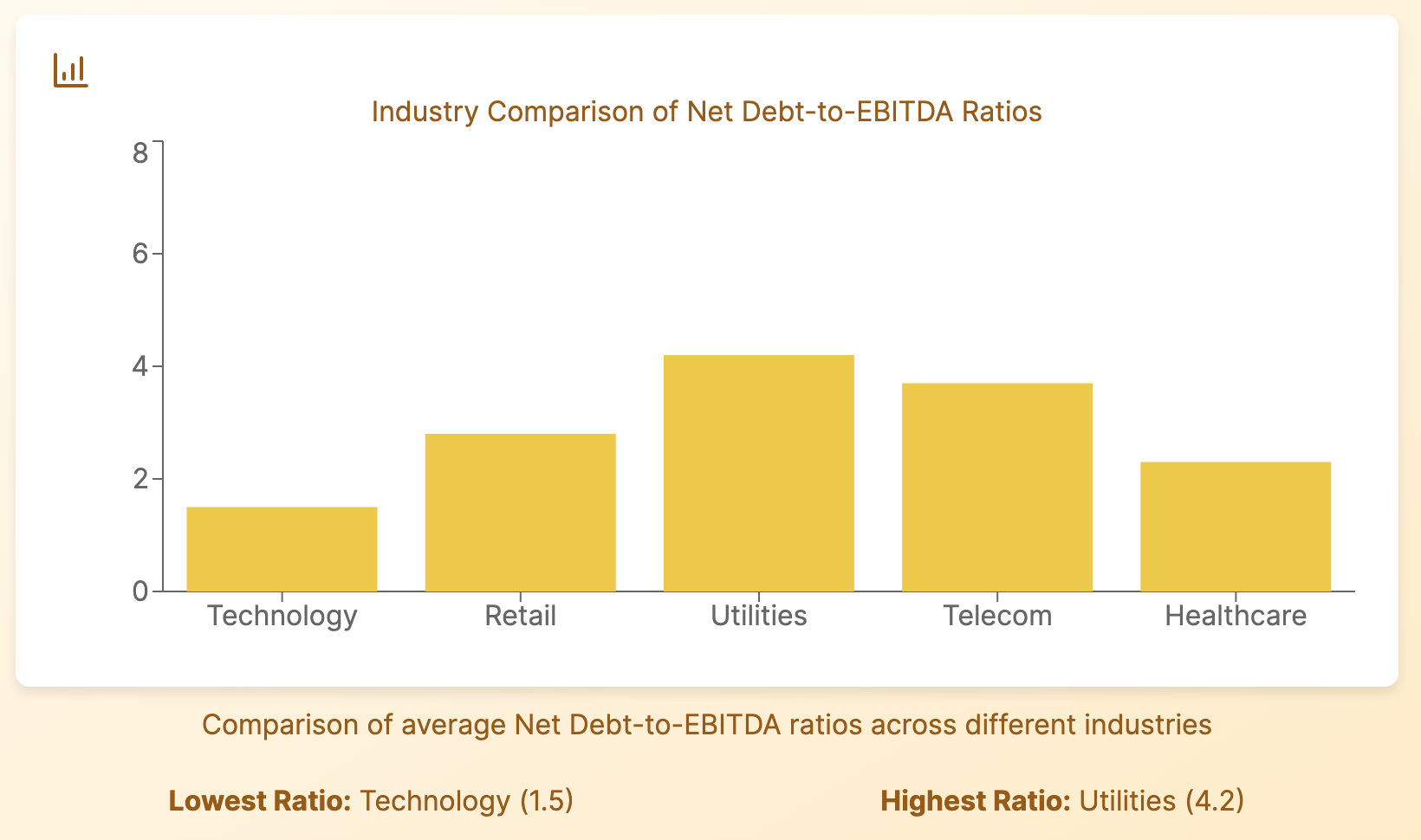

Industry Considerations

It's important to note that acceptable Net Debt-to-EBITDA ratios can vary significantly across industries. For example:

- Capital-intensive industries like utilities or telecommunications may have higher ratios

- Technology or service-based companies often have lower ratios

Always compare a company's ratio to its industry peers for a more accurate assessment.

Advantages and Limitations of the Net Debt-to-EBITDA Ratio

Like any financial metric, the Net Debt-to-EBITDA ratio has its strengths and weaknesses. Understanding these can help you use the ratio more effectively in your financial analysis.

Advantages

- Provides a clear picture of debt burden: By focusing on net debt, it offers a more accurate representation of a company's true debt obligations.

- Facilitates comparisons: The ratio allows for easier comparisons between companies of different sizes within the same industry.

- Considers earning power: By using EBITDA, it factors in a company's ability to generate earnings to cover its debt.

- Useful for lenders and investors: It's widely used by credit rating agencies and lenders to assess creditworthiness.

Limitations

- Ignores capital expenditures: The ratio doesn't account for a company's capital expenditure needs, which can be significant in some industries.

- Potential EBITDA volatility: EBITDA can fluctuate significantly, especially for cyclical businesses, potentially skewing the ratio.

- Doesn't consider interest rates: The ratio treats all debt equally, regardless of interest rates, which can vary significantly.

- May overlook future obligations: It doesn't account for off-balance-sheet liabilities or future debt obligations.

Using the Net Debt-to-EBITDA Ratio in Investment Analysis

To effectively incorporate the Net Debt-to-EBITDA ratio into your investment analysis, consider the following strategies:

- Compare historical trends: Look at how a company's ratio has changed over time to identify potential improvements or deteriorations in financial health.

- Benchmark against peers: Compare the ratio to industry averages and direct competitors to gauge relative financial strength.

- Consider alongside other metrics: Use the Net Debt-to-EBITDA ratio in conjunction with other financial ratios like the interest coverage ratio or the current ratio for a more comprehensive analysis.

- Evaluate in context: Consider the company's growth stage, industry dynamics, and overall economic conditions when interpreting the ratio.

- Assess management's strategy: Look at how management plans to use debt and their target Net Debt-to-EBITDA ratio.

Real-World Examples: Net Debt-to-EBITDA in Action

To better understand how the Net Debt-to-EBITDA ratio works in practice, let's examine two hypothetical companies in the retail industry:

Company A: LuxuryMart

- Net Debt: $500 million

- EBITDA: $200 million

- Net Debt-to-EBITDA Ratio: 2.5

LuxuryMart's ratio of 2.5 suggests a relatively healthy financial position. The company likely has a good balance between its debt obligations and earning power, indicating it should be able to service its debt comfortably.

Company B: DiscountKing

- Net Debt: $800 million

- EBITDA: $150 million

- Net Debt-to-EBITDA Ratio: 5.33

DiscountKing's higher ratio of 5.33 might raise some concerns. This could indicate that the company has taken on a significant amount of debt relative to its earnings, potentially putting it at higher financial risk.

FAQ: Common Questions About the Net Debt-to-EBITDA Ratio

What's a good Net Debt-to-EBITDA ratio?

Generally, a ratio below 3 is considered good, while ratios above 4 or 5 may indicate higher financial risk. However, these benchmarks can vary by industry and company growth stage.

How does the Net Debt-to-EBITDA ratio differ from the Debt-to-EBITDA ratio?

The Net Debt-to-EBITDA ratio uses net debt (total debt minus cash and cash equivalents) instead of total debt. This provides a more refined picture of a company's debt burden by considering its liquid assets.

Why do some investors prefer EBITDA over net income in this ratio?

EBITDA is often preferred because it provides a clearer picture of a company's operational performance by excluding the effects of financing and accounting decisions, capital structure, and tax environments.

Can a company have a negative Net Debt-to-EBITDA ratio?

Yes, if a company's cash and cash equivalents exceed its total debt, resulting in negative net debt. This generally indicates a very strong financial position.

How often should I recalculate the Net Debt-to-EBITDA ratio?

It's advisable to recalculate the ratio quarterly or at least annually, coinciding with the company's financial reporting schedule. This allows you to track changes over time and identify trends.

Conclusion: Harnessing the Power of the Net Debt-to-EBITDA Ratio

The Net Debt-to-EBITDA ratio is a powerful tool in the investor's analytical toolkit. By providing insights into a company's debt burden relative to its earning power, it offers valuable information about financial health and risk. However, like all financial metrics, it's most effective when used in conjunction with other analytical tools and considered within the broader context of a company's operations, industry dynamics, and economic conditions.

As you continue to refine your investment analysis skills, remember that the Net Debt-to-EBITDA ratio is just one piece of the puzzle. By combining it with other financial ratios, qualitative analysis, and a thorough understanding of the business and its industry, you'll be better equipped to make informed investment decisions.

Whether you're a seasoned investor or just starting your journey in financial analysis, mastering the use of the Net Debt-to-EBITDA ratio can significantly enhance your ability to assess company financial health and identify potential investment opportunities.

Ready to put your newfound knowledge into practice? Start by analyzing the Net Debt-to-EBITDA ratios of companies in your investment portfolio or watchlist. You might be surprised by what you discover!