XP reported weaker-than-expected 1Q22 results after the market close. A softer quarter was already expected after KPIs were published on Apr 13th, but the numbers were disappointing.

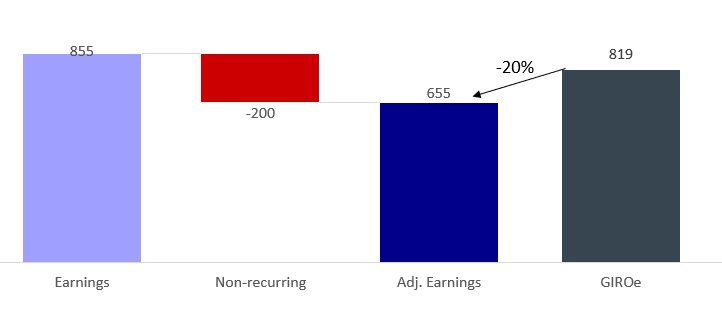

GAAP net income of R$855mn (-3% vs. Street), contracting 14% QoQ and expanding 16% YoY, which should be okay considering the weak KPIs reported a few weeks ago.

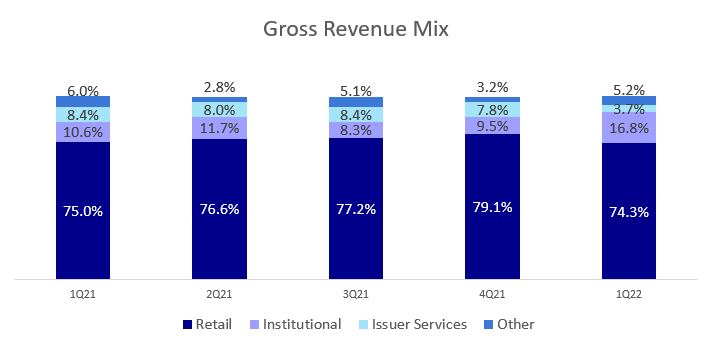

However, the bottom line was enormously helped by abnormally strong institutional revenue growing 68% QoQ and 86% YoY, supported by derivatives (high demand for hedging positions). Accordingly to the statement, the market should not expect it as a recurrent result.

According to our estimates, the non-recurring the institutional revenue helped the bottom line by ~R$200mn or 23% of XP’s net income (-20% vs. our numbers). So, without it, the earnings would be a huge miss.

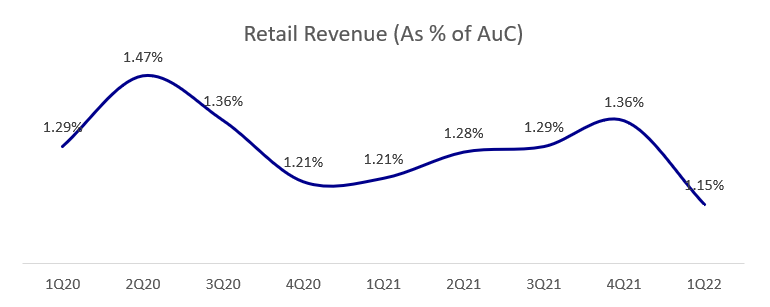

The resilient take rate in the last quarter showed a material sequential contraction in 1Q22, the main negative highlight of XP's results.

Even though the mgnt stated during the call that retail revenue yield should improve in the Q2 since March’s revs alone were already ~40% better than Jan/Feb average, it is fair to say Q1 results pose downside risks to the Street.

Also, due to more challenging macro conditions in Brazil, issuance results severely dropped 55% QoQ and down 48% YoY, chiefly driven by weak DCM and ECM activities in 1Q22.

Consequently, the revenue mix also changed, with retail revenues losing a bit of importance while institution revenues gained share.

On the expense side, the SG&A (ex-SBC) went up 34% YoY, mainly owing to a higher headcount, from 3.9k in the 1Q21 to 6.3k in the (up 60% YoY). Hopefully, we expect to dive into this headcount since our channel checks were primarily negative reviews.

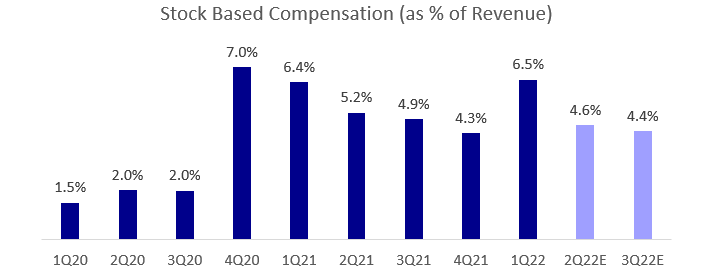

However, we highlight that stock base compensation was a yellow flag. We recognize that XP has been growing its headcount to support its growth, but macro conditions are no longer supportive.

Active clients growth decelerated, retail average daily trades decelerated, total net inflow decelerated, and volatility increased. Yet, despite all that, the IFA headcount continues to expand as if nothing happened.

If the company is growing and the exceeding revenue brings value to shareholders, it’s okay to have a quarter or other with mixed SBC compensation.

Personally, any figure above 5% is a yellow flag. Why…?

Let’s say XP revenue is R$3,5bn, and they spend ~5% to attract competent IFA, which is fine. We estimate that most IFA generates a stable revenue stream from its clients, generating an incremental R$200mn in sales and R$60 in profits.

This is a ~30% return, in line with XP’s historical return. So the 1Q22 gave us the impression that we should expect a deterioration in the fee revenue.

Then, considering the higher than expected SBC, that could be troublesome in the following quarters for XP profitability.

Finally, during the earnings call, management was vocal about a buyback program. If they do, and retail yield improves throughout the following quarters, we believe XP might re-rate.

Currently, the company is trading at inexpensive 10x cash earnings for 2023e, with a high quality 15%-20% earnings growth in the following five years. It’s a real target for our portfolio, though we’re not doing anything now.

Well, if you realized we didn't mentioned about the credit business, it's because the business line is too premature. Even though we have estimates and qualitative observations about its reporting, the lack of information might lead us to premature conclusions. So, we decided to wait for more quarterly returns, though we expect to comment about it in our post about XP.

We're collecting industry expert data from VTEX and shall soon begin on XP as well. Good stuff coming ahead. :)