Today’s post was suppose to be behind a paywall. However, considering that Amazon is not a LatAm company and it’s an unscheduled post, it’s open for everyone.

Honestly, I wasn’t expecting to write up this post. Even though I’m a shareholder, Amazon (“AMZN”) is one of the most followed companies in the world.

Typically, there isn’t much you can do without thinking about something someone hasn’t done yet. So, it’s hard for me to spend much time reading footnotes.

However, the noise and poor information about AMZN’s earnings were abnormally high. Even people I know are proficient were writing superficial and general stuff, such as “missed on Opex,” “higher than expected Capex led to cash flow losses,” etc.

Together with Meli and Sea, I have substantial exposure to companies that operate in the marketplace industry.

So, I spent roughly a dozen hours digging into AMZN’s reports, reading management’s and industry experts’ transcripts to figure out what happened to Amazon.

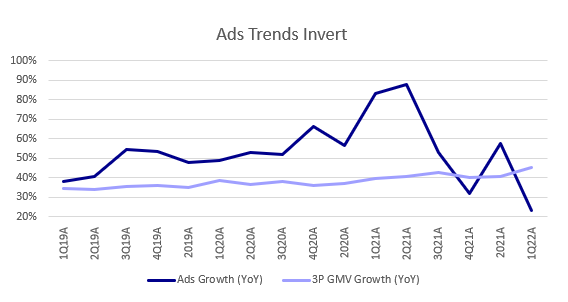

Fortunately for Meli and Sea, the long-term fundamentals are intact. AMZN is gaining share of wallet, fulfillment penetration is expanding, and, perhaps, the only pushback is regarding ads revenue, which inverted its uptrend. So, what happened?

Management Message

Amazon couldn’t have been more clear that consumer demand remains strong:

“Customer demand does remain strong”…” We’re seeing…continued strength in Prime purchases, Prime commitment levels of usage benefits being used”…” we’re not seeing softness”…“we don’t see any macroeconomic factors generally in this forecast on the demand side.”

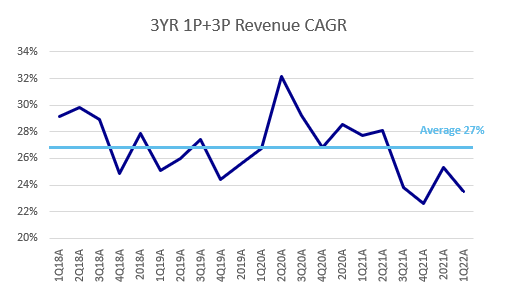

Revenue grew 7% YoY, in line with the Street and the guide. On the call, mgmt said consumer demand remains strong despite macro. So even though the 3YR CAGR has decreased 300bps, we also recognize that 2020 presented tough comps.

Also, mgmt pointed to $6B of incremental costs in 1Q22 (vs. 1Q21), which should decline to $4B in 2Q22 and decrease further through the year — we’ll get back to this, so remember it.

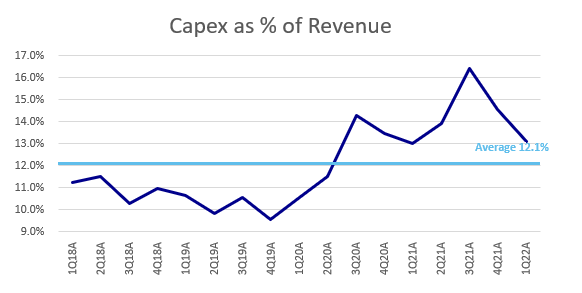

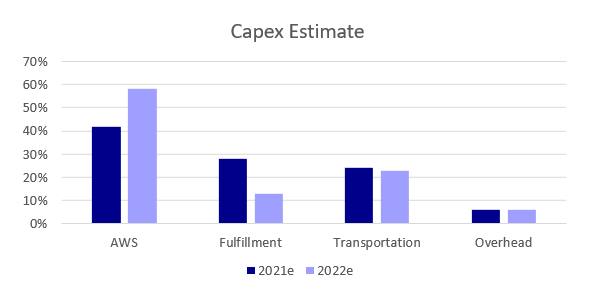

We expect fulfillment and transport Capex to be lower and transportation to be flat to down in 2022, although we recognize that Amazon isn’t transparent about its cost, so no surprise if another cost just pop up.

AWS Still a Beast…

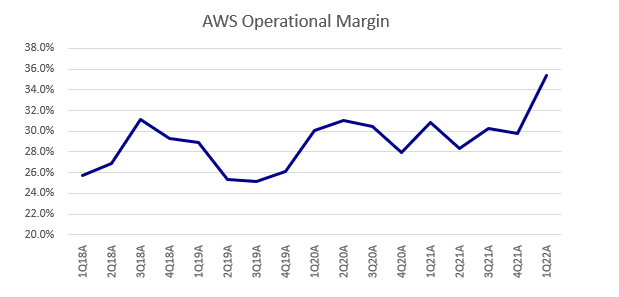

AWS growth remains robust, and with the backlog growing faster, we continue to believe there is a long runway for AWS to deliver high growth in the mid-term.

AWS revs grew 37% YoY (vs. Street 36% YoY), and segment Operating Income margins of 35.3% expanded 450 bps YoY, primarily on lower D&A. Going forward, D&A will ramp-up and margins will return to the old range.

Amazon reduced its Capex on AWS to invest more money in the fulfillment operation, so the D&A related to the incremental invested capital was below what market expected. However, as the company will increase the Capex, margin should reduce again on higher D&A.

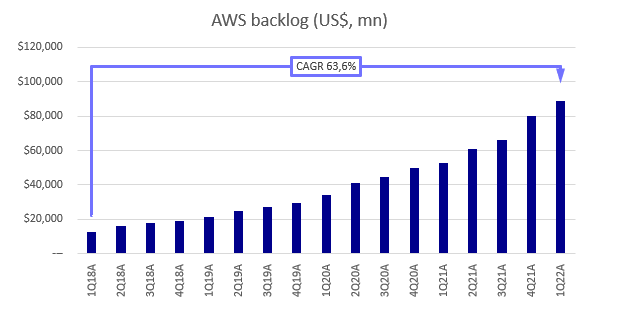

Despite many notes and comments, we saw in the past week, our view is that AWS backlog grew an impressive 68% YoY to $88.9B in contrast to GCP, where the backlog was marginally lower QoQ.

Since 1Q19, AWS has delivered an impressive 63.4% backlog CAGR, a solid leading indicator of business revenue. Beast 🚀🚀🚀

Also, even though our modeling suggests a Capex reduction between $14-$18bn, management highlighted higher investment in AWS. Historically, this has been another leading indicator of revenue growth for AWS.

For now, we still hold our view that AWS is one of the best businesses in the world.

Lack of Transparency

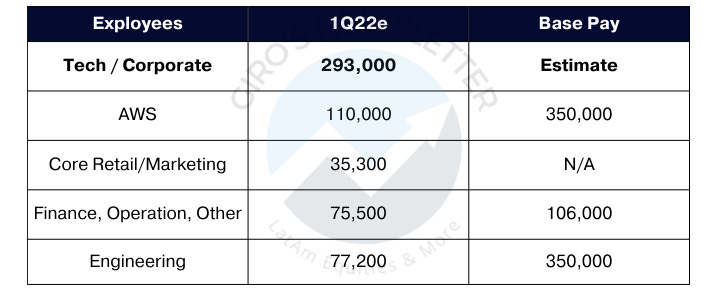

Our analysis led us to conclude that Amazon should review the amount of information disclosed. According to our estimates, Amazon should spend between $19 and $27bn per year on Engineering.

Even though the company doesn’t disclose these figures, we spend hours tracking positions on LinkedIn. Therefore, the marginal cost for the company disclosing this information is zero.

We had access to a couple of reports from the sell-side, but none flagged costs related to engineers. Instead, most highlighted “incremental costs” and “waging inflation,” though this is half the information.

In our opinion, Amazon could benefit from improving its disclosure. We have seen improved disclosure within tech lead to multiple expansions over the past years.

Better visibility into these multi-faceted companies can help investors better understand the fundamental drivers of long-term growth and margins.

Over the past 18 months, due to concerns about decelerating growth, retail share loss, labor costs, the durability of retail top-line growth, and profitability, Amazon underperformed its peers.

Specifically, we think better visibility into Amazon’s estimated $19/$27bn spent on engineers per year (excluding AWS) and emerging "other bets" projects could help investors better understand the health of its core retail business.

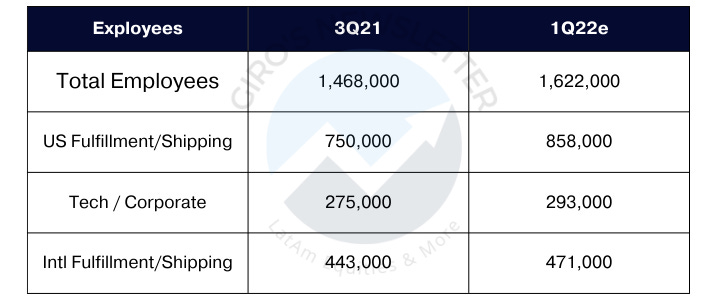

Last year, Amazon disclosed it has 750k+ frontline workers across the US. Also, they announced 275k workers for tech and corporate globally. We estimated our figures for the 1Q22 based on season-adjusted sales for temporary employees and left the weight unchanged.

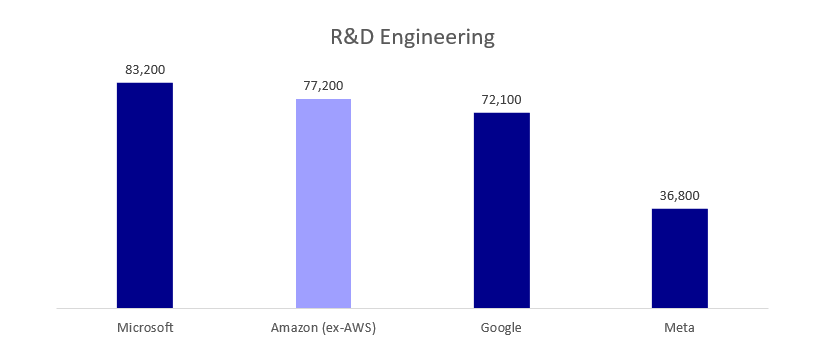

We estimate AMZN has approximately the same number of engineers (ex AWS) as FB's total headcount... Our in-depth analysis of AMZN’s ~1.6mn employee headcount forecast that the company already employs ~77.2k engineers (excluding AWS).

This implies that AMZN’s engineer employee base (ex-AWS) is more significant than GOOGL's engineering headcount (within R&D), roughly double FB's engineers.

Looking at it another way, we estimate that AMZN’s total investment in engineering (assuming $275k/head cost) was ~$19bn in ‘21.

However, Amazon announced raising base salaries to $350/head per year, which could lead expenses related to engineers to $24bn in 2022, or 60% of the total headwinds the company commented on during the earnings call.

While most of these engineers work on projects associated with core retail, large Amazon products, it is essential to remember that the company also has many long-term and yet-to-emerge “other bets” that they are investing in.

And Even if Only 20%/30% of These Engineers Work on Emerging Projects, That Would Imply $5-$8bn of "Other Bets". Sounds too much for a company going through multiple headwinds.

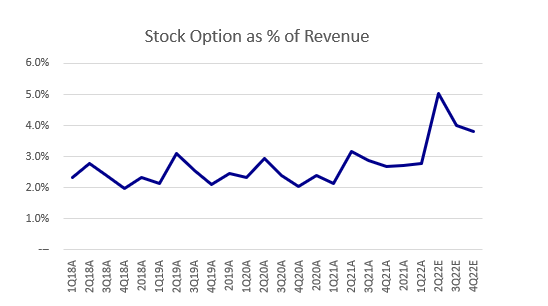

Finally, we'd like to highlight the stock compensation, which sends a distorted message to shareholders.

It surprises that instead of rationalizing and preparing for a stricter outlook, the mgmt team just issues more stock are depressed levels to compensate employees for their poor execution in the quarter.

It makes no sense for shareholders to bear dilution costs for poor execution. Therefore, they should not take more costs being diluted going forward — which is the suggested solution by company mgnt.

In our opinion, Amazon should focus on execution in their retail business and better capital allocation. The market understands that the bull market is over and the FED bullshit.

Now, it's the time for the mgnt team to understand they should deliver cash generation, not screw shareholders.

Sizing the Damage

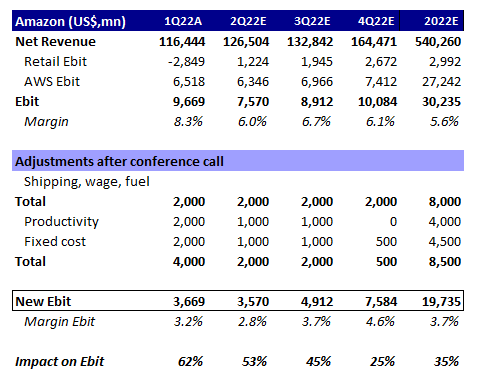

Our new estimate is an output of four comments management gave during the conference call:

“Combined with the year-over-year increases in wage inflation, these inflationary pressures have added approximately $2 billion of incremental costs when compared to last year. While we will continue to look for ways to mitigate these costs, we expect they will be around for some time”.

“This lower productivity added approximately $2 billion in costs compared to last year. In the last few weeks of the quarter and into April, we've seen productivity improvements across the network, and we expect to reduce these cost headwinds in Q2”.

“We estimate that this overcapacity coupled with the extraordinary leverage we saw in Q1 of last year resulted in $2 billion of additional costs year-over-year in Q1. We expect the effects of these fixed cost leverage to persist for the next several quarters as we grow into this capacity”.

“Our guidance includes an expectation that we will incur approximately $4 billion of these incremental costs in Q2”.

Also, we expect a substantial stake from structural costs (fuel, wage, shipping) to perdure through 2023. So, the sell-side should start reviewing their expectations for Amazon soon.

Nevertheless, in our conservative assessment of Amazon’s free cash flow to equity, we see the company trading at attractive long-term rates of return. Therefore, at least for now, I’m sticking to my shares.