The Ultimate Guide to the Method of Valuation: Unlocking the True Value of Companies

In today’s complex financial landscape, understanding the intrinsic value of a company through comprehensive company valuation is crucial for investors, business owners, and financial professionals alike. Whether you’re considering investing in publicly traded companies, evaluating potential acquisition targets, or simply want to gauge the health of your own business, mastering the art and science of business valuation is essential. This comprehensive guide will explore the top methods of valuation, providing you with the tools and knowledge to make informed investment decisions and accurately assess a company’s value.

Understanding Business Valuation: The Foundation of Financial Analysis

Before diving into specific valuation methods, it's crucial to establish a solid foundation by understanding what business valuation is and why it's so important in the world of finance and investment.

Defining Business Valuation

Business valuation is the process of determining the economic value of a company or business entity. It involves a thorough analysis of various aspects of the business, including its financial performance, assets, market position, and future prospects. The goal is to arrive at a fair value and accurate assessment of what the business is worth in the current market environment.

The Importance of Accurate Valuation

Accurate business valuation is critical for several reasons:

- Informed Investment Decisions: For investors in listed companies, understanding valuation helps in identifying undervalued or overvalued stocks, potentially leading to more profitable investment choices.

- Mergers and Acquisitions: In M&A scenarios, precise valuation ensures fair deals for both buyers and sellers.

- Strategic Planning: Business owners can use valuation insights to make informed decisions about expansion, diversification, or exit strategies.

- Financial Reporting: Many accounting standards require regular valuation of certain assets and businesses.

- Legal and Tax Purposes: Accurate valuations are essential for estate planning, divorce proceedings, and tax compliance.

The Top 5 Methods of Business Valuation

Now, let's explore the seven most widely used and respected methods of business valuation. Each valuation method has its strengths and is suited to different scenarios, so understanding when and how to apply them is key to accurate valuation.

1. Discounted Cash Flow (DCF) Method

The Discounted Cash Flow method is widely regarded as one of the most comprehensive and accurate valuation techniques, especially for companies with predictable cash flows. This method of valuation is particularly useful for assessing a company's intrinsic value based on its ability to generate future cash flows.

How the Discounted Cash Flow Method Works:

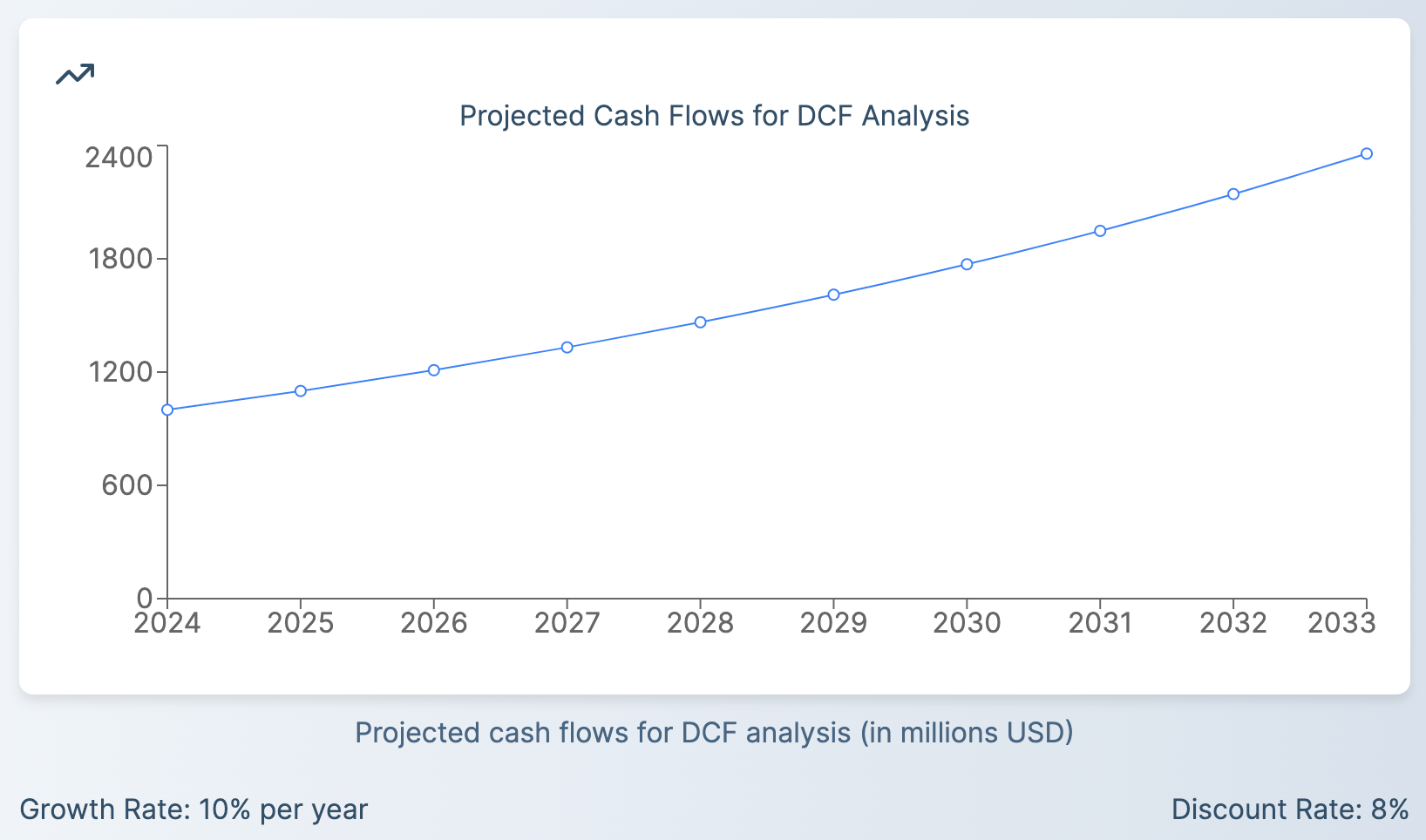

- Project the company's future cash flows over a specific period (usually 5-10 years).

- Determine a terminal value for the business at the end of the projection period.

- Apply a discount rate (usually the weighted average cost of capital) to these future cash flows to calculate their present value.

- Sum up the present values to arrive at the company's intrinsic value.

The Discounted Cash Flow (DCF) analysis is based on the principle that a company's value is equal to the present value of its expected future cash flows. By discounting these future cash flows back to their present value, investors can determine whether a company's current market price is overvalued or undervalued.

Real-World Example of Discounted Cash Flow Analysis:

Let's consider tech giant Apple Inc. (AAPL). An analyst might project Apple's cash flows for the next 10 years, factoring in expected iPhone sales, services growth, and potential new product lines. They would then discount these cash flows back to the present using Apple's cost of capital, which might be around 8-10%. The resulting value would represent the analyst's estimate of Apple's intrinsic value based on its future cash-generating potential.

Pros of the Discounted Cash Flow Method:

- Accounts for the time value of money

- Considers future growth potential

- Widely accepted in the financial community

Cons of the Discounted Cash Flow Method:

- Highly sensitive to assumptions about future performance and discount rates

- Can be complex and time-consuming

2. Comparable Company Analysis (CCA)

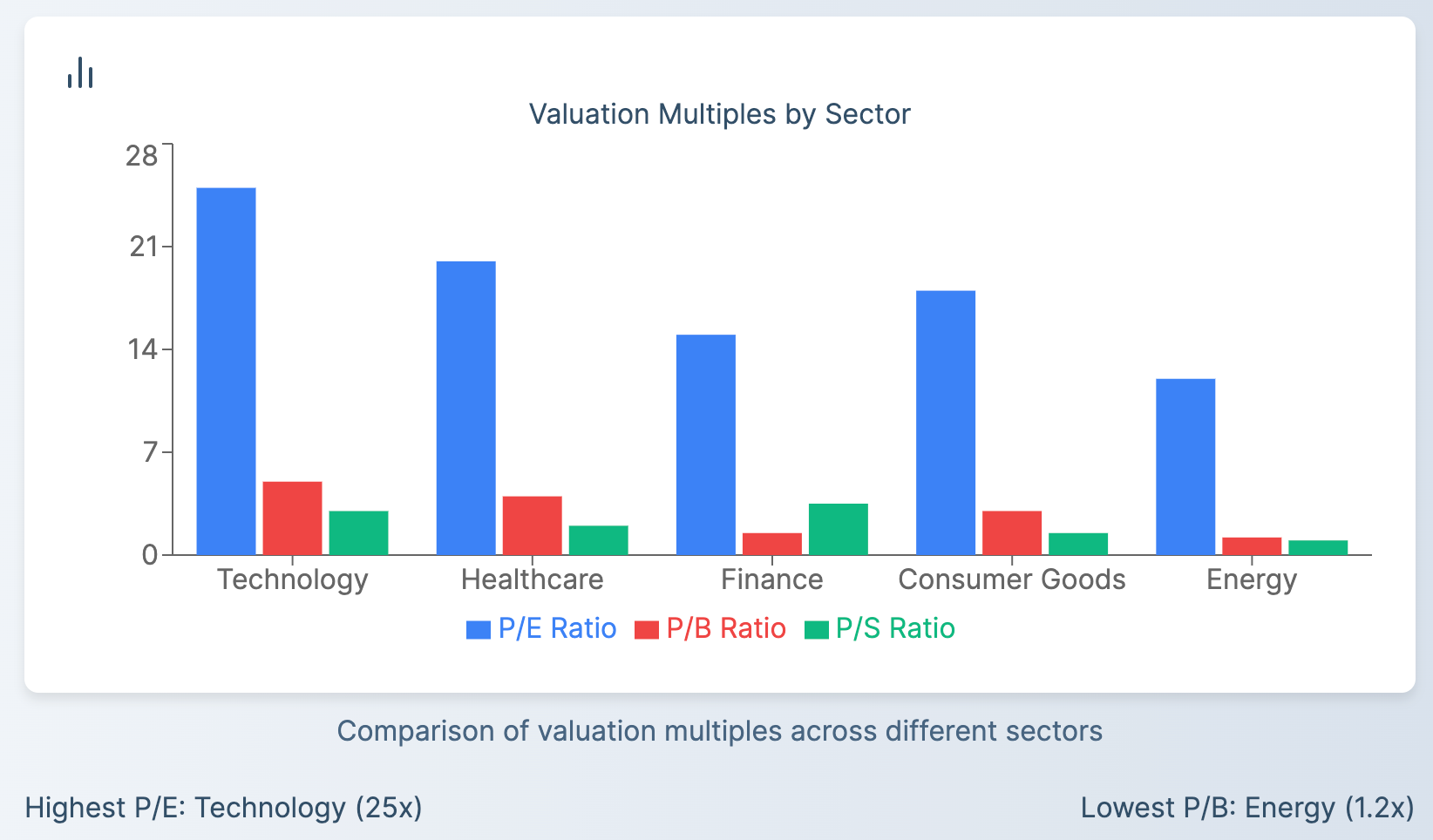

This method values a company by comparing it to similar publicly traded companies. It's a relative valuation approach that assumes similar companies should be valued similarly.

How Comparable Company Analysis Works:

- Identify a group of similar companies in terms of industry, size, and growth prospects.

- Calculate valuation multiples (e.g., Price-to-Earnings ratio, EV/EBITDA) for these companies.

- Apply the average or median multiple to the target company's relevant metric.

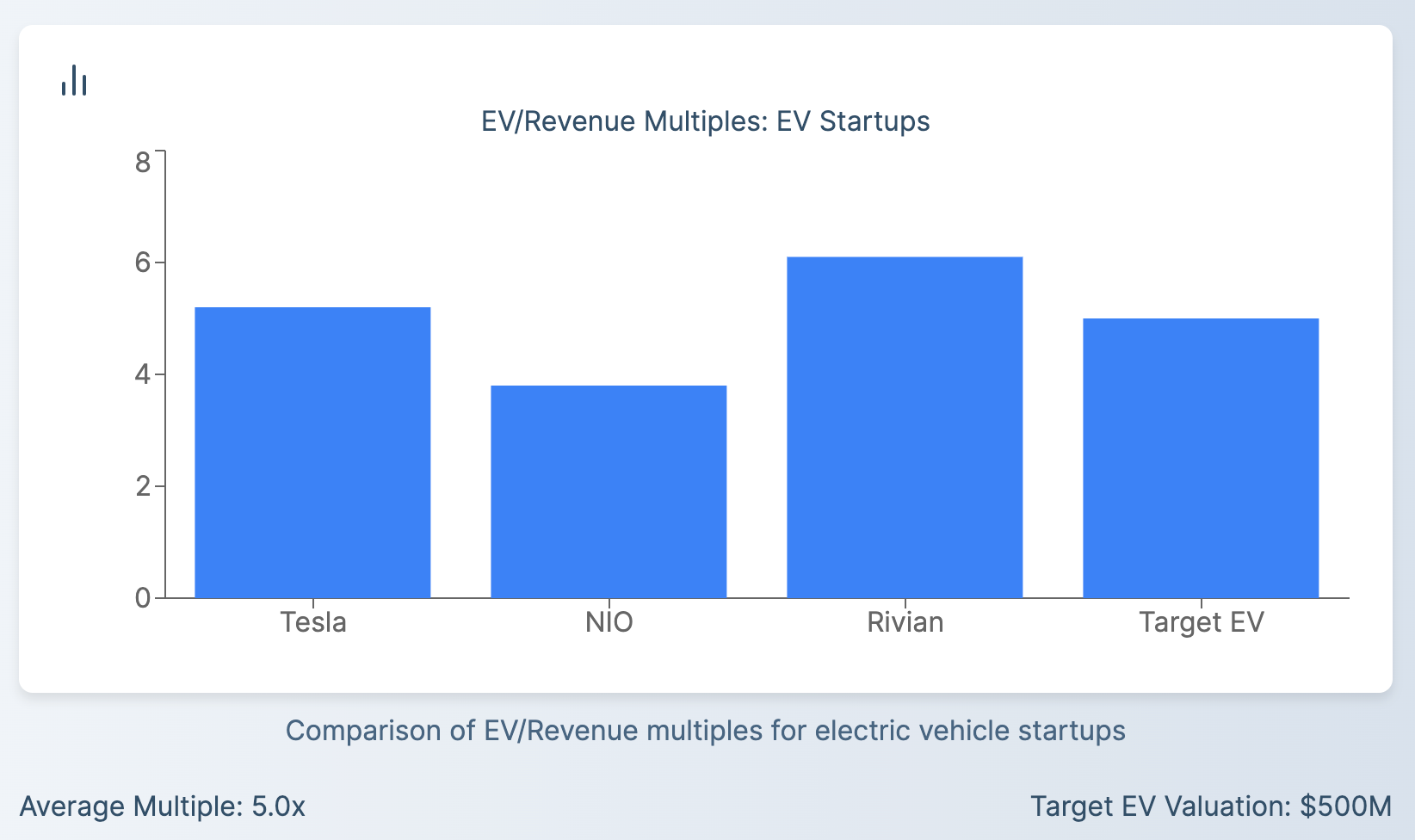

Real-World Example of Comparable Company Analysis:

Let's value a hypothetical electric vehicle (EV) startup. We might look at established EV makers like Tesla (TSLA), NIO (NIO), and Rivian (RIVN). If the average EV/Revenue multiple for these companies is 5x, and our startup has annual revenue of $100 million, we might value it at:

Estimated Value = $100 million × 5 = $500 million

This gives us a rough estimate based on how the market values similar companies in the same industry.

Pros of Comparable Company Analysis:

- Reflects current market sentiments and industry trends

- Useful when many comparable companies are available

Cons of Comparable Company Analysis:

- Can be challenging to find truly comparable companies

- May not account for company-specific strengths or weaknesses

3. Asset-Based Valuation Approach

The asset-based valuation approach focuses on a company's net asset value (NAV). This method is particularly useful for companies with significant tangible assets.

How the Asset-Based Valuation Approach Works:

- Assess the fair value of all the company’s assets.

- Subtract the fair market value of all liabilities.

- The difference represents the company’s net asset value.

Types of Asset-Based Valuation:

- Book Value Method: Uses the values reported on the company's balance sheet.

- Adjusted Book Value Method: Adjusts the book values to reflect current market values.

- Liquidation Value: Estimates the value if all assets were sold off and the company closed down.

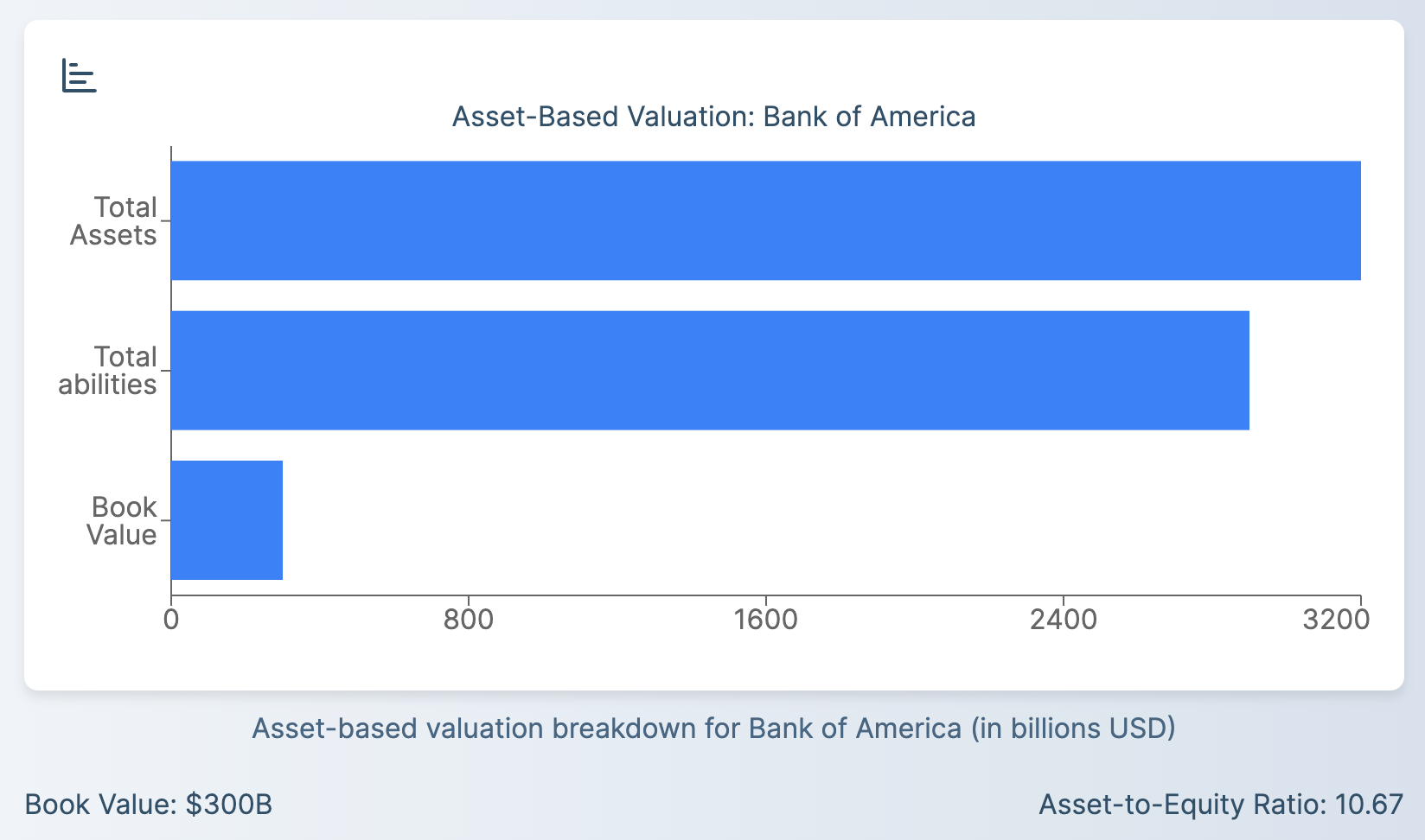

Real-World Example of Asset-Based Valuation:

Consider Bank of America (BAC). As of Q2 2023, it reported total assets of $3.2 trillion and total liabilities of $2.9 trillion. Using the simple book value method, its value would be:

Book Value = $3.2 trillion - $2.9 trillion = $300 billion

This represents the bank's net asset value according to its balance sheet. However, an adjusted book value or liquidation value might yield different results.

Pros of Asset-Based Valuation:

- Provides a concrete, asset-based valuation

- Useful for companies with significant tangible assets

Cons of Asset-Based Valuation:

- May not fully capture the value of intangible assets or future earnings potential

- Book values can be distorted by accounting practices

4. Income Approach: Capitalization of Earnings Method

The Capitalization of Earnings method is part of the income approach to valuation. It's often used for stable businesses with consistent earnings and is simpler than the Discounted Cash Flow method.

How the Capitalization of Earnings Method Works:

- Determine the company's expected annual earnings.

- Divide these earnings by a capitalization rate (typically the required rate of return minus the expected growth rate).

Formula:

Value = Expected Annual Earnings / (Required Rate of Return - Expected Growth Rate)

Real-World Example of Capitalization of Earnings:

Consider a stable retail company like Walmart (WMT). If Walmart's expected annual earnings are $20 billion, the required rate of return is 10%, and the expected long-term growth rate is 3%, the valuation would be:

Value = $20 billion / (0.10 - 0.03) = $285.7 billion

This simplified example illustrates how the method can quickly provide a ballpark valuation for stable companies with predictable earnings.

Pros of the Capitalization of Earnings Method:

- Simple and quick to calculate

- Useful for mature companies with stable earnings

Cons of the Capitalization of Earnings Method:

- Doesn't account for cyclical earnings or varying growth rates

- May not be suitable for high-growth or volatile businesses

5. Market Approach: Precedent Transactions Analysis

Precedent transactions analysis is a valuation method that looks at the prices paid for similar companies in past M&A deals. This method can provide valuable insights, especially when valuing a company for potential acquisition.

How Precedent Transactions Analysis Works:

- Identify recent transactions involving companies similar to the target in terms of industry, size, and business model.

- Calculate valuation multiples (e.g., EV/EBITDA, EV/Revenue) based on the transaction prices.

- Apply these multiples to the target company's relevant financial metrics.

Real-World Example of Precedent Transactions Analysis:

Let's say we're valuing a mid-sized software company. We find three recent acquisitions in the software industry:

- Company A: Acquired for 4x annual revenue

- Company B: Acquired for 5x annual revenue

- Company C: Acquired for 4.5x annual revenue

The average multiple is 4.5x annual revenue. If our target company has annual revenue of $50 million, we might value it at:

Estimated Value = $50 million × 4.5 = $225 million

This gives us an estimate based on what buyers have been willing to pay for similar companies in recent transactions.

Pros of Precedent Transactions Analysis:

- Reflects actual prices paid in the market

- Captures control premiums and synergy values

Cons of Precedent Transactions Analysis:

- Recent, comparable transactions may not always be available

- Market conditions and company-specific factors can vary significantly between transactions

Choosing the Right Valuation Method

Selecting the appropriate valuation method depends on various factors:

- Company Stage: Startups might benefit from DCF or comparable analysis, while mature companies might use earnings-based methods.

- Industry: Some industries have preferred valuation methods (e.g., real estate often uses net asset value).

- Available Data: The quality and quantity of available financial data will influence method selection.

- Purpose of Valuation: An M&A scenario might require different methods than an internal assessment.

The Impact of Economic Environment on Valuation

The broader economic environment can significantly influence business valuations. Factors to consider include:

- Interest Rates: Lower interest rates typically lead to higher valuations as future cash flows become more valuable.

- Economic Growth: A strong economic environment often leads to higher valuations as companies are expected to generate higher future cash flows.

- Inflation: High inflation can impact both future cash flows and discount rates, affecting valuations.

- Market Sentiment: Overall market optimism or pessimism can influence valuations, especially for publicly traded companies.

Understanding these economic factors is crucial for conducting accurate valuations and making informed investment decisions.

The Valuation Process: A Step-by-Step Guide

To conduct a thorough business valuation, follow these steps:

- Gather Financial Information: Collect historical financial statements, projections, and other relevant financial data.

- Analyze the Company and Industry: Understand the company's business model, competitive position, and industry trends.

- Choose Appropriate Valuation Methods: Based on the company's characteristics and available data, select the most suitable valuation methods.

- Apply the Chosen Methods: Perform the calculations for each chosen method, making sure to document all assumptions.

- Reconcile Different Valuation Results: If using multiple methods, analyze and reconcile any differences in the results.

- Consider Qualitative Factors: Adjust the valuation based on qualitative factors like management quality or brand strength.

- Prepare a Valuation Report: Document the entire process, including methods used, assumptions made, and final valuation conclusion.

Common Pitfalls in Business Valuation Methods

- Overreliance on a Single Method: Each valuation method has its strengths and weaknesses. Relying too heavily on one method can lead to inaccurate valuations. It's best to use multiple valuation methods and reconcile the results.

- Ignoring the Economic Environment: The broader economic context, including interest rates, inflation, and market conditions, can significantly impact a company's value. Failing to consider these factors can lead to misguided valuations.

- Overlooking Intangible Assets: In today's knowledge-based economy, intangible assets like intellectual property, brand value, and customer relationships often drive a significant portion of a company's value. Neglecting these can result in undervaluation.

- Inaccurate Future Projections: Many valuation methods, particularly the discounted cash flow method, rely heavily on projections of future cash flows. Overly optimistic or pessimistic projections can skew the valuation results.

- Misapplying Valuation Multiples: When using market-based approaches like comparable company analysis, it's crucial to ensure the selected companies and multiples are truly comparable. Misapplying multiples from dissimilar companies can lead to inaccurate valuations.

- Neglecting to Consider Control Premiums or Discounts: The value of a business can differ depending on whether you're valuing a controlling or minority stake. Failing to apply appropriate premiums or discounts can result in incorrect valuations.

- Ignoring Company-Specific Risks: Each company faces unique risks that can impact its value. These might include key person risk, customer concentration risk, or regulatory risks. Failing to account for these can lead to overvaluation.

The Future of Business Valuation

As the business landscape evolves, so too do valuation methods and practices. Several trends are shaping the future of business valuation:

- Increased Focus on Intangible Assets: As the knowledge economy grows, valuation methods are evolving to better capture the value of intangible assets like intellectual property and brand value.

- Integration of Big Data and AI: Advanced analytics and artificial intelligence are being increasingly used to improve the accuracy of financial projections and risk assessments in valuation models.

- Greater Emphasis on Non-Financial Metrics: Factors like environmental, social, and governance (ESG) performance are becoming more important in valuation considerations.

- Real-Time Valuation Tools: With the increasing availability of real-time financial and market data, there's a trend towards more dynamic, continuously updated valuation models.

- Valuation in the Digital Economy: New valuation approaches are being developed to better assess the value of digital businesses, cryptocurrencies, and other emerging asset classes.

Conclusion: The Art and Science of Business Valuation

Business valuation is both an art and a science. While the methods discussed in this guide provide structured approaches to determining a company's worth, true mastery comes from understanding when and how to apply them, and how to interpret the results in the context of broader market and economic conditions.

For investors, whether you're analyzing stocks for your portfolio or considering a private equity investment, these valuation methods are essential tools. They provide a framework for assessing whether a company is overvalued or undervalued, helping you make more informed investment decisions.

Remember, no single valuation method is perfect, and it's often best to use multiple methods to get a comprehensive view of a company's value. By understanding these valuation methods and the factors that influence them, you'll be better equipped to navigate the complex world of business valuation and make smarter investment choices.

Whether you're a seasoned financial professional or a novice investor, continual learning and adaptation are key in the ever-evolving field of business valuation. Stay informed about new valuation techniques, keep abreast of changes in accounting standards and regulations, and always be prepared to adjust your approach based on the specific circumstances of each valuation task.

By mastering the art and science of business valuation, you'll have a powerful tool at your disposal for making informed financial decisions, whether you're investing in publicly traded companies, considering private equity opportunities, or assessing the value of your own business ventures.

Frequently Asked Questions

How often should a business be valued?

For public companies, the market provides a daily valuation through stock prices. For private companies, annual valuations are common, but significant events like fundraising rounds, potential sales, or major market changes may warrant more frequent valuations. The frequency of valuation often depends on the company's stage, industry dynamics, and specific circumstances.

Can I value a company on my own, or do I need a professional?

While understanding these methods is valuable for any investor, professional valuations are often necessary for legal or financial reporting purposes. Complex valuations, especially for large or unique businesses, often benefit from professional expertise. However, for personal investment decisions or preliminary assessments, conducting your own valuation using these methods can provide valuable insights.

How do intangible assets affect business valuation?

Intangible assets like brand value, patents, and customer relationships can significantly impact a company's value. Methods like DCF and market-based approaches often capture these indirectly through their impact on cash flows or market perceptions. Specific valuation techniques for intangible assets, such as the relief from royalty method, can also be used to more directly value these assets.

How does company size affect the choice of valuation method?

Smaller companies or startups might rely more on asset-based or multiple-based methods due to limited financial history. Larger, established companies often use income-based methods like DCF. Market-based methods are applicable to companies of all sizes, provided comparable companies exist. The choice of method should always be tailored to the specific characteristics and circumstances of the company being valued.

How do economic cycles impact business valuations?

Economic cycles can significantly influence business valuations. During economic expansions, valuations tend to be higher due to optimistic growth expectations and lower perceived risk. Conversely, during recessions, valuations often decrease due to lower growth expectations and higher perceived risk. It's important to consider the current stage of the economic cycle when conducting valuations and to use normalized earnings or cash flows when appropriate to smooth out cyclical effects.

By understanding these valuation methods, their applications, and the factors that influence them, you'll be well-equipped to navigate the complex world of business valuation. Whether you're an investor, business owner, or financial professional, this knowledge will empower you to make more informed decisions and better understand the true value of companies in today's dynamic business environment.