Introduction: Demystifying Adjusted EBITDA

In the complex world of financial analysis, understanding key metrics is crucial for investors, analysts, and business leaders alike. One such metric that often takes center stage in valuation and performance assessment is Adjusted EBITDA. But what exactly is Adjusted EBITDA, and why has it become such a pivotal figure in financial circles?

Adjusted EBITDA, or Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization, is a refined financial metric that goes beyond traditional EBITDA to provide a more accurate picture of a company’s operational performance. By adjusting EBITDA to remove one-time, irregular, and non-recurring items that can distort financial results, Adjusted EBITDA offers a clearer lens through which to view a company’s true earning potential.

In this comprehensive guide, we’ll dive deep into the intricacies of Adjusted EBITDA, exploring its calculation, significance, and real-world applications. Whether you’re a seasoned financial professional or an aspiring analyst, this post will equip you with the knowledge to leverage Adjusted EBITDA effectively in your financial analyses and decision-making processes.

What is Adjusted EBITDA? Unraveling the Financial Metric

Defining Adjusted EBITDA

Adjusted EBITDA is a financial metric that builds upon the foundation of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) by incorporating additional adjustments to provide a more standardized measure of a company’s financial performance. The company's adjusted EBITDA emphasizes its importance as a normalized measure, allowing for fair comparisons between companies. These adjustments typically remove the impact of one-time, irregular, and non-recurring items that might otherwise skew the perception of a company’s ongoing operational efficiency.

The Purpose of Adjusted EBITDA

The primary purpose of Adjusted EBITDA is to offer a fair and consistent basis for comparing companies, even across different industries or with varying capital structures. By eliminating the effects of financing decisions, tax environments, and accounting practices, Adjusted EBITDA focuses on the core operational performance of a business. The company's EBITDA serves as a key metric for assessing profitability and influencing purchase price in financial transactions.

Key benefits of using Adjusted EBITDA include:

- Enhanced comparability between companies

- More accurate representation of ongoing profitability

- Clearer picture of operational efficiency

- Improved basis for valuation in mergers and acquisitions

Adjusted EBITDA in Financial Analysis

Financial analysts, investment bankers, and other finance professionals frequently use Adjusted EBITDA as a key metric in their valuations and assessments. It serves as a crucial tool for:

- Evaluating company performance over time

- Comparing peer companies within the same industry

- Assessing potential acquisition targets

- Determining appropriate leverage ratios in financing decisions

By providing a normalized view of earnings, Adjusted EBITDA allows stakeholders to make more informed decisions about a company's financial health and future prospects.

How to Calculate Adjusted EBITDA: A Step-by-Step Guide

Calculating Adjusted EBITDA involves a systematic approach that starts with traditional EBITDA and incorporates various adjustments. Let's break down the process:

Step 1: Calculate EBITDA

Begin with the company’s net income from the company's income statement and add back the following:

- Interest expense

- Income taxes

- Depreciation

- Amortization

The formula for EBITDA is:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Step 2: Identify Adjustments

Next, identify non-recurring, unusual, or one-time items that should be added back or subtracted to normalize earnings. Common EBITDA adjustments include:

- Restructuring costs

- Legal settlements

- Gains or losses from asset sales

- Stock-based compensation

- Foreign exchange gains or losses

- Non-cash impairment charges

Step 3: Apply Adjustments

Add or subtract the identified adjustments to the EBITDA figure calculated in Step 1.

The formula for Adjusted EBITDA is:

Adjusted EBITDA = EBITDA ± Adjustments

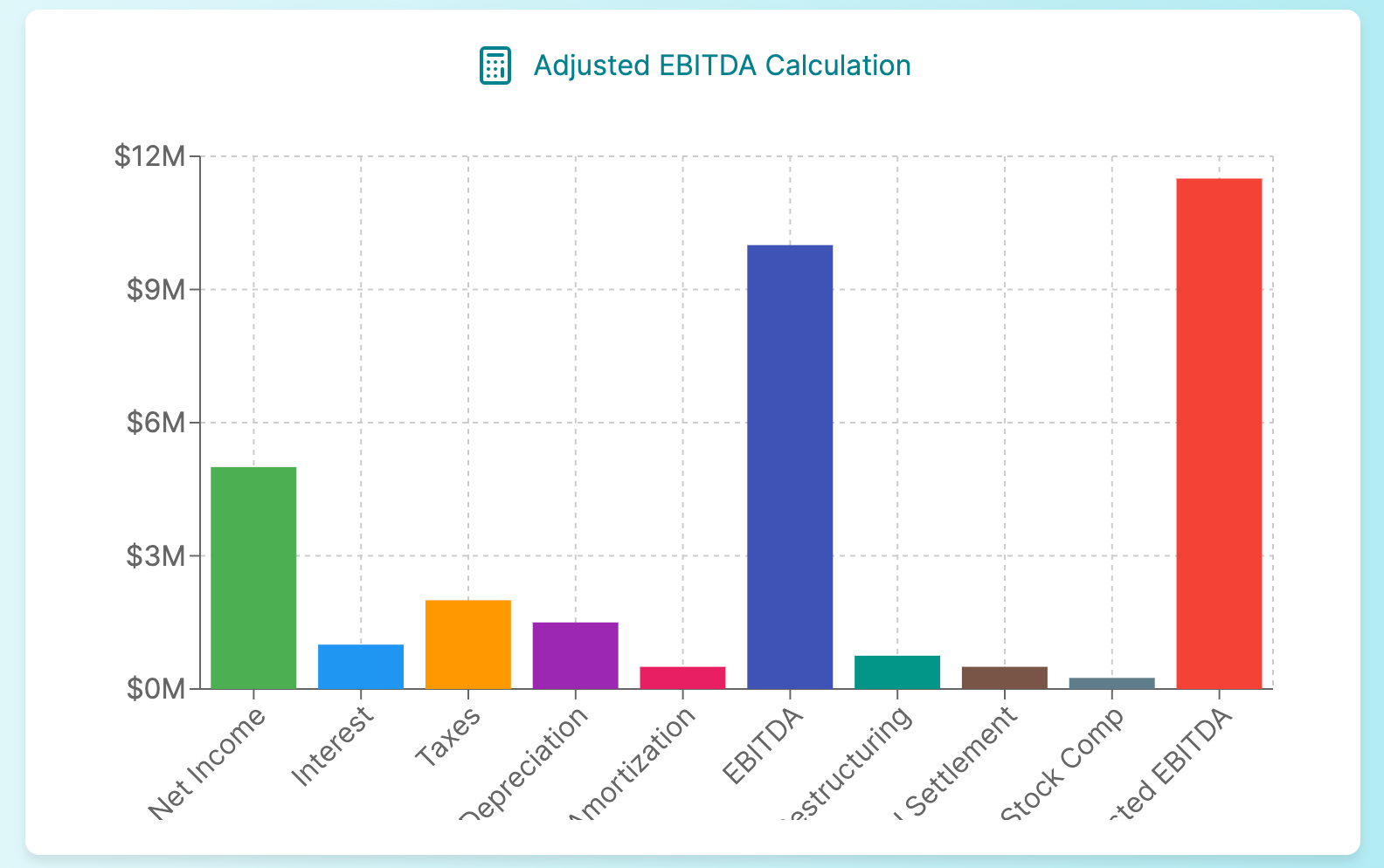

Example Calculation

Let's walk through a simplified example to calculate adjusted EBITDA:

In this example, the company's Adjusted EBITDA is $11,500,000, which is $1,500,000 higher than its standard EBITDA due to the adjustments made for non-recurring items.

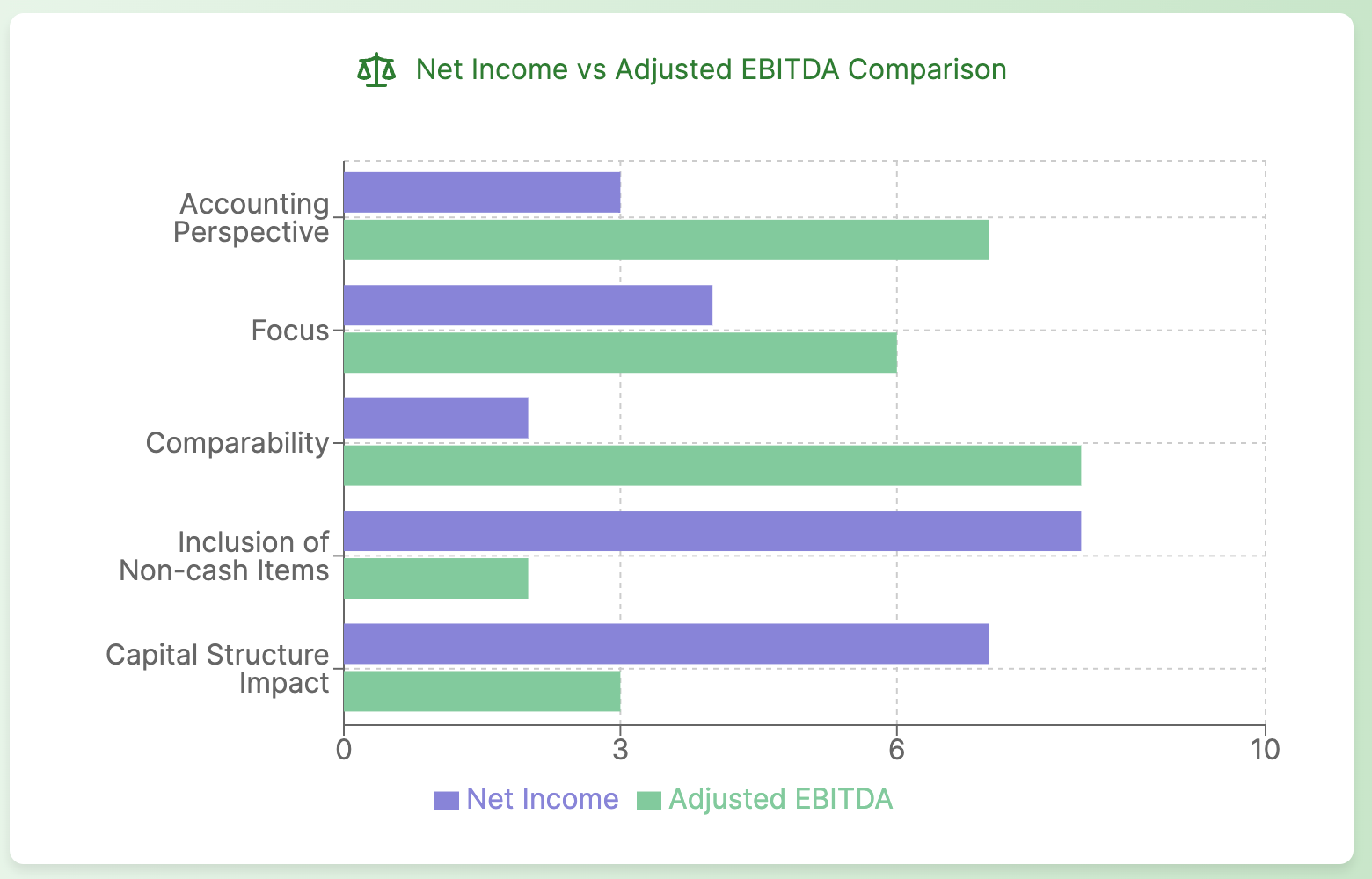

Adjusted EBITDA vs. Net Income: Understanding the Differences

While both Adjusted EBITDA and net income are important financial metrics, they serve different purposes and provide distinct insights into a company's financial performance. Understanding the differences between these two measures is crucial for accurate financial analysis.

Key Differences

- Inclusivity:

- The company's net income is the bottom line figure that includes all revenues, expenses, gains, and losses. It serves as the foundational figure to calculate adjusted EBITDA, from which adjustments are made to arrive at a more comprehensive measure of earnings.

- Adjusted EBITDA excludes interest, taxes, depreciation, amortization, and certain non-recurring items.

- Purpose:

- Net Income reflects a company’s profitability from an accounting perspective.

- Adjusted EBITDA aims to show operational performance and cash flow generation potential.

- Comparability:

- Net Income can vary significantly between companies due to differences in capital structure, tax situations, and accounting methods.

- Adjusted EBITDA attempts to level the playing field, making it easier to compare companies across different industries or with varying financial structures.

- Magnitude:

- Adjusted EBITDA is typically higher than Net Income because it adds back several expenses.

Comparative Analysis

Common Adjustments to EBITDA: What to Include and Why

Understanding the common EBITDA adjustments is crucial for accurately calculating and interpreting Adjusted EBITDA. These adjustments aim to normalize earnings by removing non-recurring, unusual, or non-operational items. Here's a comprehensive look at the most frequent adjustments and the rationale behind them:

1. Restructuring Costs

- What: Expenses related to reorganizing operations, such as severance payments or facility closure costs.

- Why: These are typically one-time expenses that don't reflect ongoing operational performance.

2. Legal Settlements

- What: Costs or gains from resolving legal disputes.

- Why: Legal settlements are usually non-recurring and can significantly distort EBITDA if not adjusted.

3. Stock-Based Compensation

- What: Non-cash expenses related to employee stock options or restricted stock units.

- Why: While recurring, these are non-cash expenses that don't directly impact operational cash flow.

4. Merger and Acquisition (M&A) Expenses

- What: Costs associated with buying or selling businesses, including advisory fees and due diligence expenses.

- Why: These are typically one-time expenses that don't reflect normal business operations.

5. Foreign Exchange Gains/Losses

- What: Profits or losses resulting from currency fluctuations.

- Why: These are often non-cash and can be volatile, potentially masking underlying operational performance.

6. Asset Impairment Charges

- What: Write-downs of asset values.

- Why: These non-cash charges are often one-time events that don't reflect ongoing operational performance.

7. Gains/Losses on Asset Sales

- What: Profits or losses from selling significant assets.

- Why: These are non-recurring events that don't represent core business operations.

8. Unusual Weather Events or Natural Disasters

- What: Costs or lost revenue due to exceptional weather conditions or natural disasters.

- Why: These events are typically non-recurring and outside of normal business operations.

9. Start-up Costs

- What: Expenses related to launching new products, services, or entering new markets.

- Why: These costs are often front-loaded and not representative of ongoing operational expenses.

10. Changes in Accounting Estimates

- What: Adjustments resulting from changes in accounting methodologies or estimates. Changes in accounting estimates must adhere to generally accepted accounting principles (GAAP), which ensures consistency and reliability in financial reporting. This adherence impacts the calculation of Adjusted EBITDA, as GAAP provides a standardized framework that companies must follow.

- Why: These changes can create artificial fluctuations in EBITDA that don’t reflect actual operational changes.

Best Practices for EBITDA Adjustments

- Consistency: Apply adjustments consistently from period to period.

- Materiality: Focus on adjustments that have a significant impact on EBITDA.

- Transparency: Clearly disclose and explain all adjustments made.

- Industry Norms: Consider industry-specific adjustments that may be relevant.

- Scrutiny: Be prepared to justify each adjustment, especially in a due diligence context.

- Related Party Transactions: Ensure related party transactions are at market value to avoid improper valuation that may necessitate adjustments to EBITDA.

Real-World Application of Adjusted EBITDA: Case Studies and Examples

To better understand how Adjusted EBITDA is used in practice, let's explore some real-world case studies and examples:

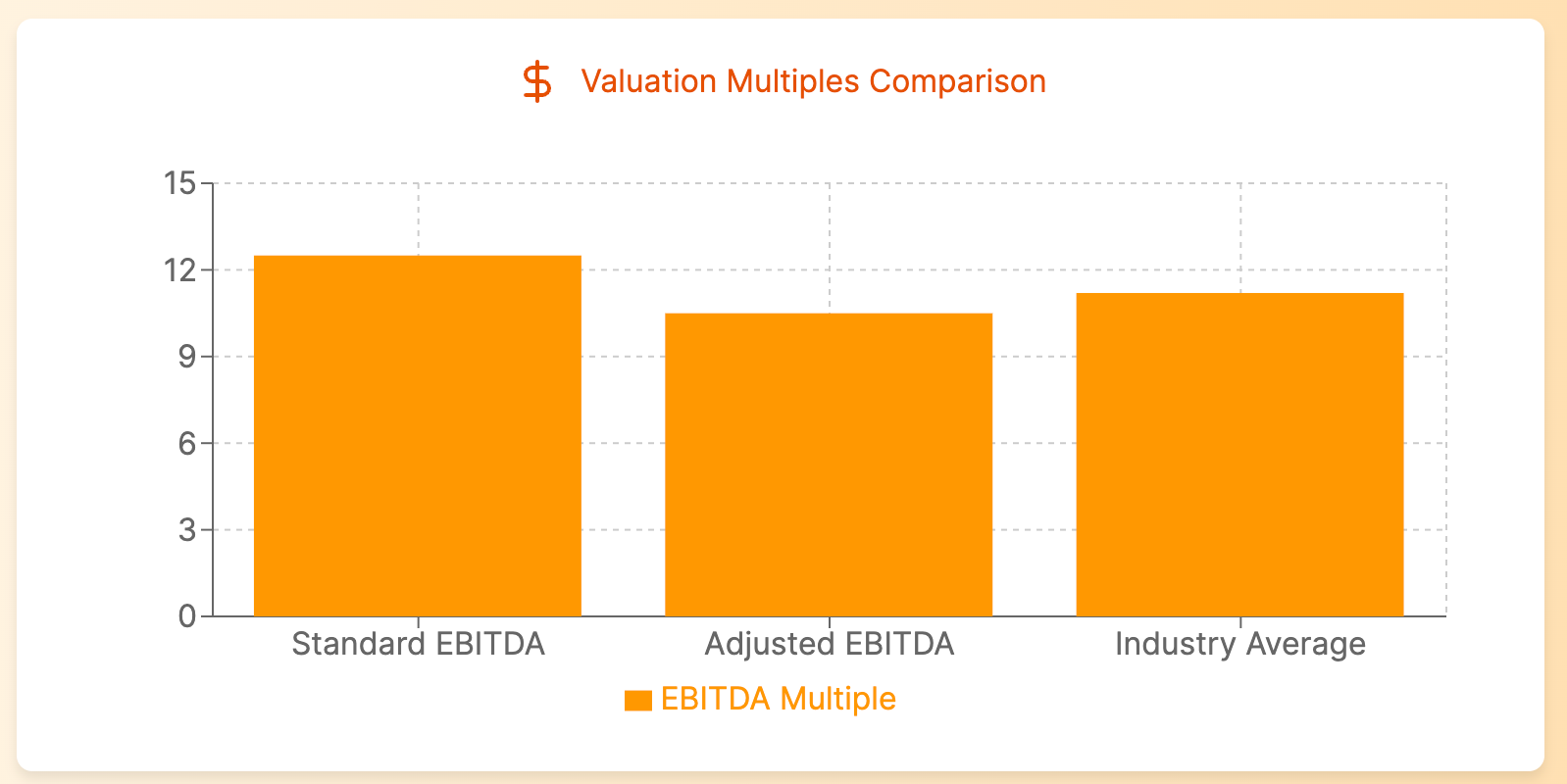

Case Study 1: Mergers and Acquisitions

Scenario: InvestCo, a private equity firm, is considering the purchase of ManufacturingInc for $100 million.

Application of Adjusted EBITDA:

- ManufacturingInc's standard EBITDA: $8 million

- Adjustments made:

- One-time litigation expense: +$1 million

- Non-recurring restructuring costs: +$500,000

- Adjusted EBITDA: $9.5 million

Analysis:

- EBITDA multiple based on standard EBITDA: 12.5x ($100 million / $8 million)

- EBITDA multiple based on Adjusted EBITDA: 10.5x ($100 million / $9.5 million)

Result: Using Adjusted EBITDA provides a more accurate valuation multiple, helping InvestCo make a more informed decision about the purchase price.

Example 2: Debt Covenant Compliance

Scenario: ManufacturingInc has a loan with a covenant requiring a minimum Adjusted EBITDA to Debt ratio of 0.2.

Application of Adjusted EBITDA:

- Net Income: $30 million

- Interest Expense: $10 million

- Taxes: $5 million

- Depreciation and Amortization: $15 million

- One-time expenses related to factory relocation: $5 million

- Total Debt: $200 million

Calculation:

- EBITDA = $30m + $10m + $5m + $15m = $60m

- Adjusted EBITDA = $60m + $5m = $65m

- Adjusted EBITDA to Debt ratio = $65m / $200m = 0.325

Result: With an Adjusted EBITDA to Debt ratio of 0.325, ManufacturingInc is comfortably in compliance with its loan covenant. This example demonstrates how Adjusted EBITDA is crucial for monitoring and maintaining compliance with financial covenants.

Case Study 3: Private Equity Performance Evaluation

Scenario: InvestCo, an investment banker firm, is assessing the performance of PortfolioBiz, one of its investments in the retail sector.

Application of Adjusted EBITDA:

- InvestCo analyzes PortfolioBiz's Adjusted EBITDA growth over the past two years.

- They adjust for one-time expenses related to rebranding and new store openings.

- The Adjusted EBITDA margin is calculated to assess operational efficiency improvements.

Result:

- Year 1 Adjusted EBITDA: $15 million (margin: 10%)

- Year 2 Adjusted EBITDA: $22 million (margin: 13%)

- Adjusted EBITDA growth: 46.7%

This analysis helps InvestCo evaluate the success of their operational improvements and the overall performance of their investment. The growth in Adjusted EBITDA and margin improvement indicates that PortfolioBiz is becoming more efficient and profitable under InvestCo's management.

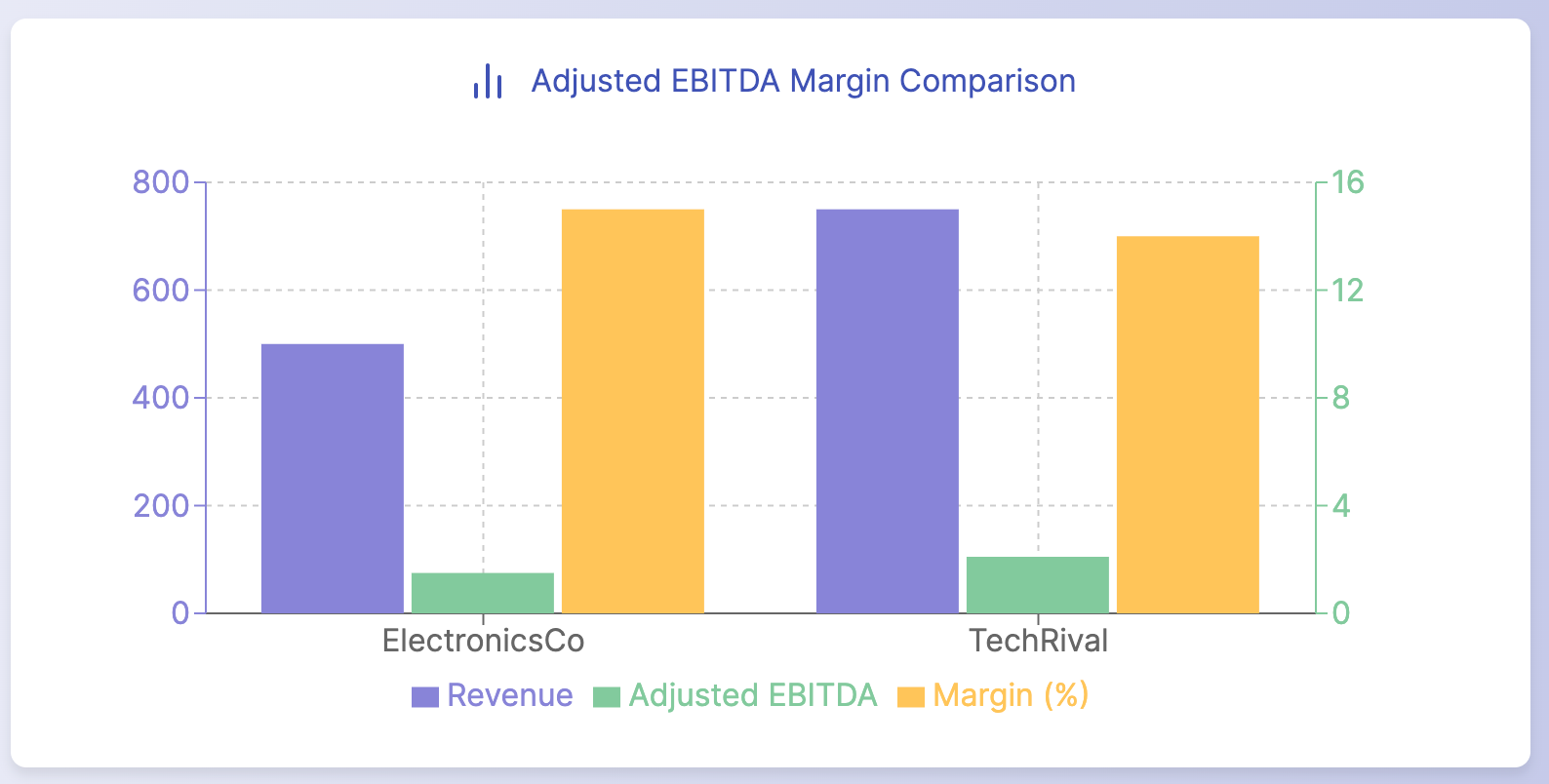

Example 4: Benchmarking Against Competitors

Scenario: ElectronicsCo wants to compare its performance against its main competitor, TechRival, using the Adjusted EBITDA metric.

Application of Adjusted EBITDA:

- Both companies' Adjusted EBITDA figures are analyzed.

- Adjustments are scrutinized to ensure comparability.

- Adjusted EBITDA margins are calculated for a size-neutral comparison.

Result:

Despite TechRival's larger size, ElectronicsCo shows a slightly higher Adjusted EBITDA margin, indicating potentially better operational efficiency. This comparison allows financial analysts to assess relative performance regardless of company size.

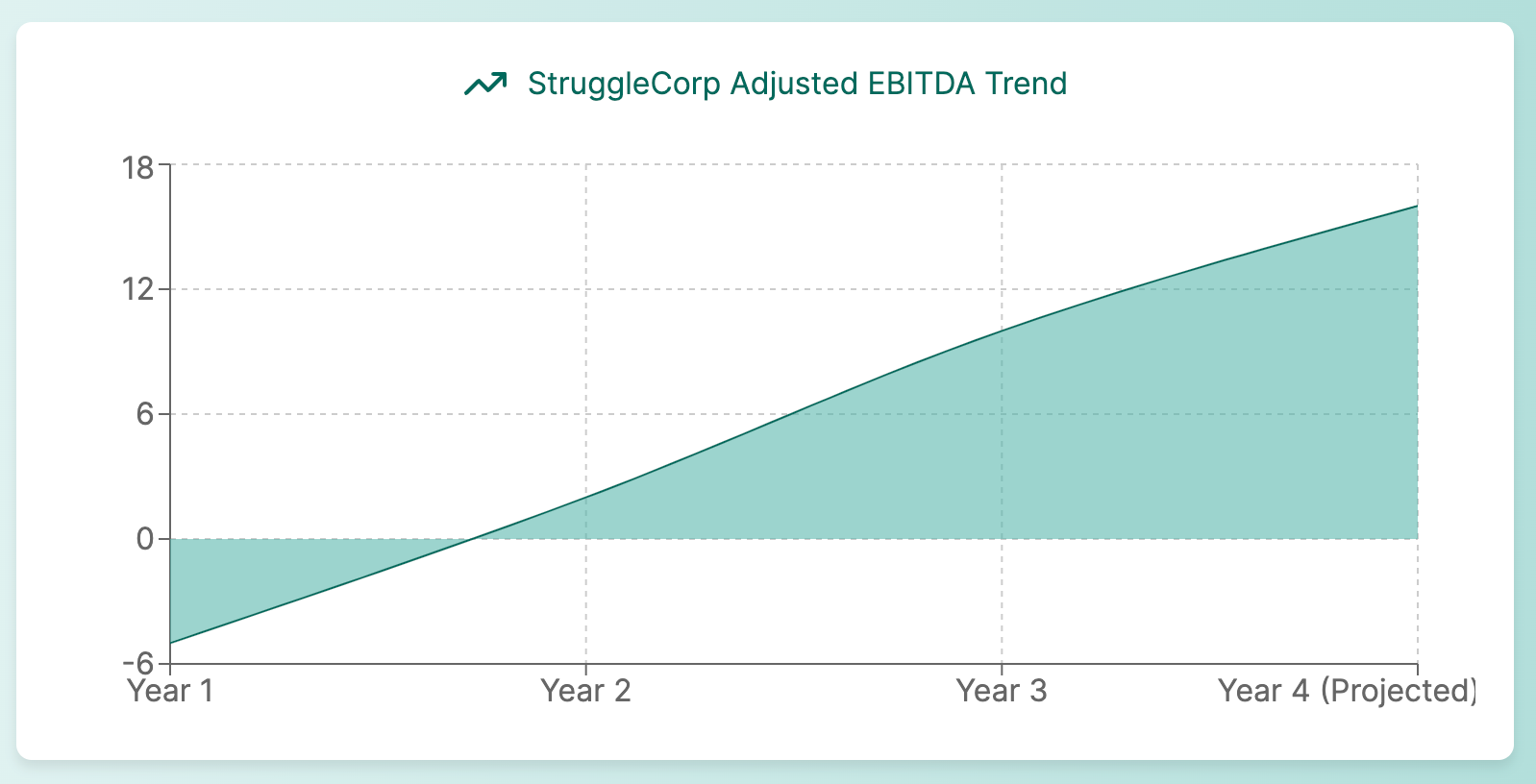

Case Study 5: Turnaround Situation Analysis

Scenario: StruggleCorp, a manufacturing company, is undergoing a turnaround effort. Management wants to demonstrate progress to stakeholders using Adjusted EBITDA.

Application of Adjusted EBITDA:

- StruggleCorp calculates Adjusted EBITDA for the past three years.

- They add back restructuring costs and impairment charges related to the turnaround.

- A "run-rate" Adjusted EBITDA is calculated based on the most recent quarter's performance.

Result:

- Year 1 Adjusted EBITDA: -$5 million

- Year 2 Adjusted EBITDA: $2 million

- Year 3 Adjusted EBITDA: $10 million

- Run-rate Adjusted EBITDA (based on Q4 of Year 3): $16 million annualized

This analysis helps StruggleCorp showcase the positive trajectory of their turnaround efforts to investors and creditors. The improving Adjusted EBITDA trend provides evidence that the company's operational performance is enhancing, even if one-time expenses related to the turnaround are still impacting the bottom line.

Conclusion: Leveraging Adjusted EBITDA for Financial Success

As we've explored throughout this comprehensive guide, Adjusted EBITDA is a powerful financial metric that offers valuable insights into a company's operational performance. When used correctly, it can be a key tool for investors, analysts, and business leaders in making informed decisions.

Key Takeaways:

- Comprehensive Understanding: Adjusted EBITDA provides a more nuanced view of a company's earnings potential by removing non-recurring and non-operational items.

- Comparative Analysis: It facilitates meaningful comparisons between companies, even across different industries or capital structures.

- Valuation Tool: Adjusted EBITDA is crucial in M&A scenarios and private equity investments, serving as a basis for company valuations and determining purchase price.

- Performance Indicator: It helps in assessing operational efficiency and the success of turnaround efforts or strategic initiatives.

- Debt Analysis: Adjusted EBITDA is vital in analyzing a company's debt-servicing capacity and compliance with financial covenants.

- Limitations Awareness: While powerful, Adjusted EBITDA should not be used in isolation. It's important to recognize its limitations and use it alongside other financial metrics.

- Best Practices: Adhering to best practices in calculation and interpretation ensures the integrity and usefulness of Adjusted EBITDA analysis.

Looking Ahead: As financial reporting continues to evolve, the role of Adjusted EBITDA is likely to remain significant. However, it's crucial for financial professionals to stay informed about:

- Regulatory changes affecting non-GAAP financial measures

- Emerging industry-specific adjustments and norms

- Technological advancements in financial analysis and reporting

By mastering the nuances of Adjusted EBITDA and staying abreast of financial reporting trends, you'll be well-equipped to leverage this metric for financial success in your professional endeavors.

Remember, the true power of Adjusted EBITDA lies not just in its calculation, but in its thoughtful application to real-world financial challenges. Whether you're valuing a company, assessing performance, or making strategic decisions, a well-calculated and properly interpreted Adjusted EBITDA can be your compass in the complex world of finance.

FAQ: Common Questions About Adjusted EBITDA

To further enhance your understanding of Adjusted EBITDA, here are answers to some frequently asked questions:

Q1: What's the difference between EBITDA and adjusted EBITDA?

A: While EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) provides a view of a company's operational performance before the impact of financial and accounting decisions, Adjusted EBITDA takes this a step further. Adjusted EBITDA removes non-recurring, unusual, or non-operational items to provide an even clearer picture of a company's ongoing operational performance. This can include adjustments for things like restructuring costs, legal settlements, or stock-based compensation.

Q2: How do you calculate the adjusted EBITDA?

A: To calculate adjusted EBITDA, start with the standard EBITDA calculation:

- Begin with net income

- Add back interest expense

- Add back income taxes

- Add back depreciation and amortization

Then, make additional adjustments for non-recurring or unusual items. These might include:

- Add back restructuring costs

- Add back legal settlement expenses

- Add back stock-based compensation

- Subtract any one-time gains

The exact adjustments will vary depending on the company and industry.

Q3: What are examples of EBITDA adjustments?

Common EBITDA adjustments include:

- Restructuring costs

- Legal settlements

- Stock-based compensation

- Merger and acquisition expenses

- Foreign exchange gains or losses

- Asset impairment charges

- Gains or losses from asset sales

- Expenses related to unusual weather events or natural disasters

- Start-up costs for new ventures

- Changes in accounting estimates

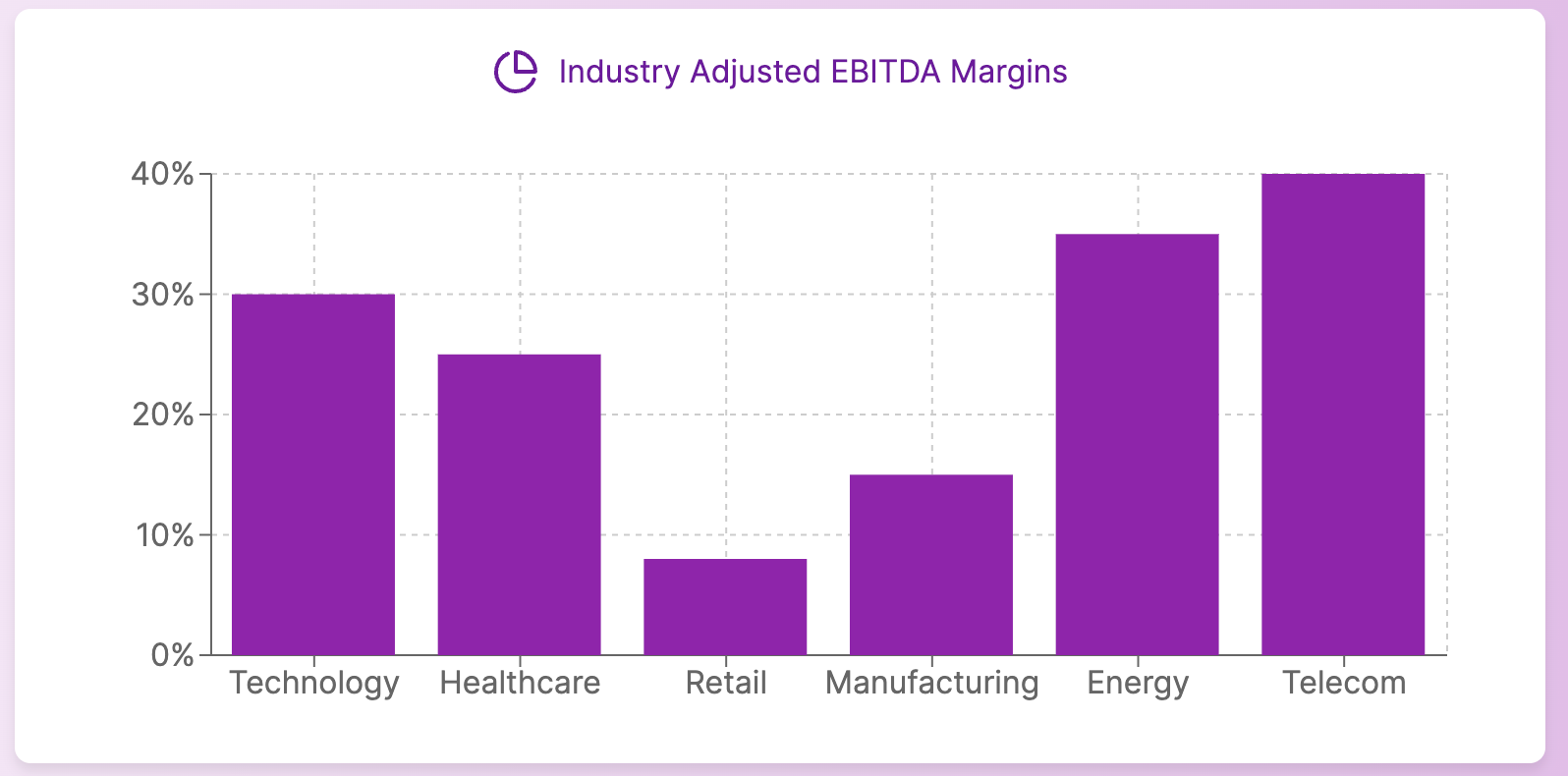

Q4: What is a good adjusted EBITDA percentage?

A "good" Adjusted EBITDA percentage (or margin) can vary widely depending on the industry and the company's stage of growth. Generally, a higher Adjusted EBITDA margin indicates better operational efficiency. However, it's important to consider:

- Industry norms: Some industries naturally have higher margins than others.

- Company lifecycle: Growing companies might have lower margins as they invest in expansion.

- Comparative analysis: How does the company's Adjusted EBITDA margin compare to its peers?

- Trend analysis: Is the company's Adjusted EBITDA margin improving over time?

As a rough guideline:

- Below 10%: May be considered low for many industries

- 10-20%: Often seen as average

- Above 20%: Generally considered good

- Above 40%: Exceptional in many industries

However, these are generalizations, and it's crucial to analyze Adjusted EBITDA in the context of the specific company, its industry, and its growth stage.

Remember, while Adjusted EBITDA is a useful metric, it should always be considered alongside other financial metrics and within the broader context of the company's financial statements and business model.