In today’s fast-paced business environment, effective inventory management is crucial for maintaining a healthy bottom line. One key metric that savvy business owners and financial analysts use to gauge inventory efficiency is Days Inventory Outstanding (DIO). Understanding how to calculate days inventory outstanding is essential for optimizing inventory management. This comprehensive guide will delve into the intricacies of DIO, exploring its calculation, interpretation, and strategies for improvement.

What is Days Inventory Outstanding?

Days Inventory Outstanding, also known as Days Sales of Inventory (DSI), is a financial metric that measures the average number of days a company holds its inventory before selling it. This powerful indicator, often referred to as DIO days inventory outstanding, provides insight into a company’s operational and financial efficiency, as well as its liquidity.

At its core, DIO answers a crucial question: How quickly can a company turn its inventory into cash? This metric is essential for businesses across various industries, from retail to manufacturing, as it directly impacts cash flow and overall financial health.

The Significance of DIO in Business Operations

DIO plays a vital role in assessing a company’s ability to manage its inventory and raw materials effectively. Improving DIO is crucial for achieving inventory management efficiency. A well-optimized DIO can lead to:

- Improved cash flow management

- Reduced storage and holding costs

- Better alignment between supply and demand

- Enhanced operational efficiency

- Increased profitability

By understanding and optimizing DIO, businesses can unlock significant value and gain a competitive edge in their respective markets.

Days Inventory Outstanding Formula and Calculation

To harness the power of DIO, it’s essential to understand the days inventory outstanding calculation and how to calculate it accurately. The DIO formula requires two primary inputs: inventory and cost of goods sold (COGS).

Breaking Down the Components

- Inventory: This represents the dollar value of a company's raw materials, work in process, and finished goods. It's typically found on the balance sheet.

- Cost of Goods Sold (COGS): This figure represents the direct costs incurred by a business in selling goods and services. COGS is usually found on the income statement.

The DIO Formula

The formula for calculating Days Inventory Outstanding is:

DIO = (Inventory / COGS) x 365

Here, 365 represents the number of days in a financial year. Some businesses may use 360 days for simplicity, but 365 is more accurate for most calculations.

Step-by-Step DIO Calculation

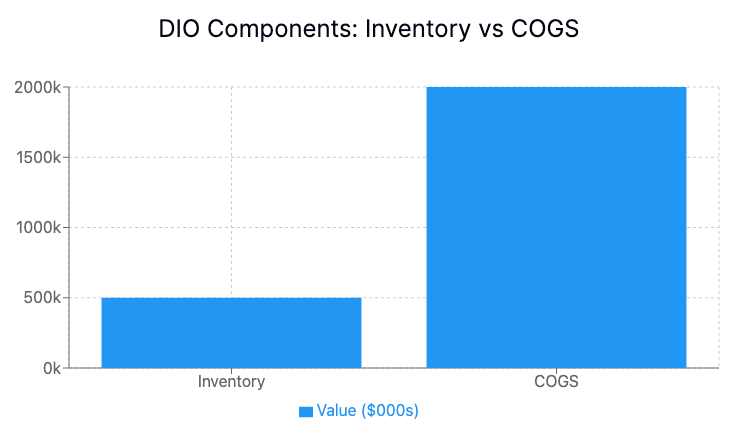

Let's walk through an example to illustrate the DIO calculation process:

- Obtain the inventory value from the balance sheet (e.g., $500,000)

- Find the COGS from the income statement (e.g., $2,000,000)

- Apply the formula: DIO = ($500,000 / $2,000,000) x 365

- Calculate: DIO = 0.25 x 365 = 91.25 days

In this example, the company's DIO is approximately 91 days, meaning it takes an average of 91 days to sell through its inventory.

Interpreting Days Inventory Outstanding Results

Now that we know how to calculate DIO, let's explore what different DIO values mean for a business.

Low DIO: Quick Sales and Efficient Inventory Management

A low DIO generally indicates that a company is selling its inventory quickly. This can be advantageous for several reasons:

- Reduced inventory carrying costs

- Lower risk of obsolescence

- Improved cash flow

- Efficient use of working capital

However, an extremely low DIO might also suggest that the company is understocked, potentially leading to lost sales opportunities.

High DIO: Slow Sales or Excess Inventory

Conversely, a high DIO may indicate:

- Slow-moving inventory

- Overstocking issues

- Potential cash flow problems

- Underutilized operational capacity

A higher inventory turnover, on the other hand, suggests more effective inventory flow and management, leading to better operational outcomes.

While a high DIO isn’t always negative (e.g., for businesses dealing with high-value, slow-moving goods), it often signals a need for improved inventory management practices.

Industry-Specific Considerations

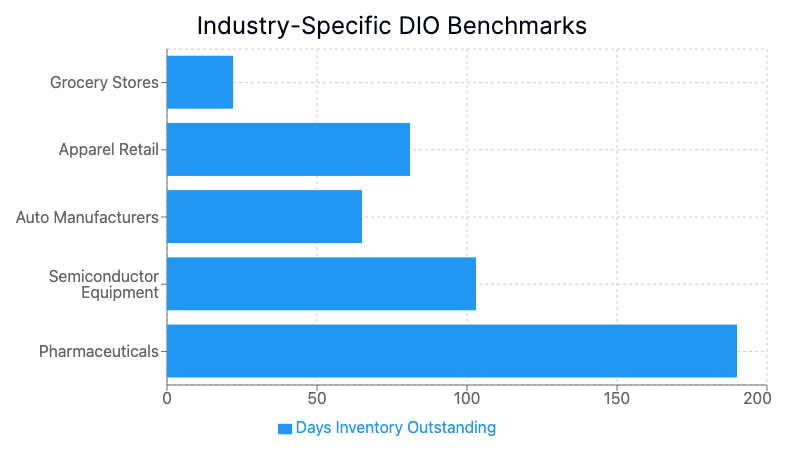

It’s crucial to note that ideal DIO values can vary significantly across industries. For example:

- Grocery stores typically have a low DIO due to perishable goods

- Luxury car dealerships may have a higher DIO due to the nature of their high-value inventory

- Technology companies might have varying DIOs depending on product lifecycles and innovation rates

Always compare your DIO against industry benchmarks for the most meaningful insights, focusing on businesses within the same industry.

Relationship Between DIO and Inventory Turnover

To gain a comprehensive understanding of inventory efficiency, it's essential to consider DIO alongside inventory turnover.

What is Inventory Turnover?

Inventory turnover measures the number of times a company sells and replaces its inventory over a given period, typically a year. The formula for inventory turnover is:

Inventory Turnover = Cost of Goods Sold / Average Inventory

How DIO and Inventory Turnover Complement Each Other

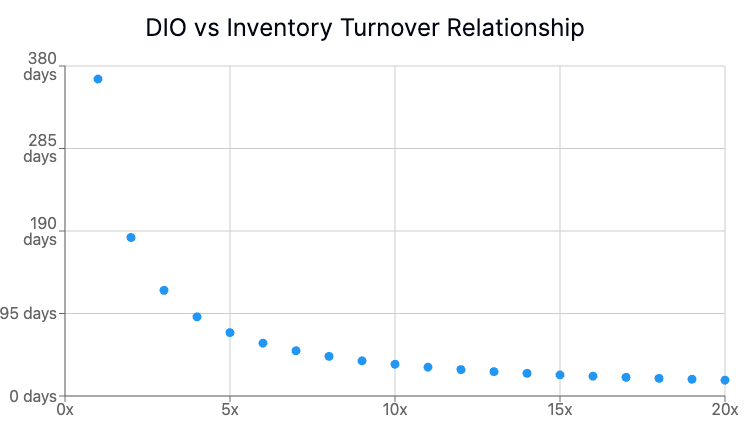

While DIO measures the time it takes to sell inventory, inventory turnover focuses on the frequency of inventory replacement. These metrics are inversely related:

DIO = 365 / Inventory Turnover

A high inventory turnover generally corresponds to a low DIO, indicating efficient inventory management. However, extremely high turnover might suggest understocking, while very low turnover (high DIO) could indicate overstocking or obsolete inventory.

Practical Applications of DIO in Inventory Management

Understanding DIO is one thing, but applying it effectively to your inventory management practices is where real value is created.

Forecasting and Trend Analysis

- Total Stock Days: DIO provides an overall measure of inventory efficiency, helping businesses understand their total stockholding trends.

- Historical Analysis: By tracking DIO over time, companies can identify seasonal trends, sales increases, or potential issues in inventory management.

- Demand Forecasting: Accurate DIO analysis contributes to better demand forecasting, helping businesses optimize inventory levels and avoid stock-outs.

Item-Level Analysis

While DIO offers a high-level view, efficient inventory management requires evaluating each stock item individually. Use DIO insights to:

- Identify slow-moving items that may need promotional efforts or discontinuation

- Optimize reorder points and quantities for fast-moving items

- Balance inventory across product categories

Average Inventory Considerations

When calculating DIO, businesses can use either ending inventory or average inventory. Average inventory, calculated as the mean of beginning and ending inventory, can provide a more accurate picture, especially for businesses with significant inventory fluctuations.

Strategies for Improving Days Inventory Outstanding

Optimizing DIO can lead to significant improvements in operational efficiency and financial performance. Here are some strategies to consider:

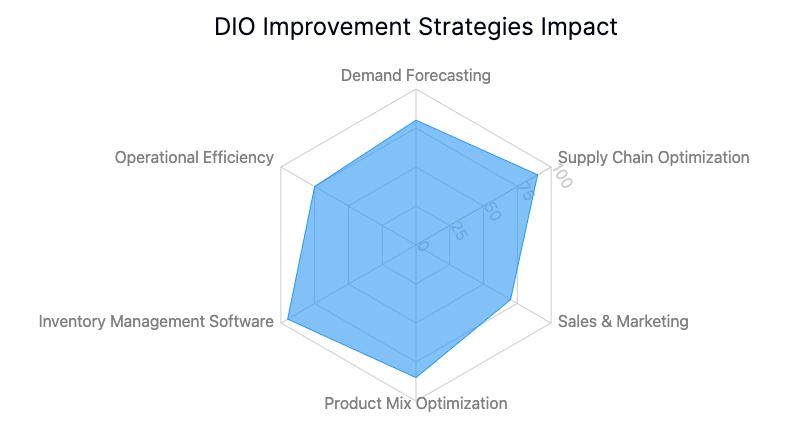

- Enhance Demand Forecasting: Implement advanced forecasting techniques, leveraging historical data, market trends, and predictive analytics to better align inventory levels with expected demand.

- Streamline Supply Chain Processes: Work closely with suppliers to reduce lead times and implement just-in-time (JIT) inventory systems where appropriate. This can help minimize excess inventory without risking stock-outs.

- Implement Effective Sales and Marketing Strategies: Develop targeted marketing campaigns and promotions to increase demand for slow-moving products, helping to reduce overall DIO.

- Optimize Product Mix: Regularly evaluate your product portfolio. Consider eliminating or reducing stock of less popular items while focusing on high-demand products.

- Utilize Advanced Inventory Management Techniques: Implement sophisticated inventory management software to track stock levels, automate reordering, and provide real-time insights into inventory performance.

- Improve Operational Efficiency: Streamline processes in receiving, storing, and shipping inventory to reduce the time products spend in your possession.

- Consider Consignment or Vendor-Managed Inventory: For certain product categories, explore arrangements where suppliers maintain ownership of the inventory until it's sold, effectively reducing your DIO.

Industry Benchmarks and Comparison

To truly understand your DIO performance, it's crucial to compare it with industry benchmarks and similar-sized companies in your sector.

Finding Relevant Benchmarks

- Industry reports and financial databases often provide average DIO figures for various sectors.

- Annual reports of publicly traded competitors can offer insights into their inventory management performance.

- Trade associations may provide benchmark data for specific industries.

Interpreting Benchmark Comparisons

When comparing your DIO to industry benchmarks:

- Consider company size, as larger companies may benefit from economies of scale in inventory management.

- Account for business model differences, such as e-commerce vs. brick-and-mortar operations.

- Look for trends over time rather than focusing solely on single-point comparisons.

A significant gap between your DIO and industry benchmarks may indicate opportunities for improvement in your inventory management practices.

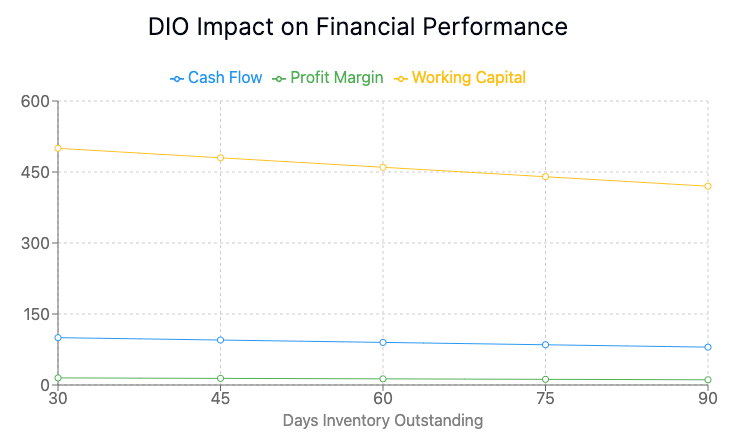

The Impact of DIO on Financial Statements and Performance

Days Inventory Outstanding has far-reaching effects on a company's financial health and performance metrics.

Balance Sheet Impact

- Current Assets: Inventory is a key component of current assets. A high DIO may inflate current assets, potentially masking liquidity issues.

- Working Capital: Excessive inventory ties up working capital, which could be used more productively elsewhere in the business.

Income Statement Considerations

- Cost of Goods Sold: Efficient inventory management (lower DIO) can lead to reduced storage and handling costs, positively impacting COGS and gross profit margins.

- Operating Expenses: High DIO may lead to increased expenses related to storage, insurance, and inventory obsolescence.

Key Performance Indicators (KPIs)

- Cash Conversion Cycle: DIO is a crucial component of the cash conversion cycle, affecting overall liquidity and cash flow management.

- Return on Assets (ROA): Efficient inventory management improves asset utilization, potentially boosting ROA.

- Gross Profit Margin: Lower inventory-related costs can contribute to improved gross profit margins.

Frequently Asked Questions About Days Inventory Outstanding

What is a good Days Inventory Outstanding ratio?

A "good" DIO varies by industry and business model. Generally, a lower DIO is preferred, but it's essential to balance inventory efficiency with the risk of stock-outs. Compare your DIO to industry benchmarks for the most meaningful assessment.

How can I reduce my company's DIO?

To reduce DIO, consider implementing just-in-time inventory systems, improving demand forecasting, optimizing your product mix, enhancing sales and marketing efforts for slow-moving items, and streamlining supply chain processes.

What's the difference between DIO and inventory turnover ratio?

DIO measures the average number of days it takes to sell inventory, while inventory turnover ratio measures how many times a company sells and replaces its inventory over a period. They are inversely related: DIO = 365 / Inventory Turnover Ratio.

How does DIO impact a company's cash conversion cycle?

DIO is a key component of the cash conversion cycle, which measures how quickly a company converts investments in inventory and other resources into cash flows from sales. A lower DIO generally contributes to a shorter, more efficient cash conversion cycle.

Can DIO be too low, and if so, what are the risks?

Yes, an extremely low DIO might indicate that a company is understocked, potentially leading to lost sales opportunities and dissatisfied customers. It's crucial to balance inventory efficiency with maintaining adequate stock to meet customer demand.

Conclusion: Mastering Days Inventory Outstanding for Business Success

Days Inventory Outstanding is a powerful metric that provides valuable insights into a company's operational efficiency and financial health. By understanding how to calculate, interpret, and optimize DIO, businesses can unlock significant improvements in cash flow, profitability, and overall performance.

Remember, the goal isn't always to achieve the lowest possible DIO, but rather to find the optimal balance that aligns with your business model, industry norms, and customer expectations. Regularly analyzing your DIO, comparing it to relevant benchmarks, and implementing targeted improvement strategies can lead to substantial competitive advantages.

As you continue to refine your inventory management practices, keep DIO at the forefront of your financial analysis toolkit. With consistent attention and optimization, you'll be well-equipped to navigate the complexities of inventory management and drive your business towards greater financial success.