Understanding Insolvencies: Navigating Financial Distress in the Business World

In today's complex economic landscape, the term "insolvencies" frequently appears in financial news, leaving many wondering about its implications for businesses, individuals, and the broader economy. This comprehensive guide delves into the intricacies of insolvencies, exploring their definition, underlying causes, and far-reaching impact on various stakeholders.

Decoding Insolvency: More Than Just a Financial Hiccup

Insolvency is a critical concept in the business world, representing a state of financial distress where an entity—be it a company or an individual—can no longer meet its financial obligations as they fall due. It's crucial to distinguish insolvency from mere temporary cash flow issues. While the latter might be resolved with short-term measures, insolvency often signals deeper, more systemic problems within an organization's financial structure.

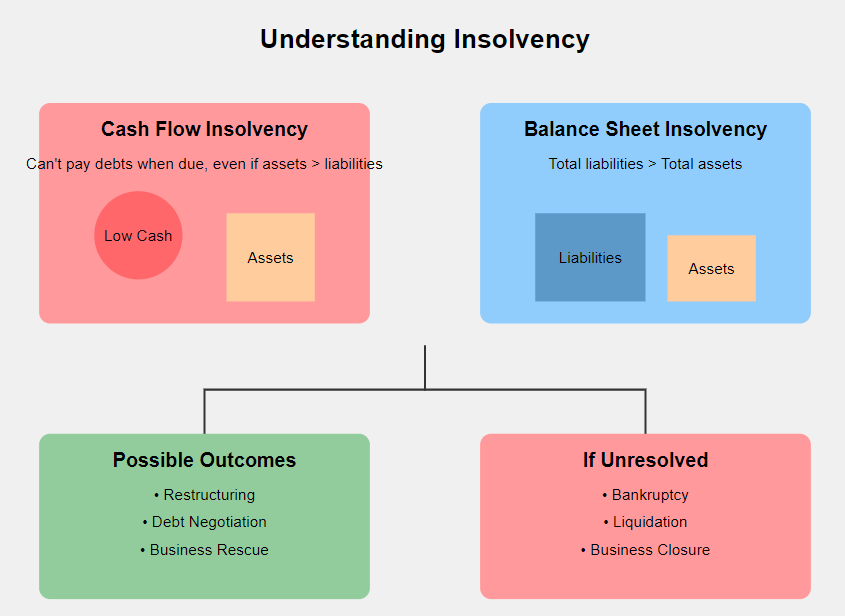

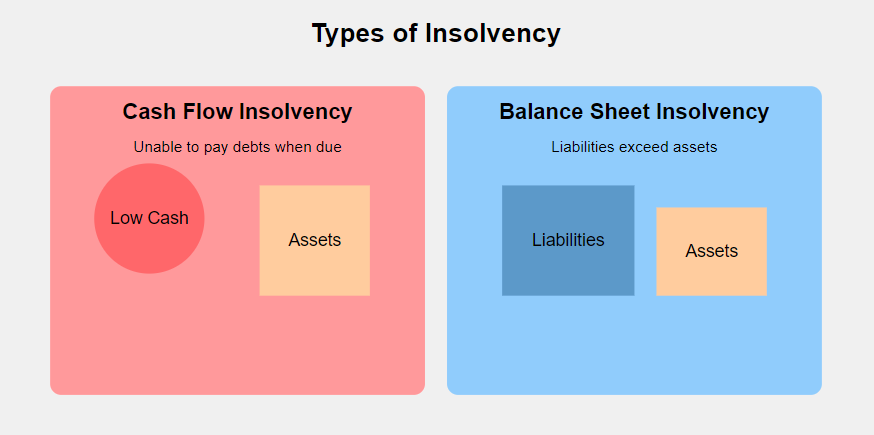

At its core, insolvency occurs when liabilities exceed assets, or when current debts cannot be paid using available funds. This state can manifest in two primary forms: cash flow insolvency and balance sheet insolvency. Cash flow insolvency arises when a company lacks the liquidity to pay its debts as they become due, even if its assets theoretically outweigh its liabilities. On the other hand, balance sheet insolvency occurs when a company's liabilities exceed its assets, indicating a fundamental imbalance in its financial position.

Understanding these nuances is crucial for businesses, creditors, and investors alike. It's not just about recognizing when a company is in trouble, but also about identifying potential red flags before the situation becomes irreversible. Early detection can mean the difference between a successful turnaround and a complete financial collapse.

The Two Faces of Insolvency: Cash Flow and Balance Sheet

To further clarify the concept of insolvencies, let's delve deeper into the two main types: cash flow insolvency and balance sheet insolvency.

Maintaining positive free cash flow is essential for avoiding cash flow insolvency.

Cash Flow Insolvency: When Liquidity Runs Dry

Cash flow insolvency occurs when a business is unable to pay its debts as they fall due, despite potentially having more assets than liabilities. This type of insolvency is often a result of poor cash flow management or unexpected financial shocks. For example, a company might have significant accounts receivable but not enough cash on hand to pay its immediate debts. In this scenario, the business is cash flow insolvent but may not necessarily be balance sheet insolvent.

Understanding balance sheet insolvency is crucial for assessing a company's financial health

Balance Sheet Insolvency: When Liabilities Outweigh Assets

Balance sheet insolvency, on the other hand, occurs when a company's total liabilities exceed its total assets. This means that even if the company were to sell all its assets, it would still not have enough money to pay off its debts. A company can be balance sheet insolvent while still managing to pay its debts in the short term, often through credit or new investment. However, this situation is unsustainable in the long run without significant restructuring or improvement in the company's financial position.

The Perfect Storm: Unraveling the Causes of Insolvency

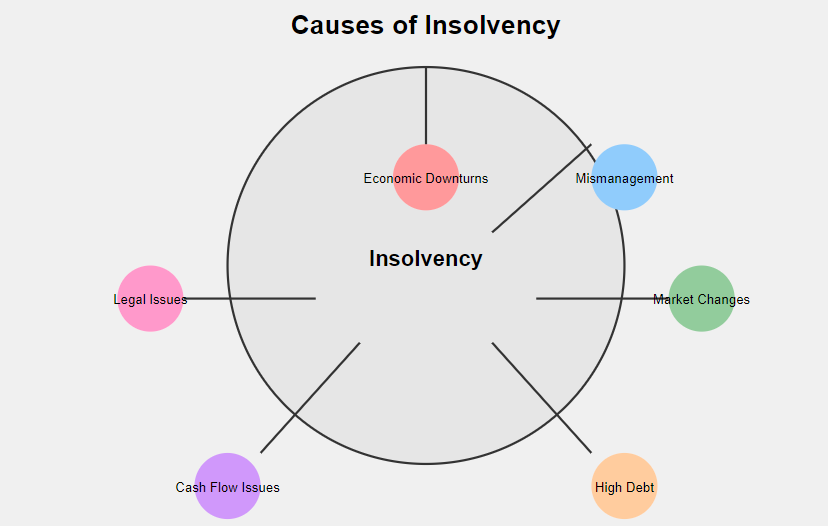

Insolvencies rarely stem from a single factor; instead, they're often the result of a complex interplay of internal and external forces. By examining these causes, businesses can better fortify themselves against potential financial distress and stakeholders can make more informed decisions.

Economic Downturns and Market Volatility

One of the most significant external factors contributing to insolvencies is the broader economic environment. During economic downturns, businesses often face reduced consumer spending, tightened credit markets, and increased uncertainty. Industries that are cyclical or heavily dependent on discretionary spending are particularly vulnerable. For instance, the travel and hospitality sectors saw a sharp rise in insolvencies during the COVID-19 pandemic, as global travel restrictions and lockdowns severely impacted their revenue streams.

Market volatility can also play a crucial role in pushing companies towards insolvency. Sudden shifts in commodity prices, exchange rates, or interest rates can wreak havoc on a company's financial planning. A manufacturer heavily reliant on imported raw materials might find itself in dire straits if currency fluctuations dramatically increase its costs overnight, potentially leading to cash flow insolvency if the company cannot pay its debts.

Market volatility can significantly impact a company's financial stability and increase the risk of insolvency.

Mismanagement and Poor Financial Planning

Internal factors, particularly mismanagement and inadequate financial planning, are often at the heart of many insolvencies. This can manifest in various ways within business operations:

Overexpansion: Companies sometimes fall into the trap of expanding too rapidly without a solid financial foundation. This can lead to overextension of resources and an inability to meet increased operational costs, potentially resulting in the company becoming balance sheet insolvent.

Inadequate cash flow management: Poor management of working capital, including inefficient inventory control or lax credit policies, can quickly lead to liquidity issues. This mismanagement of cash flow can push a business towards insolvency, even if it appears profitable on paper.

High debt leverage: While debt can be a useful tool for growth, excessive leverage leaves companies vulnerable to market downturns and interest rate hikes. If a company takes on too much debt and is unable to service these debt obligations, it may find itself insolvent and unable to pay its debts as they fall due.

Failure to adapt: In today's fast-paced business environment, companies that fail to innovate or adapt to changing market conditions risk becoming obsolete. The retail sector, for instance, has seen numerous insolvencies as companies struggled to adapt to the shift towards e-commerce, leading to both cash flow and balance sheet insolvency issues.

Regulatory Changes and Legal Challenges

The regulatory landscape can significantly impact a company's financial health and potentially lead to insolvency. New regulations might require substantial investments in compliance, eating into profits. For example, stricter environmental regulations might necessitate expensive upgrades to manufacturing processes, potentially pushing financially strained companies over the edge and making them unable to pay their debts.

Legal challenges, such as major lawsuits or patent disputes, can also lead to insolvency. These not only drain financial resources but can also damage a company's reputation and future prospects. In some cases, a single large lawsuit settlement can be enough to render a company insolvent, especially if it doesn't have enough cash or assets to cover the judgment.

The Ripple Effect: Understanding the Impact of Insolvencies

The impact of insolvencies extends far beyond the insolvent entity itself, creating a ripple effect that touches various stakeholders and the broader economy. Understanding these consequences is crucial for businesses, policymakers, and investors alike.

Employees: The Human Cost of Insolvency

Perhaps the most immediate and personal impact of insolvencies is felt by employees. Job losses are often an unfortunate consequence when a company becomes insolvent, leading to financial distress for individuals and families. Even in cases where jobs are preserved through restructuring or acquisition, employees may face reduced hours, pay cuts, or loss of benefits.

The psychological impact on employees shouldn't be underestimated. The stress and uncertainty associated with potential job loss can lead to decreased productivity and morale, potentially exacerbating the company's problems. Moreover, the skills and experience of displaced workers may not be easily transferable, particularly in specialized industries, leading to longer-term unemployment issues.

Creditors and Suppliers: A Domino Effect

Insolvencies can trigger a domino effect throughout the supply chain. When an insolvent company is unable to pay its debts, its creditors, including banks and bondholders, may face significant losses. This can potentially lead to tightened lending practices that affect other businesses. Suppliers, especially those heavily dependent on the insolvent company, may find themselves with unpaid invoices and excess inventory, potentially pushing them towards financial distress as well.

This interconnectedness means that the insolvency of a major player in an industry can have far-reaching consequences. For example, the collapse of a large construction firm might leave numerous subcontractors and material suppliers struggling, potentially leading to a wave of secondary insolvencies. In such cases, the company's creditors may need to engage in the insolvency process to recover at least a portion of what they're owed.

Investors and Shareholders: Eroded Confidence and Financial Losses

For investors and shareholders, insolvencies often result in significant financial losses. In many cases, shareholders are last in line to receive any remaining assets after creditors have been paid, often leading to a total loss of their investment. This can erode confidence in the market, potentially leading to reduced investment in similar companies or sectors.

The impact on institutional investors, such as pension funds, can be particularly concerning. Significant losses can affect the retirement savings of many individuals, highlighting the broader societal impact of major insolvencies. This underscores the importance of robust insolvency law frameworks that balance the interests of various stakeholders.

Economic and Social Implications

On a macro level, insolvencies can have significant economic and social implications. A wave of insolvencies can lead to increased unemployment, reduced consumer spending, and a general slowdown in economic activity. This can create a negative feedback loop, potentially triggering more insolvencies and broader economic challenges.

Moreover, the social impact of insolvencies, particularly in regions heavily dependent on a single large employer, can be profound. Communities may face not only economic hardship but also social challenges as unemployment rises and local businesses struggle. In such cases, government intervention through specialized programs or support may be necessary to mitigate the impact and help affected regions recover.

Navigating the Storm: Strategies for Managing and Preventing Insolvency

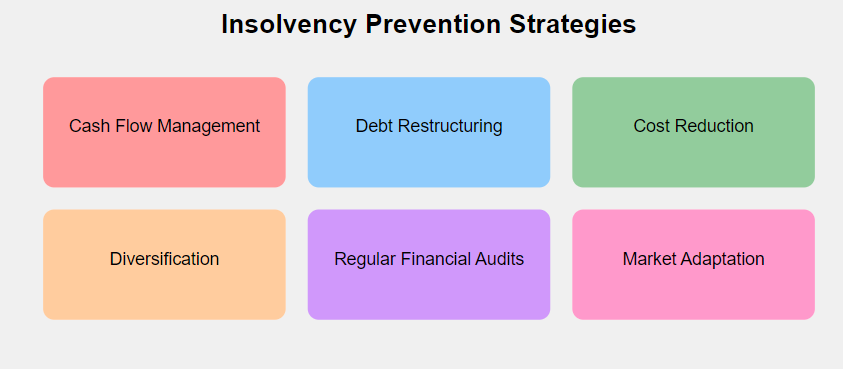

While the specter of insolvency can be daunting, there are strategies that businesses, policymakers, and stakeholders can employ to manage and prevent financial distress. These approaches focus on maintaining solvency and ensuring businesses can continue as a going concern.

Early Warning Systems and Proactive Management

For businesses, implementing robust financial monitoring systems is crucial to avoid becoming insolvent. Regular financial health checks, stress testing, and scenario planning can help identify potential issues before they become critical. This proactive approach allows companies to take corrective action early, whether through cost-cutting measures, restructuring, or seeking additional financing.

Key indicators to monitor include:

- Cash flow projections: Regularly updating and analyzing cash flow forecasts can help businesses anticipate and address potential liquidity issues before they lead to cash flow insolvency.

- Debt-to-equity ratio: Keeping a close eye on this ratio can help companies maintain a healthy balance between debt and equity financing, reducing the risk of becoming overleveraged and unable to pay debts.

- Working capital management: Efficient management of inventory, accounts receivable, and accounts payable can significantly improve a company's cash position and reduce the risk of insolvency.

- Market trends and competitive landscape: Staying attuned to industry changes and competitive pressures can help businesses adapt their strategies and avoid obsolescence.

Restructuring and Turnaround Strategies

When a company finds itself on the brink of insolvency, restructuring can be a viable option to avoid bankruptcy. This might involve renegotiating debt terms, selling off non-core assets, or implementing operational changes to improve efficiency. In some cases, entering into formal insolvency proceedings, such as Chapter 11 bankruptcy in the United States, can provide breathing room for a company to reorganize and emerge stronger.

Effective restructuring strategies may include:

- Debt restructuring: Negotiating with creditors to extend payment terms, reduce interest rates, or convert debt to equity can help alleviate immediate financial pressure.

- Operational restructuring: Streamlining operations, closing underperforming units, and focusing on core competencies can improve profitability and cash flow.

- Asset sales: Divesting non-core assets can generate cash to pay down debt and refocus the business on its most profitable activities.

- Management changes: In some cases, bringing in new leadership with turnaround experience can provide fresh perspectives and strategies to overcome financial challenges.

Policy and Regulatory Considerations

Policymakers play a crucial role in managing the broader impact of insolvencies. This can include implementing policies to support struggling businesses, such as temporary tax relief or government-backed loans during economic downturns. Additionally, ensuring that insolvency laws strike the right balance between protecting creditor rights and allowing for business rehabilitation is crucial for a well-functioning economy.

Key policy considerations may include:

- Modernizing insolvency laws: Regularly updating insolvency legislation to reflect changing business realities and international best practices can help facilitate more effective resolutions to financial distress.

- Promoting alternative dispute resolution: Encouraging mediation and other forms of alternative dispute resolution can help businesses and creditors reach mutually beneficial agreements outside of formal court processes.

- Supporting SMEs: Developing specific policies and support mechanisms for small and medium-sized enterprises, which often lack the resources of larger corporations, can help prevent unnecessary insolvencies and preserve economic diversity.

- Cross-border cooperation: In an increasingly globalized economy, enhancing cooperation between different countries' insolvency regimes can help address the challenges of cross-border insolvencies more effectively.

Building Resilience in the Business Ecosystem

Creating a more resilient business ecosystem involves efforts from various stakeholders. This includes:

- Diversification: Both businesses and investors can reduce risk through diversification, whether in terms of product lines, customer base, or investment portfolios. This can help mitigate the impact of sector-specific downturns or the loss of key clients.

- Education and support: Providing resources and education on financial management, particularly for small and medium-sized enterprises, can help prevent insolvencies. This could include workshops on cash flow management, access to financial advisory services, or mentorship programs pairing experienced business leaders with newer entrepreneurs.

- Innovation and adaptability: Fostering a culture of innovation and adaptability within businesses and industries can help them weather changing market conditions. This might involve investing in research and development, encouraging continuous learning among employees, or creating flexible business models that can quickly adapt to market shifts.

- Strong corporate governance: Implementing robust corporate governance practices can help businesses make more informed decisions, manage risks effectively, and maintain the confidence of investors and creditors.

- Sustainable business practices: Adopting sustainable and ethical business practices can enhance long-term viability and resilience, reducing the risk of reputational damage or regulatory challenges that could lead to insolvency.

The Role of Insolvency Practitioners and Liquidators

When a company becomes insolvent, insolvency practitioners and liquidators play a crucial role in managing the insolvency process. These professionals are typically appointed by the court or the company's creditors to oversee the affairs of the insolvent company and ensure that the interests of all stakeholders are considered.

Insolvency Practitioners

Insolvency practitioners are licensed professionals who specialize in managing insolvencies. Their role includes:

- Assessing the company's financial situation: They conduct a thorough review of the company's assets, liabilities, and cash flow to determine the best course of action.

- Developing a restructuring plan: If there's a possibility of saving the business, the insolvency practitioner may propose a restructuring plan to creditors.

- Negotiating with creditors: They work to reach agreements with creditors, which may involve proposing reduced payments or extended payment terms.

- Overseeing the insolvency proceedings: This includes ensuring compliance with insolvency law and managing the day-to-day affairs of the company during the process.

Liquidators

If a company cannot be saved and must be wound up, a liquidator is appointed. The liquidator's primary responsibilities include:

- Realizing assets: The liquidator sells the company's assets to generate funds for distribution to creditors.

- Investigating the company's affairs: This includes examining the actions of directors and identifying any potential wrongdoing that may have contributed to the insolvency.

- Distributing funds to creditors: The liquidator ensures that available funds are distributed to creditors in accordance with the priority order established by insolvency law.

- Closing down the company: Once all assets have been realized and funds distributed, the liquidator oversees the formal dissolution of the company.

The work of insolvency practitioners and liquidators is critical in ensuring that the insolvency process is managed fairly and efficiently, maximizing returns for creditors while also considering the interests of other stakeholders.

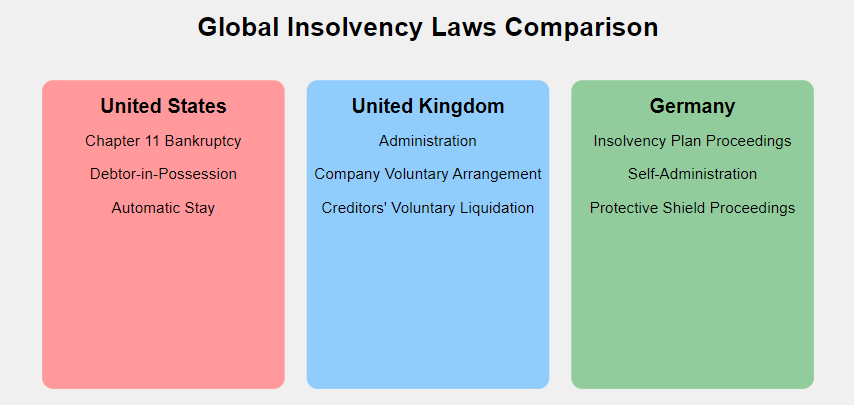

International Perspectives on Insolvency

Insolvency laws and practices can vary significantly from country to country, reflecting different legal traditions, economic priorities, and cultural attitudes towards debt and business failure. Understanding these differences is crucial for businesses operating in multiple jurisdictions and for policymakers seeking to improve their national insolvency frameworks.

Key Differences in Insolvency Regimes

- Debtor vs. Creditor Friendly Systems: Some countries, like the United States with its Chapter 11 bankruptcy process, have insolvency systems that are relatively debtor-friendly, focusing on business rescue and reorganization. Others, like the United Kingdom, have traditionally been more creditor-friendly, although reforms have sought to strike a balance.

- Personal Liability: In some countries, directors can be held personally liable for trading while insolvent, which can influence decision-making around when to initiate insolvency proceedings.

- Employee Rights: The treatment of employee claims in insolvency can vary widely. In some countries, employee wages are given priority over other unsecured creditors, while in others, they may rank equally with other claims.

- Cross-Border Insolvency: With the increase in international trade, many countries have adopted the UNCITRAL Model Law on Cross-Border Insolvency to facilitate cooperation in cross-border insolvency cases.

The Role of Insurance in Mitigating Insolvency Risks

While not a solution to fundamental financial problems, insurance policies can help businesses manage certain risks that could lead to insolvency. Various types of insurance can provide a financial safety net, potentially preventing a company from becoming unable to pay its debts due to unexpected events.

Key insurance types for businesses include:

- Business Interruption Insurance: Covers ongoing expenses and lost income if a business is forced to close temporarily.

- Credit Insurance: Protects against bad debts, helping maintain cash flow if customers fail to pay.

- Directors and Officers (D&O) Insurance: Protects company leaders from personal liability in case of lawsuits.

- Professional Indemnity Insurance: For service-based businesses, protects against claims of negligence or malpractice.

While insurance cannot prevent all instances of insolvency, it can provide a crucial buffer against certain financial shocks, helping businesses maintain solvency in challenging circumstances.

Conclusion: Navigating the Complex World of Insolvencies

Understanding insolvencies is crucial in today's dynamic business environment. Whether you're a business owner, investor, creditor, or policymaker, grasping the intricacies of insolvency can help you make more informed decisions and contribute to a more resilient economic ecosystem.

From recognizing early signs of financial distress to understanding the legal and practical implications of insolvency proceedings, knowledge in this area is invaluable. As we've seen, insolvencies are not just about financial numbers – they have far-reaching impacts on employees, communities, and entire industries.

As the business world evolves, so too will approaches to managing and preventing insolvencies. Staying informed about trends, legal changes, and best practices in this field is essential for anyone involved in the business world.

Remember, while insolvency can be challenging, it can also serve as a mechanism for restructuring and renewal. Many businesses have emerged from insolvency proceedings stronger and more resilient. By understanding the process and options available, businesses can be better prepared to navigate financial difficulties and, ideally, avoid insolvency altogether.

The goal is not just to avoid insolvency, but to build robust, adaptable businesses that can weather economic storms and continue to provide value to their stakeholders and society at large. With the right knowledge, strategies, and support, this goal is within reach for businesses of all sizes and across all sectors.

Frequently Asked Questions

What does insolvency mean?

Insolvency refers to a financial state where an individual or business is unable to pay their debts when they fall due. This can occur either because they don't have enough cash flow to meet their immediate debt obligations (cash flow insolvency) or because their total liabilities exceed their total assets (balance sheet insolvency). Insolvency is a serious financial condition that often precedes bankruptcy, though not all insolvent entities necessarily go bankrupt.

What happens when you go into insolvency?

When a business goes into insolvency, several things can happen:

- Formal declaration of insolvency

- Appointment of an insolvency practitioner

- Attempts at restructuring

- Asset liquidation (if restructuring fails)

- Distribution of funds to creditors

- Potential closure of the business

Throughout this process, the insolvent company may face restrictions on its operations, and its management may lose control to the appointed insolvency practitioner.

What is an example of insolvency?

Consider a fictional retail chain, "MainStreet Stores," struggling with declining sales due to online competition. Despite decreasing revenues, the company maintains its extensive network of physical stores, resulting in high fixed costs. It has also taken on significant debt to fund attempted turnaround strategies.

As sales continue to decline, MainStreet Stores cannot pay its suppliers, landlords, and employees on time. Its debts have accumulated to the point where they exceed the value of its assets.

In this scenario, MainStreet Stores is experiencing both cash flow insolvency (it cannot pay its immediate debts) and balance sheet insolvency (its liabilities exceed its assets). The company might attempt to negotiate with its creditors, close underperforming stores, or seek new investment. If these efforts fail, MainStreet Stores may need to enter formal insolvency proceedings, potentially leading to restructuring or liquidation.

What qualifies as insolvency?

Insolvency is generally qualified under two main criteria:

- Cash Flow Insolvency: A business or individual is unable to pay their debts as they fall due, even if their assets exceed their liabilities.

- Balance Sheet Insolvency: The total liabilities of a business or individual exceed their total assets.

Factors that might indicate insolvency include consistently late or missed payments to creditors, maxed out credit lines, inability to meet payroll or other essential expenses, receiving legal notices from creditors, and selling assets at a loss to meet short-term obligations.

What is insolvency in simple words?

In simple terms, insolvency means not having enough money to pay your debts when they're due. For a business, it means the company can't pay its bills, employees, or other debts on time. This can happen even if the company owns valuable assets because those assets can't be quickly turned into cash to pay debts. Insolvency is a serious problem that often leads to a business shutting down if it can't find a way to get more money or reduce what it owes.