As someone who has closely followed the payments industry for years, I found Visa's recent presentation at the Deutsche Bank Technology Conference particularly intriguing.

Chris Newkirk, Visa's Global Head of New Flows, Commercial & Money Movement Solutions, provided insights into the company's strategy for expanding beyond traditional consumer payments into a massive $200 trillion market opportunity.

In this post, I'll break down the key takeaways and offer a balanced perspective on what this could mean for Visa's future.

Understanding the New Flows Opportunity

Visa has long been a major player in consumer credit and debit card payments. However, the company is now setting its sights on a much larger target - the $200 trillion market for new payment flows. This includes $145 trillion in business-to-business (B2B) payments and $55 trillion in other types of money movement like peer-to-peer transfers, cross-border remittances, and various disbursements.

The scale of this opportunity is certainly eye-catching. To put it in perspective, Visa processed $14.1 trillion in payments volume in fiscal year 2022. Even capturing a small slice of this $200 trillion pie could potentially drive significant growth. However, it's important to note that penetrating new markets, especially ones as complex as B2B payments, is never easy and success is not guaranteed.

Newkirk explained that Visa's strategy has three key pillars:

- Consumer payments (the traditional core business)

- New flows

- Value-added services

The goal is for new flows and value-added services to drive growth above and beyond the consumer payments business. This approach seems logical, as it allows Visa to leverage its existing assets and capabilities into new areas. However, execution will be key, and it remains to be seen how quickly Visa can scale these new businesses.

Before you dive into our in-depth analysis, we have a quick request:

If you find this content useful, please consider sharing it!

Why? Your shares help us reach a wider audience, allowing us to continue producing high-quality, comprehensive content like this—completely free, with no paywalls or subscriptions.

Thank you for your support!

Early Signs of Growth in New Flows

One of the more encouraging aspects of Newkirk's presentation was the accelerating growth Visa is seeing in its new flows business. Revenue growth has picked up from 14% year-over-year in Q2 to 18% in Q3.

This acceleration suggests Visa's investments in areas like B2B payments and Visa Direct are starting to gain traction. However, it's important to note that this is still early days, and we'll need to see sustained growth over multiple quarters to confirm a true trend.

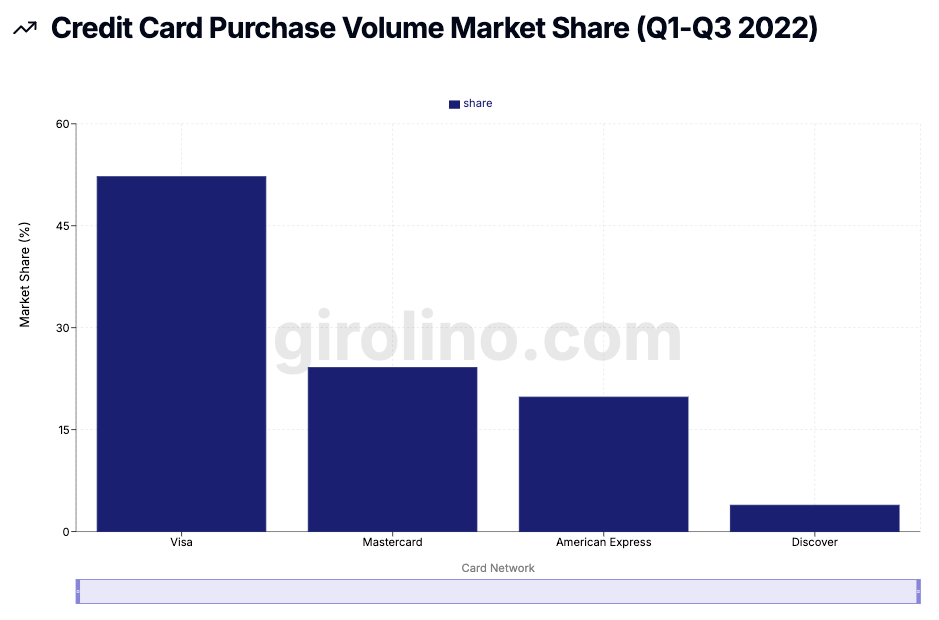

Looking at this chart, we can see that Visa already dominates consumer credit card purchase volume with over 50% market share. This strong position in consumer payments provides a solid foundation for the company to build on as it expands into new payment flows. However, it's worth noting that the dynamics in B2B and other new flows may be quite different from consumer payments, so Visa's existing market dominance may not necessarily translate directly to these new areas.

Visa Direct: A Promising Growth Driver

One of the standout performers within new flows has been Visa Direct, which enables real-time push payments for use cases like P2P transfers, gig economy payouts, and cross-border remittances. Newkirk shared some impressive stats:

- Visa Direct transactions grew over 40% year-over-year in Q3

- Cross-border use cases nearly doubled year-over-year

The growth in cross-border use cases is particularly noteworthy, as these transactions tend to have higher yields for Visa. This could potentially help drive revenue growth and profitability. However, it's important to remember that cross-border payments are a highly competitive space, with both traditional players and fintech startups vying for market share.

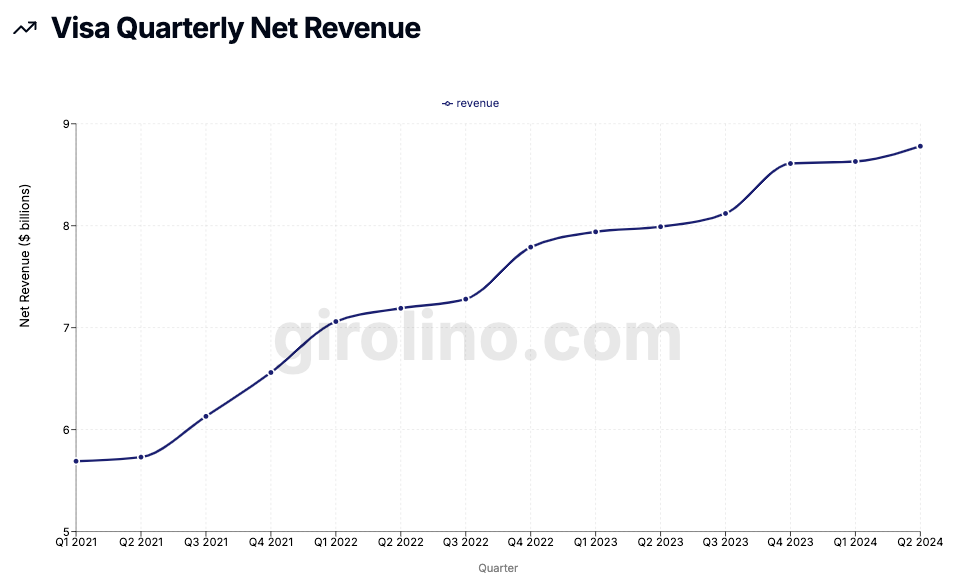

This chart shows Visa's steady revenue growth over the past few years. The acceleration we're seeing in new flows, particularly with Visa Direct, could potentially help steepen this curve in the coming quarters and years. However, it's crucial to keep in mind that new flows still represent a relatively small portion of Visa's overall business, so it may take time for this growth to significantly impact the company's top line.

B2B Payments: A Significant but Challenging Opportunity

While consumer payments have been largely digitized, B2B payments remain an area ripe for innovation. Newkirk highlighted the inefficiencies still present in many corporate finance departments, stating:

"Go spend time with like the function inside your company that is doing buyer supplier payments. And you will just -- you might be surprised at how much manual work is still going on there."

This inefficiency creates an opportunity for Visa to streamline B2B payments using its existing infrastructure and capabilities. The company is approaching this in several ways:

- Virtual payables platforms that allow businesses to issue configurable virtual cards for different use cases and user types.

- Accounts receivable automation to help businesses more efficiently process incoming payments.

- Visa B2B Connect for secure, transparent cross-border corporate transactions.

While the potential in B2B payments is significant, it's important to recognize the challenges. B2B payments are often more complex than consumer transactions, involving issues like invoice matching, approval workflows, and integration with enterprise resource planning (ERP) systems. Visa will need to navigate these complexities to successfully penetrate this market.

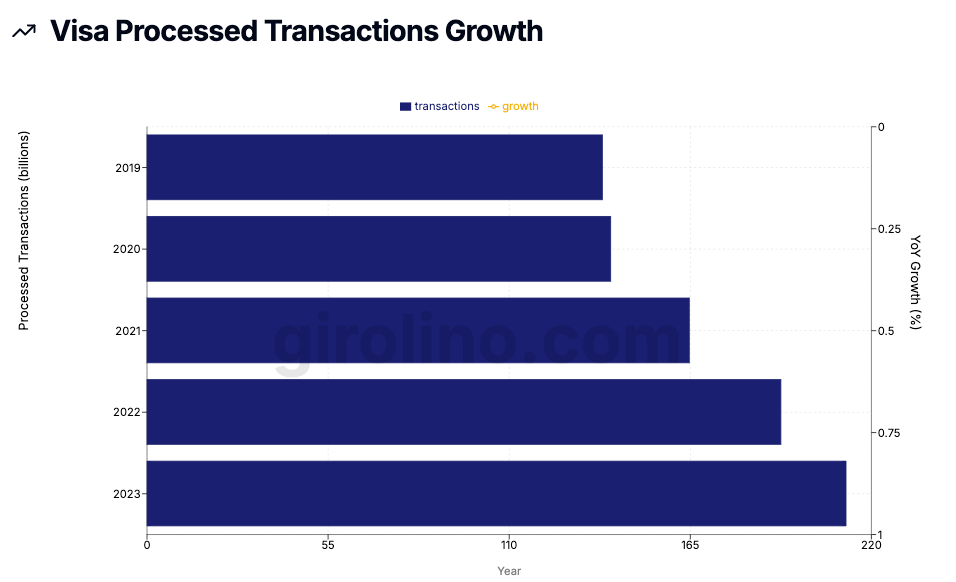

This chart shows steady growth in Visa's processed transactions over the past few years. As the company works to penetrate the B2B market, we could potentially see this growth continue or even accelerate. However, it's worth noting that B2B transactions may have different characteristics (e.g., higher value but lower volume) compared to consumer transactions, so the impact on this metric may not be straightforward.

Leveraging Existing Infrastructure for New Flows

One aspect of Visa's strategy that seems particularly sensible is how the company is leveraging its existing infrastructure to support new payment flows. This allows Visa to scale these new businesses while potentially maintaining attractive margins.

Newkirk emphasized that much of the Visa Direct business runs on the same VisaNet infrastructure used for consumer payments. This means Visa can tap into its existing investments in areas like:

- Cybersecurity

- Fraud prevention

- Risk management

- High-volume transaction processing

This capital-efficient approach to entering new markets could allow Visa to grow its new flows business without the need for massive new infrastructure investments. However, it's worth considering whether the existing infrastructure will be fully suitable for all new use cases, or if significant adaptations or new investments will be required over time.

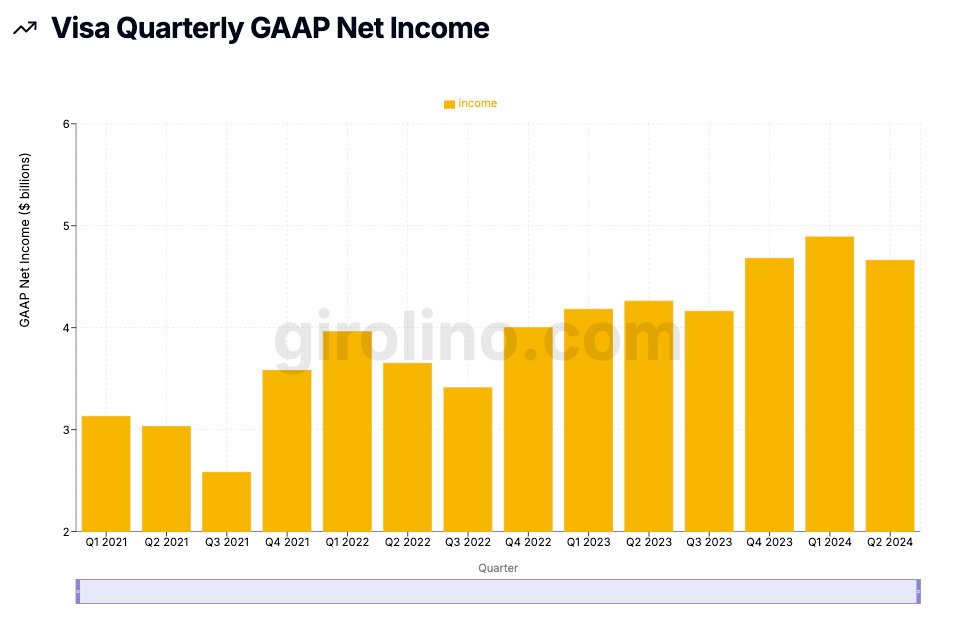

Looking at Visa's net income growth, we can see the benefits of the company's scalable business model. As new flows contribute more to overall revenue, this trend of growing profitability could potentially continue. However, it's important to note that entering new markets often involves increased costs and investments, which could impact profitability in the short to medium term.

Partnering with Real-Time Payment Systems

One potential challenge for Visa is the rise of new real-time payment (RTP) systems being developed around the world. However, rather than viewing RTPs as a threat, Visa appears to be taking a collaborative approach:

- Visa is connected to over 70 domestic payment schemes and 10+ RTP systems globally.

- The company is offering fraud prevention and risk management services to RTP operators, leveraging its expertise in these areas.

- Visa's Faster Payments Gateway allows clients to connect once and access multiple faster payment options, including both Visa Direct and systems like FedNow.

This collaborative approach could position Visa well as the payments landscape evolves. Instead of being disrupted by new technologies, the company is finding ways to add value and remain relevant. However, it's worth noting that as RTPs become more prevalent, they could potentially reduce reliance on traditional card networks in some use cases.

Currencycloud Acquisition Enhancing Cross-Border Capabilities

Visa's acquisition of Currencycloud in 2021 appears to be enhancing the company's cross-border payment capabilities in several ways:

- Real-time FX rates: Allowing more transparent and competitive pricing for cross-border transactions.

- Multi-currency virtual wallets: Enabling businesses and consumers to hold and transact in multiple currencies seamlessly.

- Expanded licensing: Giving Visa the ability to offer more licensed payment services directly in key markets.

This acquisition seems like a strategic move to strengthen Visa's position in the growing cross-border payments market. It could help the company capture more of the $55 trillion opportunity in areas like remittances and marketplace payouts. However, integrating acquisitions can be challenging, and it remains to be seen how fully Visa will be able to leverage Currencycloud's capabilities across its global network.

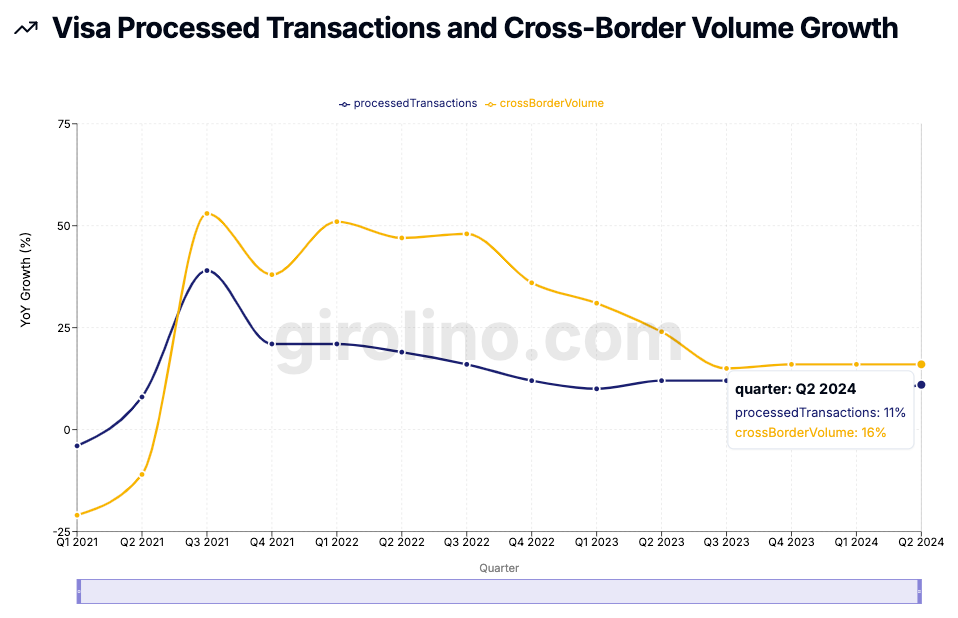

This chart shows strong growth in both processed transactions and cross-border volume. The Currencycloud acquisition and other cross-border initiatives could potentially help Visa maintain or even accelerate this momentum. However, it's important to note that cross-border payments are a highly competitive space, with both traditional financial institutions and fintech startups vying for market share.

The Consumerization of B2B Payments

One of the more interesting trends Newkirk discussed was what he called the "consumerization of B2B" payments. This essentially means bringing the simplicity and user-friendliness of consumer payment experiences to the business world.

Key aspects of this trend include:

- Mobile-first design for B2B payment solutions

- Real-time payment capabilities

- Simplified user interfaces

- Integration of consumer payment methods into B2B platforms

Visa's expertise in creating seamless consumer payment experiences could potentially translate well to the B2B world. If the company can successfully "consumerize" B2B payments, it could drive adoption in this massive market. However, it's important to recognize that B2B payments often involve more complexity than consumer transactions, including issues like multi-level approvals, integration with accounting systems, and detailed remittance information. Balancing simplicity with the necessary functionality for businesses could be a significant challenge.

Embedded Finance: Meeting Users Where They Are

Another key trend Newkirk highlighted was the growth of embedded finance - essentially integrating financial services into non-financial platforms and applications. Visa is positioning itself to capitalize on this trend through offerings like:

- Visa Direct for real-time push payments

- Tokenization services for secure embedded payments

- Open banking initiatives to enable account-to-account transfers

Embedded finance represents a significant opportunity for Visa to expand its reach and potentially drive higher transaction volumes. By making it easy for any app or platform to integrate payment capabilities, the company could insert itself into a wide range of new use cases. However, this space is becoming increasingly competitive, with fintech companies and other payment providers also vying for integration partnerships.

Challenges and Risks to Consider

While Visa's new flows strategy presents significant opportunities, it's important to also consider the potential challenges and risks:

- Competition: The new flows space, particularly in B2B payments and cross-border transactions, is highly competitive. Visa will face competition not only from traditional financial institutions but also from fintech startups and big tech companies entering the payments space.

- Regulatory environment: As Visa expands into new types of payment flows, it may face increased regulatory scrutiny. Changes in regulations around payments, data privacy, or cross-border transactions could impact the company's strategy.

- Technology risks: While leveraging existing infrastructure is efficient, Visa may need to make significant investments to adapt its systems for new use cases. There's also the risk of disruptive new technologies emerging that could challenge Visa's position.

- Economic sensitivity: B2B payments and cross-border transactions can be sensitive to economic conditions. A global economic downturn could potentially impact the growth of these new flows.

- Integration challenges: As Visa acquires companies like Currencycloud and partners with various payment schemes, successfully integrating these new capabilities and partnerships will be crucial.

- Yield pressure: As Visa enters new markets, it may face pressure on transaction yields, particularly in price-sensitive segments of the B2B market.

- Cybersecurity and fraud: Expanding into new payment flows may expose Visa to new types of fraud risks. Maintaining robust security across a broader range of transaction types will be essential.

A Significant Opportunity, but Execution is Key

Visa's strategy for new payment flows presents a significant growth opportunity for the company. The $200 trillion market for new flows dwarfs Visa's current payments volume, providing a long runway for potential growth. The company's ability to leverage its existing infrastructure and capabilities for new flows could allow for efficient scaling.

Early signs of traction, such as the acceleration in new flows revenue growth to 18% in Q3, are encouraging. Visa has multiple potential growth drivers, from Visa Direct to B2B payments to embedded finance. The company's willingness to partner with new payment systems and acquire strategic capabilities like Currencycloud demonstrates its adaptability in a changing payments landscape.

However, it's important to maintain a balanced perspective. Entering new markets, particularly ones as complex as B2B payments, comes with significant challenges. Competition is fierce, and Visa will need to navigate regulatory hurdles, technological changes, and evolving customer needs.

Success in new flows will ultimately come down to execution. Visa will need to effectively leverage its strengths while adapting to the unique requirements of new payment types and use cases. The company will also need to balance investment in new areas with maintaining its strong position in consumer payments.

As the payments landscape continues to evolve, it will be crucial to monitor Visa's progress in penetrating the new flows market. Key metrics to watch include the growth rate of new flows revenue, adoption of services like Visa Direct and B2B Connect, and the company's ability to maintain strong margins as it expands into new areas.

While the opportunity is significant, it's important for stakeholders to maintain realistic expectations about the pace of growth and the challenges involved. Visa's new flows strategy has the potential to drive long-term growth, but it will likely be a gradual process that unfolds over many years.