Understanding Marginal Price: Definition, Formula, and Examples

In the complex world of economics and business, understanding key concepts like marginal price is crucial for making informed decisions. Whether you're a business owner, investor, or simply someone interested in economics, grasping the intricacies of marginal price can provide valuable insights into pricing strategies and production decisions. This comprehensive guide will delve into the definition of marginal price, its relationship with marginal cost, and how it applies in real-world scenarios.

What is Marginal Cost?

Before we can fully understand marginal price, we need to explore the concept of marginal cost. Marginal cost is a fundamental economic principle that plays a vital role in business decision-making and pricing strategies.

Definition of Marginal Cost

Marginal cost definition refers to the additional cost incurred by a business when it increases production by one unit. In other words, it represents the change in total production cost that comes from making or producing one more unit of a product or service. This concept is crucial because it helps businesses determine the optimal level of production and pricing.

Marginal cost includes all costs that vary with the level of production. These are typically direct costs associated with producing an additional unit, such as raw materials and labor. It’s important to note that marginal cost does not include fixed costs, which remain constant regardless of the production level.

Before you dive into our in-depth analysis, we have a quick request:

If you find this content useful, please consider sharing it!

Why? Your shares help us reach a wider audience, allowing us to continue producing high-quality, comprehensive content like this—completely free, with no paywalls or subscriptions.

Thank you for your support!

The Importance of Marginal Cost

Understanding marginal cost is essential for several reasons:

- Production decisions: It helps businesses determine whether increasing production is profitable.

- Pricing strategies: Marginal cost informs pricing decisions to ensure profitability.

- Resource allocation: It guides businesses in efficiently allocating resources.

- Competitive advantage: Understanding marginal cost can help businesses stay competitive in the market.

Marginal Cost Formula and Calculation

To effectively use the concept of marginal cost in business decisions, it's crucial to understand how to calculate it. The marginal cost formula is straightforward but powerful in its applications.

The Marginal Cost Formula

The formula for calculating marginal cost is:

Marginal Cost = Change in Total Cost / Change in Quantity

Or, expressed mathematically:

MC = ΔTC / ΔQ

Where:

- MC is the marginal cost

- ΔTC is the change in total cost

- ΔQ is the change in quantity

How to Calculate Marginal Cost

To perform a marginal cost calculation, follow these steps:

- Determine the change in total cost: Calculate the difference between the total cost of producing n+1 units and the total cost of producing n units.

- Determine the change in quantity: In most cases, this will be 1 unit, but it can vary depending on the specific scenario.

- Divide the change in total cost by the change in quantity.

For example, if a company’s total cost increases from $1,000 to $1,080 when production increases from 100 to 101 units, the marginal cost would be:

MC = ($1,080 - $1,000) / (101 - 100) = $80

This means it costs the company an additional $80 to produce the 101st unit.

Types of Costs

To fully grasp the concept of marginal cost and its implications, it's essential to understand the different types of costs involved in production. Two main categories of costs are particularly relevant: fixed costs and variable costs.

Fixed Costs

Fixed costs are expenses that remain constant regardless of the level of production. These costs do not change with short-term fluctuations in output and must be paid whether the business produces one unit or a thousand units.

Examples of fixed costs include:

- Rent for facilities

- Salaries for permanent staff

- Insurance payments

- Depreciation of equipment

- Property taxes

Fixed costs are important to consider in overall business planning, but they do not directly affect marginal cost calculations.

Variable Costs

Variable costs, on the other hand, are expenses that change based on the level of production. These costs increase or decrease in proportion to the number of units produced.

Examples of variable costs include:

- Raw materials

- Direct labor costs

- Packaging materials

- Utilities directly related to production

- Commissions for salespeople

Variable costs are crucial in calculating marginal cost, as they directly influence the additional cost of producing one more unit.

Understanding the distinction between fixed and variable costs is essential for accurate marginal cost analysis and informed decision-making in production and pricing strategies.

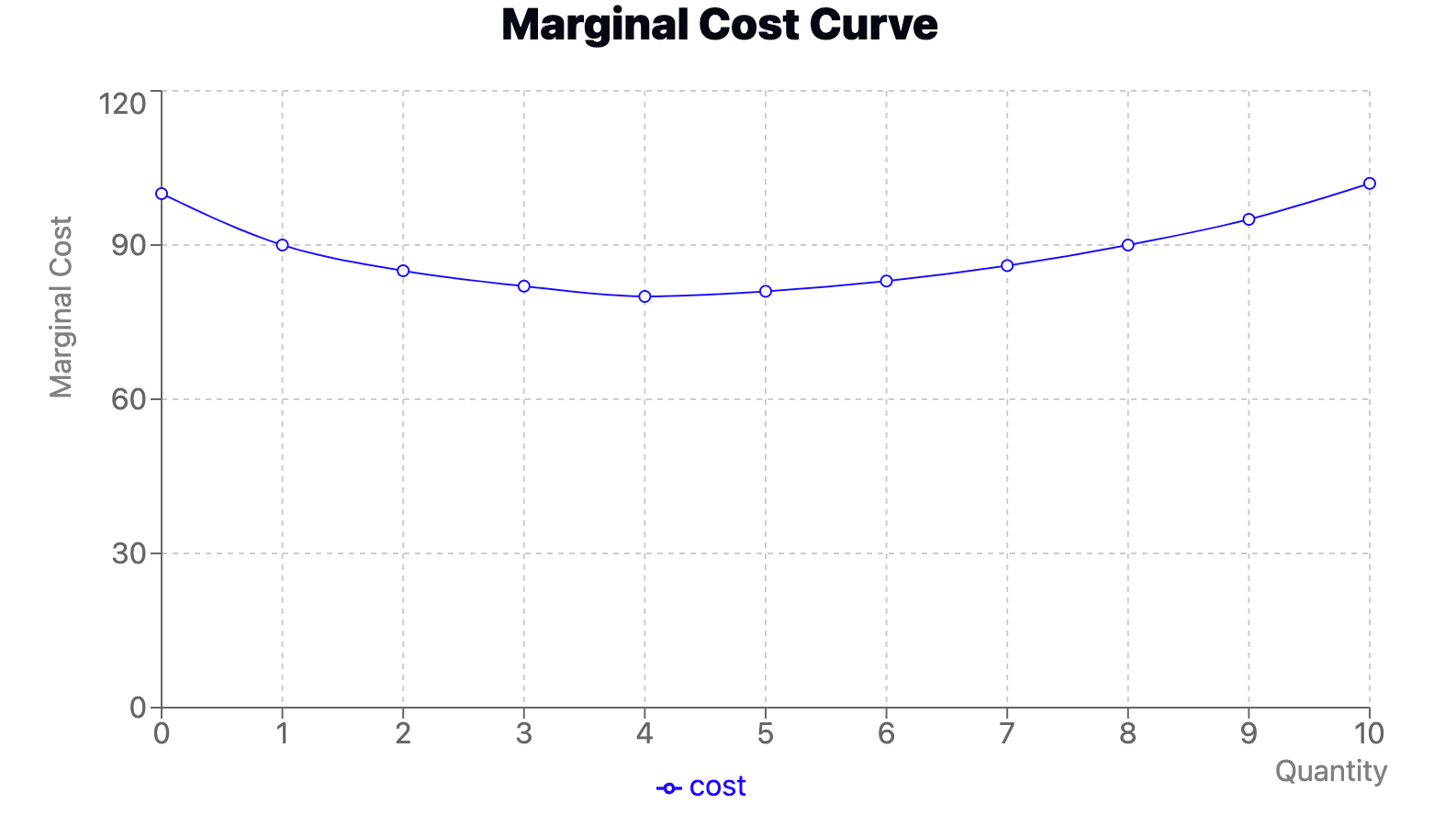

Marginal Cost Curve and Analysis

The marginal cost curve is a graphical representation of how marginal cost changes as production quantity increases. This curve is a powerful tool for businesses to visualize and analyze their production efficiency and make informed decisions about optimal production levels.

Characteristics of the Marginal Cost Curve

Typically, the marginal cost curve is U-shaped, reflecting the following pattern:

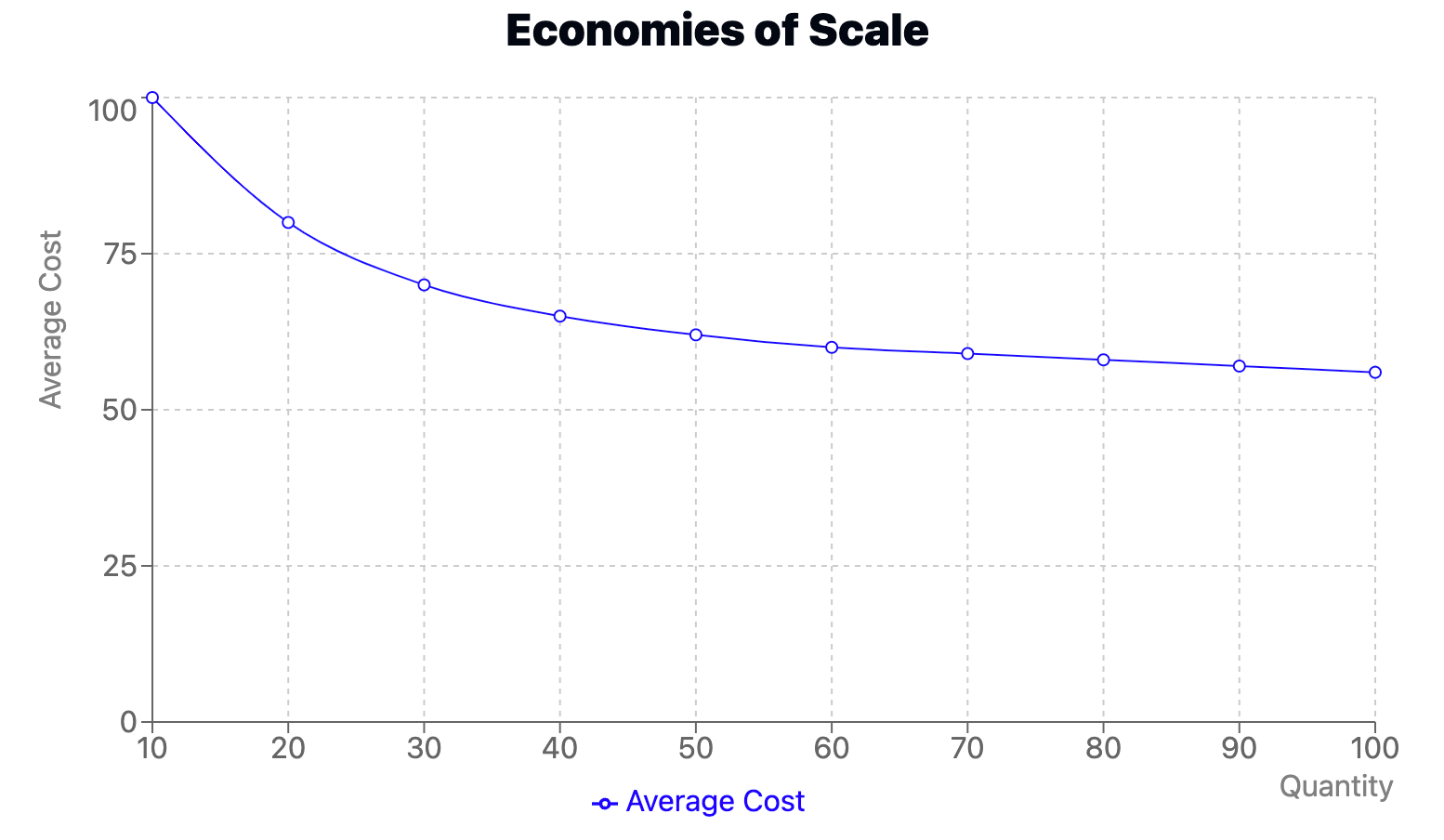

- Initial decrease: As production increases from low levels, marginal cost often decreases due to economies of scale and increased efficiency.

- Minimum point: The curve reaches its lowest point, representing the most efficient level of production volume, where fixed costs are spread over a larger number of units.

- Subsequent increase: As production continues to increase beyond the optimal point, marginal cost begins to rise due to factors like diminishing returns and capacity constraints.

Using the Marginal Cost Curve for Business Insights

The marginal cost curve provides several valuable insights for businesses:

- Optimal production level: The minimum point of the curve indicates the most cost-efficient level of production.

- Economies of scale: The initial downward slope of the curve shows where a business can benefit from economies of scale.

- Diseconomies of scale: The upward slope after the minimum point indicates when a business starts experiencing diseconomies of scale.

- Pricing decisions: By comparing the marginal cost curve with the marginal revenue curve, businesses can determine the profit-maximizing level of output and price.

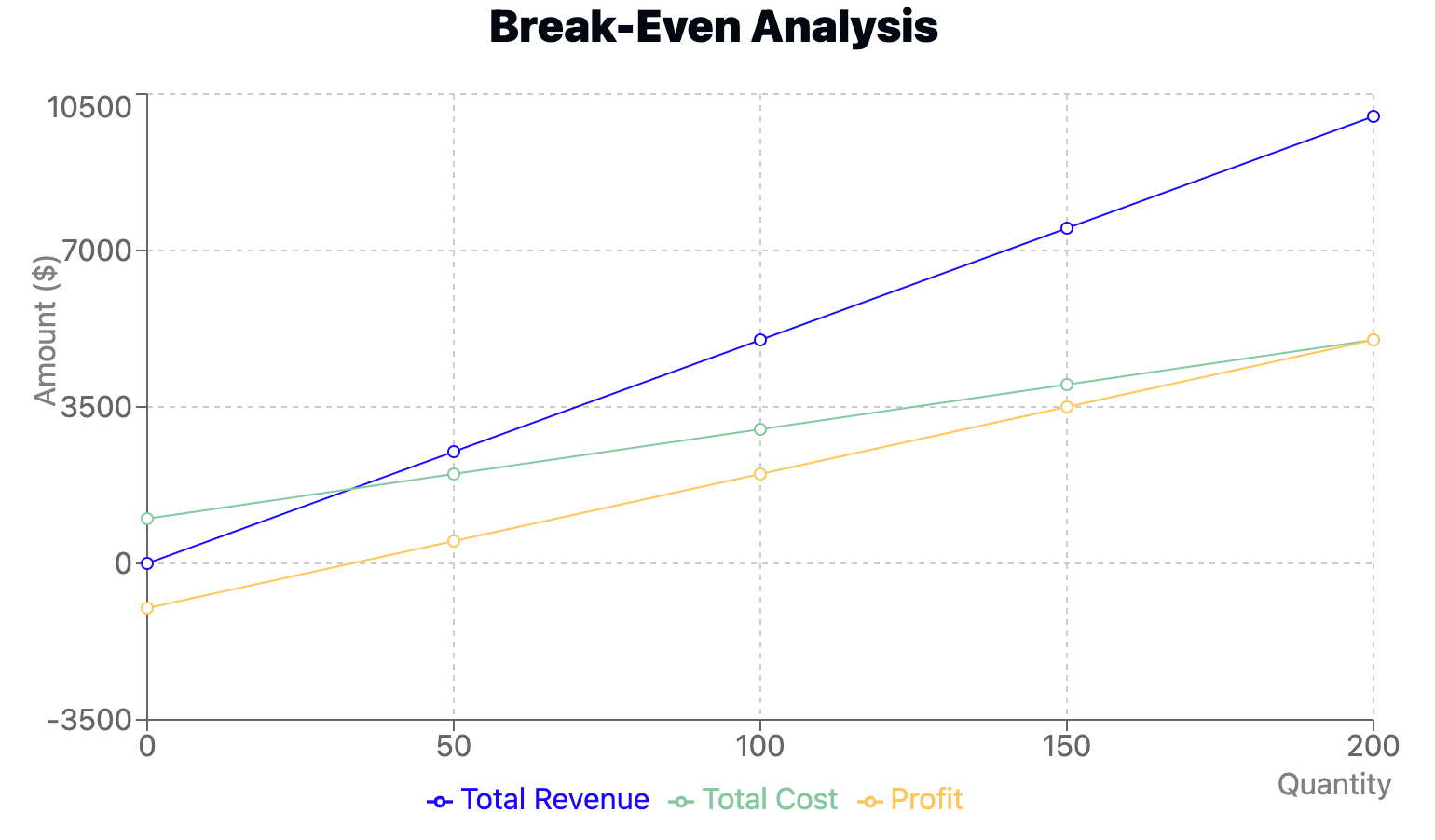

Analyzing the Journey to Profitability

The marginal cost curve can be used to track a product's journey and identify the point at which profit can be realized. By plotting both the marginal cost and average total cost curves, businesses can visualize:

- The break-even point: Where average total cost equals price

- The profit-maximizing point: Where marginal cost equals marginal revenue

- The shut-down point: Where price falls below average variable cost

This analysis helps businesses make informed decisions about production levels, pricing strategies, and whether to continue or cease production of a particular product.

Marginal Cost and Marginal Revenue

Understanding the relationship between marginal cost and marginal revenue is crucial for businesses aiming to maximize their profits. These two concepts work hand in hand to determine the optimal level of production and pricing.

Defining Marginal Revenue

Marginal revenue is the additional revenue generated by selling one extra unit of a product. Like marginal cost, which focuses on the incremental cost resulting from producing additional units, it focuses on the incremental change resulting from producing and selling one more unit.

The formula for marginal revenue is similar to that of marginal cost:

Marginal Revenue = Change in Total Revenue / Change in Quantity

The Intersection of Marginal Cost and Marginal Revenue

The point at which marginal cost equals marginal revenue is of particular importance in economics and business strategy. This intersection represents the optimal production level for profit maximization. Here's why:

- If marginal revenue exceeds marginal cost, producing additional units will increase total profit.

- If marginal cost exceeds marginal revenue, producing additional units will decrease total profit.

- When marginal cost equals marginal revenue, the business has reached the point of maximum profit.

Practical Application

By analyzing the relationship between marginal cost and marginal revenue, businesses can:

- Determine the optimal quantity to produce

- Set prices that maximize profit

- Decide whether to increase or decrease production

- Evaluate the profitability of different product lines

It's important to note that this analysis assumes perfect competition and complete information. In real-world scenarios, businesses must also consider factors such as market demand, competition, and long-term strategic goals.

Benefits of Understanding Marginal Cost

Grasping the concept of marginal cost provides numerous advantages for businesses and decision-makers. Here are some key benefits:

- Informed Production Decisions: Understanding marginal cost helps businesses decide how much to produce and at what point additional production becomes less profitable. This knowledge allows for more efficient resource allocation and production planning.

- Optimal Pricing Strategies: By analyzing marginal cost in relation to marginal revenue, businesses can develop pricing strategies that maximize profitability. This is particularly useful in competitive markets where pricing decisions can significantly impact market share and revenue.

- Cost Control: Marginal cost analysis helps identify areas where costs are increasing rapidly, allowing businesses to focus on cost-saving measures or process improvements in those specific areas.

- Economies of Scale: Knowing marginal costs allows businesses to understand when they can achieve economies of scale. This insight can inform decisions about expanding production or entering new markets.

- Break-Even Analysis: Marginal cost is a crucial component in break-even analysis, helping businesses determine the point at which they start making a profit.

- Competitive Advantage: Companies that effectively use marginal cost analysis can often gain a competitive edge by optimizing their production and pricing more efficiently than their rivals.

- Investment Decisions: Understanding marginal costs can inform decisions about capital investments in new equipment or technology, helping businesses assess whether such investments will lead to cost savings or increased profitability.

By leveraging these benefits, businesses can make more informed decisions, improve their operational efficiency, and ultimately increase their profitability.

Limitations and Considerations

While marginal cost analysis is a powerful tool, it's important to be aware of its limitations and consider other factors when making business decisions. Here are some key points to keep in mind:

- Short-Term Focus: Marginal cost is primarily a short-term concept and may not account for long-term costs or benefits. Decisions based solely on marginal cost analysis might overlook important long-term strategic considerations.

- Assumption of Clear Cost Separation: The marginal cost formula assumes that fixed costs are clearly defined and can be easily separated from variable costs. In practice, this is not always the case, as some costs may have both fixed and variable components.

- Simplification of Complex Realities: Marginal cost analysis often simplifies complex business realities. Factors such as changing technology, market conditions, or regulatory environments may not be fully captured in this analysis.

- Difficulty in Accurate Measurement: In some industries or for certain products, it can be challenging to accurately measure the marginal cost of producing one additional unit, especially when dealing with intangible or knowledge-based products.

- Ignoring Non-Financial Factors: Marginal cost analysis focuses on financial aspects and may not consider other important factors such as customer satisfaction, brand reputation, or environmental impact.

- Applicability in Different Market Structures: The usefulness of marginal cost analysis can vary depending on the market structure. In perfectly competitive markets, it's highly relevant, but in monopolistic or oligopolistic markets, other factors may play a more significant role in pricing decisions.

- Dynamic Nature of Costs: In rapidly changing industries, costs can fluctuate quickly, making it challenging to rely solely on historical marginal cost data for future decision-making.

- Capacity Constraints: Marginal cost analysis may not fully account for capacity constraints that could limit a company's ability to increase production in response to market demands.

While these limitations are important to consider, they don't negate the value of marginal cost analysis. Instead, they highlight the need for a comprehensive approach to decision-making that considers marginal cost alongside other relevant factors and analytical tools.

Real-World Examples of Marginal Cost

To better understand how marginal cost works in practice, let's look at some real-world examples:

Example 1: Furniture Manufacturing

Consider a classroom furniture company that spends £1,000 to manufacture 100 chairs. The average cost per chair is £10. Now, let’s say the company wants to produce one more chair. This scenario provides an example of marginal cost, where the marginal cost would refer to any additional expense incurred by producing this extra chair.

In this case, the company finds that the cost of materials and labor for one extra chair is £8. This £8 is the marginal cost of producing the 101st chair. It’s lower than the average cost because the company is likely benefiting from economies of scale – they’re spreading their fixed costs (like rent and equipment) over more units of production.

Example 2: Software Development

A software company has developed a cloud-based application. The initial development cost was $1 million, and the company spends $10,000 per month on server costs to support up to 10,000 users. Adding another user doesn't significantly increase the server costs.

In this scenario, the marginal cost of adding one more user (assuming we're still within the 10,000 user limit) is almost zero. This is common in digital products where the cost of serving one additional customer is negligible.

Example 3: Airline Industry

An airline has a flight from New York to London with 200 seats. The fixed costs (fuel, crew salaries, airport fees) for this flight are $100,000 regardless of how many seats are filled. The variable costs (meals, additional fuel due to passenger weight) are $50 per passenger.

If the plane has 199 passengers and wants to add one more, the marginal cost would be just the $50 for the additional meal and fuel. This explains why airlines often offer last-minute discounts – any price above $50 for that last seat contributes to covering the fixed costs.

This marginal cost example illustrates how marginal cost can vary significantly across industries and how understanding it can inform pricing and production decisions.

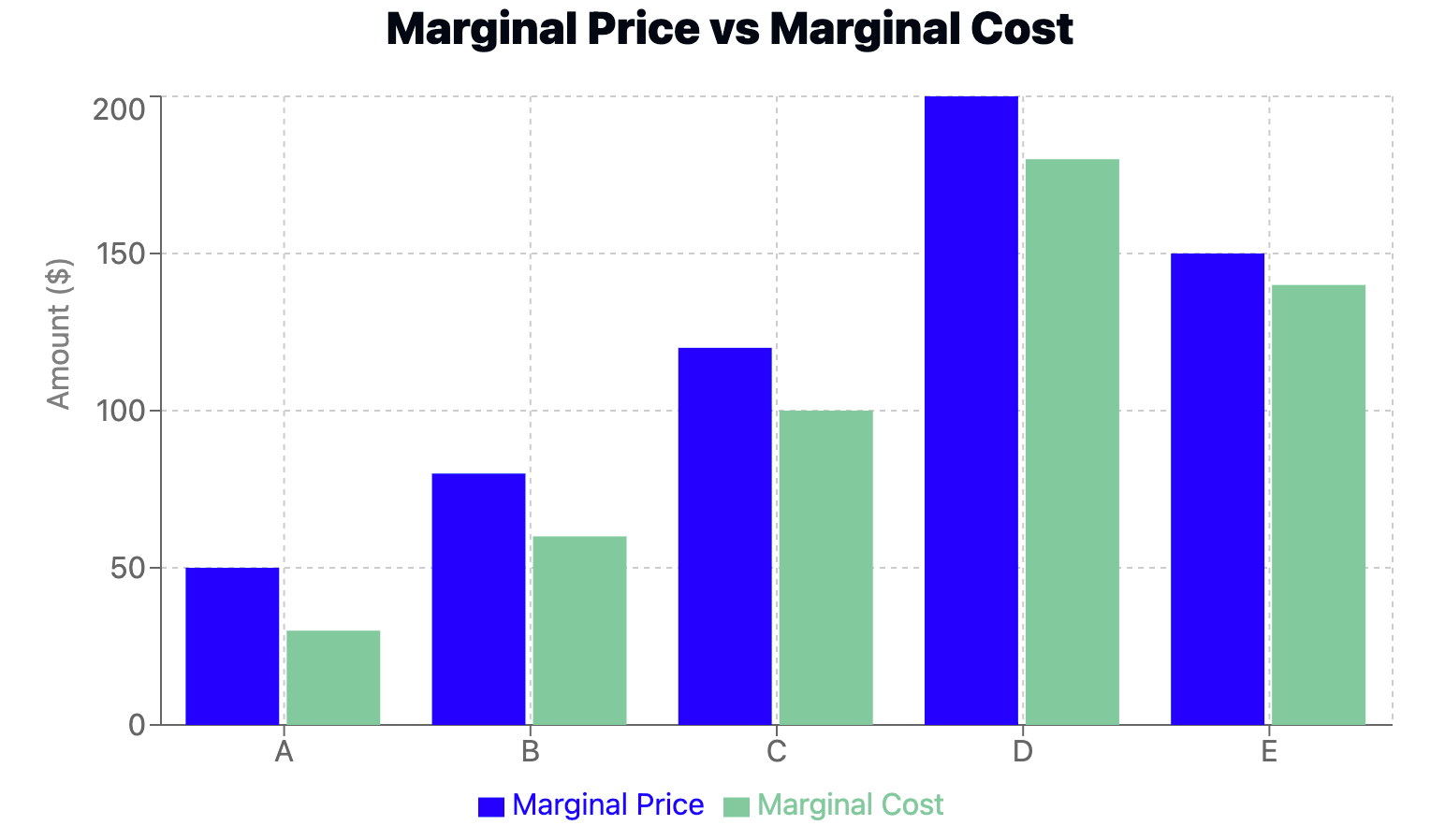

Marginal Price and Its Relationship to Marginal Cost

Now that we have a solid understanding of marginal cost, let's explore marginal price and how it relates to marginal cost.

Definition of Marginal Price

Marginal price is the price at which a business is willing to sell an additional unit of a product or service. Marginal cost refers to the additional cost incurred to produce one more unit of a product, and it’s closely related to, but distinct from, marginal price.

The Relationship Between Marginal Price and Marginal Cost

The relationship between marginal price and marginal cost is crucial for businesses to understand:

- Profit Maximization: In a perfectly competitive market, the optimal production level is where marginal price (which equals market price) equals marginal cost. At this point, the business maximizes its profit.

- Pricing Decisions: Businesses typically set their marginal price based on their marginal cost, which is influenced by various factors affecting production costs. The difference between marginal price and marginal cost represents the profit margin on each additional unit sold.

- Market Influence: In less than perfectly competitive markets, businesses have some control over their prices. They can set marginal prices above marginal cost, but must consider factors like demand elasticity and competitor pricing.

- Loss Minimization: In some cases, businesses may set marginal prices below marginal cost in the short term to minimize losses when fixed costs must be paid regardless of production levels.

Importance in Business Strategy

Understanding the relationship between marginal price and marginal cost is crucial for businesses to:

- Develop effective pricing strategies

- Make informed decisions about production levels

- Assess the profitability of different product lines

- Respond to changes in market conditions

- Evaluate potential expansion or contraction of operations

By carefully analyzing marginal price in relation to marginal cost, businesses can optimize their operations and maximize their profitability in both the short and long term.

Conclusion

Understanding marginal price and its foundational concept, marginal cost, is crucial for businesses and economists alike. These concepts provide valuable insights into pricing strategies, production decisions, and overall business efficiency.

Key takeaways from this exploration include:

- Marginal cost represents the additional cost of producing one more unit of a product or service.

- The marginal cost formula (MC = ΔTC / ΔQ) allows for precise calculation of these incremental costs.

- Fixed and variable costs play different roles in marginal cost analysis.

- The marginal cost curve provides a visual representation of how costs change with production levels.

- The relationship between marginal cost and marginal revenue is crucial for determining optimal production levels and pricing.

- Understanding marginal cost offers numerous benefits, including informed decision-making and potential competitive advantages.

- However, it's important to be aware of the limitations of marginal cost analysis and consider it alongside other factors.

- Real-world examples demonstrate how marginal cost principles apply across various industries.

- Marginal price, closely related to marginal cost, is a key factor in pricing strategies and profit maximization.

By mastering these concepts, businesses can make more informed decisions, optimize their operations, and ultimately increase their profitability. Whether you're a business owner, manager, investor, or student of economics, a solid grasp of marginal price and marginal cost will serve you well in understanding and navigating the complex world of business and economics.

As markets continue to evolve and competition intensifies, the ability to analyze and apply these concepts effectively will become increasingly valuable. By staying informed and continuously refining your understanding of these fundamental economic principles, you'll be better equipped to make sound business decisions and achieve long-term success.