Perhaps, foreign investors will finally understand I’ve ever told that PBR is a speculative asset and it cannot be called an investment.

In January, I wrote in our first edition of Food for Thought that I owned PBR and gave a good overview of the company in a different post.

I mentioned that PBR was just a short-term trade, sold it a couple of weeks later, and shorted the stock in March, pairing the trade with a long position in XOP.

In time: I’m exiting the trade.

I received a few e-mails complaining about my call that I had modeled a 20% IRR, etc. However, unfortunately, PBR is not a company like many others.

It’s a Stated-Owned-Company with a history of populist interference in its management. Because of that, nobody’s cash flow should be trusted.

One of the most essential components of estimating a free cash flow is durability. So if we have a great product, excellent management, and a great business that allows a high degree of predictability, we should really take the DCF more seriously.

However, the O&G industry is probably one of the most globally challenging industries because oil prices are volatile. Therefore, even for competent management, it’s hard to create and keep on track of strategic planning.

Considering that, I bet that PBR probably is one of the worst performers amongst E&P companies in the world in 10 years period. The problem relies on management turnover.

It’s impossible to think about the long-term in a company whose CEO turnover is 1.7 years. So I’ll say that again: historically, Petrobras changes its CEO every 1.7 years.

The CEO probably joins the company and starts contacting head hunters prospecting the next job because there is no time to catch up with the operation and formulate long-term strategic planning.

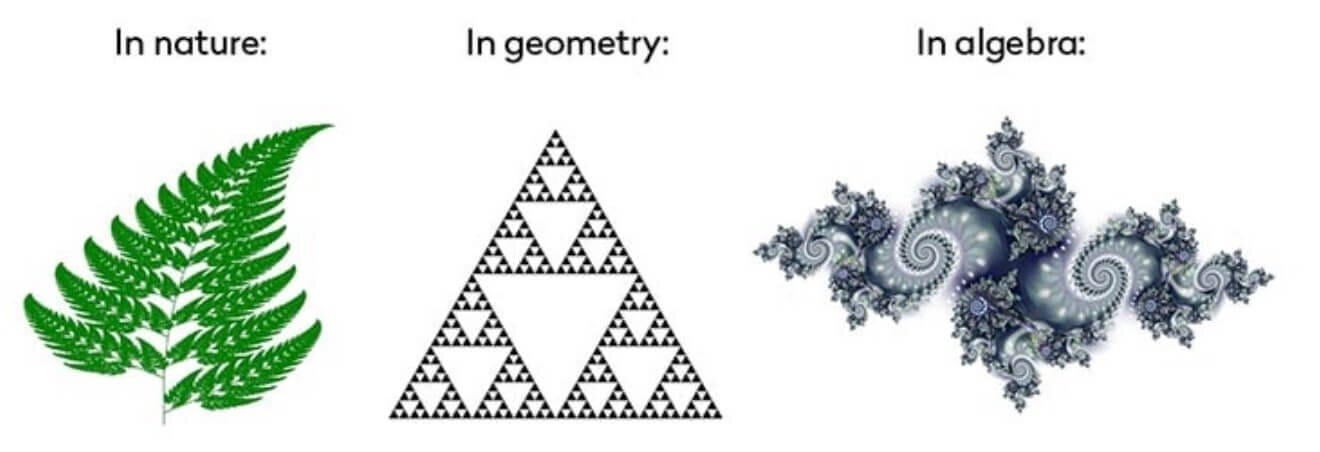

Finally, before moving on, I’d like to tell you quickly about one of my favorite scientists, Benoit Mandelbrot, the father of fractals.

It happens that Mandelbrot likes economics. He explains that international economies can be considered a single system, wherein each part influences the others.

Much like the atmosphere, the economy is a complex system in which we see only the visible outcomes—rain or shine, boom or bust.

This is actually why sharing Giro’s Newsletter is impactful. You may think it means nothing, but as Mandelbrot explained, you can also be part of something greater.

Before we move on to the latest news about PBR, we’ll give some context about CEO changes in the past 12 months.

In 2021, Mr. Roberto Castelo Branco, forme PBR’s CEO, was invited by the Mines and Energy Minister and Economy Miniter to give his opinion about fuel prices.

Mr. Castelo Branco said that higher prices weren’t his problem, but President Bolsonaro disliked his answer and fired him.

On the following day, PBR announced a new general meeting, and Mr. Castelo Branco was succeeded by Mr. Joaquim Silva e Luna, General from the Army and former Defence Minister and former Director of the Itaipu Binacional company.

Then the last time we wrote about PBR was in March. At that time, Mr. Bolsonaro considered firing Mr. Luna and Silva and looking for potential prospects.

Bolsonaro fired Mr. Luna e Silva and appointed Mr. José Mauro Coelho as the new PBR’s CEO in early April of 2022.

After firing Mr. Luna and Silva, Bolsonaro also fired his Ministry of Energy after PBR announced a subsequent increase in Diesel prices.

Not satisfied, 40 days after being nominated, Bolsonaro decided to fire Mr. Coelho, appointing Mr. Caio Mario Paes de Andrade as the new CEO.

Unfortunately, sell-side analysts can’t write this, but Mr. Bolsonaro's influence on Petrobras as a political instrument for his reelection.

The playbook is crystal clear. Appoint a new CEO urging lower fuel pricing, wait until he tells you that PBR’s bylaws don’t allow that, become the next Messiah, and remove that villain from the post, becoming everybody’s hero.

This situation is outrageous. Mr. Caio will be the 41st PBR’s CEO in its 68 years of existence. Even worse, the 4th CEO under Bolsonaro’s mandate (3rd in 2022).

Mr. Caio has a solid academic background (Duke, Harvard), although he’s never worked with an oil and gas company. Now, he has to run one of the biggest companies in LatAm.

Optimist Echo

Mr. Paes is close to Economy Minister Guedes, the current Secretary of Debureaucratization in the Economy Ministry and a person appointed by Guedes for the position.

We expect no changes in Petrobras' pricing policy or overall strategy,, considering its complexity even though the latter is cracked.

Mr. Caio is under a lot of pressure in this situation. It is becoming more evident that additional fuel price increases will hardly be tolerated amid the current high inflation backdrop.

The government is increasingly aware that it has little say in the company's daily decisions and that the political burden associated with high fuel prices falls almost entirely on itself.

A more optimistic investor may argue that this situation also favors the privatization thesis, and Bolsonaro’s government is liberal, after all.

Reality Will Come Up

Privatization in an election year? In Brazil? Really? Well, wish you luck with that.

What is being discussed in the newspaper is that the government is evaluating changes that go beyond PBR’s CEO position.

So far, we believe relevant investors have been willing to hold the position in PBR due to i) higher than expected dividends and ii) the operating team is intact.

Even though the long-term strategic plan was put aside, a technical team runs daily ops and ensures that PBR will operate to higher standards.

We'd bet on the latter between believing that Bolsonaro will take the political risk of privatizing a company in an election year or the populism stance will keep ruling the company.

Good Luck, Mr. CEO

Someone posted on Twitter if Mr. Coelho could list on his LinkedIn that he was PBR’s CEO for almost two months. Well, why not…

The same will be valid for the new CEO, Mr. Caio. If Bolsonaro doesn’t fire him in the following weeks because oil prices are above US$100/bbl, and the opposition wins the election, he’ll get fired anyway.

There's so far little that we can say about what he thinks about PBR or how he sees the company positioned to balance its role as a significant player in the local fuels market. At the same time, it needs to address the interests of all shareholders.

Again, the reality is that Mr. Caio’s view doesn’t matter, though it should mean something. If he doesn’t comply with Bolsonaro, he’ll get fired.

He’s facing a tough dilemma: how to preserve his own job while following the company's policies and without jeopardizing Brazil's fuel availability? In our opinion, only if oil prices collapse and the BRL appreciates versus the USD.

Finally, although PBR's corporate governance has avoided more direct interference, we fear that the real test is yet to come.

As happened in the dark past, maintaining prices to IPP is crucial for a healthy duel supply in Brazil, which relies on imports for meeting the demand.

We believe bringing prices to IPP is essential to maintain a healthy fuel supply for the country, which relies on imports so that supply is enough to meet demand.

Remember: freezing fuel prices to stabilize inflation is good as adding gas to a fire.