Introduction

Value investing, a time-tested strategy for building long-term wealth, has captivated the minds of investors for nearly a century. Born from the ashes of the 1929 stock market crash, this approach to investing has produced some of the world's most successful investors and continues to evolve in today's dynamic financial landscape.

At its core, value investing is about finding hidden gems in the market - companies whose true worth is not reflected in their current stock price. It's a strategy that requires patience, diligence, and a contrarian mindset. Value investors often swim against the tide of market sentiment, seeking opportunities where others see only risk.

In this comprehensive guide, we'll delve deep into the world of value investing. We'll explore its fundamental principles, trace its rich history from Benjamin Graham to Warren Buffett, and examine why it remains a powerful tool in the modern investor's arsenal.

Whether you're a seasoned investor looking to refine your strategy or a newcomer seeking to understand the foundations of smart investing, this post will provide valuable insights into:

- The core concepts that define value investing

- The historical evolution of value investing strategies

- Key figures who have shaped and continue to influence the field

- How value investing principles can be applied in today's fast-paced, technology-driven markets

As we navigate through the intricacies of value investing, you'll gain a deeper understanding of why this approach has stood the test of time. You'll learn how to spot potential value traps, calculate intrinsic value, and develop the disciplined mindset required for long-term investment success.

So, let's embark on this journey through the world of value investing - a world where patience is rewarded, thorough analysis is paramount, and the potential for significant returns awaits those willing to look beyond the surface.

To dive deeper into the fundamentals of value investing, don't miss our comprehensive guide.

Value Investing 101: Start Investing Like Warren Buffett Today

What is Value Investing?

Value investing is a financial strategy that focuses on identifying and purchasing securities trading below their intrinsic value. This approach, rooted in fundamental analysis, seeks to capitalize on market inefficiencies by investing in undervalued assets with the expectation that their price will eventually rise to reflect their true worth.

At its core, value investing is guided by several key principles:

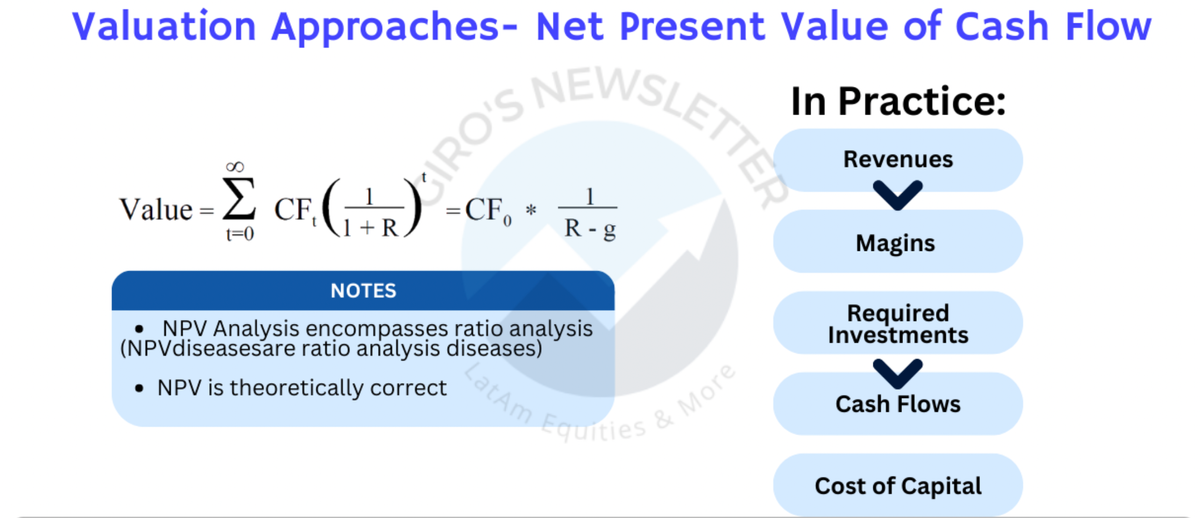

Intrinsic Value Calculation: Value investors meticulously analyze a company's financials, including balance sheets, income statements, and cash flow reports. They consider factors such as assets, earnings, dividends, and future growth prospects to determine a company's intrinsic value. This calculated value serves as a benchmark against which the current market price is compared.

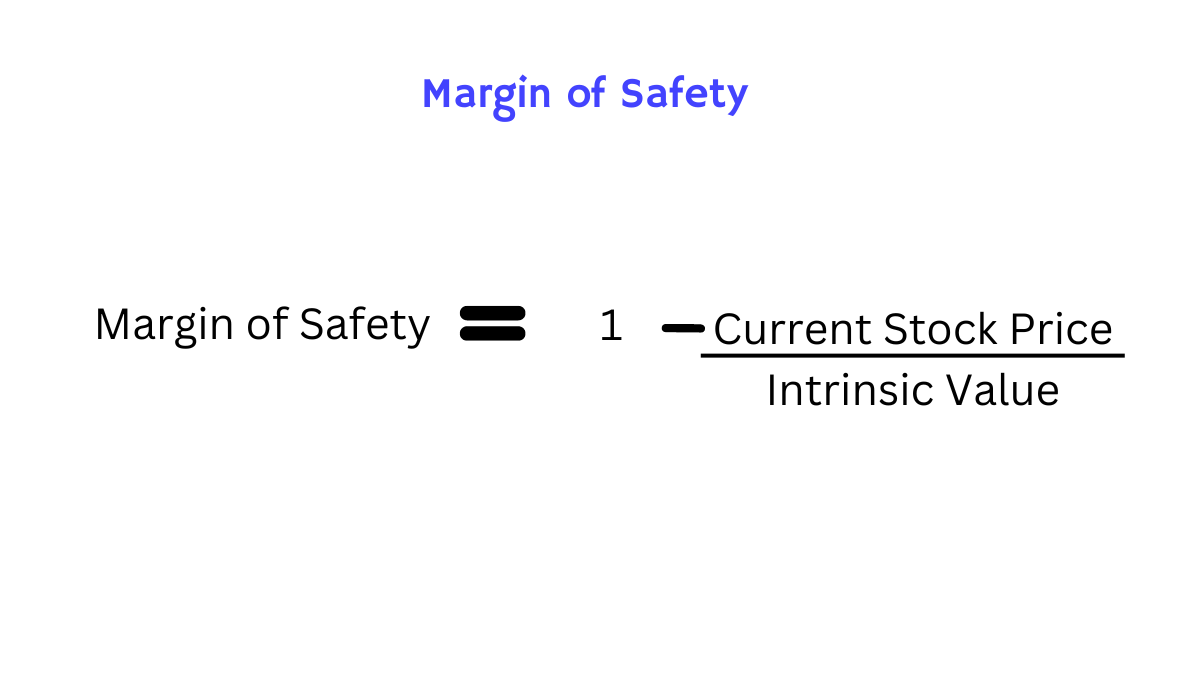

Margin of Safety: A cornerstone concept introduced by Benjamin Graham, the margin of safety is the difference between a security's intrinsic value and its market price. The larger this gap, the greater the potential return and the lower the risk. This principle helps protect investors from errors in calculation or unforeseen market downturns.

Learn how to protect your investments by identifying undervalued stocks and minimizing risk.

Long-Term Investment Horizon: Value investing typically requires patience. Undervalued stocks may take time to reach their full potential, and value investors are prepared to hold positions for years, sometimes decades. This long-term perspective allows investors to weather short-term market volatility and benefit from compounding returns.

Learn about stocks, bonds, real estate, and retirement planning to achieve your financial goals.

Contrarian Approach: Value investors often go against prevailing market sentiment. When others are fearful, they see opportunity; when the market is overly optimistic, they exercise caution. This contrarian mindset helps value investors avoid the pitfalls of emotional decision-making and market hype.

Focus on Business Fundamentals: Rather than trying to predict short-term price movements, value investors concentrate on understanding the underlying business. They look for companies with strong balance sheets, consistent earnings, competitive advantages, and competent management teams.

Our comprehensive resources cover fundamental and technical analysis, financial metrics, market trends, and valuation techniques.

Diversification with a Purpose: While value investors may not diversify as broadly as other investment strategies suggest, they do spread risk by investing in different sectors and company sizes. However, each investment is carefully chosen based on its individual merits.

Continuous Learning and Adaptation: Successful value investors are lifelong learners. They stay informed about market trends, economic conditions, and company developments. They're also willing to adapt their strategies as market conditions evolve, while staying true to core value principles.

It's important to note that value investing is not a get-rich-quick scheme. It requires discipline, patience, and a willingness to go against the crowd. Value investors must be prepared to hold onto investments during market downturns and resist the temptation to chase short-term gains.

Moreover, identifying truly undervalued stocks in today's information-rich environment can be challenging. With the advent of sophisticated financial analysis tools and instantaneous information dissemination, finding mispriced securities requires more effort and expertise than ever before.

Despite these challenges, value investing remains a powerful strategy for long-term wealth creation. By focusing on the intrinsic value of investments and maintaining a disciplined approach, value investors can potentially achieve superior returns while managing risk effectively.

In the following sections, we'll explore how this investment philosophy developed, the key figures who shaped it, and why it continues to be relevant in today's rapidly changing financial landscape.

Unlock the secrets of successful investing! Download our free eBook on value investing now and start your journey to financial freedom.

Origins of Value Investing

Value investing emerged in the 1920s as a response to the speculative excesses that led to the devastating 1929 stock market crash. The concept was pioneered at Columbia Business School by Benjamin Graham, a finance adjunct, and David Dodd, a finance professor.

Their groundbreaking work, "Security Analysis," published in 1934, laid the foundation for value investing. This seminal text introduced a systematic approach to identifying and purchasing undervalued securities, providing investors with a rational basis for decision-making in contrast to the prevalent speculative practices of the time.

The core principles they established include:

- The concept of intrinsic value

- The importance of a margin of safety

- The "Mr. Market" allegory

- The benefits of diversification

These ideas formed the bedrock of value investing and continue to influence investment strategies today.

Benjamin Graham's Influence

Benjamin Graham's impact on the field of investing has been profound and far-reaching. Often referred to as the "Father of Value Investing," Graham's teachings have shaped the investment philosophy of countless professionals and individual investors.

Key contributions:

- Development of fundamental analysis techniques

- Introduction of the "margin of safety" concept

- Emphasis on emotional discipline in investing

- Advocacy for improved corporate governance and shareholder rights

Graham's books, particularly "The Intelligent Investor," continue to be widely read and studied. Warren Buffett, his most famous student, has described it as "by far the best book on investing ever written."

Discover the investment principles and strategies of Benjamin Graham.

Warren Buffett and Charlie Munger

Warren Buffett, often called the "Oracle of Omaha," studied under Graham at Columbia Business School and went on to become one of the most successful investors in history. Along with his long-time partner Charlie Munger, Buffett has significantly evolved value investing principles through their leadership at Berkshire Hathaway.

Key developments:

- Shift from "cigar-butt" investing to focusing on high-quality businesses

- Emphasis on competitive advantages and long-term growth potential

- Willingness to pay fair prices for great companies

- Integration of qualitative factors in investment analysis

Buffett and Munger's success at Berkshire Hathaway, achieving a compound annual growth rate of 20% from 1965 to 2020 (compared to 10.2% for the S&P 500), has inspired a new generation of value investors.

Discover the investment strategies and principles of Warren Buffett. Explore his successful investment philosophy, value investing techniques, and key insights from Berkshire Hathaway.

Evolution of Value Investing Strategies

Value investing has adapted significantly since its inception, evolving through three distinct eras:

- Founding Era (1934-1973): Focused on balance sheet analysis and liquidation value.

- Post-Graham Era (1973-1991): Saw the rise of investors like John Neff and Michael Price, adapting to changing market conditions.

- Modern Era (1991-present): Incorporation of more sophisticated analysis techniques and expansion into various asset classes.

Modern Value Investing

Contemporary value investing has evolved to meet the challenges of today's complex financial markets:

- Increased focus on qualitative factors and competitive advantages

- Application of value principles to a broader range of assets

- Integration of technology and data analytics in stock screening and analysis

- Consideration of ESG (Environmental, Social, and Governance) factors

- Greater emphasis on global diversification

Despite these evolutions, the core tenets of value investing - buying undervalued assets, maintaining a long-term perspective, and exercising discipline - remain intact.

Famous Value Investors

Beyond Buffett and Munger, numerous successful practitioners have made significant contributions to value investing:

- Seth Klarman: Known for his risk-averse approach and focus on absolute returns

- Joel Greenblatt: Creator of the "Magic Formula" investing strategy

- Mohnish Pabrai: Known for his concentrated portfolio approach

- Bill Miller: Famous for beating the S&P 500 for 15 consecutive years

- Peter Lynch: While not a pure value investor, incorporated value principles in his growth-at-a-reasonable-price (GARP) approach

Rising Value Investing Stars

A new generation of value investors is adapting traditional principles to modern markets:

- Li Lu: Praised by Charlie Munger, known for his focus on Chinese companies

- Allan Mecham: Often called the "400% Man" for his impressive returns

- Guy Spier: Known for his value-oriented, global investment approach

- Vitaliy Katsenelson: Developed the "Active Value Investing" approach for sideways markets

These investors demonstrate the continued relevance and adaptability of value investing principles in today's dynamic financial landscape.

This rich history and diverse cast of influential figures underscore the enduring appeal and effectiveness of value investing as a strategy for long-term wealth creation.

Why Value Investing Matters in Today's Market

Despite the rise of passive investing, algorithmic trading, and the increasing efficiency of markets, value investing remains a relevant and powerful strategy for modern investors. Here's why it continues to matter:

Disciplined Approach in Volatile Markets: In an era of 24/7 news cycles and rapid information dissemination, market volatility has become increasingly common. Value investing provides a disciplined framework for decision-making, helping investors avoid knee-jerk reactions to short-term market fluctuations. By focusing on intrinsic value rather than daily price movements, value investors can maintain a steady course through turbulent markets.

Potential for Superior Long-Term Returns: While past performance doesn't guarantee future results, value investing has historically provided superior returns over extended periods. By identifying undervalued assets and holding them until they reach fair value, investors can potentially outperform the broader market. This approach aligns with the compounding effect, where returns build upon themselves over time, leading to significant wealth creation.

Emotional Control and Rational Decision-Making: One of the biggest challenges for investors is managing their emotions. Value investing's emphasis on thorough analysis and patience helps investors avoid common behavioral pitfalls such as panic selling during downturns or chasing hot trends. By sticking to a value-based strategy, investors can make more rational, data-driven decisions.

Adaptability to Various Market Conditions: While often associated with bull markets, value investing principles can be applied effectively in various market conditions. During bear markets, value investors can identify quality companies trading at significant discounts. In sideways markets, the focus on dividends and capital preservation can provide steady returns. This versatility makes value investing a robust strategy for long-term investors.

Protection Against Market Bubbles: Value investing's emphasis on intrinsic value and margin of safety can help protect investors from the dangers of market bubbles. By avoiding overvalued assets and maintaining a disciplined approach, value investors are less likely to get caught up in speculative frenzies that often end in significant losses.

Enhanced Risk Management: The margin of safety concept, central to value investing, provides an inherent risk management mechanism. By buying assets significantly below their intrinsic value, investors create a buffer against potential downside risks, including errors in analysis or unforeseen market events.

Alignment with Sustainable and Ethical Investing: As ESG (Environmental, Social, and Governance) factors become increasingly important, value investing's long-term perspective aligns well with sustainable investing principles. Many value investors now incorporate ESG considerations into their analysis, recognizing that these factors can significantly impact a company's long-term value and risk profile.

Counterbalance to Short-Term Trading: In an age where high-frequency trading and short-term speculation dominate daily market movements, value investing provides a necessary counterbalance. By focusing on long-term value creation, it helps maintain market stability and supports the fundamental role of financial markets in allocating capital to productive enterprises.

Continuous Learning and Adaptation: The practice of value investing encourages continuous learning and adaptation. As markets evolve, value investors must refine their analytical skills, stay informed about industry trends, and adapt their strategies accordingly. This commitment to ongoing education can benefit investors across all aspects of their financial lives.

In conclusion, value investing remains highly relevant in today's market environment. Its emphasis on thorough analysis, long-term perspective, and disciplined decision-making provides a solid foundation for navigating the complexities of modern financial markets. While the specific techniques may evolve, the core principles of value investing continue to offer a path to sustainable wealth creation and financial success. As markets become increasingly driven by short-term factors and speculation, the timeless wisdom of value investing becomes even more crucial for investors seeking long-term financial security and growth.

Transform your investment approach with our free eBook on value investing. Download it today and take the first step towards smarter investing.

Conclusion

Value investing, a strategy born nearly a century ago, continues to stand the test of time in today's complex and rapidly evolving financial landscape. As we've explored throughout this comprehensive guide, the core principles of value investing - identifying undervalued assets, maintaining a margin of safety, and adopting a long-term perspective - remain as relevant today as they were when first introduced by Benjamin Graham and David Dodd.

From its origins as a response to the speculative excesses of the 1920s, through its evolution under the guidance of investors like Warren Buffett and Charlie Munger, to its modern adaptations by a new generation of practitioners, value investing has consistently provided a framework for rational, disciplined investment decision-making.

Key takeaways from our exploration of value investing include:

- The enduring relevance of fundamental analysis in an age of algorithmic trading and passive investing.

- The importance of emotional discipline and patience in achieving long-term investment success.

- The adaptability of value investing principles to changing market conditions and new asset classes.

- The potential for superior long-term returns through a focus on intrinsic value and margin of safety.

- The alignment of value investing with sustainable and ethical investment practices.

As we look to the future, it's clear that value investing will continue to evolve. The integration of advanced technologies, the incorporation of ESG factors, and the application of value principles to emerging asset classes are just a few ways in which this time-tested strategy is adapting to meet the challenges of modern markets.

However, amidst these changes, the fundamental tenets of value investing remain constant. The focus on thorough analysis, the emphasis on intrinsic value, and the discipline to stick to one's convictions in the face of market volatility are qualities that will always be valuable in the world of investing.

For both seasoned investors and those just starting their investment journey, understanding and applying the principles of value investing can provide a solid foundation for long-term financial success. It offers a path to navigate the complexities of financial markets, manage risk effectively, and potentially achieve superior returns over time.

As Benjamin Graham famously said:

"The investor's chief problem - and even his worst enemy - is likely to be himself."

Value investing, with its emphasis on rational analysis and emotional discipline, provides a powerful antidote to the psychological pitfalls that often plague investors.

In conclusion, while markets may change and new investment fads may come and go, the timeless wisdom of value investing continues to offer a reliable compass for those seeking to build and preserve wealth over the long term. By embracing these principles and adapting them to the modern financial landscape, investors can position themselves for sustainable success in an ever-changing market environment.

As you move forward in your investment journey, remember that value investing is not just a set of techniques, but a mindset - one of patience, discipline, and continuous learning. Whether you're analyzing stocks, exploring new asset classes, or building a diversified portfolio, the principles of value investing can guide you towards making informed, rational decisions that stand the test of time.

Your Opinion Matters!

We're constantly striving to improve our content. Could you spare 2 minutes to let us know what you think? Your feedback is invaluable in helping us deliver the financial insights you need.